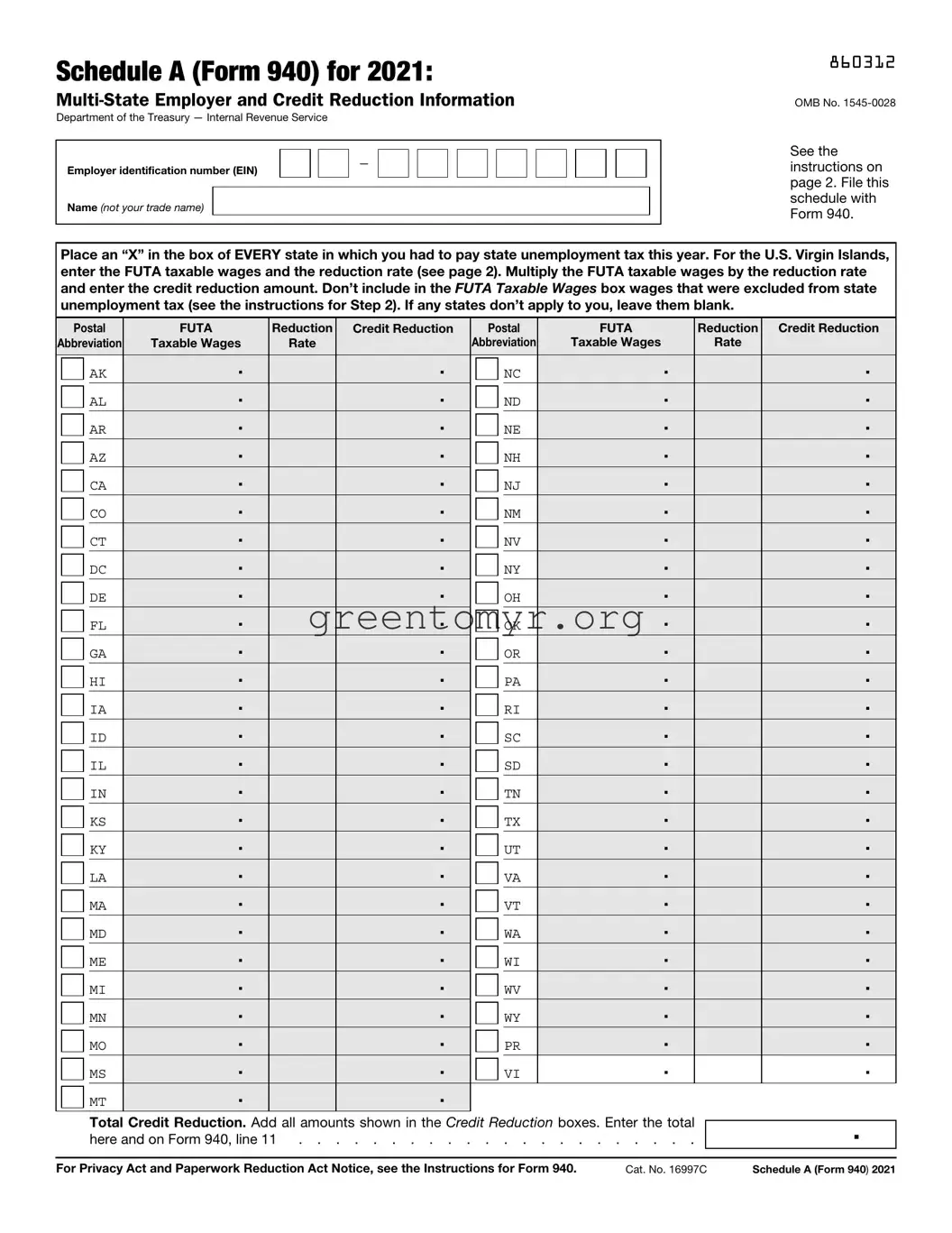

Step 1. Place an “X” in the box of every state (including the District of Columbia, Puerto Rico, and the U.S. Virgin Islands) in which you had to pay state unemployment taxes this year, even if the state’s credit reduction rate is zero.

Note: Make sure that you have applied for a state reporting number for your business. If you don’t have an unemployment account in a state in which you paid wages, contact the state unemployment agency to receive one. For a list of state unemployment agencies, visit the U.S. Department of Labor’s website at https://oui.doleta.gov/unemploy/agencies.asp.

