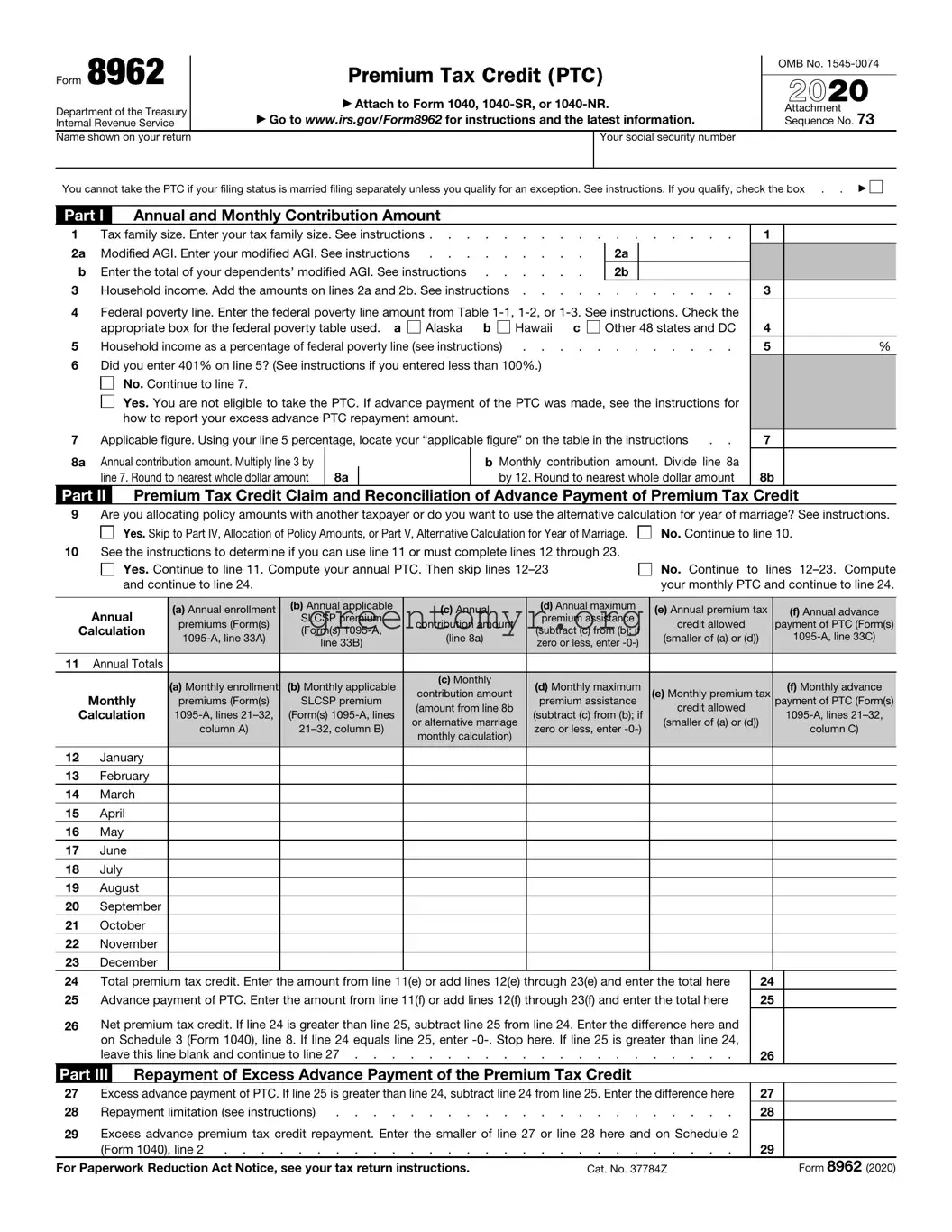

Form 8962, officially known as the Premium Tax Credit (PTC) form, is a document utilized by taxpayers to calculate their eligibility for and the amount of the premium tax credit. This credit is crucial for eligible individuals and families who obtain health insurance coverage through the Health Insurance Marketplace. By filling out this form, taxpayers can reconcile the advance payments made on their behalf to cover health insurance premiums, ensuring they receive the correct amount of tax credit based on their actual income.

Taxpayers who received advance premium tax credits to help pay for health insurance purchased through the Health Insurance Marketplace are required to file Form 8962. Additionally, those who had coverage through the Marketplace for any part of the tax year and wish to claim the premium tax credit must also complete this form. It is essential for these individuals to report their income accurately and reconcile any advance payments they received.

To accurately fill out Form 8962, individuals should gather the following information:

-

The Form 1095-A, Health Insurance Marketplace Statement, which details the amount of the advance payments received and the coverage provided.

-

Your household income information, including adjusted gross income and the number of individuals in your household.

-

Any other relevant tax documents that may affect your eligibility for the premium tax credit.

This information enables taxpayers to provide an accurate account of their situation, thereby ensuring a correct calculation of the tax credit.

If an individual who is required to file Form 8962 fails to do so, it may have significant consequences. The IRS may deny the premium tax credit, leading to an unexpected tax liability. Additionally, a failure to file the form could delay the processing of that person's tax refund. To avoid these repercussions, it is essential to complete and submit Form 8962 alongside your federal income tax return when necessary.

Form 8962 can be filed electronically or via paper. Taxpayers opting for electronic filing can use tax software, which typically includes guidance for completing the form. For those who prefer paper filing, Form 8962 can be downloaded from the IRS website. After filling it out, you should submit it with your tax return, generally by the deadline for that tax year. Ensuring accuracy in completing the form is critical for a smooth filing process.