Form 433-A (Rev. 2-2019) |

Page 4 |

|

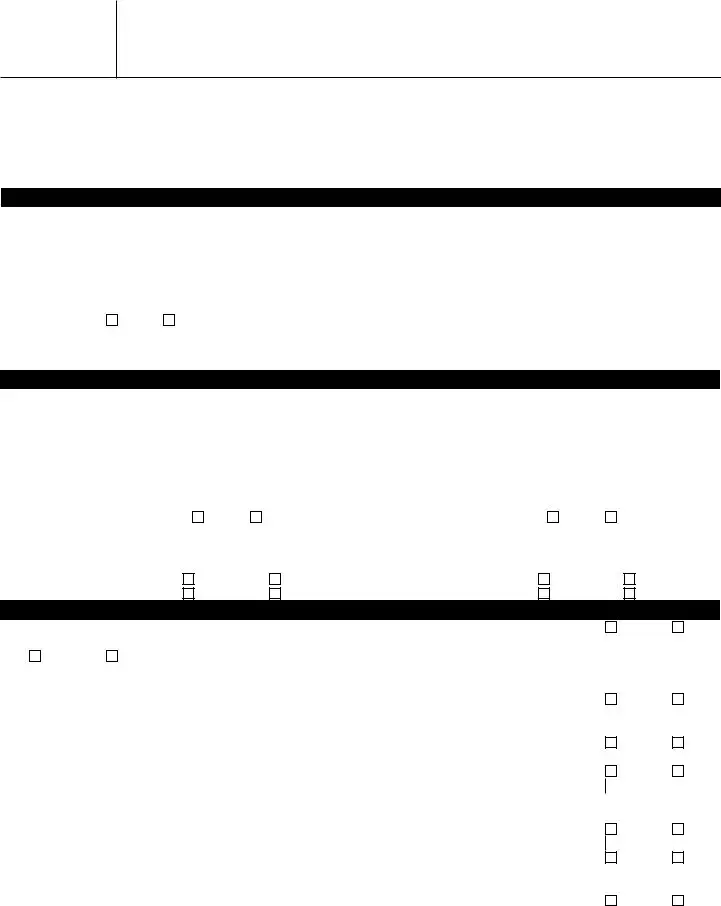

If you are self-employed, sections 6 and 7 must be completed before continuing. |

