Filling out the IRS Form 3520 can be a daunting task, and mistakes often occur. One common error is failing to file the form altogether. Individuals may overlook the requirement if they are not fully aware of their obligations regarding foreign trusts or gifts. Thus, it is important to understand when the form is necessary to avoid penalties.

Another mistake frequently made is misreporting specific amounts. When individuals fail to accurately report the value of gifts or distributions, they risk facing significant monetary fines. It is essential to carefully calculate any amounts being reported on the form to ensure accuracy.

Many also neglect to include all necessary documentation. The IRS requires that certain additional forms and information accompany the 3520. Without the proper attachments, the form is incomplete, which can trigger further inquiries from the IRS.

Some filers incorrectly assume that they can submit their form without an accompanying explanation for any discrepancies. Clear explanations regarding foreign trusts or gifts help establish context and may mitigate potential issues. Supporting documentation may also fortify one’s case during any audits.

Using the wrong form version is another prevalent error. People sometimes mistakenly refer to older versions of the form, leading to potential compliance problems. It is crucial to ensure that the most current version of the form is used at the time of submission.

In addition, individuals may be unaware of deadlines for filing. Delays can lead to late fees, so understanding all relevant timelines is vital. Planning ahead and knowing when the form is due can help avoid unnecessary stress.

A frequent oversight involves not signing the form correctly. A form that is not signed, or is signed incorrectly, is considered invalid. This seemingly small detail can delay processing and create additional complications.

Lastly, inadequate record-keeping often proves detrimental. Many individuals fail to maintain appropriate records related to foreign gifts or trusts that might be necessary for their future filings. Keeping thorough documentation can be invaluable in providing evidence if questions arise later.

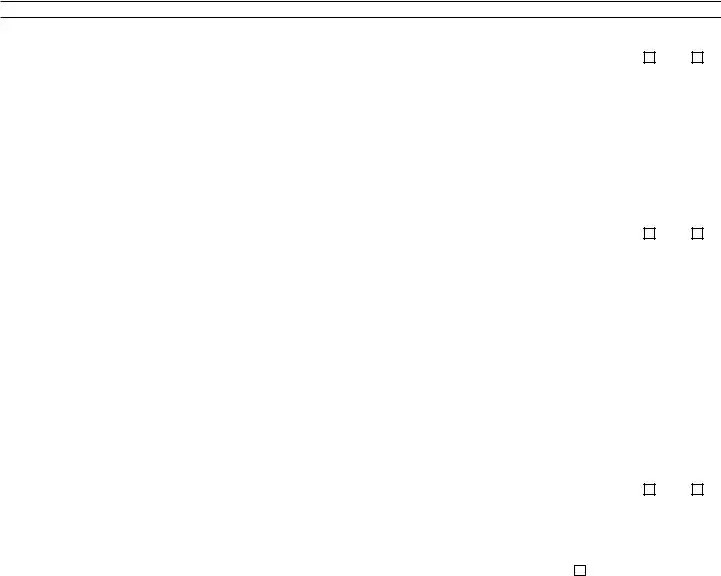

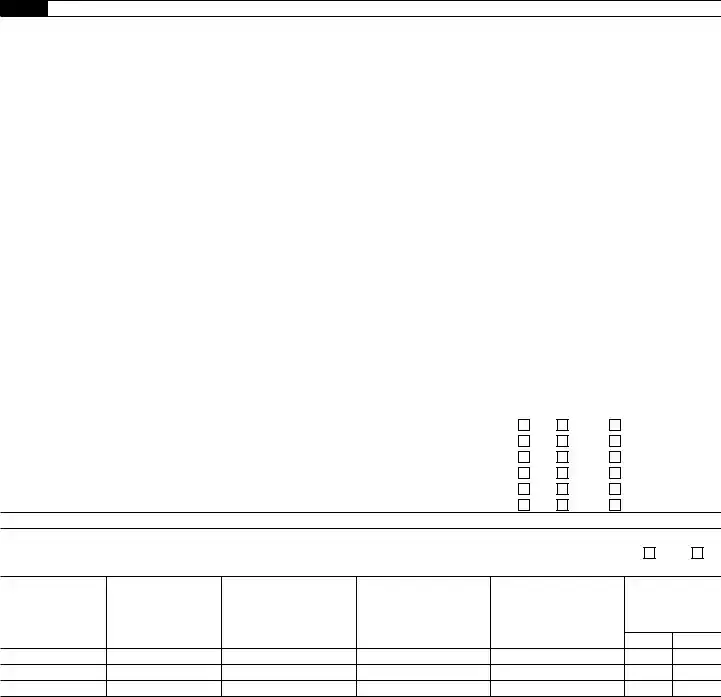

You are

You are  You are a U.S. owner of all or any portion of a foreign trust at any time during the tax year.

