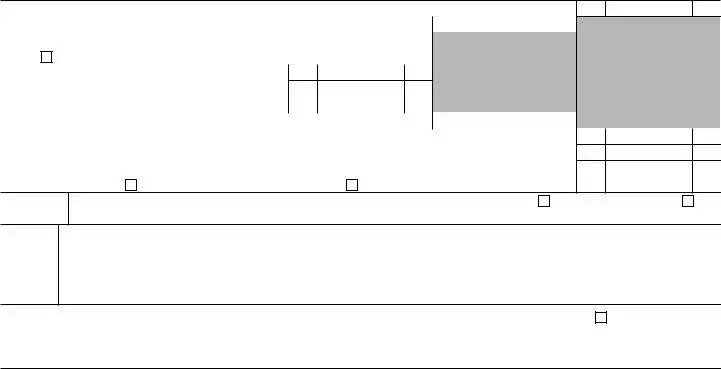

Form 720

(Rev. April 2020)

Department of the Treasury

Internal Revenue Service

Quarterly Federal Excise Tax Return

See the Instructions for Form 720.

Go to www.irs.gov/Form720 for instructions and the latest information.

Check here if:

Final return

Final return

Address change

Name |

Quarter ending |

Number, street, and room or suite no. |

Employer identification number |

(If you have a P.O. box, see the instructions.) |

|

City or town, state or province, country, and ZIP or foreign postal code

FOR IRS USE ONLY

T

FF

FD

FP

I

T

Part I

IRS No. |

Environmental Taxes (attach Form 6627) |

|

|

|

Tax |

|

IRS No. |

18 |

|

Domestic petroleum oil spill tax |

|

|

|

|

|

18 |

21 |

|

Imported petroleum products oil spill tax |

|

|

|

|

|

21 |

98 |

|

Ozone-depleting chemicals (ODCs) |

|

|

|

|

|

98 |

19 |

|

ODC tax on imported products |

|

|

|

|

|

19 |

|

|

Communications and Air Transportation Taxes (see instructions) |

|

|

Tax |

|

|

22 |

|

Local telephone service and teletypewriter exchange service |

|

|

|

|

|

22 |

26 |

|

Transportation of persons by air* |

|

|

|

|

|

26 |

28 |

|

Transportation of property by air* |

|

|

|

|

|

28 |

27 |

|

Use of international air travel facilities* |

|

|

|

|

|

27 |

|

|

Fuel Taxes |

Number of gallons |

Rate |

|

Tax |

|

|

|

|

(a) Diesel, tax on removal at terminal rack |

|

$.244 |

} |

|

|

|

60 |

|

(b) Diesel, tax on taxable events other than removal at terminal rack |

|

.244 |

|

|

60 |

|

|

(c) Diesel, tax on sale or removal of biodiesel mixture |

|

|

|

|

|

|

|

(not at terminal rack) |

|

.244 |

|

|

|

104 |

|

Diesel-water fuel emulsion |

|

.198 |

|

|

|

104 |

105 |

|

Dyed diesel, LUST tax |

|

.001 |

|

|

|

105 |

107 |

|

Dyed kerosene, LUST tax |

|

.001 |

|

|

|

107 |

119 |

|

LUST tax, other exempt removals (see instructions) |

|

.001 |

|

|

|

119 |

35 |

|

(a) Kerosene, tax on removal at terminal rack (see instructions) |

|

.244 |

} |

|

|

|

|

|

(b) Kerosene, tax on taxable events other than removal at terminal rack |

|

.244 |

|

|

35 |

69 |

|

Kerosene for use in aviation (see instructions) |

|

.219 |

|

|

|

69 |

77 |

|

Kerosene for use in commercial aviation (other than foreign trade)** |

|

.044 |

|

|

|

77 |

111 |

|

Kerosene for use in aviation, LUST tax on nontaxable uses |

|

.001 |

|

|

|

111 |

79 |

|

Other fuels (see instructions) |

|

|

|

|

|

79 |

62 |

|

(a) Gasoline, tax on removal at terminal rack |

|

.184 |

} |

|

|

|

|

|

(b) Gasoline, tax on taxable events other than removal at terminal rack |

|

.184 |

|

|

62 |

13 |

|

Any liquid fuel used in a fractional ownership program aircraft |

|

.141 |

|

|

|

13 |

14 |

|

Aviation gasoline |

|

.194 |

|

|

|

14 |

112 |

|

