Form 990-PF (2020) |

|

|

Page 2 |

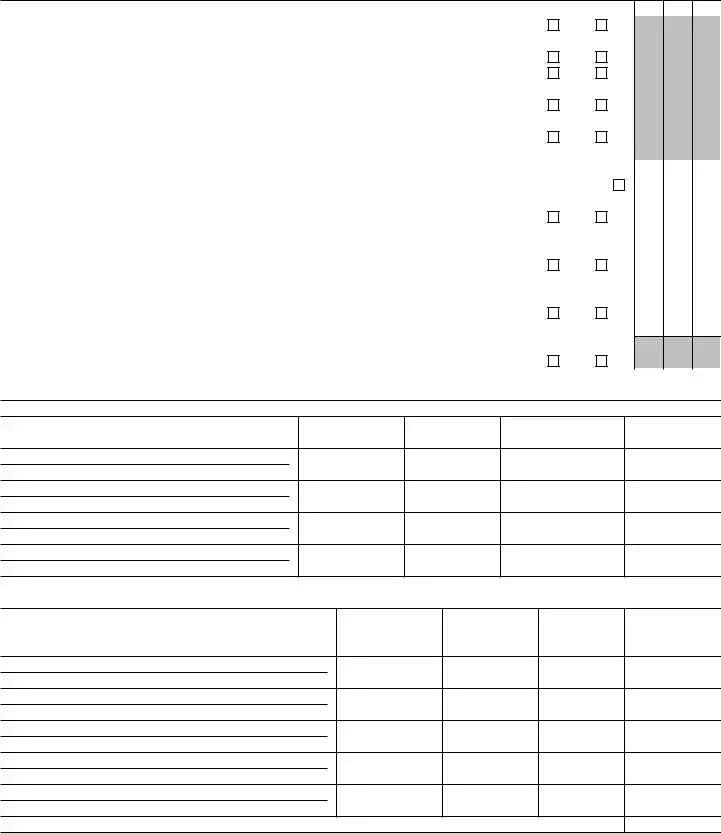

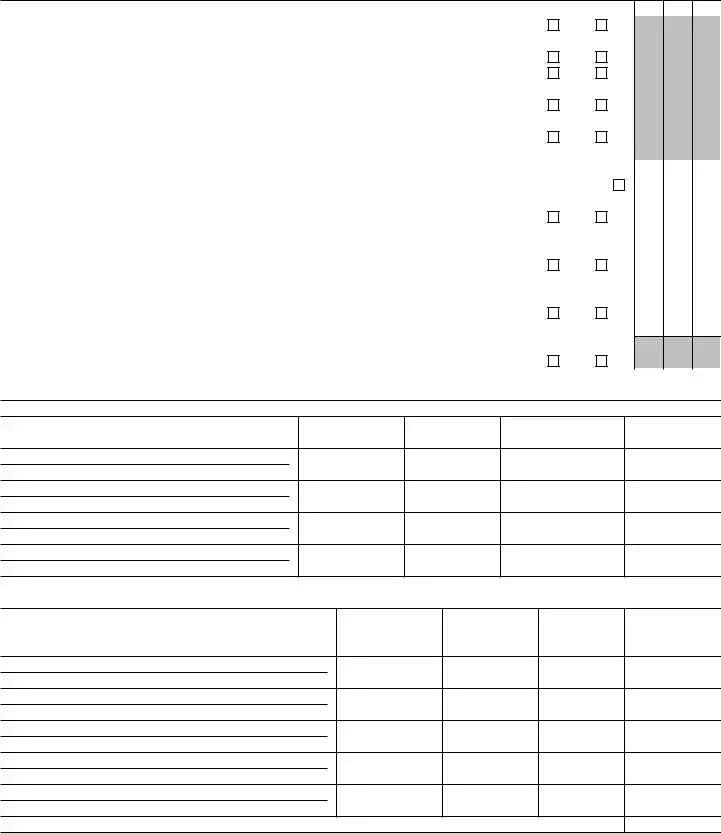

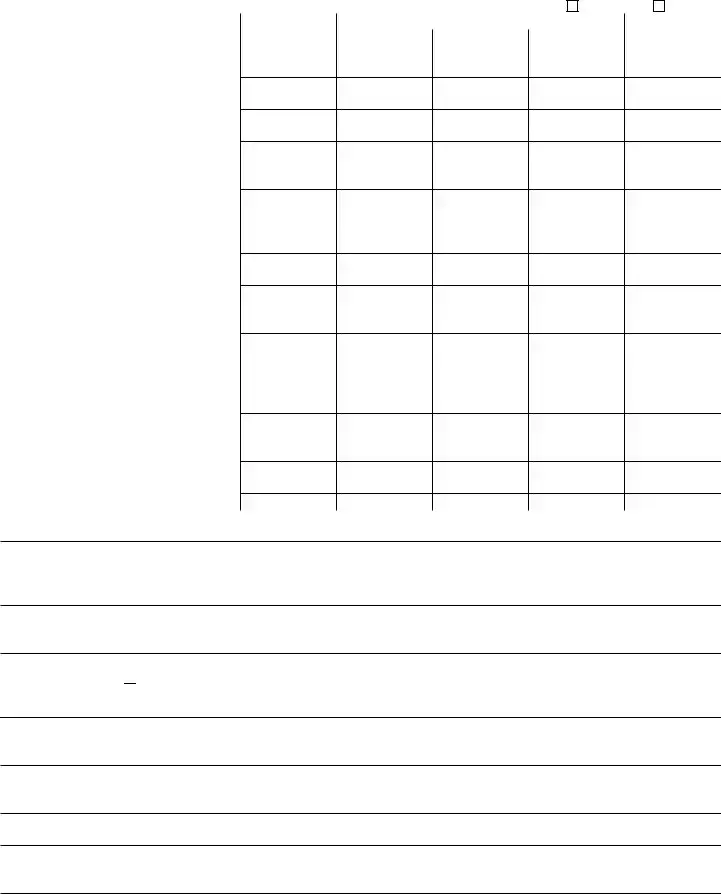

Part II |

Balance Sheets Attached schedules and amounts in the description column |

Beginning of year |

End of year |

|

should be for end-of-year amounts only. (See instructions.) |

(a) Book Value |

(b) Book Value |

(c) Fair Market Value |

|

|

|

|

|

1 |

Cash—non-interest-bearing |

|

|

|

2 |

Savings and temporary cash investments |

|

|

|

3 |

Accounts receivable ▶ |

|

|

|

|

Less: allowance for doubtful accounts ▶ |

|

|

|

4 |

Pledges receivable ▶ |

|

|

|

|

Less: allowance for doubtful accounts ▶ |

|

|

|

5 |

Grants receivable |

|

|

|

6Receivables due from officers, directors, trustees, and other

|

|

disqualified persons (attach schedule) (see instructions) . . |

|

7 |

Other notes and loans receivable (attach schedule) ▶ |

|

|

Less: allowance for doubtful accounts ▶ |

Assets |

8 |

Inventories for sale or use |

9 |

Prepaid expenses and deferred charges |

10a |

Investments—U.S. and state government obligations (attach schedule) |

bInvestments—corporate stock (attach schedule) . . . . .

c |

Investments—corporate bonds (attach schedule) . . . . |

11 |

Investments—land, buildings, and equipment: basis ▶ |

|

Less: accumulated depreciation (attach schedule) ▶ |

12Investments—mortgage loans . . . . . . . . . . .

13 |

Investments—other (attach schedule) |

|

14 |

Land, buildings, and equipment: basis ▶ |

|

|

Less: accumulated depreciation (attach schedule) ▶ |

|

15 |

Other assets (describe ▶ |

) |

16Total assets (to be completed by all filers—see the

|

|

instructions. Also, see page 1, item I) |

