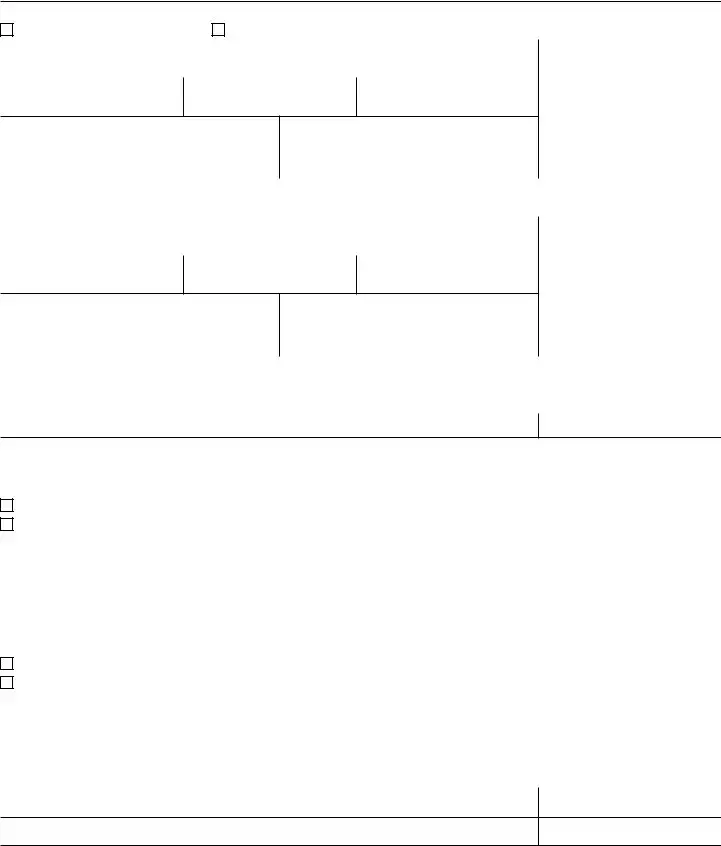

Under penalties of perjury, I declare that I have examined this offer, including accompanying documents, and to the best of my knowledge it is true, correct, and complete.

|

|

►Signature of Taxpayer |

Date (mm/dd/yyyy) |

|

|

|

►Signature of Spouse |

Date (mm/dd/yyyy) |

Remember to include all applicable attachments listed below. |

|

Copies of the most recent pay stub, earnings statement, etc., from each employer.

Copies of the most recent statement for each investment and retirement account.

Copies of the most recent statement, etc., from all other sources of income such as pensions, Social Security, rental income, interest and dividends (including any received from a related partnership, corporation, LLC, LLP, etc.), court order for child support, alimony, royalties, and rent subsidies.

Copies of individual bank statements for the three most recent months. If you operate a business, copies of the six most recent statements for each business bank account.

Copies of the most recent statement from lender(s) on loans such as mortgages, second mortgages, vehicles, etc., showing monthly payments, loan payoffs, and balances.

List of Notes Receivable, if applicable.

Verification of delinquent State/Local Tax Liability showing total delinquent state/local taxes and amount of monthly payments, if applicable.

Documentation to support any special circumstances described in the “Explanation of Circumstances” on Form 656, if applicable.

Attach a Form 2848, Power of Attorney, if you would like your attorney, CPA, or enrolled agent to represent you and you do not have a current form on file with the IRS.

Completed and signed current Form 656.

No

No

No

No