Liquefied petroleum gas (LPG) (see instructions) |

|

.183 |

|

|

|

112 |

118 |

|

“P Series” fuels |

|

.184 |

|

|

|

118 |

120 |

|

Compressed natural gas (CNG) (see instructions) |

|

.183 |

|

|

|

120 |

121 |

|

Liquefied hydrogen |

|

.184 |

|

|

|

121 |

122 |

|

Fischer-Tropsch process liquid fuel from coal (including peat) |

|

.244 |

|

|

|

122 |

123 |

|

Liquid fuel derived from biomass |

|

.244 |

|

|

|

123 |

124 |

|

Liquefied natural gas (LNG) (see instructions) |

|

.243 |

|

|

|

124 |

* No tax on amounts paid for transportation from March 28, 2020, through December 31, 2020. See instructions. ** Tax is $.001 per gallon on removals from March 28, 2020, through December 31, 2020. See instructions.

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. |

Cat. No. 10175Y |

Form 720 (Rev. 4-2020) |

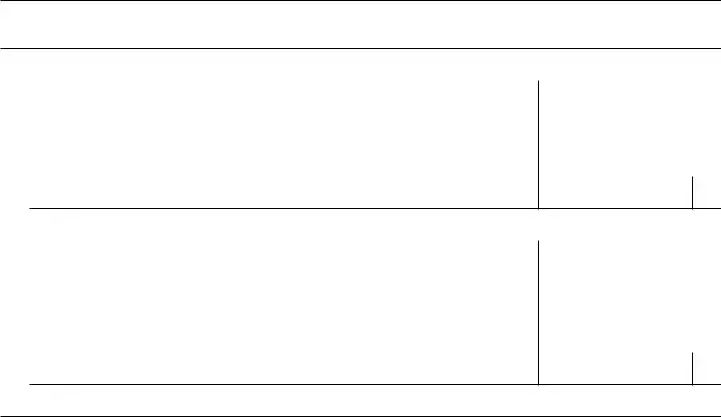

Form 720 (Rev. 4-2020) |

Page 4 |

Schedule A Excise Tax Liability (see instructions)

Note: You must complete Schedule A if you have a liability for any tax in Part I of Form 720. Don’t complete Schedule A for Part II taxes or for a one-time filing of the gas guzzler tax.

1Regular method taxes

(a) Record of Net |

|

|

Period |

|

Tax Liability |

|

1st–15th day |

|

|

16th–last day |

|

First month |

A |

|

|

B |

|

|

|

Second month |

C |

|

|

D |

|

|

|

Third month |

E |

|

|

F |

|

|

|

Special rule for September |

* |

. . . . . . . . . |

|

G |

|

|

|

(b)Net liability for regular method taxes. Add the amounts for each semimonthly period.

2Alternative method taxes (IRS Nos. 22, 26, 28, and 27)

(a) Record of Taxes |

|

|

Period |

|

Considered as |

|

1st–15th day |

|

|

16th–last day |

|

Collected |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First month |

M |

|

|

N |

|

|

|

Second month |

O |

|

|

P |

|

|

|

Third month |

Q |

|

|

R |

|

|

|

Special rule for September |

* |

. . . . . . . . . |

|

S |

|

|

|

(b)Alternative method taxes. Add the amounts for each semimonthly period.

* Complete only as instructed (see instructions).

Schedule T Two-Party Exchange Information Reporting (see instructions)

Fuel |

Number of gallons |

Diesel fuel, gallons received in a two-party exchange within a terminal, included |

|

on Form 720, IRS No. 60(a) |

|

Diesel fuel, gallons delivered in a two-party exchange within a terminal |

|

|

|

Kerosene, gallons received in a two-party exchange within a terminal, included |

|

on Form 720, IRS No. 35(a), 69, 77, or 111 |

|

Kerosene, gallons delivered in a two-party exchange within a terminal |

|

|

|

Gasoline, gallons received in a two-party exchange within a terminal, included |

|

on Form 720, IRS No. 62(a) |

|

Gasoline, gallons delivered in a two-party exchange within a terminal |

|

|

|

Aviation gasoline, gallons received in a two-party exchange within a terminal, included |

