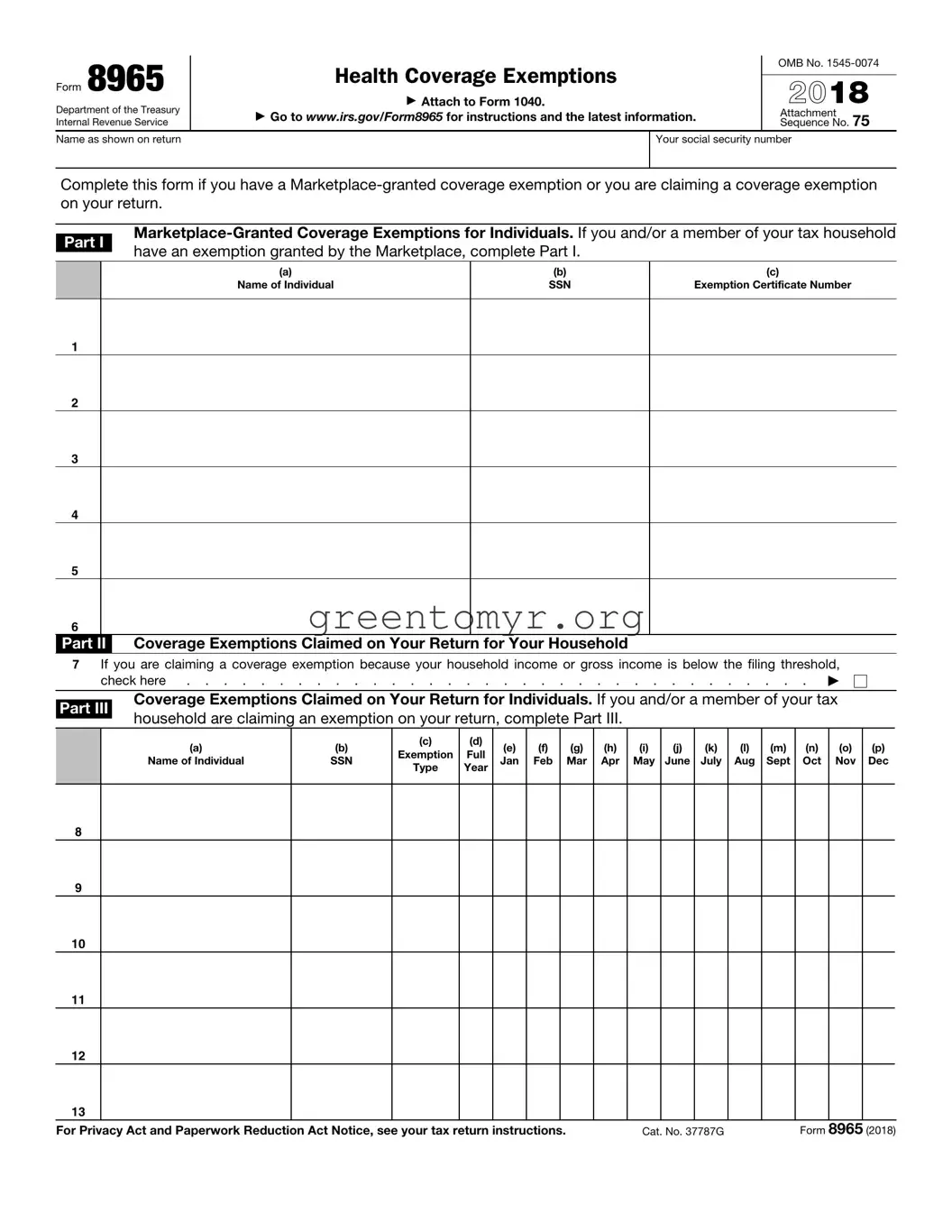

Form 8965 is used to claim health coverage exemptions when filing your federal tax return. It is specifically for individuals who are granted a coverage exemption by the Health Insurance Marketplace or who are qualifying for an exemption based on certain criteria. This form should be attached to your Form 1040.

If you and/or a member of your tax household have received a coverage exemption from the Marketplace, you must complete Form 8965. Additionally, if you are claiming an exemption on your tax return due to income or other qualifying reasons, you’ll need this form as well.

What types of exemptions can I claim?

There are various exemptions you can claim, including:

-

Marketplace-granted exemptions

-

Income below the filing threshold

-

Other specific individual exemptions

Each exemption has specific criteria you need to meet, so make sure to check them out before filing.

How do I obtain an exemption certificate?

If you got an exemption from the Marketplace, you would have received an exemption certificate number. This number is necessary for completing Form 8965. If you did not receive one, you should contact the Marketplace for assistance.

You will need the following information:

-

Your name and Social Security Number (SSN)

-

For each household member claiming an exemption, their name and SSN

-

The exemption certificate number (if applicable)

-

Details on the type of exemption being claimed

What if my income is below the filing threshold?

If your income or gross income is below the filing threshold, you can claim an exemption by checking the appropriate box on Form 8965. This indicates that you do not need to file a tax return due to your income level.

Form 8965 must be attached to your Form 1040 when you file your tax return. Ensure that all information is accurate and complete to avoid any delays or issues with your return.

Yes, you can file Form 8965 electronically if you are using tax preparation software. Make sure the software you choose supports Form 8965. Typically, if you are e-filing your Form 1040, Form 8965 can be included in the same submission.

For the most current instructions and additional information about Form 8965, visit the IRS website at www.irs.gov/Form8965. This site includes valuable resources to help you understand the form and how to complete it correctly.