|

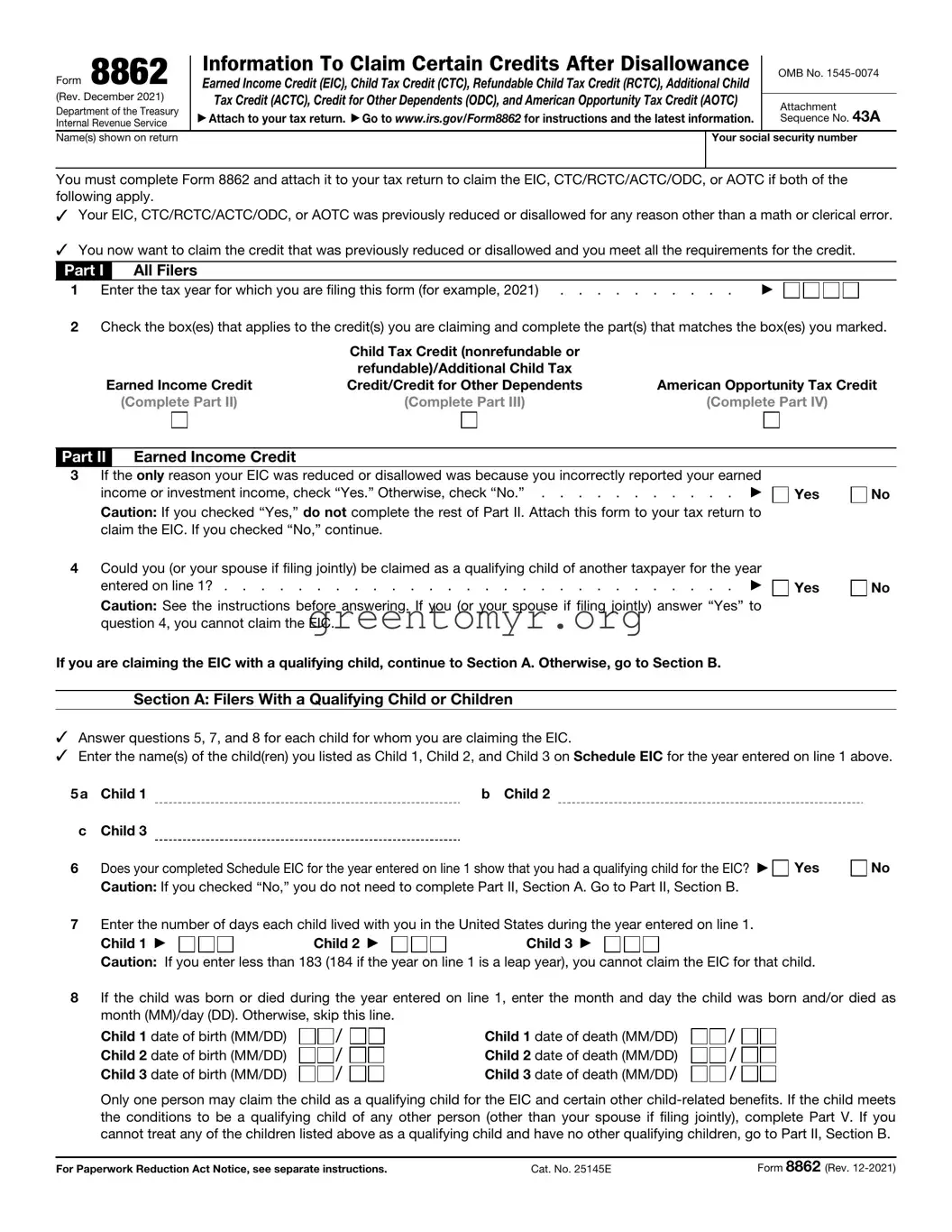

Form 8862 |

Information To Claim Certain Credits After Disallowance |

OMB No. 1545-0074 |

|

Earned Income Credit (EIC), American Opportunity Tax Credit (AOTC), Child Tax Credit (CTC), |

|

|

(Rev. November 2018) |

Additional Child Tax Credit (ACTC), and Credit for Other Dependents (ODC) |

|

|

Attachment |

|

Department of the Treasury |

|

|

|

Attach to your tax return. Go to www.irs.gov/Form8862 for instructions and the latest information. |

Sequence No. 43A |

|

Internal Revenue Service |

|

|

|

|

|

Name(s) shown on return |

|

Your social security number |

|

|

|

|

|

You must complete Form 8862 and attach it to your tax return to claim the EIC, CTC/ACTC/ODC, or AOTC if both of the following apply.

Your EIC, CTC/ACTC/ODC, or AOTC was previously reduced or disallowed for any reason other than a math or clerical error.