|

on Form 720, IRS No. 14 |

|

Aviation gasoline, gallons delivered in a two-party exchange within a terminal |

|

|

|

|

Form 720 (Rev. 4-2020) |

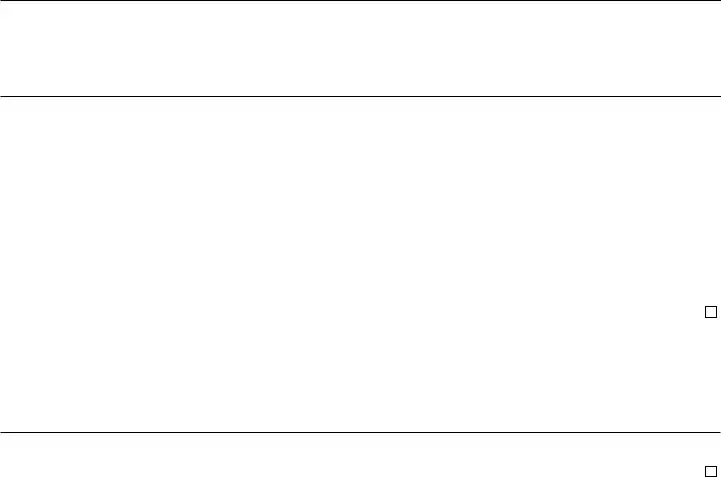

Form 720 (Rev. 4-2020) |

|

Page 5 |

Schedule C |

Claims |

Month your income tax year ends |

•Complete Schedule C for claims only if you are reporting liability in Part I or II of Form 720.

•See instructions for kerosene used in commercial aviation from March 28, 2020, through December 31, 2020.

•Attach a statement explaining each claim as required. Include your name and EIN on the statement (see instructions).

Caution: Claimant has the name and address of the person(s) who sold the fuel to the claimant, the dates of purchase, and if exported, the required proof of export. For claims on lines 1a and 2b (type of use 13 and 14), 3c, 4b, and 5, claimant hasn’t waived the right to make the claim.

1 |

Nontaxable Use of Gasoline |

Note: CRN is credit reference number. |

Period of claim |

|

|

|

|

|

|

Type of use |

Rate |

Gallons |

Amount of claim |

CRN |

a Gasoline (see Caution above line 1) |

|

$.183 |

|

$ |

|

362 |

|

|

|

|

|

|

|

|

b Exported (see Caution above line 1) |

|

.184 |

|

|

|

411 |

2 |

Nontaxable Use of Aviation Gasoline |

Period of claim |

|

|

|

|

|

|

Type of use |

Rate |

Gallons |

Amount of claim |

CRN |

a Used in commercial aviation (other than foreign trade) |

|

$.15 |

|

$ |

|

354 |

|

|

|

|

|

|

|

|

b Other nontaxable use (see Caution above line 1) |

|

.193 |

|

|

|

324 |

|

|

|

|

|

|

|

|

c Exported (see Caution above line 1) |

|

.194 |

|

|

|

412 |

|

|

|

|

|

|

|

|

d LUST tax on aviation fuels used in foreign trade |

|

.001 |

|

|

|

433 |

3 |

Nontaxable Use of Undyed Diesel Fuel |

Period of claim |

|

|

|

Claimant certifies that the diesel fuel did not contain visible evidence of dye.

Exception. If any of the diesel fuel included in this claim did contain visible evidence of dye, attach a detailed explanation and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

|

Type of use |

Rate |

Gallons |

|

Amount of claim |

CRN |

a |

Nontaxable use |

|

$.243 |

|

$ |

|

|

360 |

b |

Use in trains |

|

.243 |

|

|

|

|

353 |

c Use in certain intercity and local buses (see Caution above line 1) |

|

.17 |

|

|

|

|

350 |

|

|

|

|

|

|

|

|

|

d Use on a farm for farming purposes |

|

.243 |

|

|

|

|

360 |

|

|

|

|

|

|

|

|

|

e Exported (see Caution above line 1) |

|

.244 |

|

|

|

|

413 |

4Nontaxable Use of Undyed Kerosene (Other Than Kerosene Used in Aviation) Period of claim

Claimant certifies that the kerosene did not contain visible evidence of dye.

