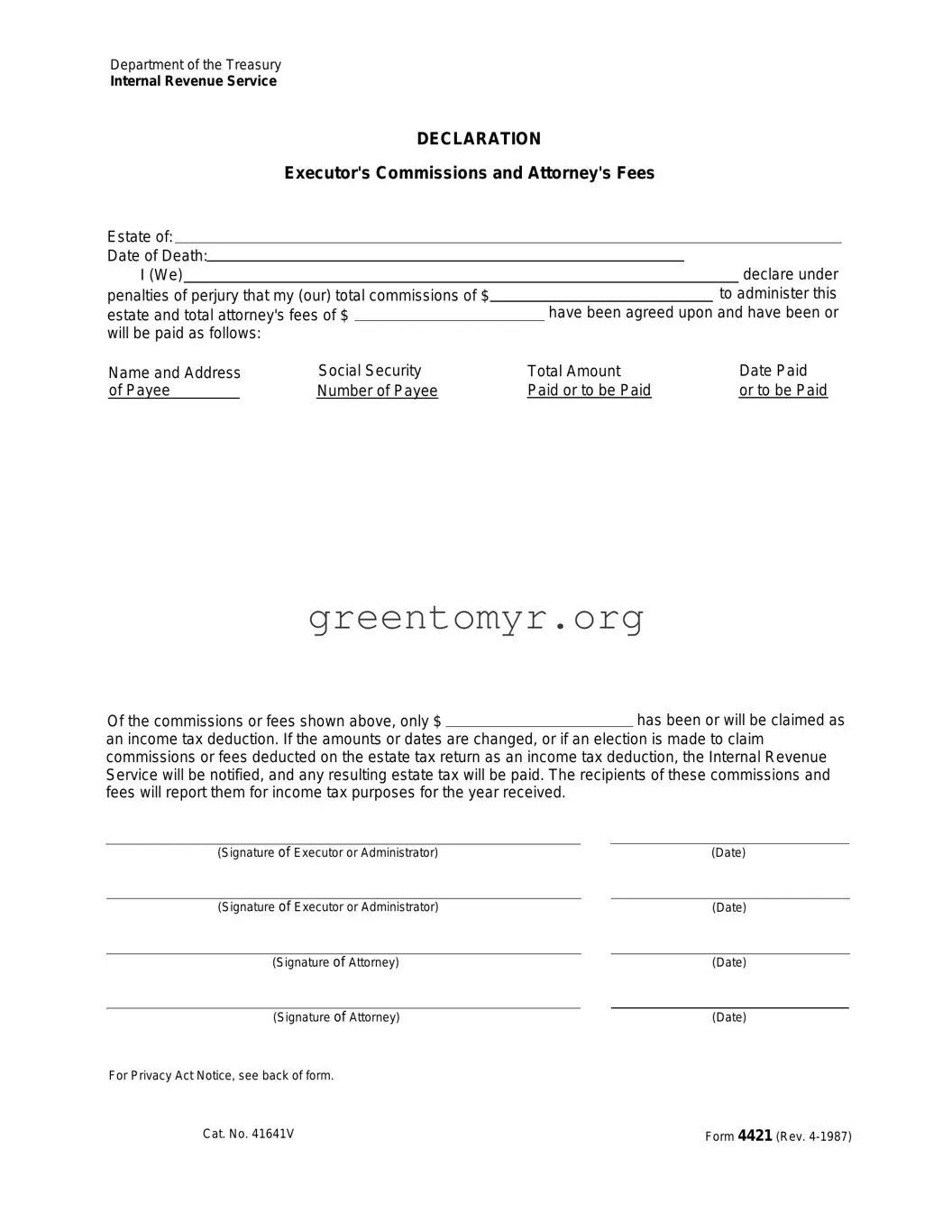

Filling out the IRS Form 4421 can be straightforward, yet many people make common mistakes that can cause delays or issues. One significant error occurs when individuals fail to accurately report the total commissions and attorney’s fees. It is crucial to ensure that the amounts listed match the actual agreements made regarding the estate. Discrepancies can lead to complications or audits.

Another common oversight is neglecting to provide complete details about the payees. Each payee's name, address, and Social Security number should be listed correctly. Incomplete or incorrect information can result in difficulties for the recipients when they report the commissions and fees on their tax returns.

Furthermore, people often forget to sign and date the form appropriately. Signatures from both the executor and the attorney are essential. This validates the declaration under penalties of perjury. Without these signatures, the form may be considered invalid or incomplete by the IRS.

Some individuals fail to indicate how much of the commissions or fees will be claimed as an income tax deduction. This section is important, as it informs the IRS about the tax implications for the estate. Overlooking this may create confusion regarding the estate's tax liabilities.

An additional pitfall includes not notifying the IRS about any changes in amounts or dates after submission. If there are modifications to the agreement, it is necessary to inform the IRS. This ensures that the correct estate tax is calculated and paid, preventing future issues.

Many mistakenly assume they do not need to keep a copy of the form for their records. Retaining a copy is vital for tracking and managing the estate’s finances and answering any follow-up inquiries from the IRS.

In terms of deadlines, failing to submit the form on time is a frequent problem. Missing a deadline can lead to penalties or delays in processing. It is essential to be aware of the submission timeline to avoid unnecessary complications.

Some filers also disregard the implications of not providing the Social Security numbers as required. This information is crucial for the IRS to process returns accurately, and its absence can cause significant issues.

Finally, individuals sometimes misjudge the need for consulting with a tax professional. While Form 4421 might seem simple, complexities in estate administration can arise. Seeking guidance from a qualified expert can help navigate potential pitfalls and ensure accurate completion.

Our legal right to ask for the information and whether the law says you must give it.

Our legal right to ask for the information and whether the law says you must give it. What major purposes we have in asking for it, and how it will be used.

What major purposes we have in asking for it, and how it will be used. What could happen if we do not receive it.

What could happen if we do not receive it. filed with them. Any questions we need to ask

filed with them. Any questions we need to ask you so we can:

you so we can: