6. Address (include ZIP code)

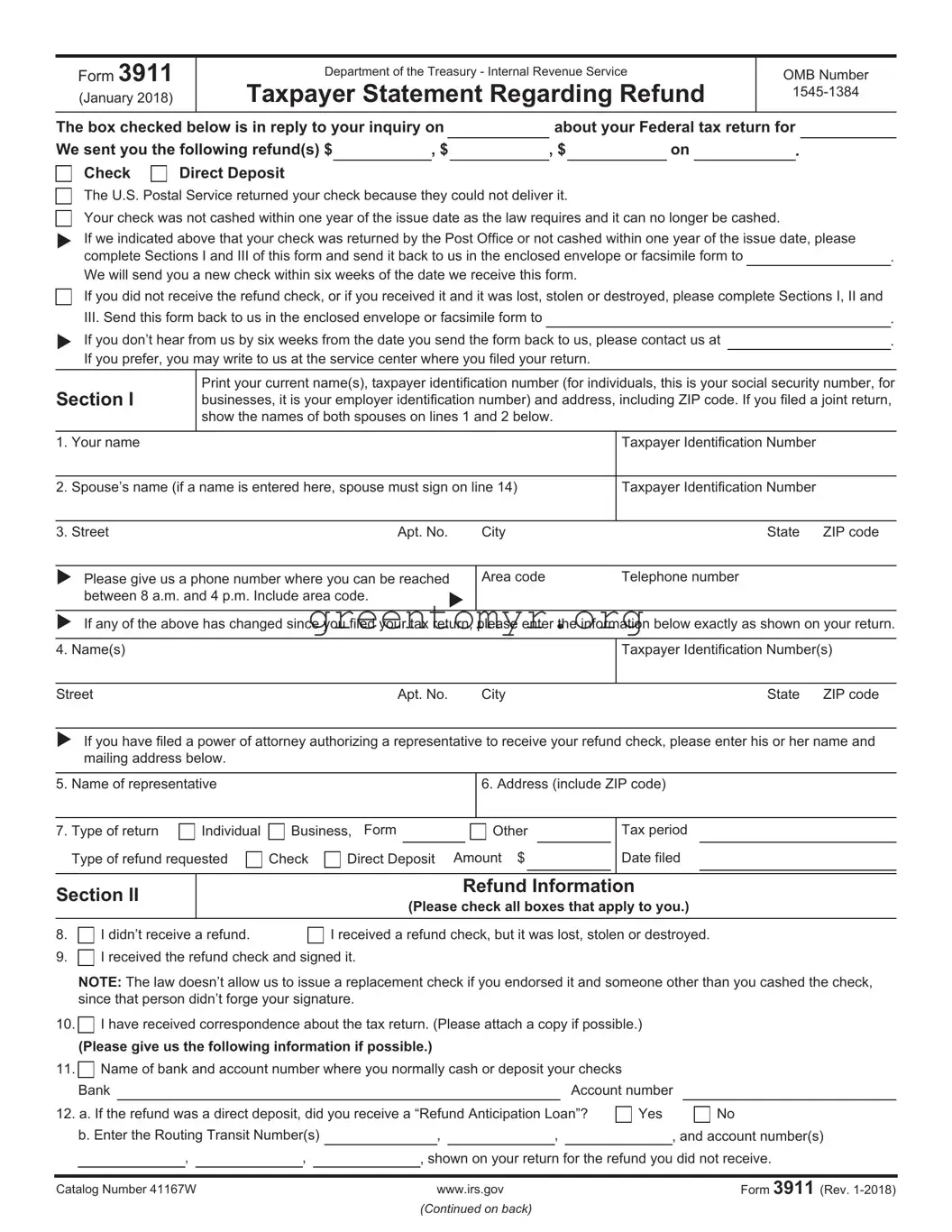

Department of the Treasury - Internal Revenue Service

Taxpayer Statement Regarding Refund

The box checked below is in reply to your inquiry on |

|

|

about your Federal tax return for |

We sent you the following refund(s) $ |

, $ |

, $ |

|

on |

. |

Check |

Direct Deposit |

|

|

|

|

|

|

|

|

|

The U.S. Postal Service returned your check because they could not deliver it.

Your check was not cashed within one year of the issue date as the law requires and it can no longer be cashed.

XIf we indicated above that your check was returned by the Post Office or not cashed within one year of the issue date, please complete Sections I and III of this form and send it back to us in the enclosed envelope or facsimile form to

We will send you a new check within six weeks of the date we receive this form.

If you did not receive the refund check, or if you received it and it was lost, stolen or destroyed, please complete Sections I, II and III. Send this form back to us in the enclosed envelope or facsimile form to

XIf you don’t hear from us by six weeks from the date you send the form back to us, please contact us at If you prefer, you may write to us at the service center where you filed your return.

Print your current name(s), taxpayer identification number (for individuals, this is your social security number, for businesses, it is your employer identification number) and address, including ZIP code. If you filed a joint return, show the names of both spouses on lines 1 and 2 below.

Taxpayer Identification Number

2. Spouse’s name (if a name is entered here, spouse must sign on line 14)

Taxpayer Identification Number

3. Street |

Apt. No. |

City |

State |

ZIP code |

XPlease give us a phone number where you can be reached

between 8 a.m. and 4 p.m. Include area code. |

X |

Area code |

Telephone number |

XIf any of the above has changed since you filed your tax return, please enter the information below exactly as shown on your return.

Taxpayer Identification Number(s)

Street |

Apt. No. |

City |

State |

ZIP code |

XIf you have filed a power of attorney authorizing a representative to receive your refund check, please enter his or her name and mailing address below.