Exception. If any of the kerosene included in this claim did contain visible evidence of dye, attach a detailed explanation and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

Caution: Claims cannot be made on line 4 for kerosene sales from a blocked pump. |

Type of use |

Rate |

Gallons |

Amount of claim |

CRN |

a |

Nontaxable use |

|

$.243 |

|

$ |

|

346 |

b |

Use in certain intercity and local buses (see Caution above line 1) |

|

.17 |

|

|

|

347 |

c |

Use on a farm for farming purposes |

|

.243 |

|

|

|

346 |

d |

Exported (see Caution above line 1) |

|

.244 |

|

|

|

414 |

e |

Nontaxable use taxed at $.044 |

|

.043 |

|

|

|

377 |

f |

Nontaxable use taxed at $.219 |

|

.218 |

|

|

|

369 |

5 Kerosene Used in Aviation (see Caution above line 1) |

Period of claim |

|

|

|

|

|

Type of use |

Rate |

Gallons |

Amount of claim |

CRN |

a |

Kerosene used in commercial aviation (other than foreign |

|

|

|

|

|

|

|

trade) taxed at $.244 |

|

$.200 |

|

$ |

|

417 |

b |

Kerosene used in commercial aviation (other than foreign |

|

|

|

|

|

|

|

trade) taxed at $.219 |

|

.175 |

|

|

|

355 |

c |

Nontaxable use (other than use by state or local |

|

|

|

|

|

|

|

government) taxed at $.244 |

|

.243 |

|

|

|

346 |

d |

Nontaxable use (other than use by state or local |

|

|

|

|

|

|

|

government) taxed at $.219 |

|

.218 |

|

|

|

369 |

e |

LUST tax on aviation fuels used in foreign trade |

|

.001 |

|

|

|

433 |

Form 720 (Rev. 4-2020)

