Form 709 (2019) |

Page 3 |

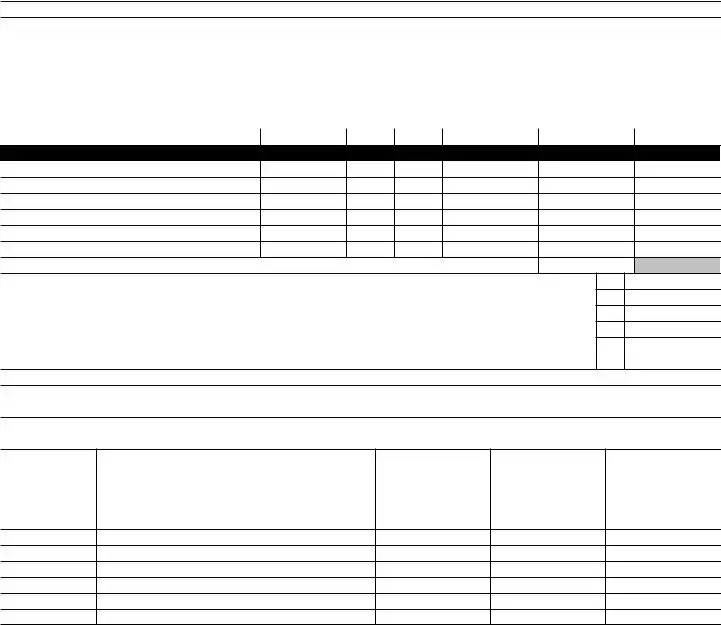

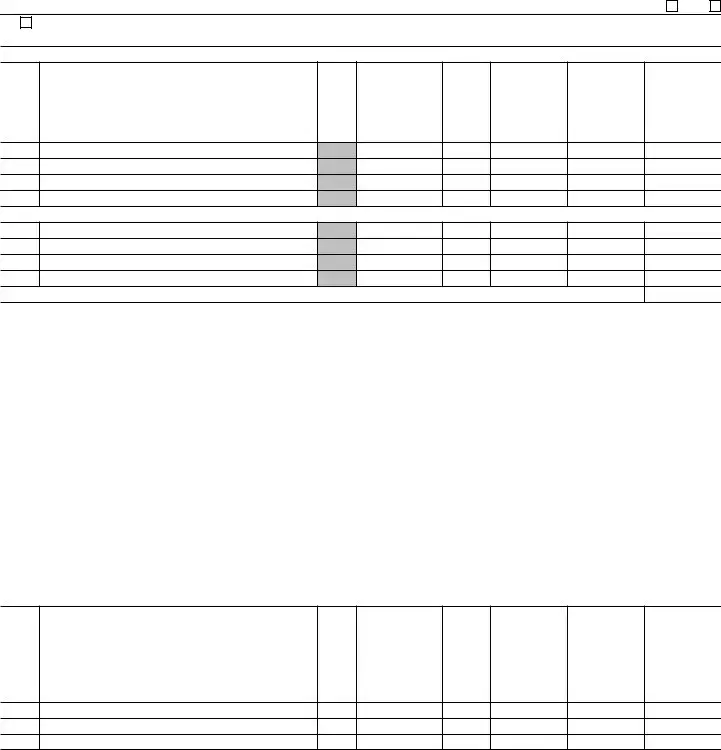

Part 4—Taxable Gift Reconciliation |

|

1 |

Total value of gifts of donor. Add totals from column H of Parts 1, 2, and 3 |

1 |

2 |

Total annual exclusions for gifts listed on line 1 (see instructions) |

2 |

3 |

Total included amount of gifts. Subtract line 2 from line 1 |

3 |

Deductions (see instructions) |

|

4Gifts of interests to spouse for which a marital deduction will be claimed, based on item

|

numbers |

of Schedule A |

|

4 |

|

|

5 |

Exclusions attributable to gifts on line 4 . . |

. . . . . . . . . . . . |

|

5 |

|

|

6 |

Marital deduction. Subtract line 5 from line 4 . |

. . . . . . . . . . . . |

|

6 |

|

|

7 |

Charitable deduction, based on item numbers |

less exclusions |

|

7 |

|

|

8 |

Total deductions. Add lines 6 and 7 . . . |

. . . . . . . . . . . . |

. . . . . . . . |

8 |

9 |

Subtract line 8 from line 3 |

. . . . . . . . . . . . |

. . . . . . . . |

9 |

10 |

Generation-skipping transfer taxes payable with this Form 709 (from Schedule D, Part 3, col. G, total) . . . . |

