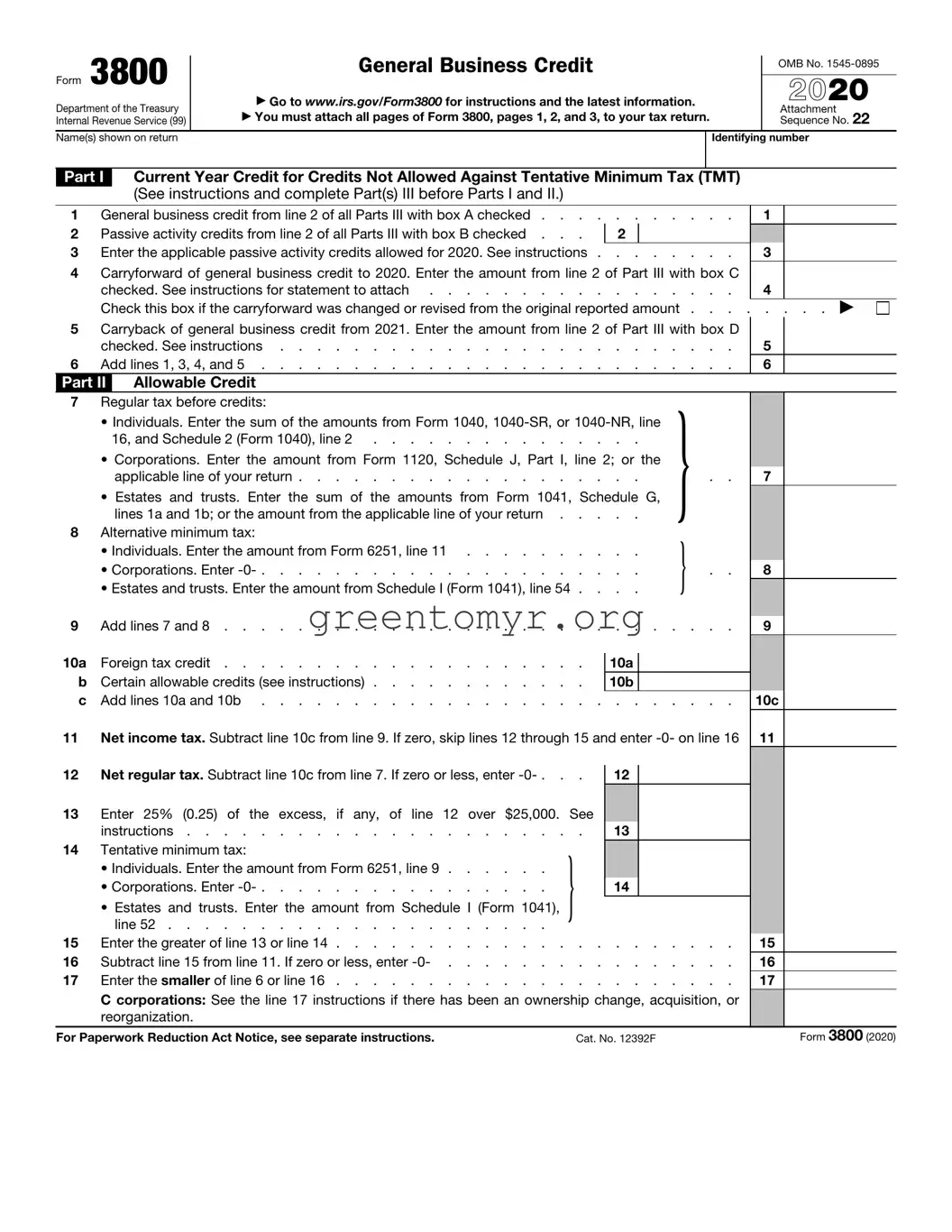

Form IRS 3800, also known as the "General Business Credit," allows businesses to claim a variety of tax credits for certain activities, investments, and expenditures. This form consolidates multiple credits into a single credit which is applied against a business's tax liability. It plays a crucial role in reducing the overall tax burden for eligible businesses.

Any business entity that qualifies for one or more of the specific credits included in the form can use IRS 3800. This includes corporations, partnerships, and some sole proprietorships. Generally, businesses must meet certain criteria for eligibility concerning the activities or expenses incurred to qualify for the various credits.

Form 3800 includes several credits, such as:

-

Investment Credit

-

Work Opportunity Credit

-

Small Business Health Care Credit

-

Research Credit

-

Renewable Energy Production Credit

Each of these credits has specific requirements that must be met to qualify.

To calculate the amount to enter on Form 3800, you need to determine the credit amounts you are eligible for. This involves filling out any additional forms associated with the specific credits you are claiming. After calculations, the total credit amount is reported on Form 3800, which is then applied to your tax return.

Form 3800 is generally due when you file your income tax return. If you are filing an extension, Form 3800 must be submitted along with your extended return. Ensure that you check the current tax year guidelines for exact due dates, as they may vary.

Yes, you can amend Form 3800 if you discover an error after submission. Use the appropriate procedures to file an amended return, and include the corrected Form 3800. Keep records of both the original and amended forms for your documentation.

If you do not file Form 3800, you will miss out on potential tax credits that could lower your tax liability. Additionally, failure to file may result in penalties or interest charges if you owe taxes. It's important to consider filing even if you are unsure of eligibility.

Yes, you can file Form 3800 electronically through the IRS e-file system, provided your tax software supports it. E-filing can streamline the process and help ensure that all forms are submitted accurately and on time.

For more information about Form 3800, visit the official IRS website. The IRS provides guidance, instructions, and resources to help you understand how to complete and file this form. Consulting with a tax professional is also a good option if you have specific questions or need assistance.