|

|

|

|

|

17 |

Accounts payable and accrued expenses |

|

Liabilities |

18 |

Grants payable |

|

19 |

Deferred revenue |

|

|

|

|

20 |

Loans from officers, directors, trustees, and other disqualified persons |

|

|

21 |

Mortgages and other notes payable (attach schedule) . . . |

|

|

22 |

Other liabilities (describe ▶ |

) |

|

|

23 |

Total liabilities (add lines 17 through 22) |

|

Balances |

25 |

Foundations that follow FASB ASC 958, check here |

▶ |

|

Net assets with donor restrictions |

|

|

|

and complete lines 24, 25, 29, and 30. |

|

|

|

24 |

Net assets without donor restrictions |

|

Fund |

|

Foundations that do not follow FASB ASC 958, check here ▶ |

|

|

|

|

|

|

and complete lines 26 through 30. |

|

|

or |

26 |

Capital stock, trust principal, or current funds |

|

27 |

Paid-in or capital surplus, or land, bldg., and equipment fund |

|

Assets |

|

28 |

Retained earnings, accumulated income, endowment, or other funds |

|

|

29 |

Total net assets or fund balances (see instructions) . . . |

|

Net |

30 |

Total liabilities and net assets/fund balances (see |

|

|

instructions) |

|

Part III |

Analysis of Changes in Net Assets or Fund Balances |

|

1Total net assets or fund balances at beginning of year—Part II, column (a), line 29 (must agree with

|

end-of-year figure reported on prior year’s return) |

1 |

2 |

Enter amount from Part I, line 27a |

2 |

3 |

Other increases not included in line 2 (itemize) ▶ |

3 |

4 |

Add lines 1, 2, and 3 |

4 |

5 |

Decreases not included in line 2 (itemize) ▶ |

5 |

6 |

Total net assets or fund balances at end of year (line 4 minus line 5)—Part II, column (b), line 29 . . |

6 |

Form 990-PF (2020)

