Note: The form, instructions, or publication you are looking

for begins after this coversheet.

Please review the updated information below.

Reporting a Refundable Minimum Tax Credit on a 2018 or 2019 Form

990-T

A corporate 990-T filer who is completing Form 8827 and claiming a refundable minimum tax credit (line 5c (2019) or 8c (2018) of Form 8827) should report the credit on Form 990-T as follows.

•On a 2018 Form 990-T, report the credit on line 50g, Other credits, adjustments, and payments. Check the “Other” box. Enter “F8827” and the amount of the credit.

•On a 2019 Form 990-T, report the credit on line 51g, Other credits, adjustments, and payments. Check the “Other” box. Enter “F8827” and the amount of the credit.

|

Form 990-T |

|

Exempt Organization Business Income Tax Return |

OMB No. 1545-0047 |

|

|

|

|

|

|

|

|

|

|

|

(and proxy tax under section 6033(e)) |

|

|

2019 |

|

|

|

|

|

|

For calendar year 2019 or other tax year beginning |

, 2019, and ending |

, 20 |

. |

|

Department of the Treasury |

|

|

Go to www.irs.gov/Form990T for instructions and the latest information. |

|

|

|

|

|

|

|

Open to Public Inspection for |

|

Internal Revenue Service |

Do not enter SSN numbers on this form as it may be made public if your organization is a 501(c)(3). |

|

501(c)(3) Organizations Only |

|

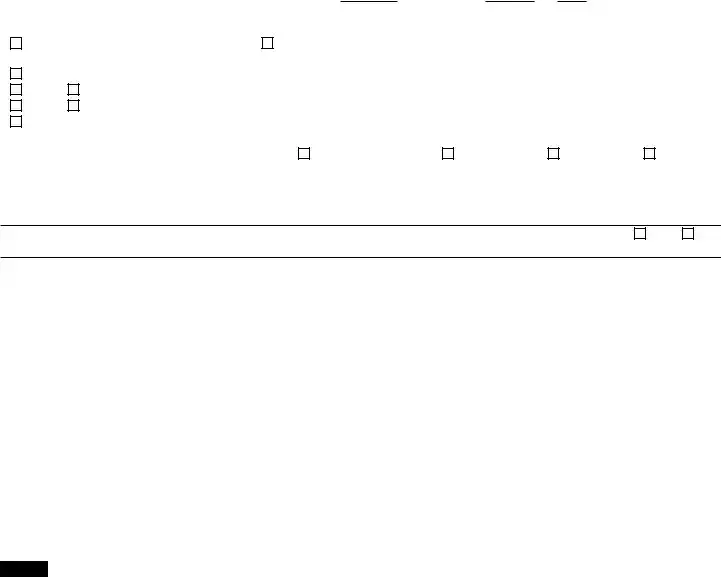

A |

Check box if |

|

|

|

Name of organization ( |

Check box if name changed and see instructions.) |

|

D Employer identification number |

|

address changed |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Employees’ trust, see instructions.) |

|

B Exempt under section |

Print |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

501( |

) ( |

) |

Number, street, and room or suite no. If a P.O. box, see instructions. |

|

|

|

|

|

|

|

|

or |

|

|

|

|

|

|

|

|

408(e) |

|

220(e) |

|

|

|

|

|

|

|

E Unrelated business activity code |

|

|

|

|

Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(See instructions.) |

|

|

|

|

408A |

|

530(a) |

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

529(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C Book value of all assets |

F |

Group exemption number (See instructions.) |

|

|

|

|

|

|

|

|

|

|

at end of year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G |

Check organization type |

501(c) corporation |

501(c) trust |

401(a) trust |

Other trust |

|

|

|

|

|

|

|

H Enter the number |

of the organization’s unrelated trades or businesses. |

|

|

|

Describe the only (or first) unrelated |

|

|

|

trade or business here |

|

|

|

. If only one, complete Parts I–V. If more than one, describe the |

|

|

|

first in the blank space at the end of the previous sentence, complete Parts I and II, complete a Schedule M for each additional |

|

|

|

trade or business, then complete Parts III–V. |

|

|

|

|

|

|

|

|

|

IDuring the tax year, was the corporation a subsidiary in an affiliated group or a parent-subsidiary controlled group? . . If “Yes,” enter the name and identifying number of the parent corporation.

