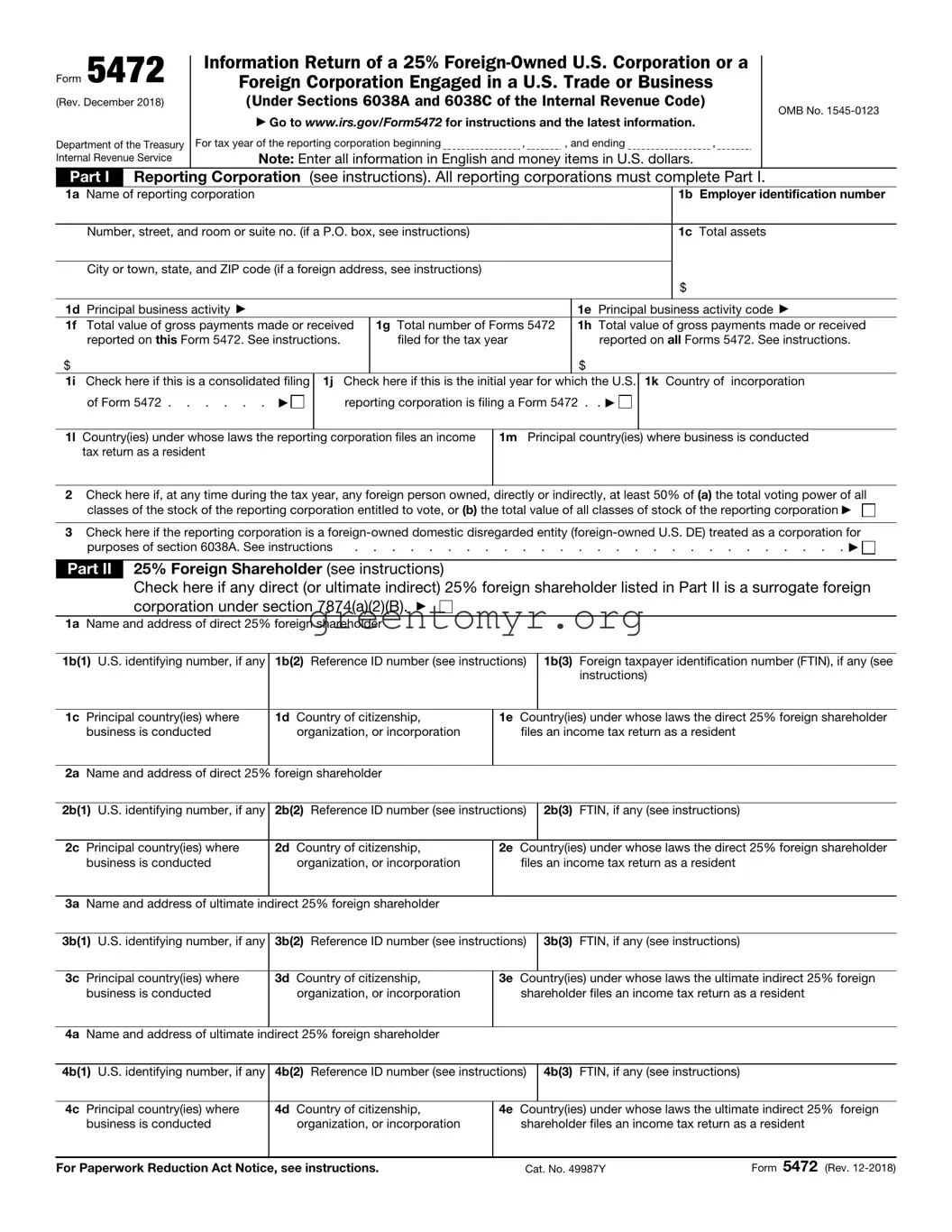

|

|

|

|

|

|

|

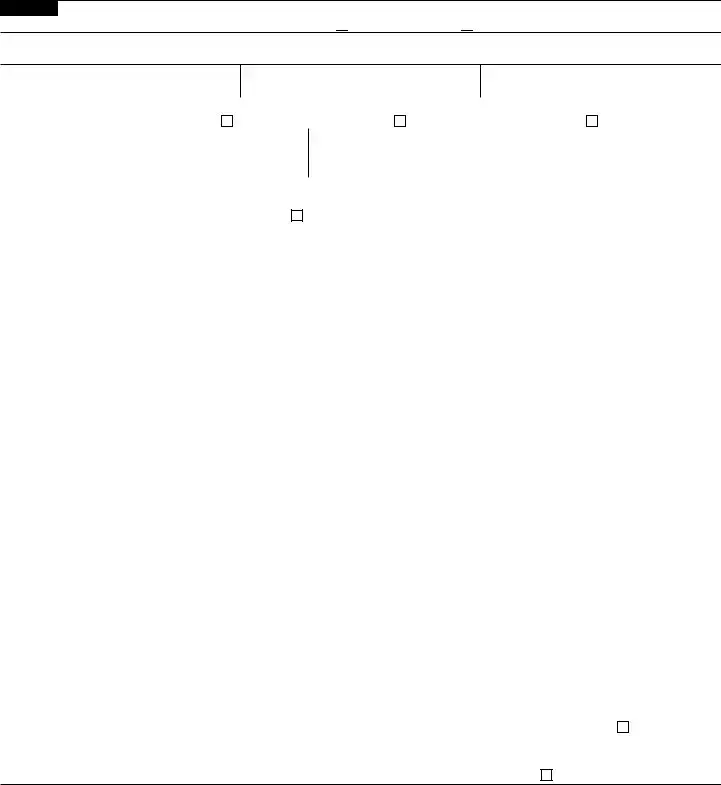

Part IV |

Monetary Transactions Between Reporting Corporations and Foreign Related Party (see instructions) |

|

|

Caution: Part IV must be completed if the “foreign person” box is checked in the heading for Part III. |

|

|

If estimates are used, check here. ▶ |

|

|

|

|

|

|

|

|

1 |

Sales of stock in trade (inventory) |

1 |

|

2 |

Sales of tangible property other than stock in trade |

2 |

|

3 |

Platform contribution transaction payments received |

3 |

|

4 |

Cost-sharing transaction payments received |

4 |

|

5a |

Rents received (for other than intangible property rights) |

5a |

|

b |

Royalties received (for other than intangible property rights) |

5b |

|

6 |

Sales, leases, licenses, etc., of intangible property rights (for example, patents, trademarks, secret formulas) . . |

6 |

|

7 |

Consideration received for technical, managerial, engineering, construction, scientific, or like services . . . . |

7 |

|

8 |

Commissions received |

8 |

|

9 |

Amounts borrowed (see instructions) a Beginning balance |

|

b Ending balance or monthly average ▶ |

9b |

|

10 |

Interest received |

10 |

|

11 |

Premiums received for insurance or reinsurance |

11 |

|

12 |

Other amounts received (see instructions) |

12 |

|

13 |

Total. Combine amounts on lines 1 through 12 |

13 |

|

14 |

Purchases of stock in trade (inventory) |

14 |

|

15 |

Purchases of tangible property other than stock in trade |

15 |

|

16 |

Platform contribution transaction payments paid |

16 |

|

17 |