|

|

|

|

|

|

|

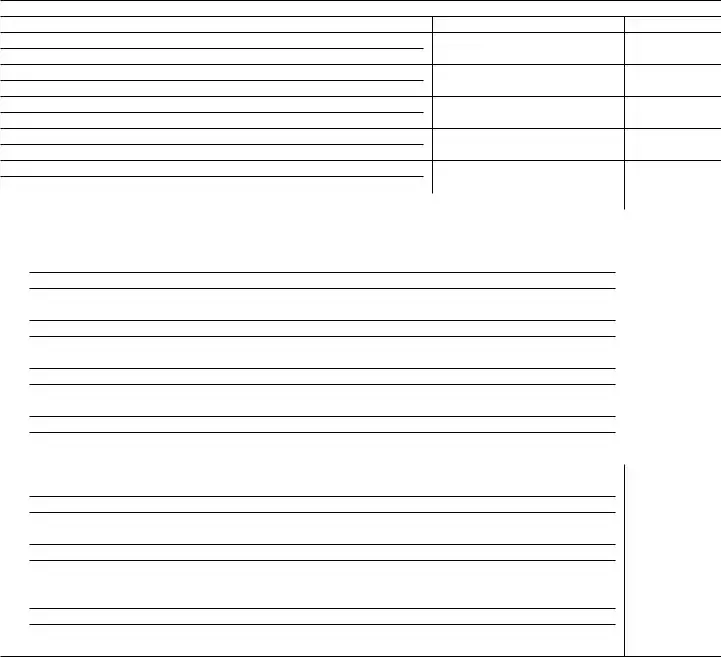

Form 990-PF (2020) |

|

|

|

|

Page 4 |

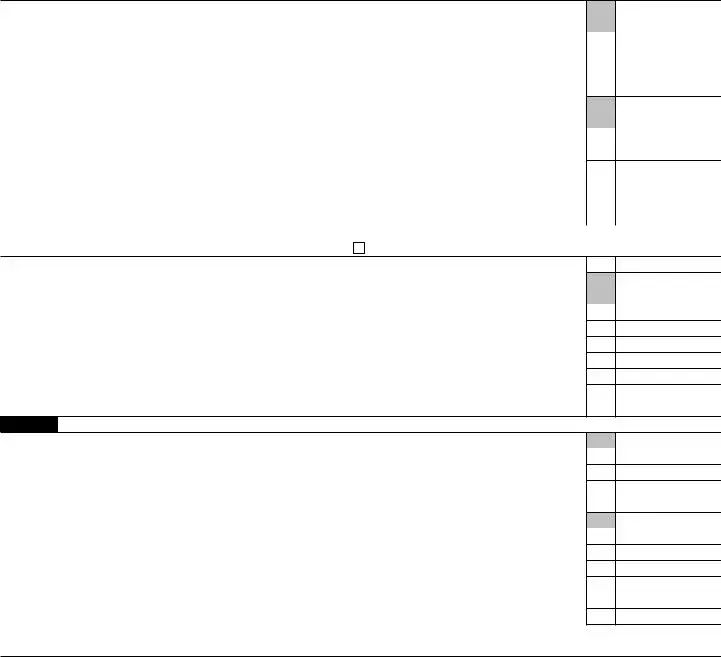

Part VI |

Excise Tax Based on Investment Income (Section 4940(a), 4940(b), or 4948—see instructions) |

1a Exempt operating foundations described in section 4940(d)(2), check here ▶ |

and enter “N/A” on line 1. |

} |

|

|

|

|

|

Date of ruling or determination letter: |

(attach copy of letter if necessary—see instructions) |

|

|

|

b Reserved |

. . . . . . . . . . |

. . . . . . . . . |

|

1 |

|

cAll other domestic foundations enter 1.39% of line 27b. Exempt foreign organizations, enter 4% of

|

Part I, line 12, col. (b) |

|

2 |

Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only; others, enter -0-) |

2 |

3 |

Add lines 1 and 2 |

3 |

4 |

Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only; others, enter -0-) |

4 |

5 |

Tax based on investment income. Subtract line 4 from line 3. If zero or less, enter -0- |

5 |

6Credits/Payments:

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

2020 estimated tax payments and 2019 overpayment credited to 2020 . . |

|

6a |

|

|

|

|

|

|

|

b |

Exempt foreign organizations—tax withheld at source |

|

6b |

|

|

|

|

|

|

|

c |

Tax paid with application for extension of time to file (Form 8868) . . . . |

|

6c |

|

|

|

|

|

|

|

d |

Backup withholding erroneously withheld |

|

6d |

|

|

|

|

|

|

|

7 |

Total credits and payments. Add lines 6a through 6d |

. . . . . . . . |

|

7 |

|

|

|

8 |

Enter any penalty for underpayment of estimated tax. Check here |

if Form 2220 is attached |

|

|

8 |

|

|

|

9 |

Tax due. If the total of lines 5 and 8 is more than line 7, enter amount owed |

. . . . . . . ▶ |

|

9 |

|

|

|

10 |

Overpayment. If line 7 is more than the total of lines 5 and 8, enter the amount overpaid . . . |

▶ |

|

10 |

|

|

|

11 |

Enter the amount of line 10 to be: Credited to 2021 estimated tax ▶ |

|

|

|

Refunded |

▶ |

11 |

|

|

|

Part VII-A |

Statements Regarding Activities |

|

|

|

|

|

|

|

|

|

|

1a |

During the tax year, did the foundation attempt to influence any national, state, or local legislation or did it |

|

Yes No |

|

participate or intervene in any political campaign? |

. . . . . . . . . |

. |

|

1a |

bDid it spend more than $100 during the year (either directly or indirectly) for political purposes? See the

|

|

|

|

instructions for the definition |

1b |

If the answer is “Yes” to 1a or 1b, attach a detailed description of the activities and copies of any materials |

|

|

published or distributed by the foundation in connection with the activities. |

|

c Did the foundation file Form 1120-POL for this year? |

|

1c |

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year: |

|

(1) On the foundation. ▶ $ |

(2) On foundation managers. ▶ $ |

|

eEnter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed

on foundation managers. ▶ $ |

|

|

|

2 Has the foundation engaged in any activities that have not previously been reported to the IRS? . . . . |

2 |

If “Yes,” attach a detailed description of the activities. |

|

3Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles

|

of incorporation, or bylaws, or other similar instruments? If “Yes,” attach a conformed copy of the changes . |

3 |

4a |

Did the foundation have unrelated business gross income of $1,000 or more during the year? |