|

|

|

|

|

|

|

|

|

J The books are in care of |

|

|

Telephone number |

|

Part |

I |

Unrelated Trade or Business Income |

|

|

(A) Income |

(B) Expenses |

(C) Net |

1a |

Gross receipts or sales . . |

|

|

|

|

|

|

b |

Less returns and allowances |

|

c Balance |

1c |

|

|

|

2 |

Cost of goods sold (Schedule A, line 7) |

2 |

|

|

|

3 |

Gross profit. Subtract line 2 from line 1c |

3 |

|

|

|

4a |

Capital gain net income (attach Schedule D) |

4a |

|

|

|

b |

Net gain (loss) (Form 4797, Part II, line 17) (attach Form 4797) . |

4b |

|

|

|

c |

Capital loss deduction for trusts |

4c |

|

|

|

5 |

Income (loss) from a partnership or an S corporation (attach |

|

|

|

|

|

statement) |

5 |

|

|

|

6 |

Rent income (Schedule C) |

6 |

|

|

|

7 |

Unrelated debt-financed income (Schedule E) |

7 |

|

|

|

8 |

Interest, annuities, royalties, and rents from a controlled organization (Schedule F) |

8 |

|

|

|

9 |

Investment income of a section 501(c)(7), (9), or (17) organization (Schedule G) |

9 |

|

|

|

10 |

Exploited exempt activity income (Schedule I) |

10 |

|

|

|

11 |

Advertising income (Schedule J) |

11 |

|

|

|

12 |

Other income (See instructions; attach schedule) |

12 |

|

|

|

13 |

Total. Combine lines 3 through 12 |

13 |

|

|

|

Part II Deductions Not Taken Elsewhere (See instructions for limitations on deductions.) (Deductions must be directly connected with the unrelated business income.)

14 |

Compensation of officers, directors, and trustees (Schedule K) |

14 |

|

15 |

Salaries and wages |

15 |

|

16 |

Repairs and maintenance |

16 |

|

17 |

Bad debts |

17 |

|

18 |

Interest (attach schedule) (see instructions) |

18 |

|

19 |

Taxes and licenses |

19 |

|

20 |

Depreciation (attach Form 4562) |

20 |

|

|

|

21 |

Less depreciation claimed on Schedule A and elsewhere on return . . . . |

21a |

|

21b |

|

22 |

Depletion |

22 |

|

23 |

Contributions to deferred compensation plans |

23 |

|

24 |

Employee benefit programs |

24 |

|

25 |

Excess exempt expenses (Schedule I) |

25 |

|

26 |

Excess readership costs (Schedule J) |

26 |

|

27 |

Other deductions (attach schedule) |

27 |

|

28 |

Total deductions. Add lines 14 through 27 |

28 |

|

29 |

Unrelated business taxable income before net operating loss deduction. Subtract line 28 from line 13 |

29 |

|

30 |

Deduction for net operating loss arising in tax years beginning on or after January 1, 2018 (see |

