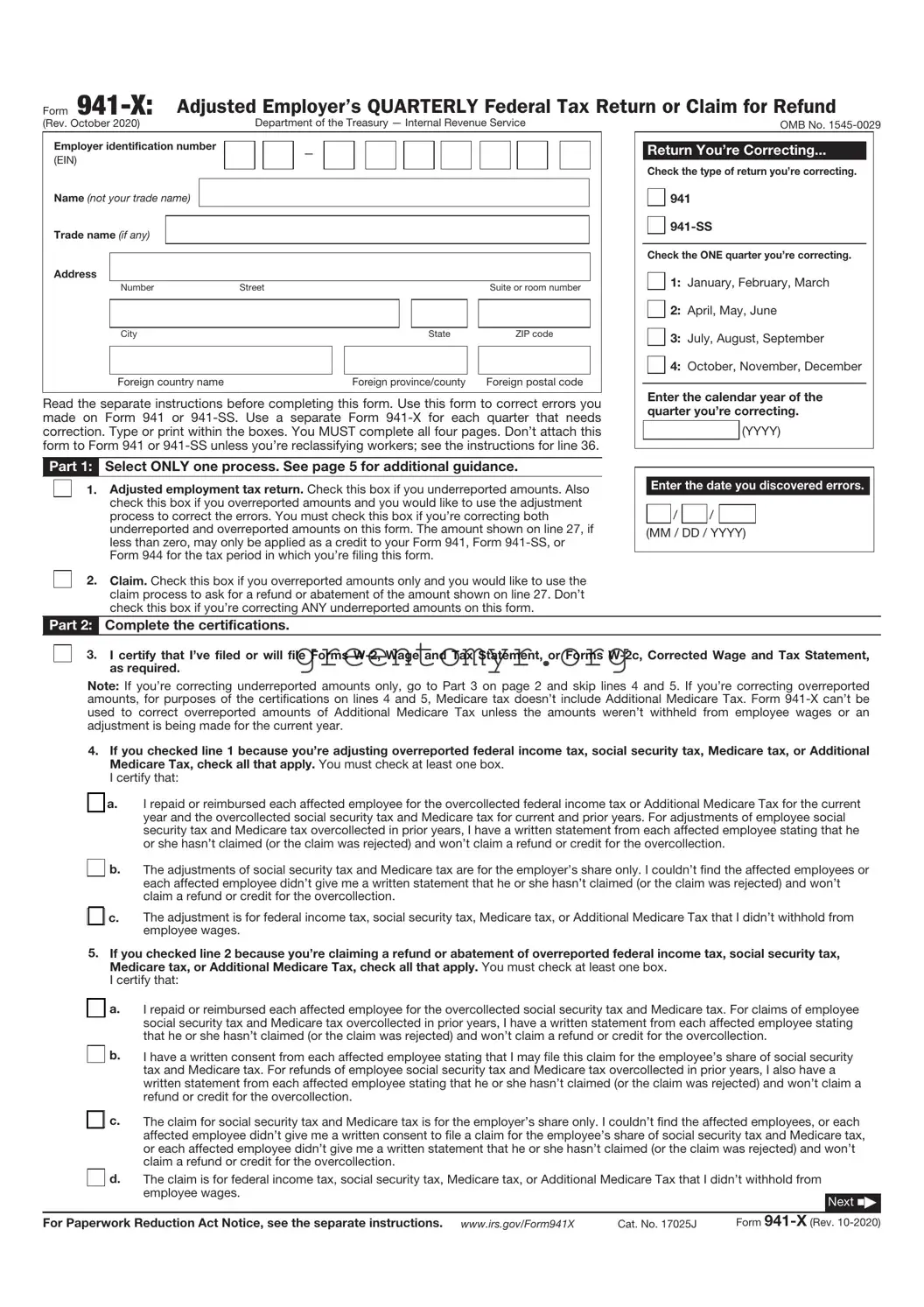

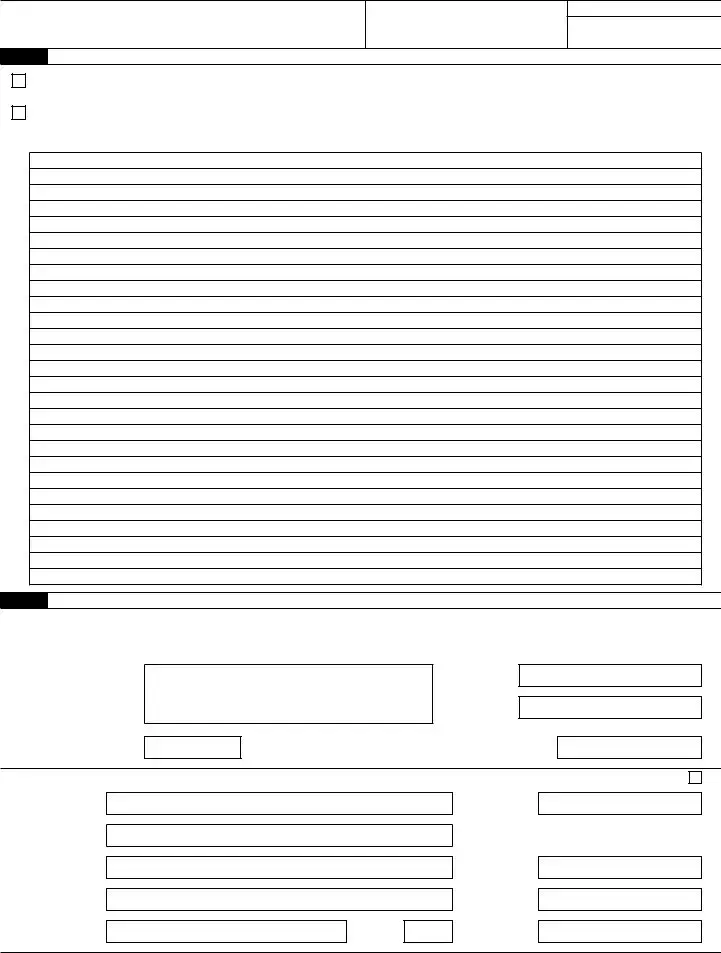

The IRS 941-X form is a document taxpayers use to correct errors on the previously filed Form 941, which is the Employer’s Quarterly Federal Tax Return. Employers must file Form 941 to report income taxes, Social Security tax, and Medicare tax withheld from employees’ paychecks, as well as their portion of Social Security and Medicare taxes. If an employer realizes they made a mistake on their original Form 941, they should use Form 941-X to rectify it.

Any employer who has filed Form 941 and later identifies errors, whether in wages paid, taxes withheld, or credits claimed, should consider filing Form 941-X. This applies to businesses of all sizes, including those that may employ part-time or seasonal workers. If mistakes were made that affect the reported amounts, using Form 941-X is necessary to correct the record.

Form 941-X can address a variety of mistakes, including:

-

Incorrect employee wages reported.

-

Errors in calculating and reporting Social Security or Medicare taxes.

-

Miscalculated tax credits that were claimed.

-

Errors in the identification or reporting of taxes due.

Essentially, it is for correcting virtually any error found after filing the original Form 941.

To file Form 941-X, follow these steps:

-

Obtain the most current version of Form 941-X, available on the IRS website.