4a |

b |

If “Yes,” has it filed a tax return on Form 990-T for this year? |

4b |

5 |

Was there a liquidation, termination, dissolution, or substantial contraction during the year? |

5 |

|

If “Yes,” attach the statement required by General Instruction T. |

|

6Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either:

•By language in the governing instrument, or

•By state legislation that effectively amends the governing instrument so that no mandatory directions that

|

conflict with the state law remain in the governing instrument? |

6 |

7 |

Did the foundation have at least $5,000 in assets at any time during the year? If “Yes,” complete Part II, col. (c), and Part XV |

7 |

8a |

Enter the states to which the foundation reports or with which it is registered. See instructions. ▶ |

|

bIf the answer is “Yes” to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General

(or designate) of each state as required by General Instruction G? If “No,” attach explanation |

8b |

9Is the foundation claiming status as a private operating foundation within the meaning of section 4942(j)(3) or 4942(j)(5) for calendar year 2020 or the tax year beginning in 2020? See the instructions for Part XIV. If “Yes,”

10Did any persons become substantial contributors during the tax year? If “Yes,” attach a schedule listing their

names and addresses |

10 |

|

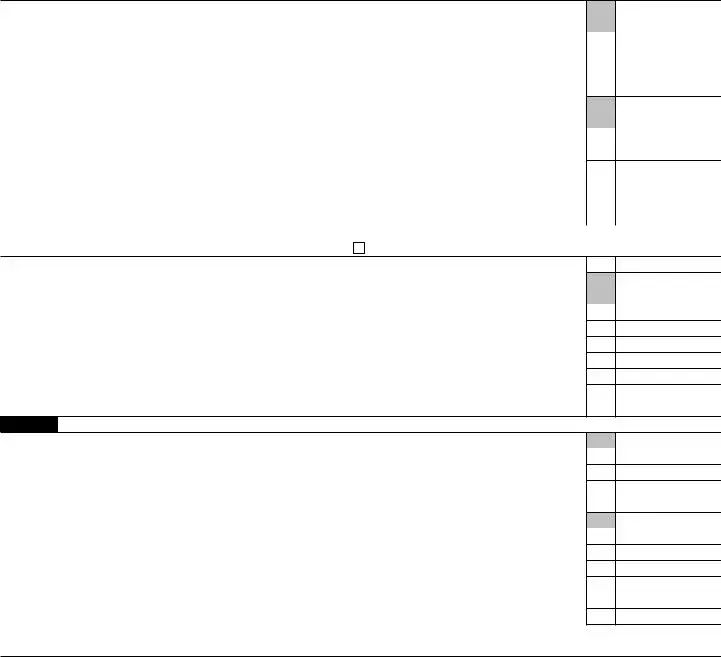

Form 990-PF (2020) |

Form 990-PF (2020) |

Page 5 |

Part VII-A |

|

Statements Regarding Activities (continued) |

11At any time during the year, did the foundation, directly or indirectly, own a controlled entity within the

meaning of section 512(b)(13)? If “Yes,” attach schedule. See instructions . . . . . . . . . . .

12Did the foundation make a distribution to a donor advised fund over which the foundation or a disqualified

person had advisory privileges? If “Yes,” attach statement. See instructions . . . . . . . . . . .

13Did the foundation comply with the public inspection requirements for its annual returns and exemption application?

Website address ▶ |

|

14 The books are in care of ▶ |

Telephone no. ▶ |

Located at ▶ |

ZIP+4 ▶ |

Yes No

Yes No

11

12

13

15Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041—check here . . . . . . . ▶

and enter the amount of tax-exempt interest received or accrued during the year . . . . . ▶ |

15 |

|

|

|

16 At any time during calendar year 2020, did the foundation have an interest in or a signature or other |

authority |

|

Yes No |

over a bank, securities, or other financial account in a foreign country? |

|

|

16 |

|

See the instructions for exceptions and filing requirements for FinCEN Form 114. If “Yes,” enter the name of |

|

|

the foreign country ▶ |

|

|

Part VII-B |

Statements Regarding Activities for Which Form 4720 May Be Required |

|

|

|

|

File Form 4720 if any item is checked in the “Yes” column, unless an exception applies. |

|

|

|

Yes No |

1a During the year, did the foundation (either directly or indirectly): |

|

|

|

|

(1) Engage in the sale or exchange, or leasing of property with a disqualified person? . . |

Yes |

No |

(2)Borrow money from, lend money to, or otherwise extend credit to (or accept it from) a

|

disqualified person? |

Yes |

No |

(3) |

Furnish goods, services, or facilities to (or accept them from) a disqualified person? . . |

Yes |

No |

(4) |

Pay compensation to, or pay or reimburse the expenses of, a disqualified person? . . |

Yes |

No |

(5)Transfer any income or assets to a disqualified person (or make any of either available for

the benefit or use of a disqualified person)? |

Yes |

No |

(6)Agree to pay money or property to a government official? (Exception. Check “No” if the

foundation agreed to make a grant to or to employ the official for |

a period |

after |

|

|

termination of government service, if terminating within 90 days.) . . . |

. . . |

. . |

Yes |

No |

bIf any answer is “Yes” to 1a(1)–(6), did any of the acts fail to qualify under the exceptions described in

Regulations section 53.4941(d)-3 or in a current notice regarding disaster assistance? See instructions |

. |

1b |

Organizations relying on a current notice regarding disaster assistance, check here |

▶ |

|

cDid the foundation engage in a prior year in any of the acts described in 1a, other than excepted acts, that

were not corrected before the first day of the tax year beginning in 2020? |

1c |

2Taxes on failure to distribute income (section 4942) (does not apply for years the foundation was a private operating foundation defined in section 4942(j)(3) or 4942(j)(5)):

aAt the end of tax year 2020, did the foundation have any undistributed income (Part XIII, lines

6d and 6e) for tax year(s) beginning before 2020? |

. . . . . . . . . . . . . . |

Yes |

No |

If “Yes,” list the years ▶ |

20 |

, 20 |

, 20 |

, 20 |

|

|

bAre there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2) (relating to incorrect valuation of assets) to the year’s undistributed income? (If applying section 4942(a)(2) to

all years listed, answer “No” and attach statement—see instructions.) |

2b |

cIf the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here.

