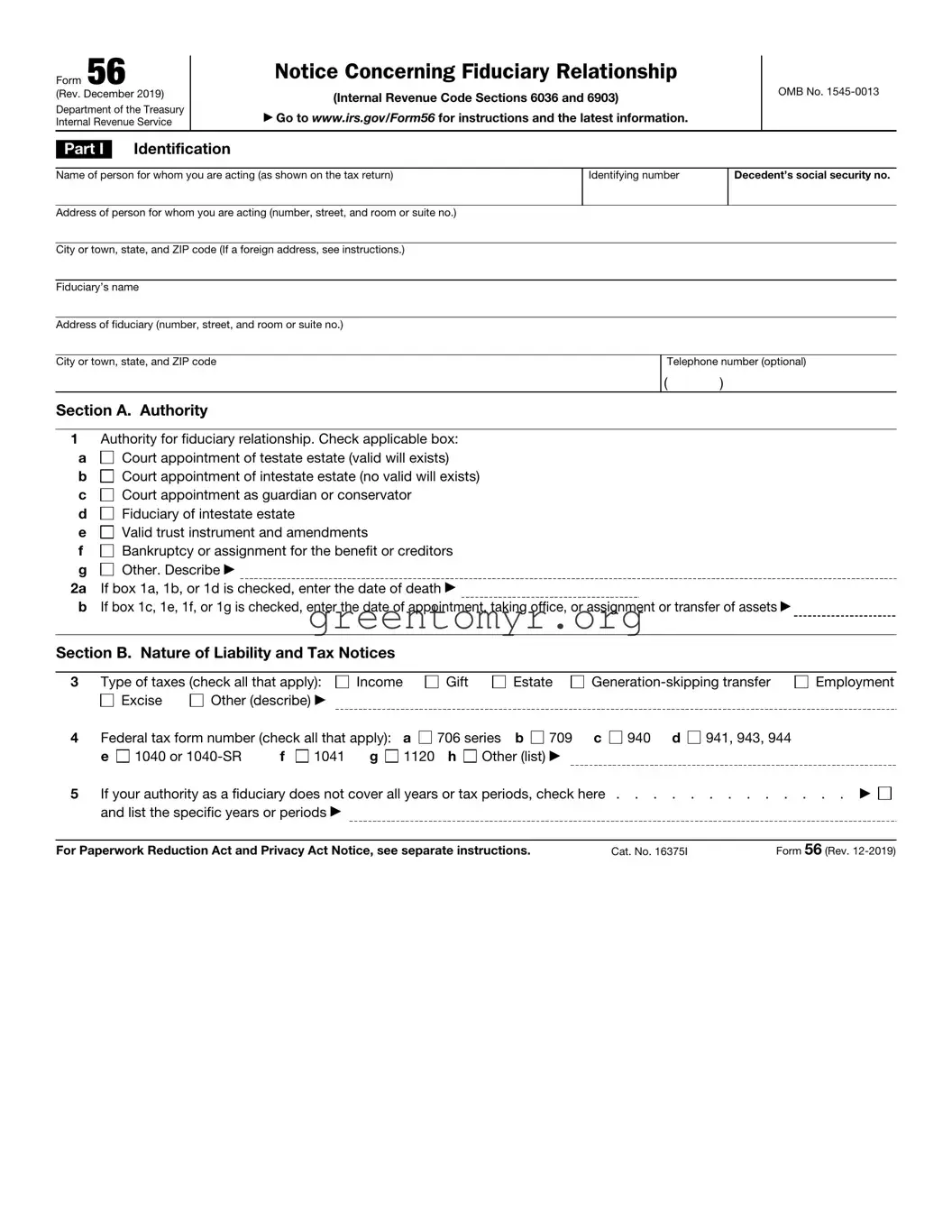

Filling out IRS Form 56 can be a daunting task, and many people make mistakes that can lead to delays or complications in their fiduciary responsibilities. One common error includes failing to provide accurate identification numbers. Every fiduciary must include the Social Security number of the person they are representing. Omitting or misinputting this information can cause significant issues with the IRS.

