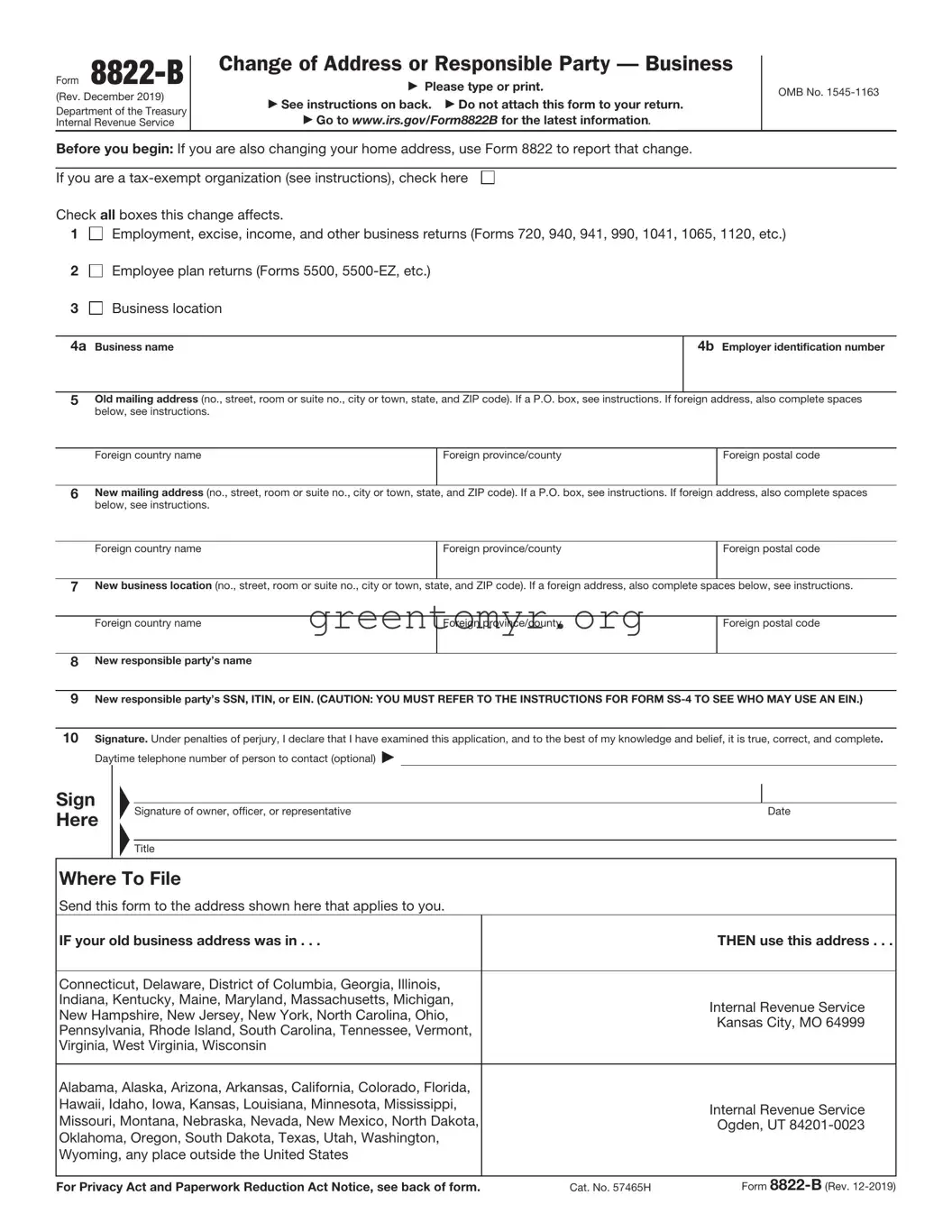

Sign |

FF |

Signature of owner, officer, or representative |

|

Here |

|

|

|

|

|

Title |

|

|

|

Where To File

Send this form to the address shown here that applies to you.

IF your old business address was in . . .

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming, any place outside the United States

Date

THEN use this address . . .

Internal Revenue Service Kansas City, MO 64999

Internal Revenue Service Ogden, UT 84201-0023

Employment, excise, income, and other business returns (Forms 720, 940, 941, 990, 1041, 1065, 1120, etc.)

Employment, excise, income, and other business returns (Forms 720, 940, 941, 990, 1041, 1065, 1120, etc.)