You now want to claim the credit that was previously reduced or disallowed and you meet all the requirements for the credit.

|

|

|

Part I |

All Filers |

1 |

Enter the tax year for which you are filing this form (for example, 2018) |

2Check the box(es) that applies to the credit(s) you are claiming and complete the part(s) that matches the box(es) you marked.

|

Child Tax Credit/Additional Child Tax |

|

Earned Income Credit |

Credit/Credit for Other Dependents |

American Opportunity Tax Credit |

(Complete Part II) |

(Complete Part III) |

(Complete Part IV) |

Part II Earned Income Credit

3If the only reason your EIC was reduced or disallowed was because you incorrectly reported your earned

income or investment income, check “Yes.” Otherwise, check “No.” |

Yes |

Caution: If you checked “Yes,” do not complete the rest of Part II. Attach this form to your tax return to |

|

claim the EIC. If you checked “No,” continue. |

|

4Could you (or your spouse if filing jointly) be claimed as a qualifying child of another taxpayer for the year entered on line 1? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Caution: See the instructions before answering. If you (or your spouse if filing jointly) answer “Yes” to question 4, you cannot claim the EIC.

If you are claiming the EIC with a qualifying child, continue to Section A. Otherwise, go to Section B.

Section A: Filers With a Qualifying Child or Children

Answer questions 5, 7, and 8 for each child for whom you are claiming the EIC.

Enter the name(s) of the child(ren) you listed as Child 1, Child 2, and Child 3 on Schedule EIC for the year entered on line 1 above.

5a |

Child 1 |

b Child 2 |

|

c |

Child 3 |

|

|

6 |

Does your completed Schedule EIC for the year entered on line 1 show that you had a qualifying child for the EIC? |

Yes |

|

Caution: If you checked “No,” you do not need to complete Part II, Section A. Go to Part II, Section B. |

|

7Enter the number of days each child lived with you in the United States during the year entered on line 1.

Caution: If you enter less than 183 (184 if the year on line 1 is a leap year), you cannot claim the EIC for that child.

8If the child was born or died during the year entered on line 1, enter the month and day the child was born and/or died as month (MM)/day (DD). Otherwise, skip this line.

Child 1 date of birth (MM/DD) |

/ |

Child 1 date of death (MM/DD) |

/ |

Child 2 date of birth (MM/DD) |

/ |

Child 2 date of death (MM/DD) |

/ |

Child 3 date of birth (MM/DD) |

/ |

Child 3 date of death (MM/DD) |

/ |

Only one person may claim the child as a qualifying child for the EIC and certain other child-related benefits. If the child meets the conditions to be a qualifying child of any other person (other than your spouse if filing jointly), complete Part V. If you cannot treat any of the children listed above as a qualifying child and have no other qualifying children, go to Part II, Section B.

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 25145E |

Form 8862 (Rev. 11-2018) |

Form 8862 (Rev. 11-2018)Page 2

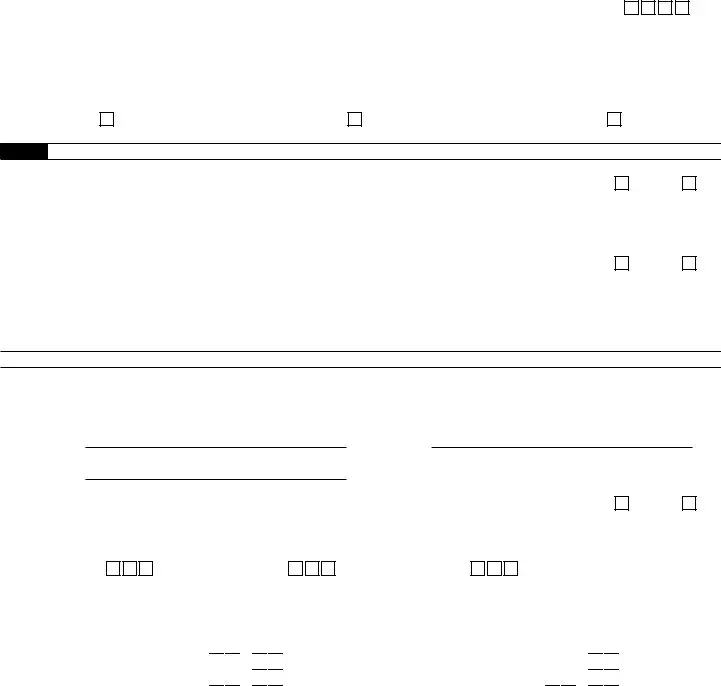

Section B: Filers Without a Qualifying Child or Children

9a Enter the number of days during the year entered on line 1 that your main home was in the United States . . .