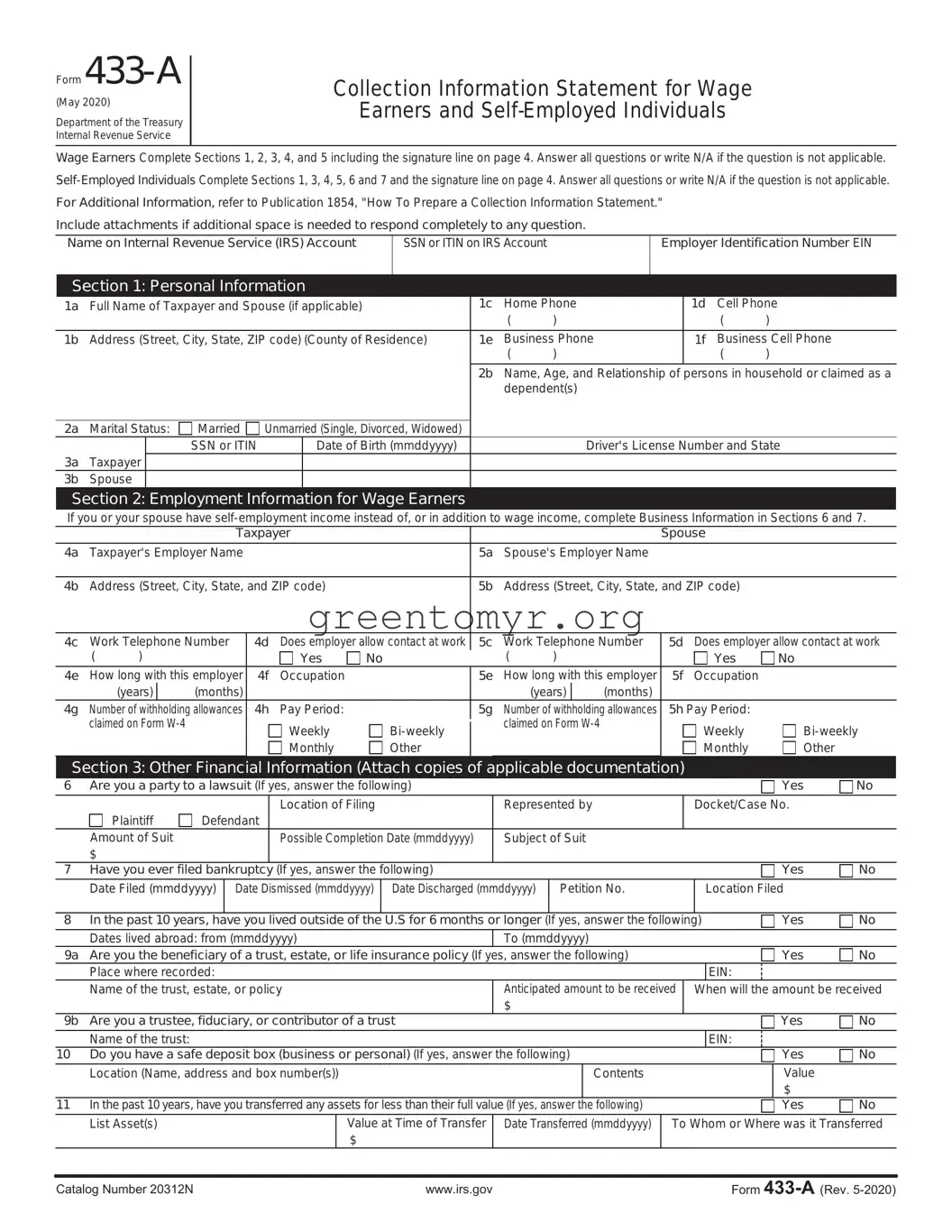

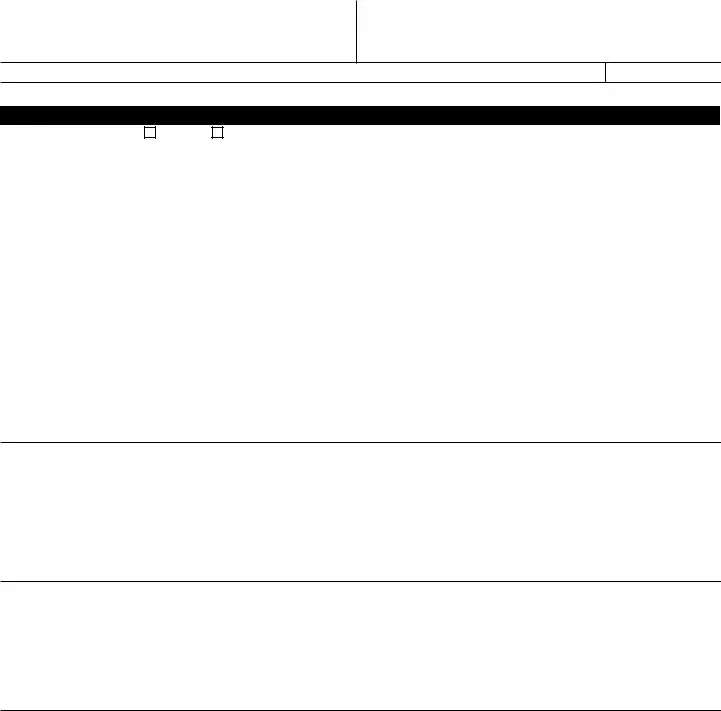

Section 5: Monthly Income and Expenses

Monthly Income/Expense Statement (For additional information, refer to Publication 1854.)