▶ 20 |

, 20 |

, 20 |

, 20 |

|

|

3a Did the foundation hold more than a 2% direct or indirect interest in any business enterprise |

|

|

at any time during the year? . |

. . . . . . . . . . . . . . . . . . . . . |

Yes |

No |

bIf “Yes,” did it have excess business holdings in 2020 as a result of (1) any purchase by the foundation or disqualified persons after May 26, 1969; (2) the lapse of the 5-year period (or longer period approved by the Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest; or (3) the lapse of the 10-, 15-, or 20-year first phase holding period? (Use Form 4720, Schedule C, to determine if the

foundation had excess business holdings in 2020.) |

3b |

4a Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes? |

4a |

bDid the foundation make any investment in a prior year (but after December 31, 1969) that could jeopardize its charitable purpose that had not been removed from jeopardy before the first day of the tax year beginning in 2020? 4b

Form 990-PF (2020)

Form 990-PF (2020) |

Page 6 |

Part VII-B |

|

Statements Regarding Activities for Which Form 4720 May Be Required (continued) |

5a During the year, did the foundation pay or incur any amount to: |

|

|

|

Yes No |

(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? . |

Yes |

No |

(2)Influence the outcome of any specific public election (see section 4955); or to carry on,

directly or indirectly, any voter registration drive? |

Yes |

No |

(3) Provide a grant to an individual for travel, study, or other similar purposes? |

Yes |

No |

(4)Provide a grant to an organization other than a charitable, etc., organization described in

section 4945(d)(4)(A)? See instructions |

Yes |

No |

(5)Provide for any purpose other than religious, charitable, scientific, literary, or educational

purposes, or for the prevention of cruelty to children or animals? |

Yes |

No |

bIf any answer is “Yes” to 5a(1)–(5), did any of the transactions fail to qualify under the exceptions described

|

in Regulations section 53.4945 or in a current notice regarding disaster assistance? See instructions . |

. |

|

5b |

|

Organizations relying on a current notice regarding disaster assistance, check here |

▶ |

|

c |

If the answer is “Yes” to question 5a(4), does the foundation claim exemption from the tax |

|

|

|

|

|

because it maintained expenditure responsibility for the grant? |

Yes |

No |

|

|

If “Yes,” attach the statement required by Regulations section 53.4945-5(d). |

|

|

|

|

6a |

Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiums |

|

|

|

|

|

on a personal benefit contract? |

Yes |

No |

|

b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract? |

. |

|

6b |

|

If “Yes” to 6b, file Form 8870. |

|

|

|

|

7a |

At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction? |

Yes |

No |

|

b If “Yes,” did the foundation receive any proceeds or have any net income attributable to the transaction? |

. |

|

7b |

8Is the foundation subject to the section 4960 tax on payment(s) of more than $1,000,000 in

remuneration or excess parachute payment(s) during the year? |

Yes |

No |

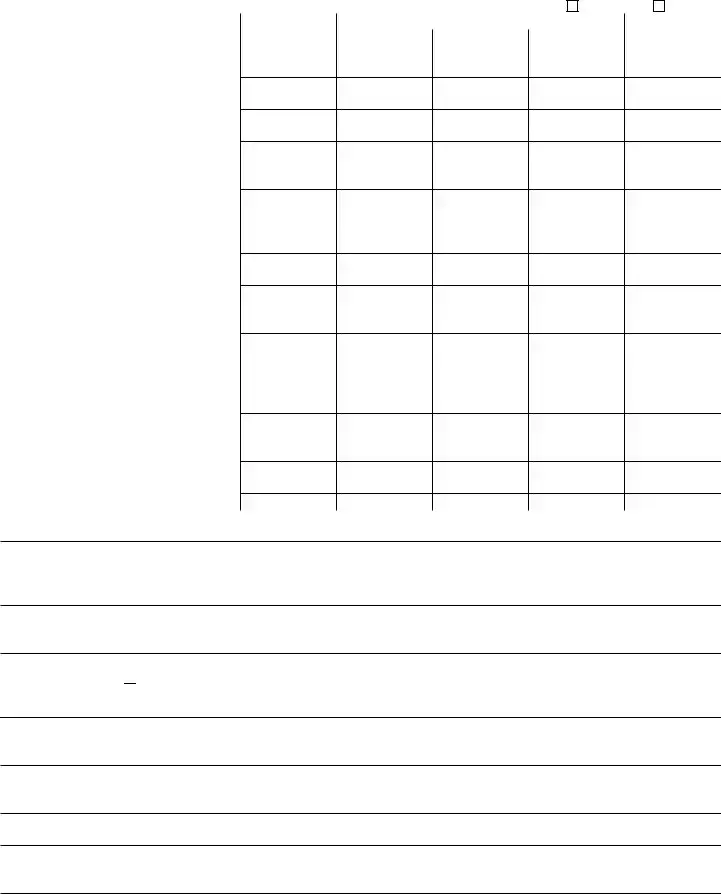

Part VIII |

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, |

|

and Contractors |

|

|

1 List all officers, directors, trustees, and foundation managers and their compensation. See instructions.

(b)Title, and average hours per week

devoted to position

(c)Compensation

(If not paid,

enter -0-)

(d)Contributions to employee benefit plans

and deferred compensation

(e)Expense account, other allowances

2Compensation of five highest-paid employees (other than those included on line 1—see instructions). If none, enter “NONE.”

