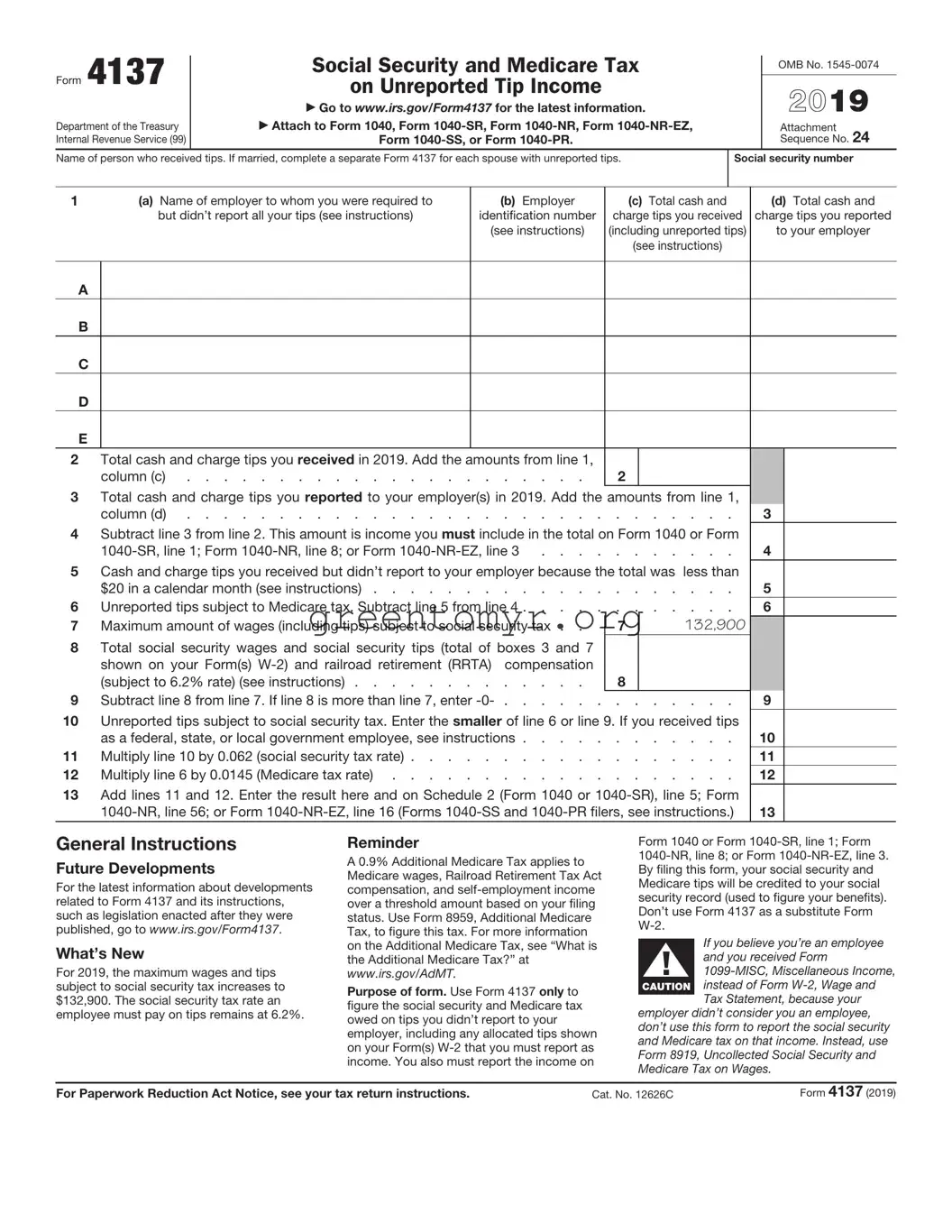

Who must file. You must file Form 4137 if you received cash and charge tips of $20 or more in a calendar month and didn’t report all of those tips to your employer. You also must file Form 4137 if your Form(s) W-2, box 8, shows allocated tips that you must report as income.

Allocated tips. You must report all your tips from 2019, including both cash tips and noncash tips, as income on Form 1040 or Form 1040-SR, line 1; Form 1040-NR, line 8; or Form 1040-NR-EZ, line 3. Any tips you reported to your employer in 2019 are included in the wages shown on your Form W-2, box 1. Add to the amount in box 1 only the tips you received in 2019 and didn’t report to your employer. This should include any allocated tips shown on your Form(s) W-2, box 8, unless you have adequate records to show that your unreported tips are less than the amount in box 8. Although allocated tips are shown on your Form W-2, they aren’t included in box 1 on that form and no tax is withheld from these tips.

Tips you must report to your employer. If you receive $20 or more in cash tips, you must report 100% of those tips to your employer through a written report. Cash tips include tips paid by cash, check, debit card, and credit card. The written report should include tips your employer paid to you for charge customers, tips you received directly from customers, and tips you received from other employees under any tip-sharing arrangement. If, in any month, you worked for two or more employers and received tips while working for each, the $20 rule applies separately to the tips you received while working for each employer and not to the total you received. You must report your tips to your employer by the 10th day of the month following the month you received them. If the 10th day of the month falls on a Saturday, Sunday, or legal holiday, give your employer the report by the next business day. For example, because May 10, 2020, is a Sunday, you must report your tips received in April 2020 by May 11, 2020.