10 |

11 |

Taxable gifts. Add lines 9 and 10. Enter here and on page 1, Part 2—Tax Computation, line 1 |

11 |

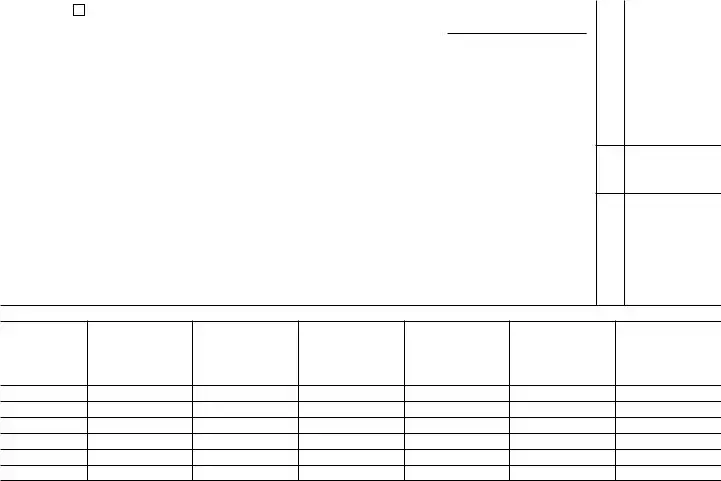

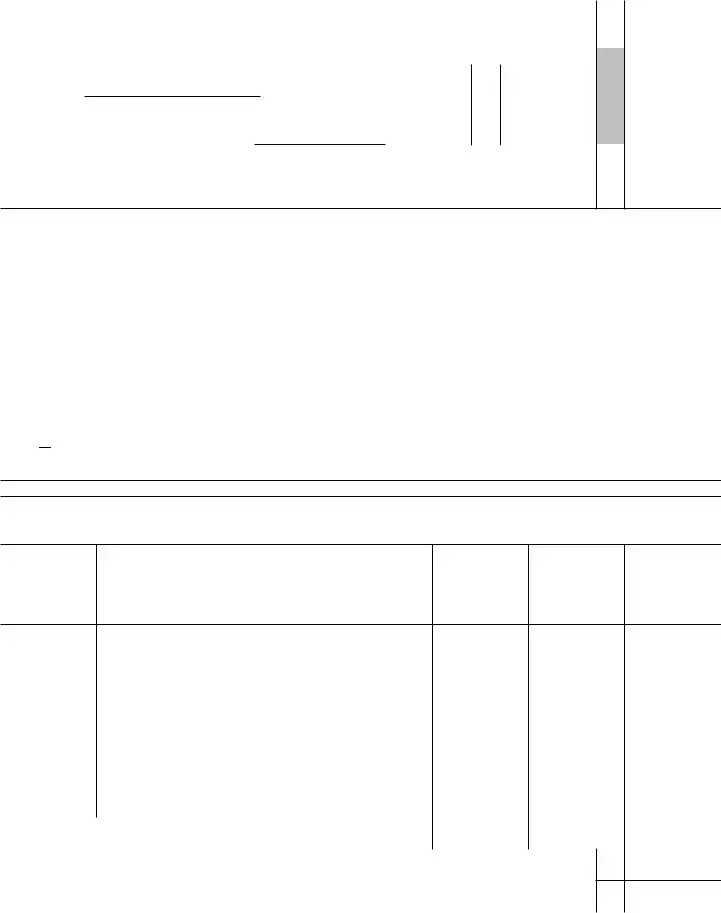

Terminable Interest (QTIP) Marital Deduction. (See instructions for Schedule A, Part 4, line 4.)

If a trust (or other property) meets the requirements of qualified terminable interest property under section 2523(f), and: a. The trust (or other property) is listed on Schedule A; and

b. The value of the trust (or other property) is entered in whole or in part as a deduction on Schedule A, Part 4, line 4, then the donor shall be deemed to have made an election to have such trust (or other property) treated as qualified terminable interest property under section 2523(f).