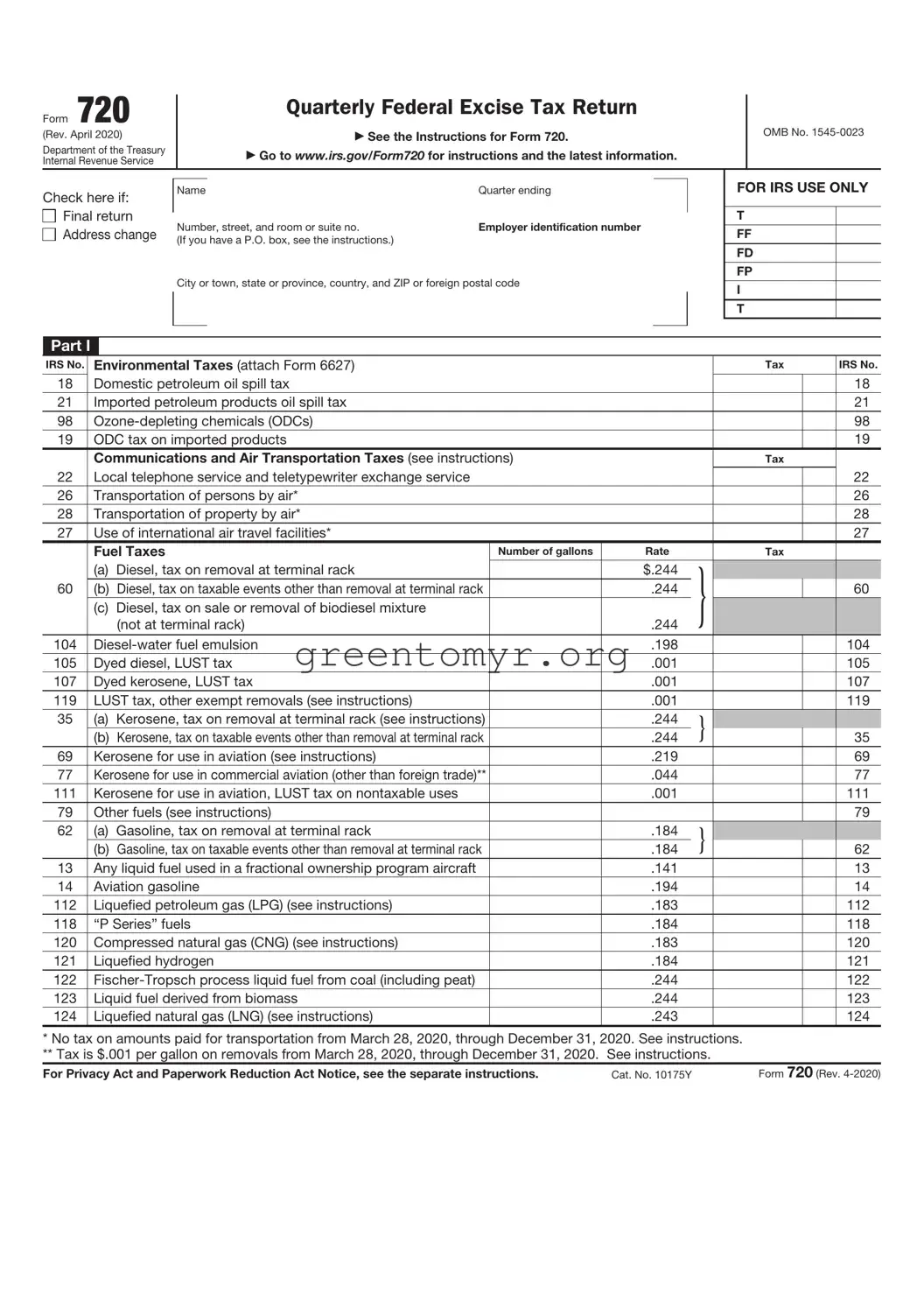

Form 720 (Rev. 4-2020) |

Page 6 |

6Nontaxable Use of Alternative Fuel

Caution: There is a reduced credit rate for use in certain intercity and local buses (type of use 5) (see instructions).

|

|

Type of use |

Rate |

Gallons, or gasoline |

Amount of claim |

CRN |

|

|

or diesel gallon |

|

|

|

|

equivalents |

|

|

|

a |

Liquefied petroleum gas (LPG) (see instructions) |

|

$.183 |

|

$ |

|

419 |

b |

“P Series” fuels |

|

.183 |

|

|

|

420 |

c |

Compressed natural gas (CNG) (see instructions) |

|

.183 |

|

|

|

421 |

d |

Liquefied hydrogen |

|

.183 |

|

|

|

422 |

e |

Fischer-Tropsch process liquid fuel from coal (including peat) |

|

.243 |

|

|

|

423 |

f |

Liquid fuel derived from biomass |

|

.243 |

|

|

|

424 |

g |

Liquefied natural gas (LNG) (see instructions) |

|

.243 |

|

|

|

425 |

h |

Liquefied gas derived from biomass |

|

.183 |

|

|

|

435 |

7 Sales by Registered Ultimate Vendors of Undyed Diesel Fuel |

|

Period of claim |

|

|

|

|

|

|

Registration number |

|

|

|

Claimant certifies that it sold the diesel fuel at a tax-excluded price, repaid the amount of tax to the buyer, or has obtained written consent of the buyer to make the claim. Claimant certifies that the diesel fuel didn’t contain visible evidence of dye. Exception. If any of the diesel fuel included in this claim did contain visible evidence of dye, attach a detailed explanation and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

|

Rate |

Gallons |

|

Amount of claim |

CRN |

a Use by a state or local government |

$.243 |

|

$ |

|

|

360 |

|

|

|

|

|

|

|

|

b Use in certain intercity and local buses |

.17 |

|

|

|

|

350 |

8 Sales by Registered Ultimate Vendors of Undyed Kerosene |

|

Period of claim |

|

|

|

|

|

(Other Than Kerosene For Use in Aviation) |

Registration number |

|

|

|

|

Claimant certifies that it sold the kerosene at a tax-excluded price, repaid the amount of tax to the buyer, or has obtained the written consent of the buyer to make the claim. Claimant certifies that the kerosene didn’t contain visible evidence of dye. Exception. If any of the kerosene included in this claim did contain visible evidence of dye, attach a detailed

explanation and check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

|

Rate |

Gallons |

Amount of claim |

CRN |

a Use by a state or local government |

$.243 |

|

$ |

|

346 |

|

|

|

|

|

|

b Sales from a blocked pump |

.243 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c Use in certain intercity and local buses |

.17 |

|

|

|

347 |

9 Sales by Registered Ultimate Vendors of Kerosene For Use in Aviation |

Registration number |

|

|

|

•See Caution above line 1.