Employees subject to the Railroad Retirement Tax Act. Don’t use Form 4137 to report tips received for work covered by the Railroad Retirement Tax Act. To get railroad retirement credit, you must report these tips to your employer.

Payment of tax. Tips you reported to your employer are subject to social security and Medicare tax (or railroad retirement tax), Additional Medicare Tax, and income tax withholding. Your employer collects these taxes from wages (excluding tips) or other funds of yours available to cover them. If your wages weren’t enough to cover these taxes, you may have given your employer the additional amounts needed. Your Form W-2

will include the tips you reported to your employer and the taxes withheld. If there wasn’t enough money to cover the social security and Medicare tax (or railroad retirement tax), your Form W-2 also will show the uncollected tax due in box 12 with codes A and B. See the instructions for Schedule 2 (Form 1040 or 1040-SR), line 8, or Form

1040-NR, line 60, to find out how to report the tax due. If you worked in American Samoa, Guam, or the U.S. Virgin Islands, the amount of uncollected tax due is identified in box 12 on Form W-2AS, W-2GU, or W-2VI with codes A and B. If you worked in Puerto Rico, Form 499R-2/W-2PR, boxes 22 and 23, show the uncollected tax due. Unlike the uncollected portion of the regular (1.45%) Medicare tax, the uncollected Additional Medicare Tax isn’t reported on Form W-2, box 12, with code B.

Penalty for not reporting tips. If you didn’t report tips to your employer as required, you may be charged a penalty equal to 50% of the social security, Medicare, and Additional Medicare Taxes due on those tips. You can avoid this penalty if you can show (in a statement attached to your return) that your failure to report tips to your employer was due to reasonable cause and not due to willful neglect.

Additional information. See Pub. 531, Reporting Tip Income. See Rev. Rul. 2012-18 for guidance on taxes imposed on tips and the difference between tips and service charges. You can find Rev. Rul. 2012-18, 2012-26 I.R.B. 1032, at www.irs.gov/ irb/2012-26_IRB#RR-2012-18.

Specific Instructions

Line 1. Complete a separate line for each employer. If you had more than five employers in 2019, attach a statement that contains all of the information (and in a similar format) as required on Form 4137, line 1, or complete and attach line 1 of additional Form(s) 4137. Complete lines 2 through 13 on only one Form 4137. The line 2 and line 3 amounts on that Form 4137 should be the combined totals of all your Forms 4137 and attached statements. Include your name, social security number, and calendar year (2019) on the top of any attachment.

Column (a). Enter your employer’s name exactly as shown on your Form W-2.

Column (b). For each employer’s name you entered in column (a), enter the employer identification number (EIN) or the words “Applied For” exactly as shown on your Form W-2.

Columns (c) and (d). Include all cash and charge tips you received. All of the following tips must be included.

•Total tips you reported to your employer on time. Tips you reported, as required, by the 10th day of the month following the month you received them are considered income in the month you reported them. For example, tips you received in December 2018 that you reported to your employer after December 31, 2018, but by January 10, 2019, are considered income in 2019 and should be included on your 2019 Form W-2 and reported on Form 4137, line 1. Report these tips in column (d).

•Tips you received in December 2019 that you reported to your employer after December 31, 2019, but by January 10, 2020, are considered income in 2020. Don’t include these tips on line 1 for 2019. Instead, report these tips on line 1, column (d), on your 2020 Form 4137.

•Tips you didn’t report to your employer on time. Report these tips in column (d).

•Tips you didn’t report at all (include any allocated tips (see Allocated tips, earlier) shown in box 8 on your Form(s) W-2 unless you can prove that your unreported tips are less than the amount in box 8). Report these tips in column (c). These tips are considered income to you in the month you actually received them. For example, tips you received in December 2019 that you reported to your employer after January 10, 2020, are considered income in 2019 because you didn’t report them to your employer on time.

•Tips you received that you weren’t required to report to your employer because they totaled less than $20 during the month. Report these tips in column (c).

Line 5. Enter only the tips you weren’t required to report to your employer because the total received was less than $20 in a calendar month. These tips aren’t subject to social security and Medicare tax.

Line 6. Enter this amount on Form 8959, line 2, if you’re required to file that form.

Line 8. For railroad retirement (RRTA) compensation, don’t include an amount greater than $132,900, which is the amount subject to the 6.2% rate for 2019.

Line 10. If line 6 includes tips you received for work you did as a federal, state, or local government employee and your pay was subject only to the 1.45% Medicare tax, subtract the amount of those tips from the line 6 amount only for the purpose of comparing lines 6 and 9. Don’t reduce the actual entry on line 6. Enter “1.45% tips” and the amount you subtracted on the dotted line next to line 10.

Line 11. Multiply the amount on line 10 by 0.062 (the social security rate for 2019).

Line 13. Form 1040-SS and Form 1040-PR filers, include the amount from line 13 on Form 1040-SS or Form 1040-PR, line 6. See the instructions for Form 1040-SS or Form 1040-PR for more information.