(a)Name and address of each employee paid more than $50,000

(b)Title, and average hours per week

devoted to position

(d)Contributions to employee benefit

plans and deferred

compensation

(e)Expense account, other allowances

Total number of other employees paid over $50,000 . . . . . . . . . . . . . . . . . . . . ▶

Form 990-PF (2020)

Form 990-PF (2020) |

Page 7 |

Part VIII |

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees, |

|

|

and Contractors (continued) |

|

3 Five highest-paid independent contractors for professional services. See instructions. If none, enter “NONE.”

(a)Name and address of each person paid more than $50,000

Total number of others receiving over $50,000 for professional services |

. |

. . |

. |

. ▶ |

|

Part IX-A |

Summary of Direct Charitable Activities |

|

|

|

|

|

List the foundation’s four largest direct charitable activities during the tax year. Include relevant statistical information such as the number of |

Expenses |

organizations and other beneficiaries served, conferences convened, research papers produced, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part IX-B |

Summary of Program-Related Investments (see instructions) |

|

|

|

|

|

Describe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2. |

|

|

|

|

Amount |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All other program-related investments. See instructions. |

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total. Add lines 1 through 3 |

. |

. . |

. |

. ▶ |

|

Form 990-PF (2020)

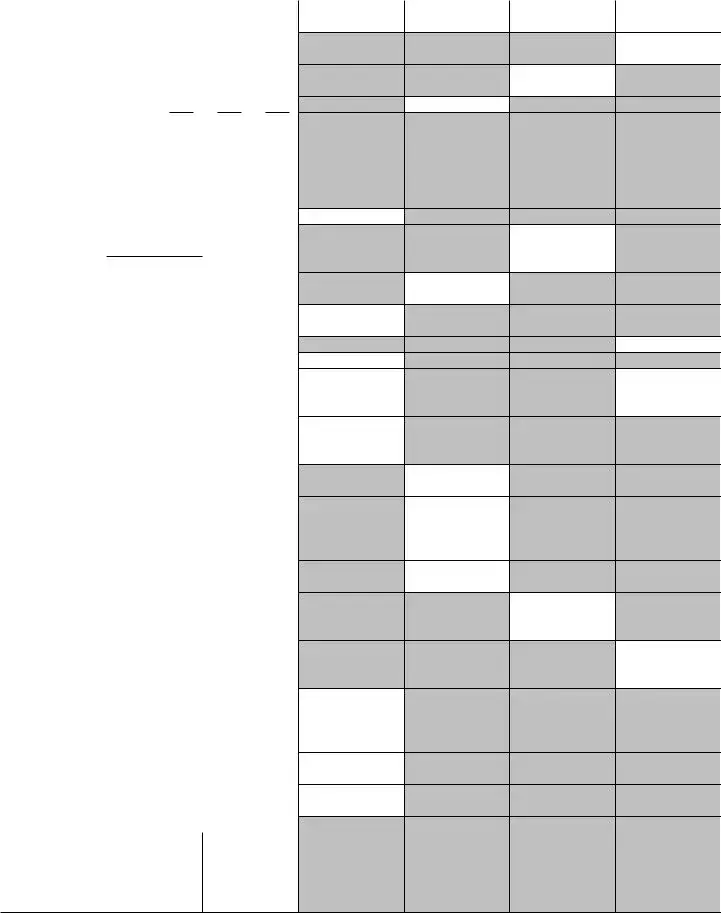

Form 990-PF (2020) |

Page 8 |

Part X |

Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations, |

|

|

see instructions.) |

|

1Fair market value of assets not used (or held for use) directly in carrying out charitable, etc., purposes:

a |

Average monthly fair market value of securities |

1a |

b |

Average of monthly cash balances |

1b |

c |

Fair market value of all other assets (see instructions) |

1c |

d |

Total (add lines 1a, b, and c) |

1d |

eReduction claimed for blockage or other factors reported on lines 1a and

|

1c (attach detailed explanation) |

1e |

|

|

|

2 |

Acquisition indebtedness applicable to line 1 assets |

. . . . . . . |

|

2 |

3 |

Subtract line 2 from line 1d |

. . . . . . . |

|

3 |

4Cash deemed held for charitable activities. Enter 11/2% of line 3 (for greater amount, see

|

instructions) |

4 |

5 |

Net value of noncharitable-use assets. Subtract line 4 from line 3. Enter here and on Part V, line 4 |