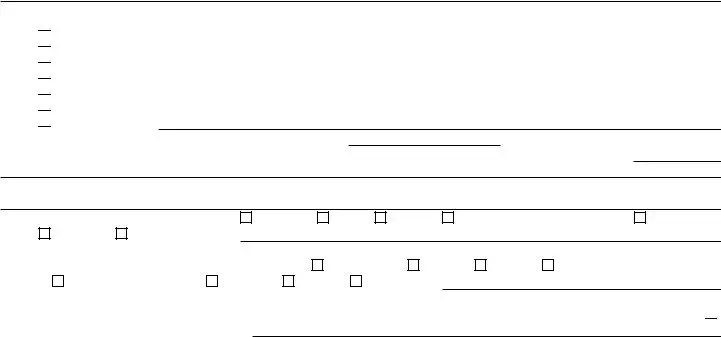

Another frequent mistake is neglecting to indicate the correct type of fiduciary authority. This form has several checkboxes under Section A, and it’s crucial to select the one that accurately reflects your situation. Selecting the wrong category could lead to misunderstandings or even legal consequences regarding your fiduciary duties.

Many individuals also forget to enter important dates. When checking certain boxes, the form will require the date of death or the date of appointment. Skip this vital step, and the IRS may not process the form properly, leading to potential delays in any necessary tax matters.

A common oversight is checking too few boxes under the type of taxes section. It’s essential to identify all forms of taxes applicable to the fiduciary relationship. If you neglect to do this, it could hinder the IRS's understanding of your obligations and responsibilities.

In Section B, failing to specify particular years or periods when the fiduciary authority does not cover all tax matters is another prevalent error. If your authority is limited, the IRS needs to know this to ensure compliance with your fiduciary duties. Missing this information can lead to confusion and complications.

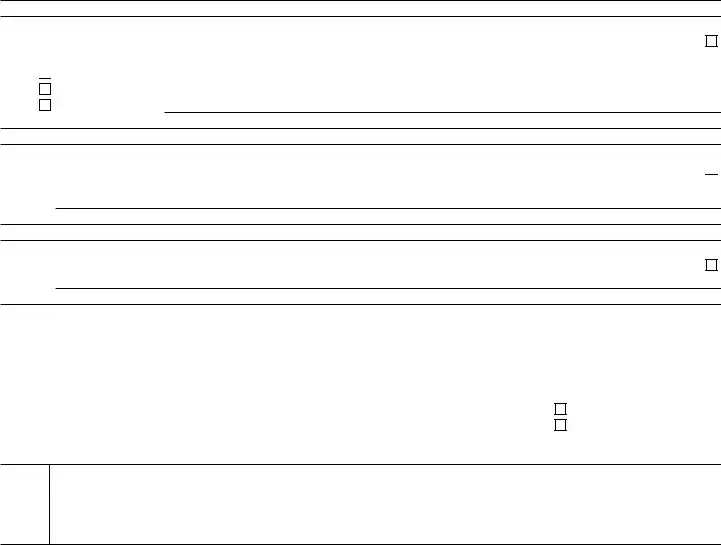

Additionally, when completing the revocation or termination section, it is vital to accurately describe the reason for termination. If you check the box without providing a clear reason, the IRS may require further clarification, potentially delaying the processing of the form.

Many people also fail to confirm that they have revoked previous notices properly. When submitting a form for the termination of fiduciary relationships, it is necessary to indicate if all prior notices are being revoked. Without this clarification, the IRS might not appreciate the full scope of your fiduciary responsibilities, leading to legal issues.

Another mistake involves incomplete signatures. The form requires that the fiduciary's signature be included under the penalties of perjury. Omitting your signature or not dating the document can render the form invalid. Always check that you’ve signed and dated the form appropriately before submitting it.

Lastly, people sometimes neglect to double-check their forms for accuracy. Before submitting, take a moment to review all the information provided. An errant typographical error or miscommunication can lead to significant problems with the IRS, such as audits or penalties.

Being aware of these common mistakes can make a substantial difference in the smooth processing of IRS Form 56. By taking the time to understand the requirements and checking for errors, fiduciaries can ensure their submissions are complete and accurate.

Court appointment of testate estate (valid will exists)

Court appointment of testate estate (valid will exists) Court appointment of intestate estate (no valid will exists)

Court appointment of intestate estate (no valid will exists) Court appointment as guardian or conservator

Court appointment as guardian or conservator Fiduciary of intestate estate

Fiduciary of intestate estate Valid trust instrument and amendments

Valid trust instrument and amendments Bankruptcy or assignment for the benefit or creditors

Bankruptcy or assignment for the benefit or creditors Other. Describe

Other. Describe

and list the specific years or periods

and list the specific years or periods

Court order revoking fiduciary authority

Court order revoking fiduciary authority