Cost-sharing transaction payments paid |

17 |

|

18a |

Rents paid (for other than intangible property rights) |

18a |

|

b |

Royalties paid (for other than intangible property rights) |

18b |

|

19 |

Purchases, leases, licenses, etc., of intangible property rights (for example, patents, trademarks, secret formulas) |

19 |

|

20 |

Consideration paid for technical, managerial, engineering, construction, scientific, or like services |

20 |

|

21 |

Commissions paid |

21 |

|

22 |

Amounts loaned (see instructions) a Beginning balance |

|

b Ending balance or monthly average ▶ |

22b |

|

23 |

Interest paid |

23 |

|

24 |

Premiums paid for insurance or reinsurance |

24 |

|

25 |

Other amounts paid (see instructions) |

25 |

|

26 |

Total. Combine amounts on lines 14 through 25 |

26 |

|

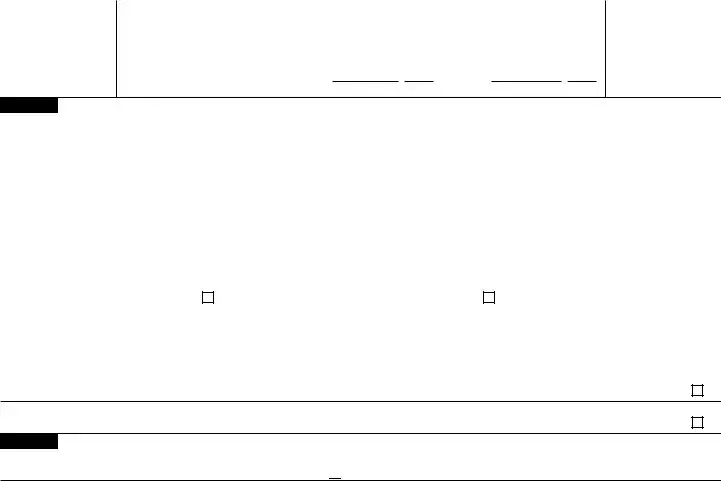

Part V |

Reportable Transactions of a Reporting Corporation That is a Foreign-Owned U.S. DE (see instructions) |

|

|

Describe on an attached separate sheet any other transaction as defined by Regulations section 1.482-1(i)(7), |

|

|

such as amounts paid or received in connection with the formation, dissolution, acquisition, and disposition |

|

|

of the entity, including contributions to and distributions from the entity, and check here. ▶ |

|

|

Part VI |

Nonmonetary and Less-Than-Full Consideration Transactions Between the Reporting Corporation and |

|

|

the Foreign Related Party (see instructions) |

|

|

|

|

|

Describe these transactions on an attached separate sheet and check here. ▶ |

|

|

foreign person or

foreign person or  U.S. person?

U.S. person?