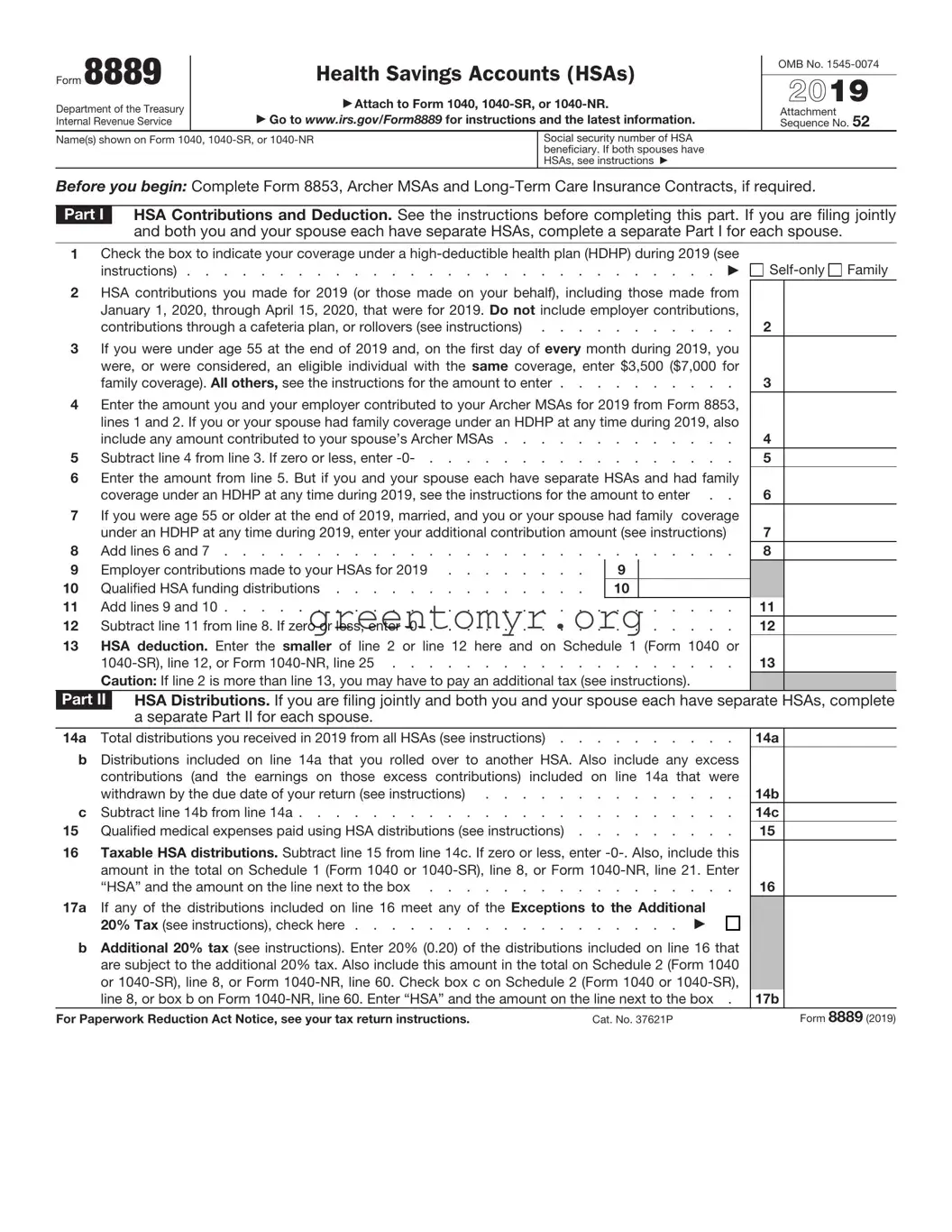

1Check the box to indicate your coverage under a high-deductible health plan (HDHP) during 2019 (see

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2HSA contributions you made for 2019 (or those made on your behalf), including those made from January 1, 2020, through April 15, 2020, that were for 2019. Do not include employer contributions,

contributions through a cafeteria plan, or rollovers (see instructions) . . . . . . . . . . .

3If you were under age 55 at the end of 2019 and, on the first day of every month during 2019, you were, or were considered, an eligible individual with the same coverage, enter $3,500 ($7,000 for

family coverage). All others, see the instructions for the amount to enter . . . . . . . . . .

4Enter the amount you and your employer contributed to your Archer MSAs for 2019 from Form 8853, lines 1 and 2. If you or your spouse had family coverage under an HDHP at any time during 2019, also

include any amount contributed to your spouse’s Archer MSAs . . . . . . . . . . . . .

5 Subtract line 4 from line 3. If zero or less, enter -0- . . . . . . . . . . . . . . . . .

6Enter the amount from line 5. But if you and your spouse each have separate HSAs and had family

coverage under an HDHP at any time during 2019, see the instructions for the amount to enter . .

7If you were age 55 or older at the end of 2019, married, and you or your spouse had family coverage under an HDHP at any time during 2019, enter your additional contribution amount (see instructions)

|

|

|

|

|

|

8 |

Add lines 6 |

and |

7 |

9 |

Employer contributions made to your HSAs for 2019 |

9 |

|

10 |

Qualified HSA funding distributions |

10 |

|

11 |

Add lines 9 |

and |

10 |

12 |

Subtract line 11 from line 8. If zero or less, enter -0- |

13HSA deduction. Enter the smaller of line 2 or line 12 here and on Schedule 1 (Form 1040 or 1040-SR), line 12, or Form 1040-NR, line 25 . . . . . . . . . . . . . . . . . . .

Caution: If line 2 is more than line 13, you may have to pay an additional tax (see instructions).

Family

Family