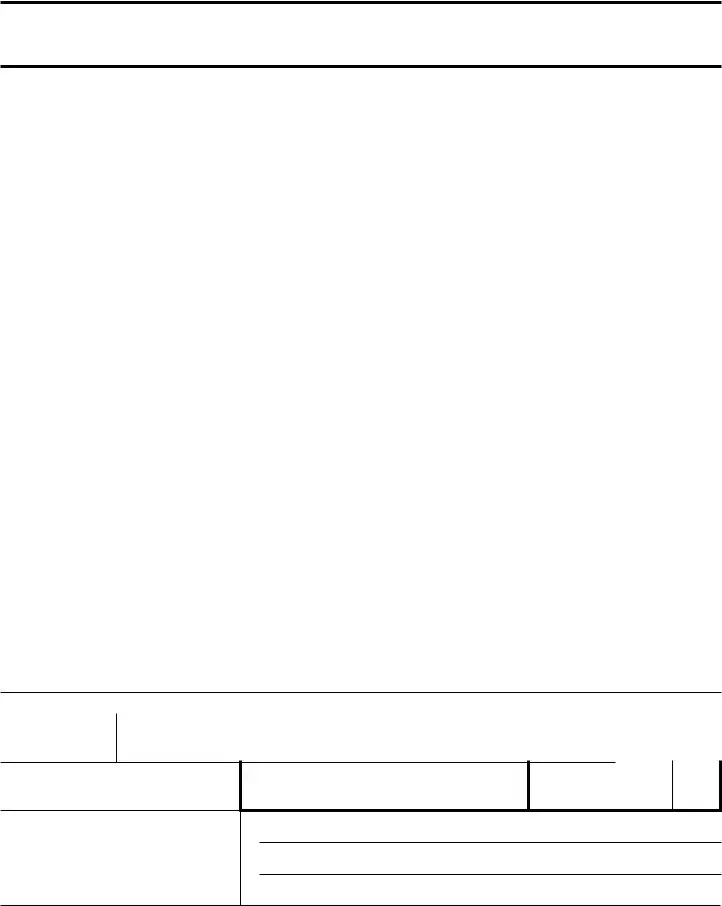

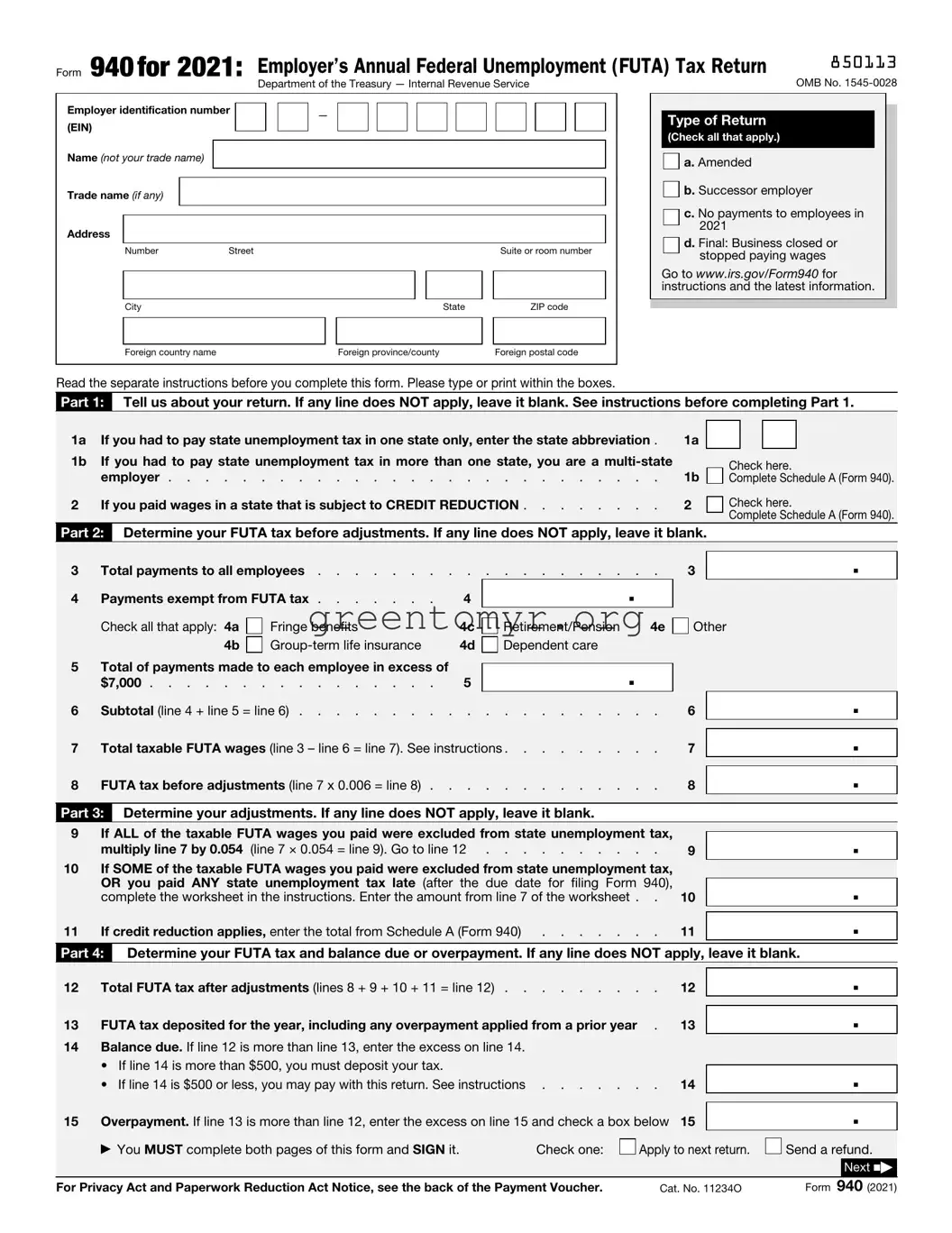

IRS Form 940 is an annual report that businesses use to calculate and report their Federal Unemployment Tax Act (FUTA) tax obligations. This form helps the IRS track employers’ contributions to unemployment benefits at the federal level, which can be crucial during times of economic downturns.

Employers must file Form 940 if they paid $1,500 or more in wages to employees in any calendar quarter of the current or previous year. Additionally, if at least one employee worked for you for some portion of a day in any 20 or more different weeks during the current or previous year, you are required to file the form.

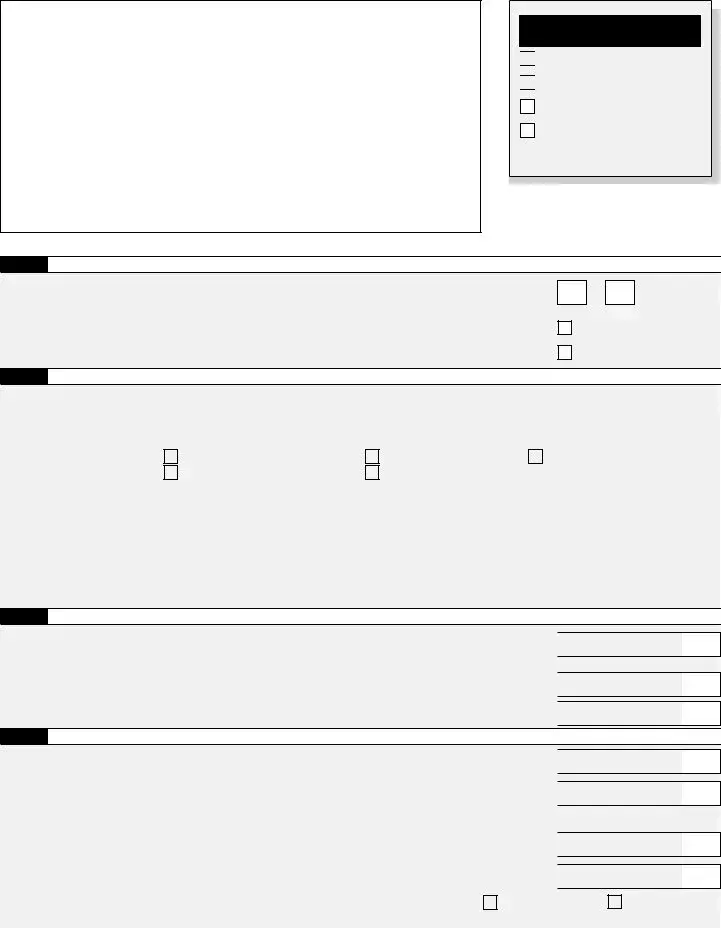

The due date for filing IRS Form 940 is January 31 of the following year. If you owe taxes, payment must also be made by this date to avoid penalties. However, if you file electronically and owe taxes, you may have until February 10 to submit the form.

To complete Form 940, you will need the following:

-

Your employer identification number (EIN)

-

Total gross payroll for the year

-

The amount of FUTA tax you owe

-

Any credits you may claim for state unemployment taxes

Having these details ready can expedite your filing process and ensure accuracy.

Failing to file Form 940 by the due date may result in penalties and interest charges. The IRS may impose a penalty of up to 5% of the unpaid tax for each month the form is late. Additionally, unresolved unpaid FUTA taxes can lead to further legal repercussions, including liens against your property.

Yes, if you discover an error after submitting Form 940, you can amend it using Form 940-X. This form allows you to correct any mistakes regarding wages, taxes owed, or other details. It is important to file an amendment as soon as you realize the error to avoid additional penalties.

What is the FUTA tax rate?

The Federal Unemployment Tax Act (FUTA) tax rate is currently set at 6.0% of the first $7,000 of an employee’s annual salary. However, if you pay state unemployment taxes, you may qualify for a credit of up to 5.4%, effectively reducing your federal rate to 0.6% for most employers.

You can file Form 940 electronically using the IRS e-file system or through third-party tax software. Alternatively, you may choose to send a paper form via mail. Ensure that you send it to the correct address specified by the IRS for your location to avoid delays.

.

. .

. .

. .

. .

. .

. .

.

Select a

Select a

No.

No.