bIf married filing jointly, enter the number of days during the year entered on line 1 that your spouse’s main home was

|

in the United States |

|

Caution: Members of the military stationed outside the United States during the year entered on line 1, see the instructions |

|

before answering. If you enter less than 183 (184 if the year on line 1 is a leap year) on either line 9a or 9b (if filing jointly), you |

|

cannot claim the EIC. |

10a |

Enter your age at the end of the year on line 1 |

|

b |

Enter your spouse’s age at the end of the year on line 1 |

|

|

Caution: If your spouse died during the year entered on line 1 or you are preparing a return for someone who died during the |

|

year entered on line 1, see the instructions before answering. If neither you (nor your spouse if filing jointly) were at least age 25 |

|

but under age 65 at the end of the year on line 1, you cannot claim the EIC. |

11a Can you be claimed as a dependent on another taxpayer’s return? . . . . . . . . . . . .

bCan your spouse (if filing jointly) be claimed as a dependent on another taxpayer’s return? . . . .

Caution: If either you (or your spouse if filing jointly) answer “Yes” to question 11, you cannot claim the EIC.

Part III Child Tax Credit/Additional Child Tax Credit/Credit for Other Dependents

12Enter the name(s) of each child for whom you are claiming the child tax credit/additional child tax credit (CTC/ACTC). If you are claiming the CTC/ACTC for more than four qualifying children, attach a statement also answering questions 12 and 14–17 for those children.

a |

Child 1 |

b |

Child 2 |

c |

Child 3 |

d |

Child 4 |

13Enter the name(s) of each person for whom you are claiming the credit for other dependents (ODC). If you are claiming the credit for more than four dependents, attach a statement answering questions 13, 16, and 17 for those dependents.

a |

Other dependent 1 |

b |

Other dependent 2 |

c |

Other dependent 3 |

d |

Other dependent 4 |

14For each child listed in response to question 12, did the child live with you for more than half of the year or meet an exception described in the instructions?

15For each child listed in response to question 12, did the child meet the requirements to be a qualifying child for the CTC/ACTC?

16For each person claimed as a qualifying child or other dependent for the CTC/ACTC/ODC, is that person your dependent?

17For each person claimed as a qualifying child or other dependent for the CTC/ACTC/ODC, is that person a citizen, national, or resident of the United States? See Pub. 519 for more information on when a person is a resident of the United States or is treated as a resident of the United States.

Other dependent 1 Other dependent 3

Other dependent 2 Other dependent 4

Caution: If the answer is “No” for questions 14, 15, 16, or 17, you cannot claim the CTC/ACTC/ODC for that child or other dependent.

Only one person can claim the child as a qualifying child for the CTC/ACTC/ODC. If the child meets the conditions to be a qualifying child of any other person (other than your spouse if filing jointly), complete Part V. If you cannot treat any of the children listed above as a qualifying child and have no other qualifying children, you cannot claim the CTC/ACTC or the ODC based on having a qualifying child. If you are a noncustodial parent who is entitled to treat the child as a qualifying child, you do not need to complete Part V.

Form 8862 (Rev. 11-2018) |

Page 3 |

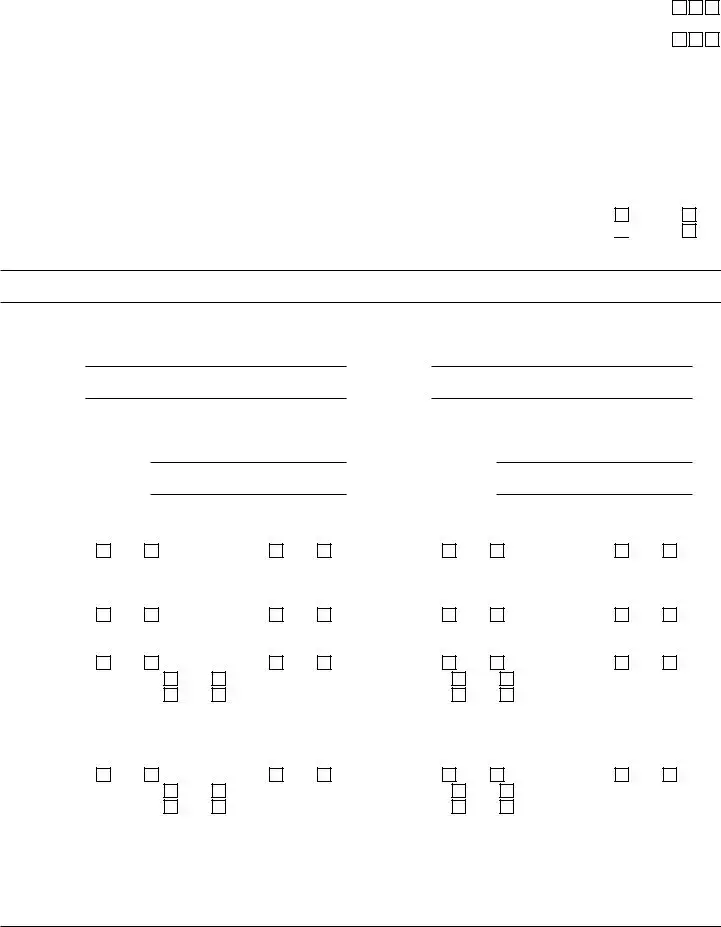

Part IV |

American Opportunity Tax Credit |

|

Answer the following questions for each student for whom you are claiming the AOTC. If you have more than three students, attach a statement also answering questions 18 and 19 for those students.

