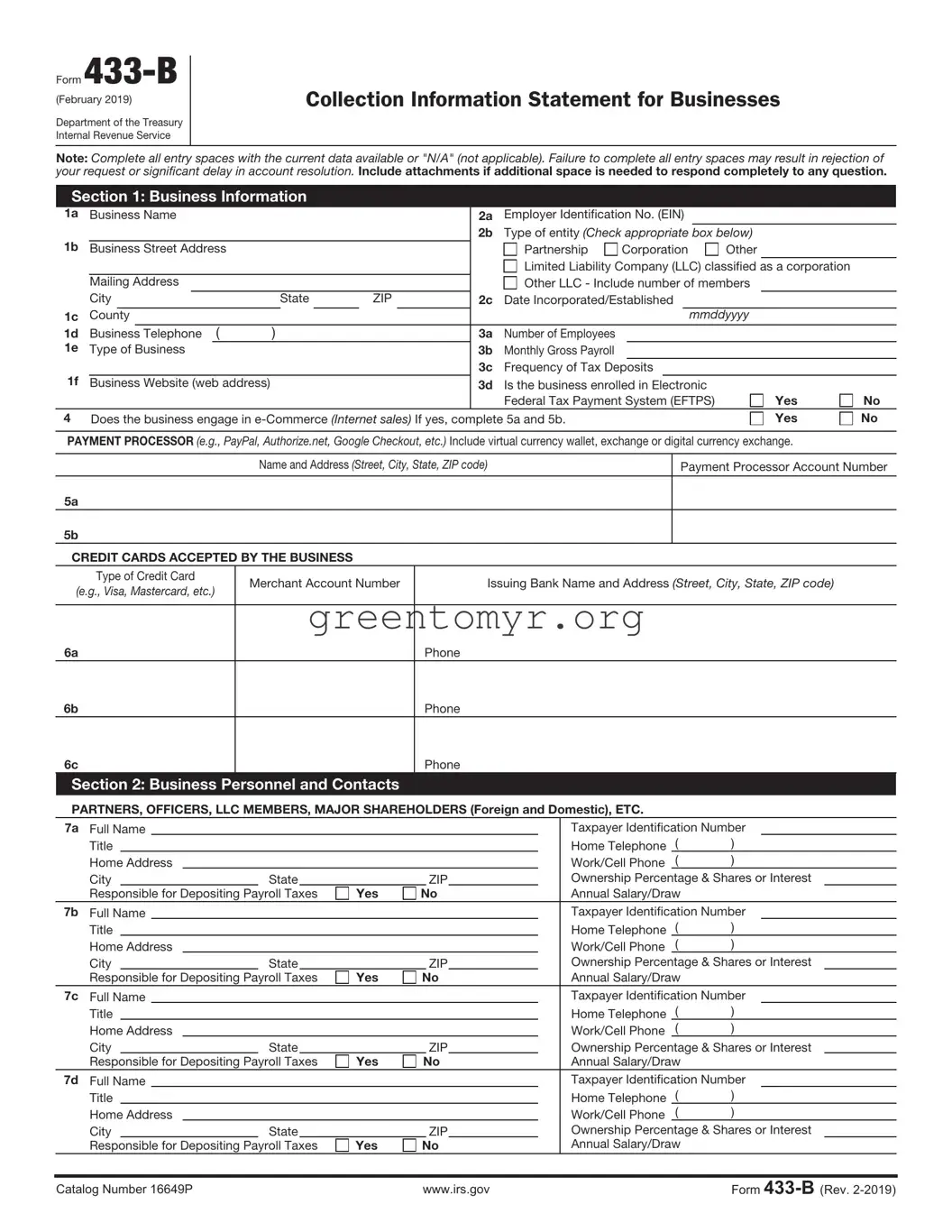

Completing the IRS Form 433-B can be overwhelming, and errors are common. One major mistake is providing insufficient information about the business. The form requires detailed data, including assets, liabilities, and income. Leaving out any significant information can delay the process or lead to rejection.

Another frequent error is underestimating the value of assets. Business owners might undervalue their equipment or inventory, which affects the overall financial picture provided to the IRS. Always ensure that valuations are accurate and reflect current market conditions to avoid complications.

Misreporting income is another pitfall. It is essential to report all sources of income accurately. Understating income may seem tempting, but the IRS has ways to verify this information, which could lead to penalties.

Failing to include all business expenses is also a common mistake. This omission can lead to an inflated assessment of the business's ability to pay taxes. Make sure to list all relevant expenses thoroughly to paint a clear picture of the business's financial standing.

Additionally, some individuals forget to sign the form. A missing signature can halt processing, which creates unnecessary delays. It’s wise to double-check that all required signatures are in place before submission.

Calculating payment plans inaccurately is yet another area where mistakes can occur. A wrong calculation can misrepresent the business's ability to pay. Ensure that the figures are double-checked for accuracy and that they comply with IRS guidelines.

Many people neglect to keep copies of the form. Not having records of what was submitted can hinder future interactions with the IRS. Always save a copy of the completed form for personal records and reference.

Missing deadlines can also complicate the matter. Timely submission of Form 433-B is crucial for compliance. Keep track of due dates and plan to submit the form early to avoid rushing at the last minute.

Finally, failing to seek professional help when needed can lead to mistakes that may have been avoided. Consulting with a tax professional may provide insights and assistance in filling out the form correctly. Involving an expert can save time and reduce the risk of errors.