|

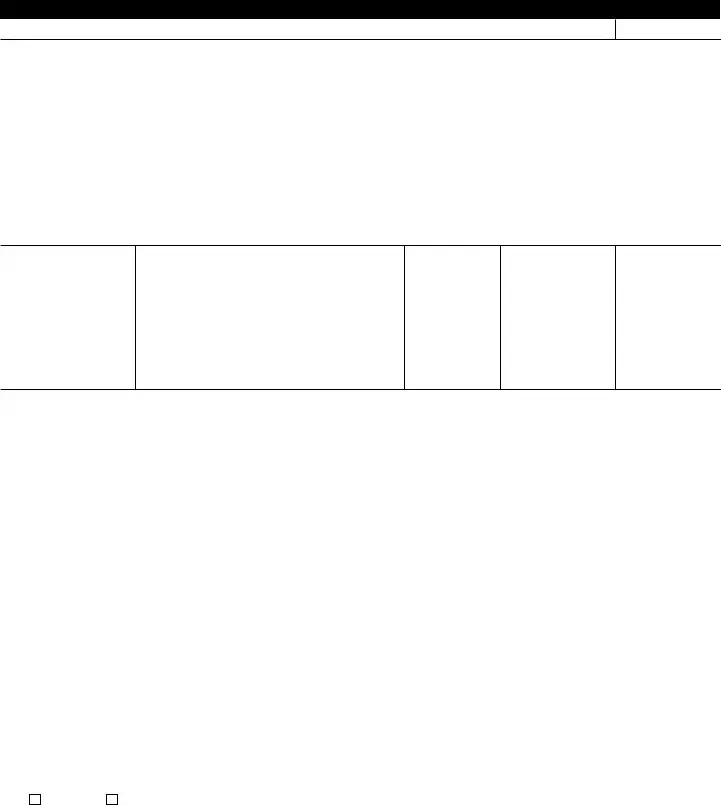

Total Income |

|

|

|

Total Living Expenses |

|

IRS USE ONLY |

|

Source |

|

Gross Monthly |

|

Expense Items 6 |

Actual Monthly |

Allowable Expenses |

20 |

Wages (Taxpayer) 1 |

$ |

|

35 |

Food, Clothing and Misc. 7 |

$ |

|

21 |

Wages (Spouse) 1 |

$ |

|

36 |

Housing and Utilities 8 |

$ |

|

22 |

Interest - Dividends |

$ |

|

37 |

Vehicle Ownership Costs 9 |

$ |

|

23 |

Net Business Income 2 |

$ |

|

38 |

Vehicle Operating Costs 10 |

$ |

|

24 |

Net Rental Income 3 |

$ |

|

39 |

Public Transportation 11 |

$ |

|

25 |

Distributions (K-1, IRA, etc.) 4 |

$ |

|

40 |

Health Insurance |

$ |

|

26 |

Pension (Taxpayer) |

$ |

|

41 |

Out of Pocket Health Care Costs 12 |

$ |

|

27 |

Pension (Spouse) |

$ |

|

42 |

Court Ordered Payments |

$ |

|

28 |

Social Security (Taxpayer) |

$ |

|

43 |

Child/Dependent Care |

$ |

|

29 |

Social Security (Spouse) |

$ |

|

44 |

Life Insurance |

$ |

|

30 |

Child Support |

$ |

|

45 |

Current year taxes (Income/FICA) 13 |

$ |

|

31 |

Alimony |

$ |

|

46 |

Secured Debts (Attach list) |

$ |

|

|

Other Income (Specify below) 5 |

|

|

47 |

Delinquent State or Local Taxes |

$ |

|

32 |

|

$ |

|

48 |

Other Expenses (Attach list) |

$ |

|

33 |

|

$ |

|

49 |

Total Living Expenses (add lines 35-48) |

$ |

|

34 |

Total Income (add lines 20-33) |

$ |

|

50 |

Net difference (Line 34 minus 49) |

$ |

|

1Wages, salaries, pensions, and social security: Enter gross monthly wages and/or salaries. Do not deduct tax withholding or allotments taken out of pay, such as insurance payments, credit union deductions, car payments, etc. To calculate the gross monthly wages and/or salaries:

If paid weekly - multiply weekly gross wages by 4.3. Example: $425.89 x 4.3 = $1,831.33

If paid biweekly (every 2 weeks) - multiply biweekly gross wages by 2.17. Example: $972.45 x 2.17 = $2,110.22

If paid semimonthly (twice each month) - multiply semimonthly gross wages by 2. Example: $856.23 x 2 = $1,712.46

2Net Income from Business: Enter monthly net business income. This is the amount earned after ordinary and necessary monthly business expenses are paid. This figure is the amount from page 6, line 89. If the net business income is a loss, enter “0”. Do not enter a negative number. If this amount is more or less than previous years, attach an explanation.

3Net Rental Income: Enter monthly net rental income. This is the amount earned after ordinary and necessary monthly rental expenses are paid. Do not include deductions for depreciation or depletion. If the net rental income is a loss, enter “0.” Do not enter a negative number.

4Distributions: Enter the total distributions from partnerships and subchapter S corporations reported on Schedule K-1, and from limited liability companies reported on Form 1040, Schedule C, D or E. Enter total distributions from IRAs if not included under pension income.

5Other Income: Include agricultural subsidies, unemployment compensation, gambling income, oil credits, rent subsidies, sharing economy income from providing on-demand work, services or goods (e.g., Uber, Lyft, AirBnB, VRBO) and income through digital platforms like an app or website, etc.

6Expenses not generally allowed: We generally do not allow tuition for private schools, public or private college expenses, charitable contributions, voluntary retirement contributions or payments on unsecured debts. However, we may allow the expenses if proven that they are necessary for the health and welfare of the individual or family or the production of income. See Publication 1854 for exceptions.

7Food, Clothing and Miscellaneous: Total of food, clothing, housekeeping supplies, and personal care products for one month. The miscellaneous allowance is for expenses incurred that are not included in any other allowable living expense items. Examples are credit card payments, bank fees and charges, reading material, and school supplies.

8Housing and Utilities: For principal residence: Total of rent or mortgage payment. Add the average monthly expenses for the following: property taxes, homeowner’s or renter’s insurance, maintenance, dues, fees, and utilities. Utilities include gas, electricity, water, fuel, oil, other fuels, trash collection, telephone, cell phone, cable television and internet services.

9Vehicle Ownership Costs: Total of monthly lease or purchase/loan payments.

10Vehicle Operating Costs: Total of maintenance, repairs, insurance, fuel, registrations, licenses, inspections, parking, and tolls for one month.

11Public Transportation: Total of monthly fares for mass transit (e.g., bus, train, ferry, taxi, etc.)

12Out of Pocket Health Care Costs: Monthly total of medical services, prescription drugs and medical supplies (e.g., eyeglasses, hearing aids, etc.)

13Current Year Taxes: Include state and Federal taxes withheld from salary or wages, or paid as estimated taxes.

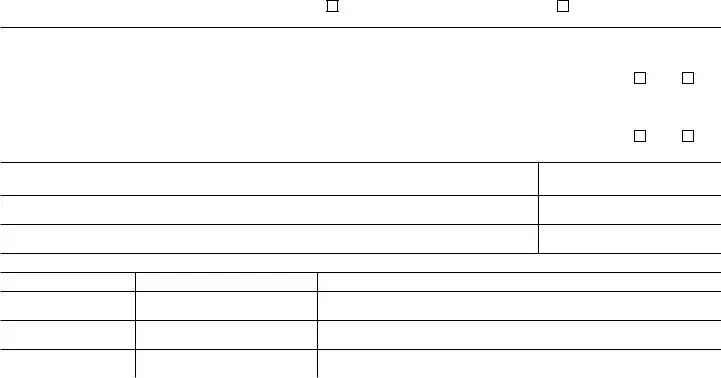

Certification: Under penalties of perjury, I declare that to the best of my knowledge and belief this statement of assets, liabilities, and other information is true, correct, and complete.