•Claimant sold the kerosene for use in aviation at a tax-excluded price and hasn’t collected the amount of tax from the buyer, repaid the amount of tax to the buyer, or has obtained written consent of the buyer to make the claim. See the instructions for additional information to be submitted.

|

|

Type of use |

Rate |

Gallons |

Amount of claim |

CRN |

a |

Use in commercial aviation (other than foreign trade) taxed at $.219 |

|

$.175 |

|

$ |

|

355 |

b |

Use in commercial aviation (other than foreign trade) taxed at $.244 |

|

.200 |

|

|

|

417 |

c |

Nonexempt use in noncommercial aviation |

|

.025 |

|

|

|

418 |

d |

Other nontaxable uses taxed at $.244 |

|

.243 |

|

|

|

346 |

e |

Other nontaxable uses taxed at $.219 |

|

.218 |

|

|

|

369 |

f |

LUST tax on aviation fuels used in foreign trade |

|

.001 |

|

|

|

433 |

10 Sales by Registered Ultimate Vendors of Gasoline |

Registration number |

|

|

|

Claimant sold the gasoline at a tax-excluded price and hasn’t collected the amount of tax from the buyer, repaid the amount of tax to the buyer, or has obtained written consent of the buyer to take the claim; and obtained an unexpired certificate from the buyer and has no reason to believe any information in the certificate is false. See the instructions for additional information to be submitted.

|

|

Rate |

Gallons |

Amount of claim |

CRN |

a Use by a nonprofit educational organization |

$.183 |

|

$ |

|

362 |

|

|

|

|

|

|

b Use by a state or local government |

.183 |

|

|

|

|

|

|

|

Form 720 (Rev. 4-2020) |

|

|

|

|

|

|

|

Page 7 |

11 Sales by Registered Ultimate Vendors of Aviation Gasoline |

Registration number |

|

|

|

|

|

Claimant sold the aviation gasoline at a tax-excluded price and hasn’t collected the amount of tax from the buyer, repaid the amount |

|

of tax to the buyer, or has obtained written consent of the buyer to take the claim; and obtained an unexpired certificate from the buyer |

|

and has no reason to believe any information in the certificate is false. See the instructions for additional information to be submitted. |

|

|

|

|

|

|

|

|

|

|

|

|

Rate |

|

Gallons |

|

Amount of claim |

|

CRN |

a Use by a nonprofit educational organization |

$.193 |

|

|

$ |

|

|

|

324 |

|

|

|

|

|

|

|

|

|

b Use by a state or local government |

.193 |

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

Biodiesel or Renewable Diesel Mixture Credit Period of claim |

|

|

Registration number |

|

|

Biodiesel mixtures. Claimant produced a mixture by mixing biodiesel with diesel fuel. The biodiesel used to produce the |

|

mixture met ASTM D6751 and met EPA’s registration requirements for fuels and fuel additives. The mixture was sold by the |

|

claimant to any person for use as a fuel or was used as a fuel by the claimant. Claimant has attached the Certificate for |

|

|

Biodiesel and, if applicable, the Statement of Biodiesel Reseller. Renewable diesel mixtures. Claimant produced a mixture by |

|

mixing renewable diesel with liquid fuel (other than renewable diesel). The renewable diesel used to produce the renewable |

|

diesel mixture was derived from biomass, met EPA’s registration requirements for fuels and fuel additives, and met ASTM |

|

D975, D396, or other equivalent standard approved by the IRS. The mixture was sold by the claimant to any person for use as |

|

a fuel or was used as a fuel by the claimant. Claimant has attached the Certificate for Biodiesel and, if applicable, Statement of |

|

Biodiesel Reseller, both of which have been edited as discussed in the instructions for line 12. See the instructions for line 12 |

|

for information about renewable diesel used in aviation. |

|

|

|

|

|

|

|

|

|

|

Rate |

Gal. of biodiesel or |

|

Amount of claim |

|

CRN |

|

|

|

renewable diesel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a Biodiesel (other than agri-biodiesel) mixtures |

$1.00 |

|

|

$ |

|

|

|

388 |

b |

Agri-biodiesel mixtures |

1.00 |

|

|

|

|

|

|

390 |

c |

Renewable diesel mixtures |

1.00 |

|

|

|

|

|

|

307 |

13 Alternative Fuel Credit and Alternative Fuel Mixture Credit |

|

Registration number |

|

For the alternative fuel mixture credit, claimant produced a mixture by mixing taxable fuel with alternative fuel. Claimant certifies that it (a) produced the alternative fuel, or (b) has in its possession the name, address, and EIN of the person(s) that sold the alternative fuel to the claimant; the date of purchase; and an invoice or other documentation identifying the amount of the alternative fuel. The claimant also certifies that it made no other claim for the amount of the alternative fuel, or has repaid the amount to the government. The alternative fuel mixture was sold by the claimant to any person for use as a fuel or was used as a fuel by the claimant.