Enter the name(s) of the student(s) as listed on Form 8863.

18a Student 1 |

b Student 2 |

cStudent 3

19a Did the student meet the requirements to be an eligible student for purposes of the AOTC for the year entered on line 1? See Pub. 970 for more information.

bHas the Hope Scholarship Credit or AOTC been claimed for the student for any 4 tax years before the year entered on line 1?

Caution: If you answered “No” to question 19a or “Yes” to question 19b, you cannot claim the credit for that student.

Part V Qualifying Child of More Than One Person

Answer the following questions for each child who meets the conditions to be a qualifying child of any other person (other than your spouse if filing jointly). If you have more than four qualifying children, attach a statement also answering questions 20–22 for those children.

20a |

Child 1 |

b |

Child 2 |

c |

Child 3 |

d |

Child 4 |

21Enter the address where you and the child lived together during the year entered on line 1. If you lived with the child at more than one address during the year, attach a list of the addresses where you lived.

Child 1 Number and street

City or town, state, and ZIP code

Child 2 If same as shown for Child 1, check this box

Number and street

City or town, state, and ZIP code

Child 3 If same as shown for Child 1, check this box

Number and street

City or town, state, and ZIP code

Child 4 If same as shown for Child 1, check this box

Number and street

City or town, state, and ZIP code

Otherwise, enter below.

Otherwise, enter below.

Otherwise, enter below.

Form 8862 (Rev. 11-2018) |

Page 4 |

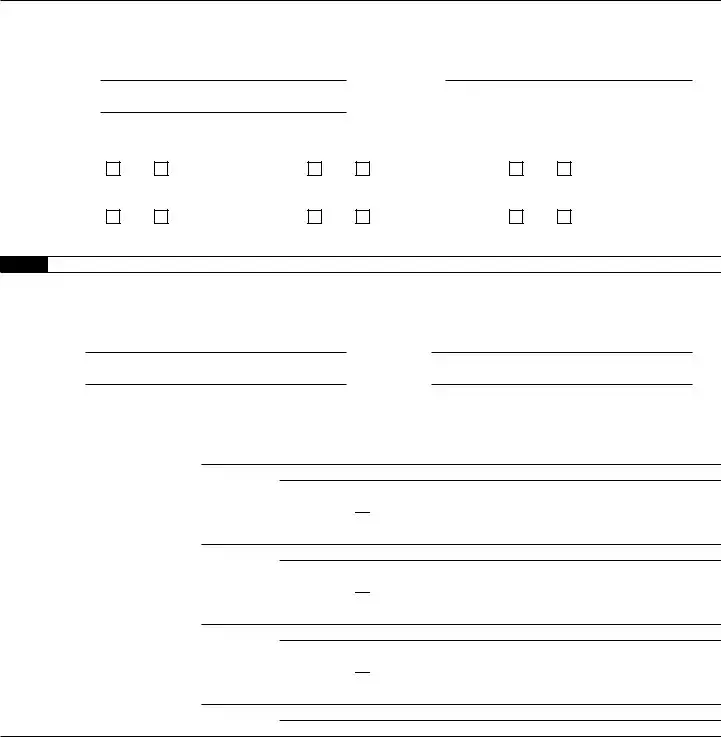

Part V |

Qualifying Child of More Than One Person (continued) |

|

22Did any other person (except your spouse, if filing jointly, and your dependents claimed on your return)

live with Child 1, Child 2, Child 3, or Child 4 for more than half the year? |

Yes |

If “Yes,” enter the relationship of each person to the child on the appropriate line below. |

|

Other person living with Child 1: Name

Relationship to Child 1

Other person living with Child 2: If same as shown for Child 1, check this box

Name

Relationship to Child 2

Other person living with Child 3: If same as shown for Child 1, check this box

Name

Relationship to Child 3

Other person living with Child 4: If same as shown for Child 1, check this box

Name

Relationship to Child 4

Otherwise, enter below.

Otherwise, enter below.

Otherwise, enter below.

To determine which person can treat the child as a qualifying child for the EIC and CTC/ACTC, see Qualifying Child of More Than One Person in Pub. 501.

Note: The IRS may ask you to provide additional information to verify your eligibility to claim each credit.

Form 8862 (Rev. 11-2018)