If less than the entire value of the trust (or other property) that the donor has included in Parts 1 and 3 of Schedule A is entered as a deduction on line 4, the donor shall be considered to have made an election only as to a fraction of the trust (or other property). The numerator of this fraction is equal to the amount of the trust (or other property) deducted on Schedule A, Part 4, line 6. The denominator is equal to the total value of the trust (or other property) listed in Parts 1 and 3 of Schedule A.

If you make the QTIP election, the terminable interest property involved will be included in your spouse’s gross estate upon his or her death (section 2044). See instructions for line 4 of Schedule A. If your spouse disposes (by gift or otherwise) of all or part of the qualifying life income interest, he or she will be considered to have made a transfer of the entire property that is subject to the gift tax. See Transfer of Certain Life Estates Received From Spouse in the instructions.

12 Election Out of QTIP Treatment of Annuities

Check here if you elect under section 2523(f)(6) not to treat as qualified terminable interest property any joint and survivor annuities that are reported on Schedule A and would otherwise be treated as qualified terminable interest property under section 2523(f). See instructions. Enter the item numbers from Schedule A for the annuities for which you are making this election

Check here if you elect under section 2523(f)(6) not to treat as qualified terminable interest property any joint and survivor annuities that are reported on Schedule A and would otherwise be treated as qualified terminable interest property under section 2523(f). See instructions. Enter the item numbers from Schedule A for the annuities for which you are making this election

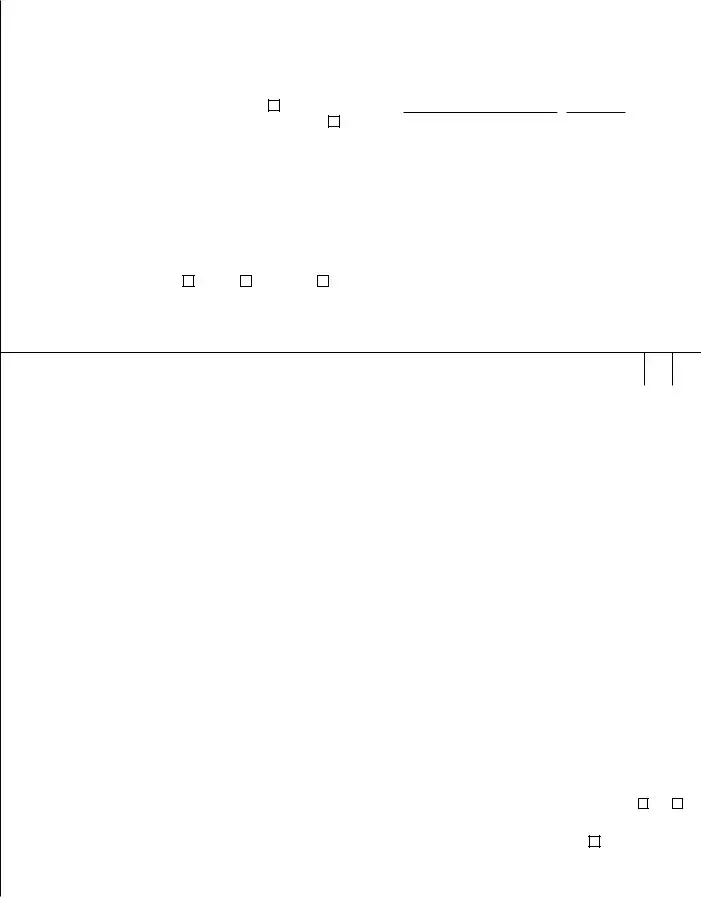

SCHEDULE B Gifts From Prior Periods

If you answered “Yes” on line 11a of page 1, Part 1, see the instructions for completing Schedule B. If you answered “No,” skip to the Tax Computation on page 1 (or Schedule C or D, if applicable). Complete Schedule A before beginning Schedule B. See instructions for recalculation of the column C amounts. Attach calculations.

Check here if you elect under section 2523(f)(6)

Check here if you elect under section 2523(f)(6)