The table below provides the two-letter postal abbreviations used on Schedule A.

|

Postal |

|

Postal |

State |

Abbreviation |

State |

Abbreviation |

|

|

|

|

Alabama |

AL |

Montana |

MT |

Alaska |

AK |

Nebraska |

NE |

Arizona |

AZ |

Nevada |

NV |

Arkansas |

AR |

New Hampshire |

NH |

California |

CA |

New Jersey |

NJ |

Colorado |

CO |

New Mexico |

NM |

Connecticut |

CT |

New York |

NY |

Delaware |

DE |

North Carolina |

NC |

District of Columbia |

DC |

North Dakota |

ND |

Florida |

FL |

Ohio |

OH |

Georgia |

GA |

Oklahoma |

OK |

Hawaii |

HI |

Oregon |

OR |

Idaho |

ID |

Pennsylvania |

PA |

Illinois |

IL |

Rhode Island |

RI |

Indiana |

IN |

South Carolina |

SC |

Iowa |

IA |

South Dakota |

SD |

Kansas |

KS |

Tennessee |

TN |

Kentucky |

KY |

Texas |

TX |

Louisiana |

LA |

Utah |

UT |

Maine |

ME |

Vermont |

VT |

Maryland |

MD |

Virginia |

VA |

Massachusetts |

MA |

Washington |

WA |

Michigan |

MI |

West Virginia |

WV |

Minnesota |

MN |

Wisconsin |

WI |

Mississippi |

MS |

Wyoming |

WY |

Missouri |

MO |

Puerto Rico |

PR |

|

|

U.S. Virgin Islands |

VI |

Credit reduction state. For 2021, the U.S. Virgin Islands (USVI) is the only credit reduction state. The credit reduction rate is 0.033 (3.3%).

Step 2. You’re subject to credit reduction if you paid FUTA taxable wages that were also subject to state unemployment taxes in the USVI.

In the FUTA Taxable Wages box, enter the total FUTA taxable wages that you paid in the USVI. (The FUTA wage base for all states is $7,000.) However, don’t include in the FUTA Taxable Wages box wages that were excluded from state unemployment tax. For example, if you paid $5,000 in FUTA taxable wages in the USVI but $1,000 of those wages were excluded from state unemployment tax, report $4,000 in the FUTA Taxable Wages box.

Note: Don’t enter your state unemployment wages in the FUTA Taxable Wages box.

Enter the reduction rate and then multiply the total FUTA taxable wages by the reduction rate.

Enter your total in the Credit Reduction box at the end of the line.

Step 3. Total credit reduction

To calculate the total credit reduction, add up all of the Credit Reduction boxes and enter the amount in the Total Credit Reduction box.

Then enter the total credit reduction on Form 940, line 11.

Example 1

You paid $20,000 in wages to each of three employees in State A. State A is subject to credit reduction at a rate of 0.033 (3.3%). Because you paid wages in a state that is subject to credit reduction, you must complete Schedule A and file it with Form 940.

Total payments to all employees in State A . . . . . . $60,000

Payments exempt from FUTA tax

(see the Instructions for Form 940) . . . . . . . . . . $0

Total payments made to each employee in

excess of $7,000 (3 x ($20,000 - $7,000)) . . . . . . . $39,000

Total FUTA taxable wages you paid in State A entered in

the FUTA Taxable Wages box ($60,000 - $0 - $39,000) . . . $21,000 Credit reduction rate for State A . . . . . . . . . . 0.033 Total credit reduction for State A ($21,000 x 0.033) . . . . $693.00

|

Don’t include in the FUTA Taxable Wages box wages |

▲ |

! |

in excess of the $7,000 wage base for each employee |

subject to state unemployment insurance in the credit |

CAUTION |

reduction state. The credit reduction applies only |

|

to FUTA taxable wages that were also subject to state unemployment tax.

In this case, you would write $693.00 in the Total Credit Reduction box and then enter that amount on Form 940, line 11.

Example 2

You paid $48,000 ($4,000 a month) in wages to Mary Smith and no payments were exempt from FUTA tax. Mary worked in State B (not subject to credit reduction) in January and then transferred to State C (subject to credit reduction) on February

1.Because you paid wages in more than one state, you must complete Schedule A and file it with Form 940.

The total payments in State B that aren’t exempt from FUTA tax are $4,000. Since this payment to Mary doesn’t exceed the $7,000 FUTA wage base, the total FUTA taxable wages paid in State B are $4,000.

The total payments in State C that aren’t exempt from FUTA tax are $44,000. However, $4,000 of FUTA taxable wages was paid in State B with respect to Mary. Therefore, the total FUTA taxable wages with respect to Mary in State C are $3,000 ($7,000 (FUTA wage base) - $4,000 (total FUTA taxable wages paid in State B)). Enter $3,000 in the FUTA Taxable Wages box, multiply it by the Reduction Rate, and then enter the result in the Credit Reduction box.

Attach Schedule A to Form 940 when you file your return.