|

|

|

Gallons, or |

|

|

|

|

|

Rate |

gasoline or diesel |

Amount of claim |

CRN |

|

|

|

gallon equivalents |

|

|

|

|

|

|

(see instructions) |

|

|

|

a |

Liquefied petroleum gas (LPG)* |

$.50 |

|

|

$ |

|

426 |

b |

“P Series” fuels |

.50 |

|

|

|

|

427 |

c |

Compressed natural gas (CNG)* |

.50 |

|

|

|

|

428 |

d |

Liquefied hydrogen |

.50 |

|

|

|

|

429 |

e |

Fischer-Tropsch process liquid fuel from coal (including peat) |

.50 |

|

|

|

|

430 |

f |

Liquid fuel derived from biomass |

.50 |

|

|

|

|

431 |

g |

Liquefied natural gas (LNG)* |

.50 |

|

|

|

|

432 |

h |

Liquefied gas derived from biomass* |

.50 |

|

|

|

|

436 |

i |

Compressed gas derived from biomass* |

.50 |

|

|

|

|

437 |

|

* You can’t claim the alternative fuel mixture credit for this fuel. |

|

|

|

|

|

|

|

|

|

|

|

14 |

Other claims. See the instructions. For lines 14b and 14c, see the Caution above line 1 on page 5. |

Amount of claim |

CRN |

a |

Section 4051(d) tire credit (tax on vehicle reported on IRS No. 33) |

|

|

|

$ |

|

366 |

b |

Exported dyed diesel fuel and exported gasoline blendstocks taxed at $.001 |

|

|

|

|

415 |

c |

Exported dyed kerosene |

|

|

|

|

|

416 |

d |

Diesel-water fuel emulsion |

|

|

|

|

|

|

e |

Registered credit card issuers |

|

|

|

|

|

|

|

|

|

Number of tires |

Amount of claim |

CRN |

f |

Taxable tires other than bias ply or super single tires |

|

|

|

$ |

|

396 |

g |

Taxable tires, bias ply or super single tires (other than super single tires designed for steering) |

|

|

|

|

304 |

h |

Taxable tires, super single tires designed for steering |

|

|

|

|

|

305 |

i |

|

|

|

|

|

|

|

j |

|

|

|

|

|

|

|

k |

|

|

|

|

|

|

|

15 |

Total claims. Add amounts on lines 1 through 14. Enter the result here and on Form 720, Part III, line 4. |

15 |

|

|

|

Form 720-V, Payment Voucher

Purpose of Form

Complete Form 720-V if you’re making a payment by check or money order with Form 720, Quarterly Federal Excise Tax Return. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you.

If you have your return prepared by a third party and a payment is required, provide this payment voucher to the return preparer.

Don’t file Form 720-V if you’re paying the balance due on line 10 of Form 720 using EFTPS.

Specific Instructions

Box 1. If you don’t have an EIN, you may apply for one online by visiting www.irs.gov/EIN. You may also apply for an EIN by faxing or mailing Form SS-4, Application for Employer Identification Number, to the IRS. However, if you’re making a one-time filing, enter your social security number.

Box 2. Enter the amount paid from line 10 of Form 720.

Box 3. Darken the circle identifying the quarter for which the payment is made. Darken only one circle.

Box 4. Enter your name and address as shown on Form 720.

•Enclose your check or money order made payable to “United States Treasury.” Be sure to enter your

EIN (SSN for one-time filing), “Form 720,” and the tax period on your check or money order. Don’t send cash. Don’t staple this voucher or your payment to the return (or to each other).

•Detach the completed voucher and send it with your payment and Form 720. See Where To File in the Instructions for Form 720.

Form 720-V (2020)

Detach here and mail with your payment and Form 720.

Form 720-V

Department of the Treasury

Internal Revenue Service

1Enter your employer identification

number (EIN). See instructions.

|

Payment Voucher |

OMB No. 1545-0023 |

|

|

|

|

|

Don’t staple or attach this voucher to your payment. |

2020 |

|

|

|

|

Enter the amount of your payment.

Make your check or money order payable to “United States Treasury.”

3Tax Period

1st |

3rd |

Quarter |

Quarter |

2nd |

4th |

Quarter |

Quarter |

4Enter your business name (individual name if sole proprietor).

Enter your address.

City or town, state or province, country, and ZIP or foreign postal code

Final return

Final return