|

Form 4868 (2019) |

|

Page 4 |

|

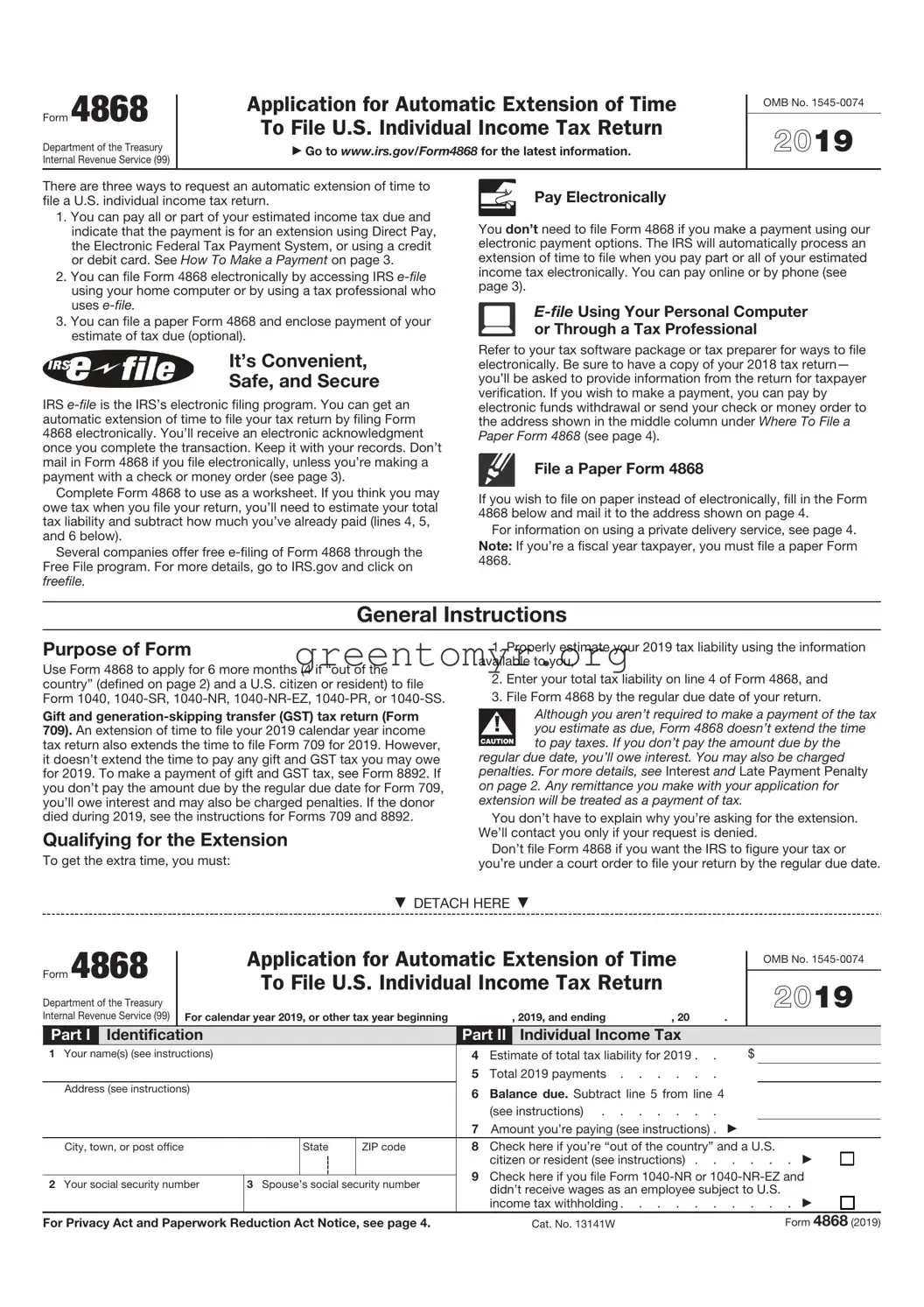

Where To File a Paper Form 4868 |

And you’re making a payment, send |

And you’re not making a |

|

Form 4868 with your payment to |

payment, send Form 4868 to |

|

If you live in: |

Internal Revenue Service: |

Department of the Treasury, |

|

|

Internal Revenue Service Center: |

|

|

|

|

|

Alabama, North Carolina, South Carolina |

P.O. Box 1302 Charlotte, NC 28201-1302 |

Kansas City, MO 64999-0045 |

|

|

|

|

|

Alaska, California, Hawaii, Washington |

P.O. Box 7122 San Francisco, CA 94120-7122 |

Fresno, CA 93888-0045 |

|

|

|

|

|

Arizona, Colorado, Idaho, Kansas, Montana, Nebraska, New Mexico, Nevada, |

P.O. Box 802503 Cincinnati, OH 45280-2503 |

Ogden, UT 84201-0045 |

|

North Dakota, Oregon, South Dakota, Utah, Wyoming |

|

|

|

|

|

|

|

|

Arkansas, Georgia, Indiana, Iowa, Kentucky, Missouri, New Jersey, Oklahoma, |

P.O. Box 931300 Louisville, KY 40293-1300 |

Kansas City, MO 64999-0045 |

|

Tennessee, Virginia |

|

|

|

|

|

|

|

|

Connecticut, District of Columbia, Maryland, Rhode Island, West Virginia |

P.O. Box 931300 Louisville, KY 40293-1300 |

Ogden, UT 84201-0045 |

|

|

|

|

|

Delaware, Maine, Massachusetts, New Hampshire, New York, Vermont |

P.O. Box 37009 Hartford, CT 06176-7009 |

Kansas City, MO 64999-0045 |

|

|

|

|

|

Florida, Louisiana, Mississippi, Texas |

P.O. Box 1302 Charlotte, NC 28201-1302 |

Austin, TX 73301-0045 |

|

|

|

|

|

Illinois, Michigan, Minnesota, Ohio, Wisconsin |

P.O. Box 802503 Cincinnati, OH 45280-2503 |

Fresno, CA 93888-0045 |

|

|

|

|

|

Pennsylvania |

P.O. Box 37009 Hartford, CT 06176-7009 |

Ogden, UT 84201-0045 |

|

|

|

|

|

A foreign country, American Samoa, or Puerto Rico, or are excluding income |

|

|

|

under Internal Revenue Code section 933, or use an APO or FPO address, or file |

P.O. Box 1302 Charlotte, NC 28201-1302 USA |

Austin, TX 73301-0215 |

|

Form 2555 or 4563, or are a dual-status alien, or are a nonpermanent resident of |

|

|

|

|

Guam or the U.S. Virgin Islands |

|

|

|

|

|

|

|

All foreign estate and trust Form 1040-NR filers |

P.O. Box 1303 Charlotte, NC 28201-1303 USA |

Kansas City, MO 64999-0045 USA |

|

|

|

|

|

All other Form 1040-NR, 1040-NR-EZ, 1040-PR, and 1040-SS filers |

P.O. Box 1302 Charlotte, NC 28201-1302 USA |

Austin, TX 73301-0045 USA |

|

|

|

|