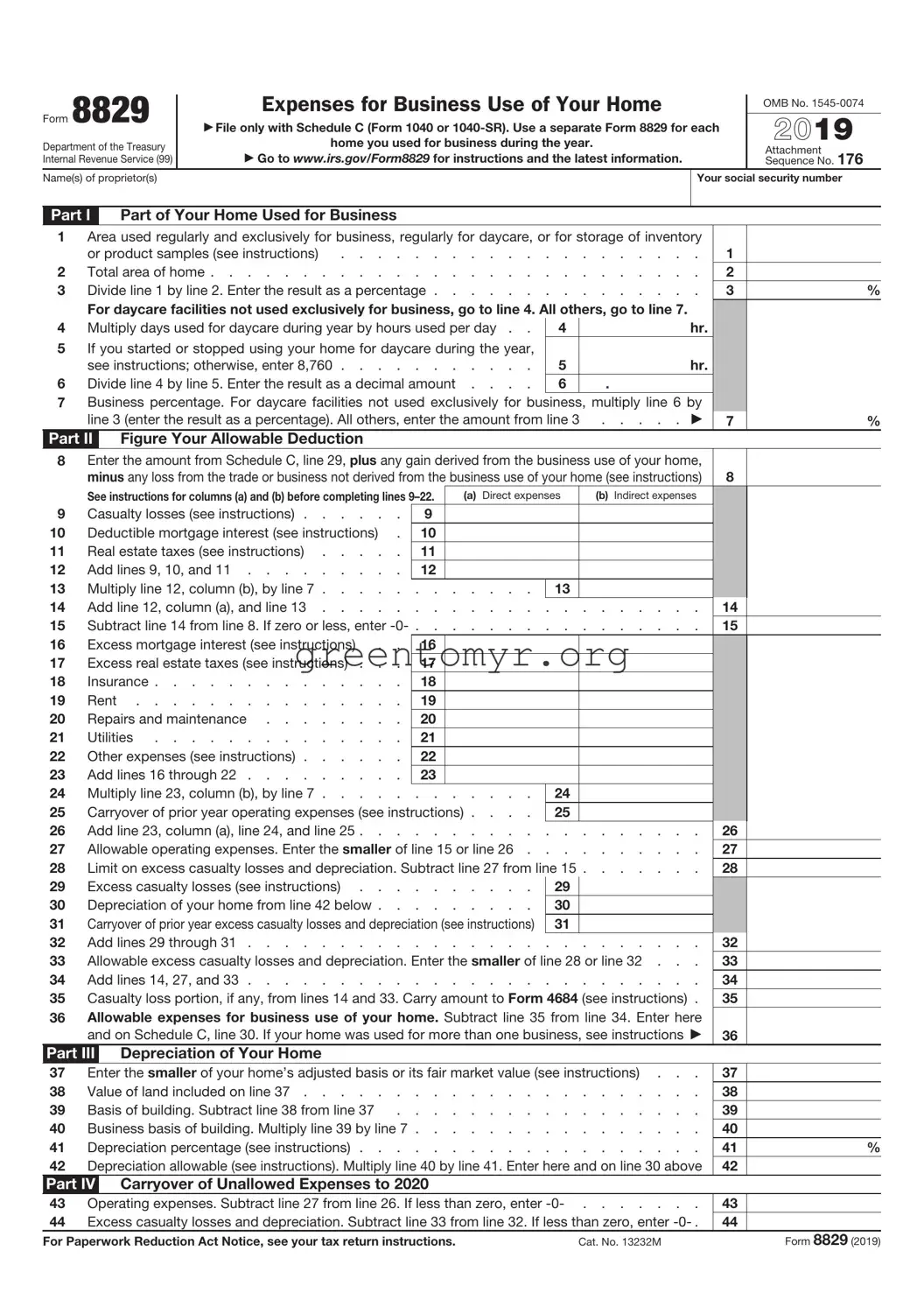

Filling out the IRS 8829 form can be a complex task, and many people misstep along the way. One common mistake is failing to accurately measure the space used for business purposes. It's essential to calculate the square footage correctly. Missing this detail can lead to significant errors in the deductions claimed.

Another frequent issue is not keeping proper records. Individuals often overlook the need to document expenses related to the business use of their home. Without receipts and supporting documentation, the IRS may question the deductions. It's vital to maintain thorough records for all related expenditures.

Some taxpayers mistakenly combine personal and business expenses. When completing the IRS 8829, it is crucial to clearly distinguish between costs associated with business and personal use. Mixing these expenses can result in audits and potential penalties.

Additionally, individuals sometimes neglect to include specific indirect expenses associated with the business use of their home. These can include utilities, mortgage interest, and insurance. Failing to account for these indirect costs can lead to a lower deduction claim than what is actually allowable.

Another common mistake is misunderstanding the qualifications for the home office deduction itself. Many believe that having a desk in a spare room automatically qualifies them for the deduction. However, to qualify, the space must be used regularly and exclusively for business. Misinterpretation of this rule can lead to incorrect filings.

People often forget to accurately calculate the percentage of the home used for business. This percentage is crucial in determining the deductible amount. Errors here can lead to deductions that are either too low or too high, potentially causing problems with the IRS.

Some taxpayers also fail to update their information when their business expenses or home use changes. It is important to revisit the IRS 8829 form as your situation changes. Regular updates ensure that your claims remain accurate and comply with IRS regulations.

Completing the form but failing to sign and date it is another error to avoid. A signature indicates that all the information provided is truthful and accurate. Not including this crucial step can lead to processing delays or, worse, an assumption that the form is incomplete.

People sometimes overlook the importance of deadlines. Submitting the IRS 8829 form late can incur penalties or affect your refund. Staying aware of important tax dates will help ensure that submissions are made on time.

Lastly, individuals often ignore the instructions for the IRS 8829 form. The instructions provide critical guidance on completing the form correctly. Skipping this resource can lead to confusion and misstatements on the form.