-

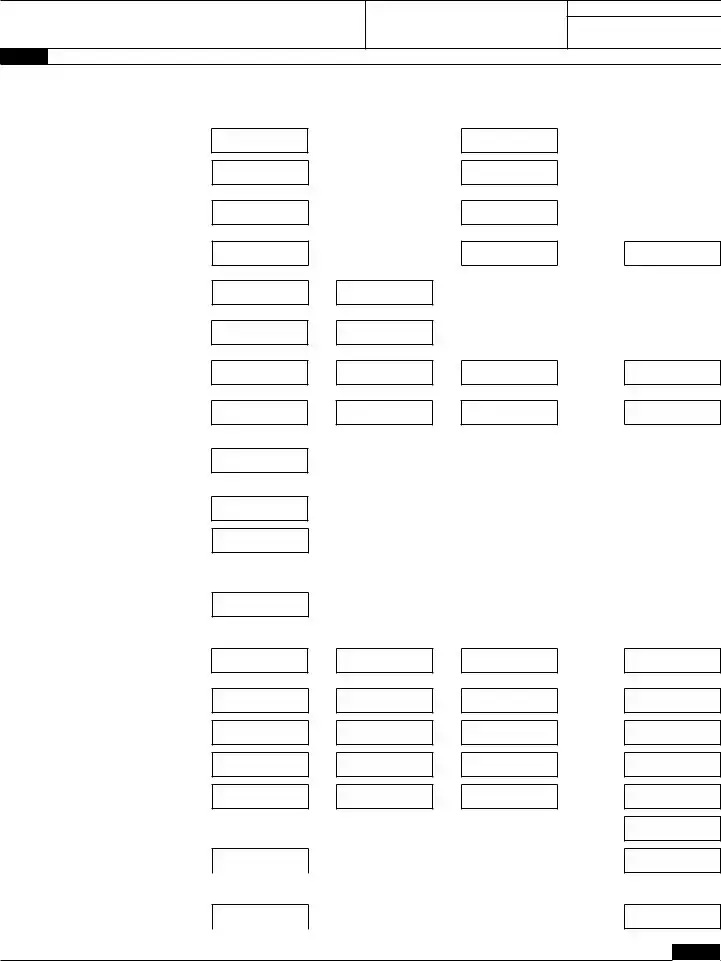

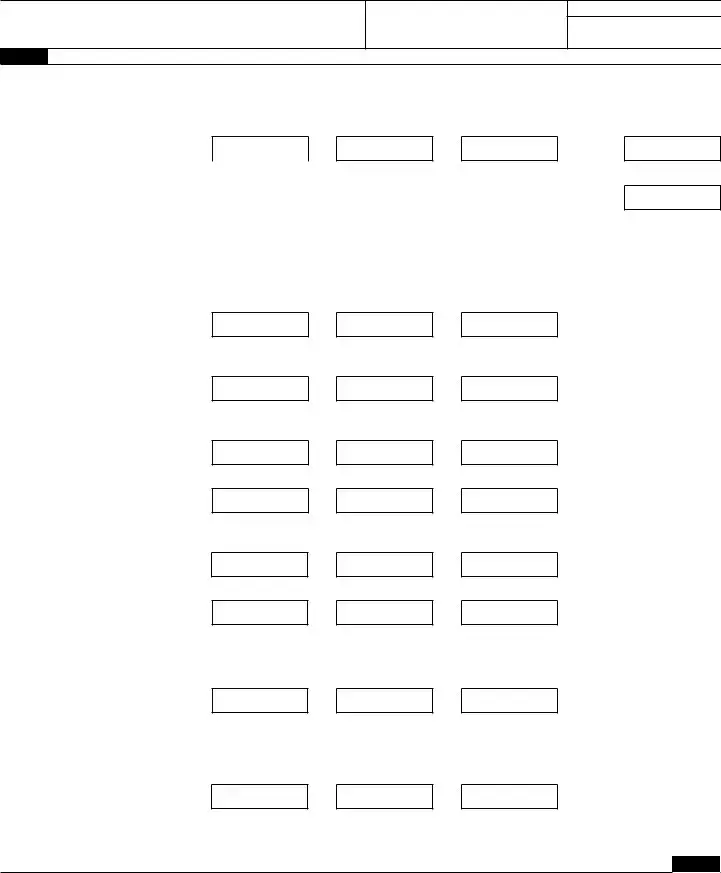

Correctly complete the form, specifying the quarter and year related to the original Form 941.

-

Clearly indicate the errors and provide correct figures in the designated areas.

-

Submit the completed form to the IRS either electronically (if eligible) or by mailing it to the appropriate address as outlined in the form's instructions.

The deadline for filing Form 941-X is generally within three years from the date you filed the original Form 941 or within two years from when the taxes were paid, whichever is later. It is important to keep track of these timelines to ensure that corrections can be made within the permissible period.

Yes, filing Form 941-X may affect your tax liabilities. If the corrections reduce the amount of tax you owe, you may receive a refund. Conversely, if the corrections increase your tax liabilities, you will need to pay the additional amount owed. Properly completing the form is essential, as it impacts your financial responsibilities and compliance with tax laws.

No, Form 941-X is designed to correct errors for one specific quarter at a time. If you need to make corrections for multiple quarters, you must file a separate Form 941-X for each quarter in which an error occurred. This ensures clarity and accuracy in the correction process.

Currently, the IRS does not provide a direct way for taxpayers to check the status of their submitted Form 941-X. However, you can contact the IRS directly for updates. It is beneficial to maintain records of your submission, including tracking numbers if you sent it by mail, to have information handy when inquiring about the status.