5. Name of representative

|

|

|

|

|

|

|

7. Type of return |

Individual |

Business, Form |

|

|

Other |

Type of refund requested |

Check |

Direct Deposit |

Amount $ |

Refund Information

(Please check all boxes that apply to you.)

8. |

I didn’t receive a refund. |

I received a refund check, but it was lost, stolen or destroyed. |

9. I received the refund check and signed it.

I received the refund check and signed it.

NOTE: The law doesn’t allow us to issue a replacement check if you endorsed it and someone other than you cashed the check, since that person didn’t forge your signature.

10. I have received correspondence about the tax return. (Please attach a copy if possible.)

I have received correspondence about the tax return. (Please attach a copy if possible.)

(Please give us the following information if possible.)

11.

Name of bank and account number where you normally cash or deposit your checks

Name of bank and account number where you normally cash or deposit your checks

|

Bank |

|

|

|

|

|

|

|

|

|

|

|

Account number |

|

12. a. If the refund was a direct deposit, did you receive a “Refund Anticipation Loan”? |

Yes |

|

No |

|

b. Enter the Routing Transit Number(s) |

, |

|

, |

|

|

|

, and account number(s) |

|

, |

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

, shown on your return for the refund you did not receive. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Catalog Number 41167W |

|

|

|

|

www.irs.gov |

|

|

|

|

|

|

Form 3911 (Rev. 1-2018) |

|

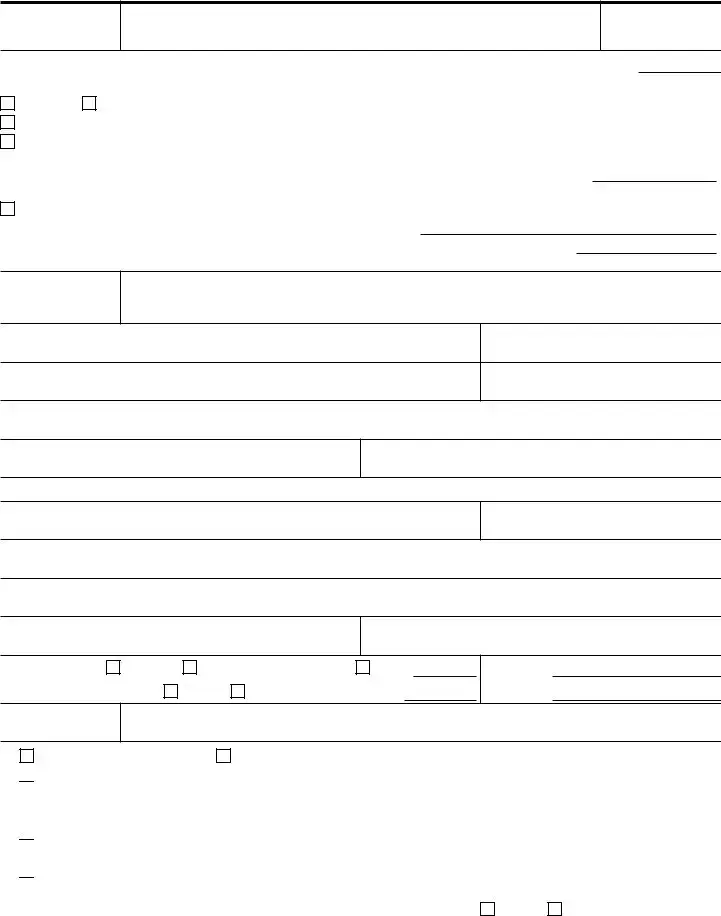

XPlease sign below, exactly as you signed the return. If this refund was from a joint return, we need the signatures of both spouses before we can trace it.

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge and belief, the information is true, correct, and complete. I request that you send a replacement refund, and if I receive two refunds I will return one.

13. Signature (For business returns, signature of person authorized to sign the check)

14. Spouse’s signature, if required (For businesses, enter the title of the person who signed above.)

|

Section IV |

Description of Check |

|

(For Internal Revenue Service use only) |

|

|

|

|

|

Schedule number |

Refund Date |

Amount |

Other (DLN, Check/Symbol, etc.) |

|

|

|

|

Schedule number |

Refund Date |

Amount |

Other (DLN, Check/Symbol, etc.) |

|

|

|

|

Schedule number |

Refund Date |

Amount |

Other (DLN, Check/Symbol, etc.) |

Privacy Act and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States.

You aren’t required to give us the information since the refund you claimed has already been issued. However, without the information we won’t be able to trace your refund, and may be unable to replace it. You may give us the information we need in a letter.

We need the information to ensure that you are complying with these laws and to allow us to determine the correctness of your refund or the right amount of payment. Your Social Security Number and the other information are being requested in order that the Department of the Treasury can process your refund. The authority of requesting your social security number is 26 United States Code, section 6109. If you cannot or will not furnish the information, the tracing of your refund may be delayed.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or record relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Internal Revenue Code section 6103. The time needed to compete and file this form will vary depending on individual circumstances. The estimated average time is less than 5 minutes.

If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Attention: Tax Products Coordinating Committee, Western Area Distribution Center, Rancho Cordova, CA 95743-0001.

Do not send this form to this office. Instead, please use the envelope provided or mail the form to the Internal Revenue Service center where you would normally file a paper tax return.

Catalog Number 41167W |

www.irs.gov |

Form 3911 (Rev. 1-2018) |

I received the refund check and signed it.

I received the refund check and signed it. I have received correspondence about the tax return. (Please attach a copy if possible.)

I have received correspondence about the tax return. (Please attach a copy if possible.)

Name of bank and account number where you normally cash or deposit your checks

Name of bank and account number where you normally cash or deposit your checks