You are a U.S. owner of all or any portion of a foreign trust at any time during the tax year.

You are

You are

You are a U.S. person who, during the current tax year, received certain gifts or bequests from a foreign person.

You are a U.S. person who, during the current tax year, received certain gifts or bequests from a foreign person.

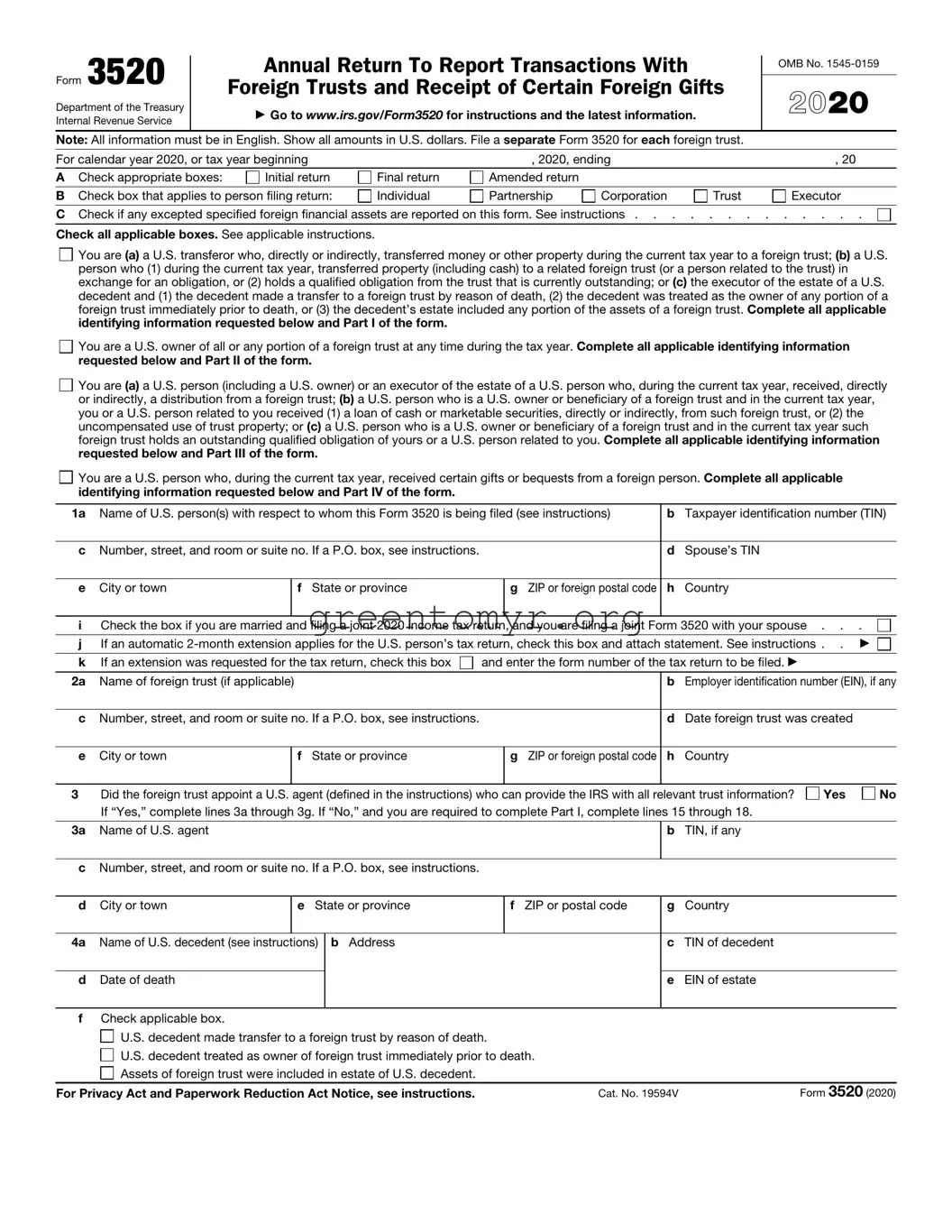

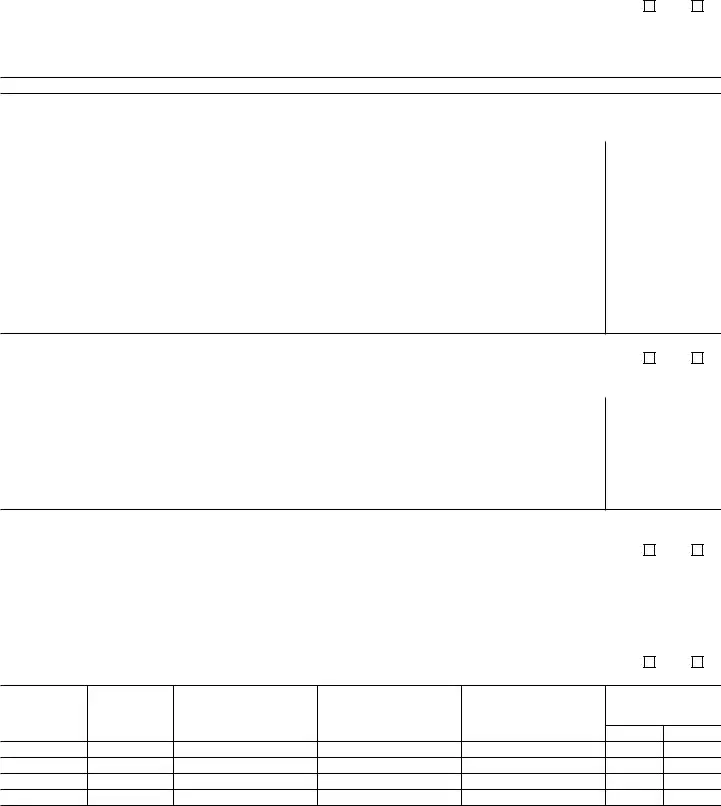

Yes

Yes  No

No

Yes

Yes  No

No

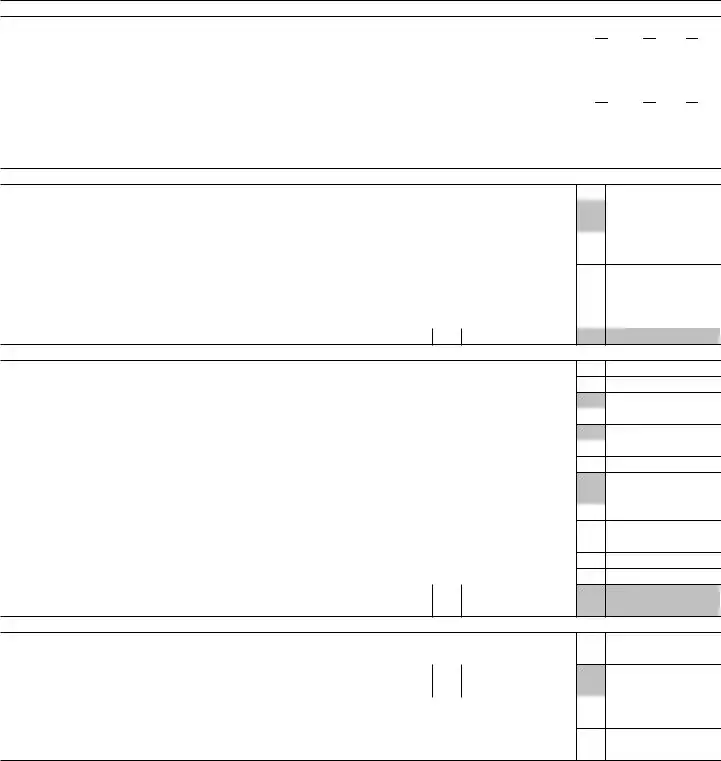

Yes

Yes

Yes

Yes

No

No  N/A

N/A

No

No  N/A

N/A