5 |

6 |

Minimum investment return. Enter 5% of line 5 |

6 |

Part XI |

Distributable Amount (see instructions) (Section 4942(j)(3) and (j)(5) private operating foundations |

|

|

and certain foreign organizations, check here ▶ |

and do not complete this part.) |

|

1 |

Minimum investment return from Part X, line 6 |

2a |

Tax on investment income for 2020 from Part VI, line 5 |

2a |

|

b |

Income tax for 2020. (This does not include the tax from Part VI.) . . . |

2b |

|

c |

Add lines 2a and 2b |

3 |

Distributable amount before adjustments. Subtract line 2c from line 1 |

4 |

Recoveries of amounts treated as qualifying distributions |

5 |

Add lines 3 and 4 |

6 |

Deduction from distributable amount (see instructions) |

7Distributable amount as adjusted. Subtract line 6 from line 5. Enter here and on Part XIII, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part XII Qualifying Distributions (see instructions)

1Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes:

a |

Expenses, contributions, gifts, etc.—total from Part I, column (d), line 26 |

b |

Program-related investments—total from Part IX-B |

2Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc.,

purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3Amounts set aside for specific charitable projects that satisfy the:

a |

Suitability test (prior IRS approval required) |

b |

Cash distribution test (attach the required schedule) |

4Qualifying distributions. Add lines 1a through 3b. Enter here and on Part V, line 8; and Part XIII, line 4

5Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment income.

|

Enter 1% of Part I, line 27b. See instructions |

6 |

Adjusted qualifying distributions. Subtract line 5 from line 4 |

Note: The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation qualifies for the section 4940(e) reduction of tax in those years.

Form 990-PF (2020)

Form 990-PF (2020) |

|

|

Page 9 |

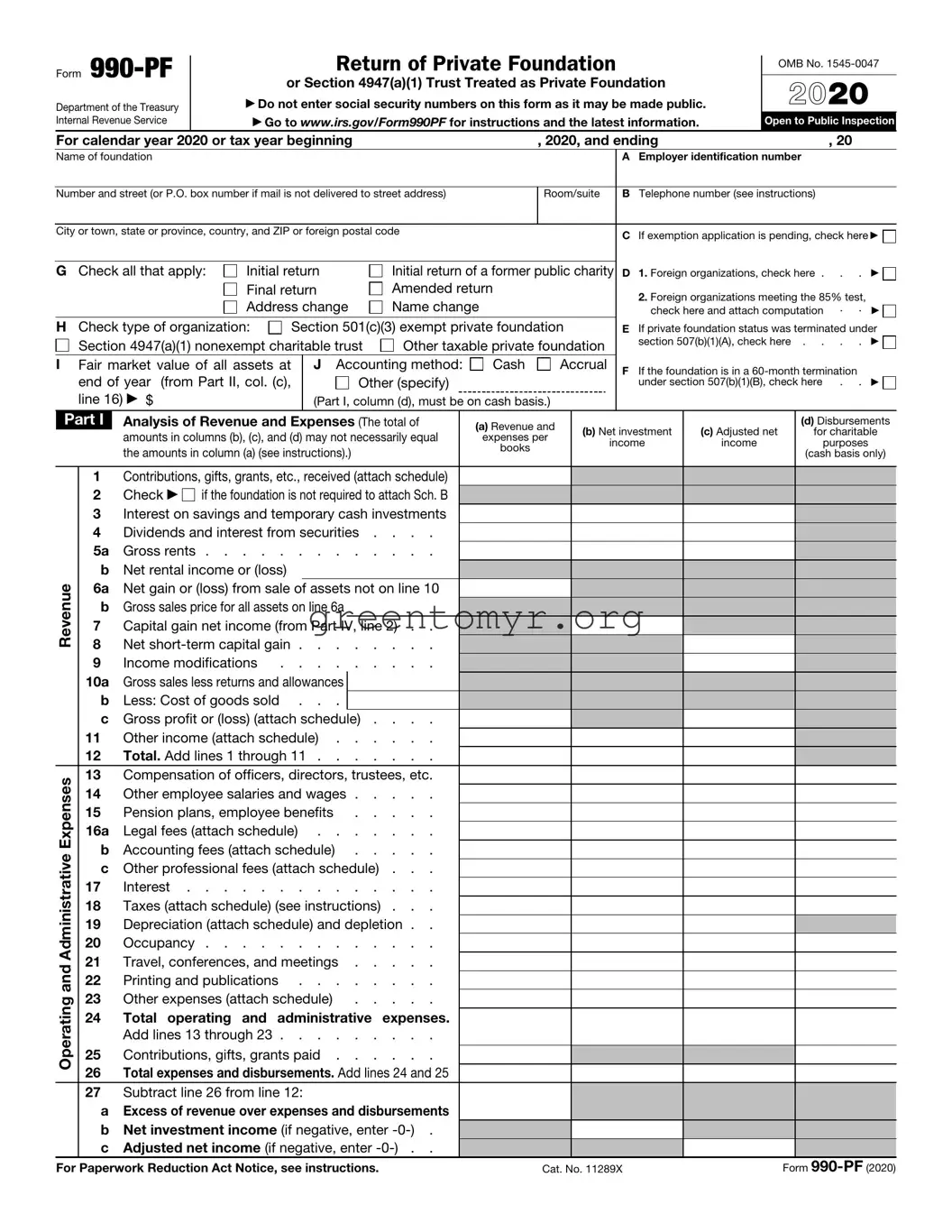

Part XIII |

Undistributed Income (see instructions) |

|

|

|

|

(a) |

(b) |

(c) |

(d) |

|

Corpus |

Years prior to 2019 |

2019 |

2020 |

1Distributable amount for 2020 from Part XI,

line 7 . . . . . . . . . . . . .

2 Undistributed income, if any, as of the end of 2020:

a |

Enter amount for 2019 only |

b |

Total for prior years: 20 |

, 20 |

, 20 |

3 Excess distributions carryover, if any, to 2020:

a |

From 2015 |

|

b |

From 2016 |

|

c |

From 2017 |

|

d |

From 2018 |

|

e |

From 2019 |

|

f |

Total of lines 3a through e |

4Qualifying distributions for 2020 from Part XII, line 4: ▶ $

a Applied to 2019, but not more than line 2a .

bApplied to undistributed income of prior years (Election required—see instructions) . . .

cTreated as distributions out of corpus (Election

required—see instructions) . . . . . .

d Applied to 2020 distributable amount . . e Remaining amount distributed out of corpus

5Excess distributions carryover applied to 2020 (If an amount appears in column (d), the same

amount must be shown in column (a).) . .

6Enter the net total of each column as indicated below:

a Corpus. Add lines 3f, 4c, and 4e. Subtract line 5

bPrior years’ undistributed income. Subtract

line 4b from line 2b . . . . . . . .

cEnter the amount of prior years’ undistributed income for which a notice of deficiency has been issued, or on which the section 4942(a) tax has been previously assessed . . . .

dSubtract line 6c from line 6b. Taxable

amount—see instructions . . . . . .

eUndistributed income for 2019. Subtract line 4a from line 2a. Taxable amount—see

instructions . . . . . . . . . . .

fUndistributed income for 2020. Subtract lines 4d and 5 from line 1. This amount must be

distributed in 2021 . . . . . . . . .

7Amounts treated as distributions out of corpus to satisfy requirements imposed by section 170(b)(1)(F) or 4942(g)(3) (Election may be

required—see instructions) . . . . . .

8Excess distributions carryover from 2015 not applied on line 5 or line 7 (see instructions) .

9Excess distributions carryover to 2021.

|

Subtract lines 7 and 8 from line 6a . . . |

10 Analysis of line 9: |

a |

Excess from 2016 . . . . |

|

b |

Excess from 2017 . . . . |

|

c |

Excess from 2018 . . . . |

|

d |

Excess from 2019 . . . . |

|

e |

Excess from 2020 . . . . |

Form 990-PF (2020)

|

|

|

|

|

|

|

|

|

|

Form 990-PF (2020) |

|

|

|

|

|

|

Page 10 |

Part XIV |

Private Operating Foundations (see instructions and Part VII-A, question 9) |

|

|

|

1a If the foundation has received a ruling or determination letter that it is a private operating |

|

|

|

|

|

foundation, and the ruling is effective for 2020, enter the date of the ruling . |

. . . . . ▶ |

|

|

|

|

|

|

|

|

|

b Check box to indicate whether the foundation is a private operating foundation described in section |

4942(j)(3) or |

4942(j)(5) |

2a |

Enter the lesser of the adjusted net |

Tax year |

|

Prior 3 years |

|

|

(e) Total |

|

income from Part I or the minimum |

|

|

|

|

|

|

|

(a) 2020 |

(b) 2019 |

(c) 2018 |

(d) 2017 |

|

investment return from Part X for |

|

|

|

|

|

|

|

|

|

|

each year listed |

|

|

|

|

|

|

|

b |

85% of line 2a |

|

|

|

|

|

|

|

cQualifying distributions from Part XII, line 4, for each year listed . . . .

dAmounts included in line 2c not used directly for active conduct of exempt activities . .

eQualifying distributions made directly for active conduct of exempt activities.

Subtract line 2d from line 2c . . .

3Complete 3a, b, or c for the alternative test relied upon:

a“Assets” alternative test—enter:

(1) Value of all assets . . . . .

(2)Value of assets qualifying under

section 4942(j)(3)(B)(i) . . . .

b“Endowment” alternative test—enter 2/3 of minimum investment return shown in

Part X, line 6, for each year listed |

. . |

c“Support” alternative test—enter:

(1)Total support other than gross investment income (interest, dividends, rents, payments on

securities loans (section 512(a)(5)), or royalties) . . . .

(2)Support from general public and 5 or more exempt organizations as provided in section 4942(j)(3)(B)(iii) . . . .

(3)Largest amount of support from

an exempt organization . . .

(4)Gross investment income . . .

Part XV |

Supplementary Information (Complete this part only if the foundation had $5,000 or more in assets at |

|

any time during the year—see instructions.) |

1 Information Regarding Foundation Managers:

aList any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any tax year (but only if they have contributed more than $5,000). (See section 507(d)(2).)

bList any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership or other entity) of which the foundation has a 10% or greater interest.

2Information Regarding Contribution, Grant, Gift, Loan, Scholarship, etc., Programs:

Check here ▶  if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If the foundation makes gifts, grants, etc., to individuals or organizations under other conditions, complete items 2a, b, c, and d. See instructions.

if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If the foundation makes gifts, grants, etc., to individuals or organizations under other conditions, complete items 2a, b, c, and d. See instructions.

aThe name, address, and telephone number or email address of the person to whom applications should be addressed:

bThe form in which applications should be submitted and information and materials they should include:

cAny submission deadlines:

dAny restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other factors:

Yes No

Yes No

if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If the foundation makes gifts, grants, etc., to individuals or organizations under other conditions, complete items 2a, b, c, and d. See instructions.

if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If the foundation makes gifts, grants, etc., to individuals or organizations under other conditions, complete items 2a, b, c, and d. See instructions.