|

|

|

instructions) |

30 |

|

31 |

Unrelated business taxable income. Subtract line 30 from line 29 |

31 |

|

For Paperwork Reduction Act Notice, see instructions. |

Cat. No. 11291J |

Form 990-T (2019) |

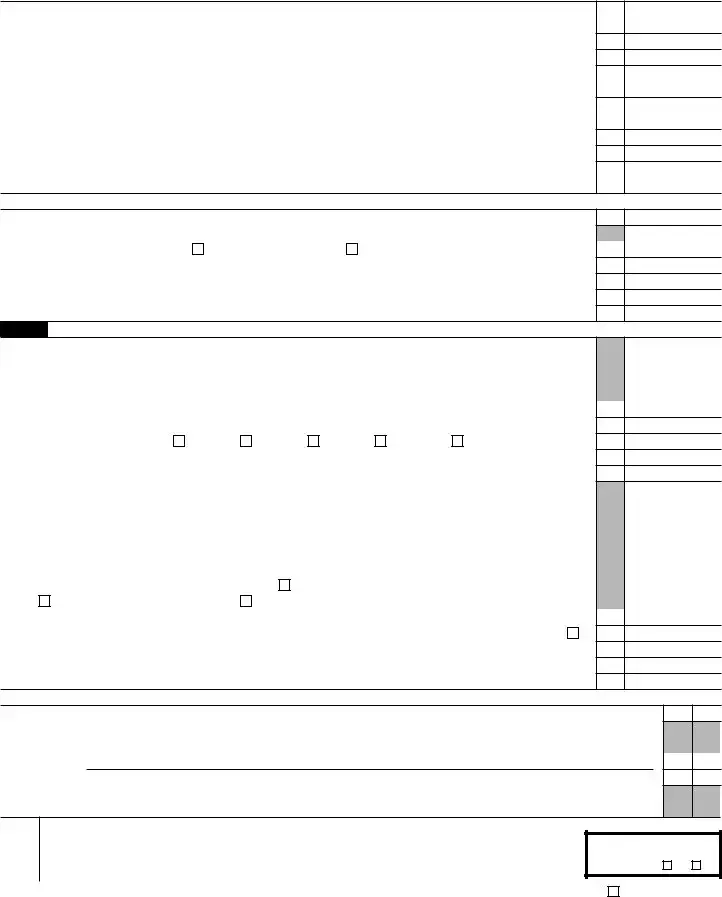

Form 990-T (2019) |

Page 2 |

Part III |

Total Unrelated Business Taxable Income |

|

32Total of unrelated business taxable income computed from all unrelated trades or businesses (see

|

instructions) |

33 |

Amounts paid for disallowed fringes |

34 |

Charitable contributions (see instructions for limitation rules) |

35Total unrelated business taxable income before pre-2018 NOLs and specific deduction. Subtract line

34 from the sum of lines 32 and 33 . . . . . . . . . . . . . . . . . . . . . .

36Deduction for net operating loss arising in tax years beginning before January 1, 2018 (see

|

instructions) |

37 |

Total of unrelated business taxable income before specific deduction. Subtract line 36 from line 35 . |

38 |

Specific deduction (Generally $1,000, but see line 38 instructions for exceptions) |

39Unrelated business taxable income. Subtract line 38 from line 37. If line 38 is greater than line 37, enter the smaller of zero or line 37 . . . . . . . . . . . . . . . . . . . . . . .

40 |

Organizations Taxable as Corporations. Multiply line 39 by 21% (0.21) |

41 |

Trusts Taxable at Trust |

Rates. See instructions |

for tax computation. Income tax on |

|

the amount on line 39 from: |

Tax rate schedule or |

Schedule D (Form 1041) |

42 |

Proxy tax. See instructions |

43 |

Alternative minimum tax (trusts only) |

44 |

Tax on Noncompliant Facility Income. See instructions |

45 |

Total. Add lines 42, 43, and 44 to line 40 or 41, whichever applies |

46a |

Foreign tax credit (corporations attach Form 1118; trusts attach Form 1116) . |

46a |

|

b |

Other credits (see instructions) |

46b |

|

c |

General business credit. Attach Form 3800 (see instructions) |

46c |

|

d |

Credit for prior year minimum tax (attach Form 8801 or 8827) |

46d |

|

e |

Total credits. Add lines 46a through 46d |

47 |

Subtract line 46e from line 45 |

48 |

Other taxes. Check if from: |

Form 4255 |

Form 8611 |

Form 8697 |

Form 8866 |

Other (attach schedule) |

49 |

Total tax. Add lines 47 and 48 (see instructions) |

502019 net 965 tax liability paid from Form 965-A or Form 965-B, Part II, column (k), line 3 . . . . .

|

|

|

|

|

|

|

|

|

|

|

51a |

Payments: A 2018 overpayment credited to 2019 |

51a |

|

b |

2019 estimated tax payments |

51b |

|

c |

Tax deposited with Form 8868 |

51c |

|

d |

Foreign organizations: Tax paid or withheld at source (see instructions) . . |

51d |

|

e |

Backup withholding (see instructions) |

51e |

|

f |

Credit for small employer health insurance premiums (attach Form 8941) . . |

51f |

|

g |

Other credits, adjustments, and payments: |

Form 2439 |

|

|

|

|

|

Form 4136 |

|

Other |

|

|

|

Total |

51g |

|

52 |

Total payments. Add lines 51a through 51g |

53 |

Estimated tax penalty (see instructions). Check if Form 2220 is attached |

54 |

Tax due. If line 52 is less than the total of lines 49, 50, and 53, enter amount owed |

55Overpayment. If line 52 is larger than the total of lines 49, 50, and 53, enter amount overpaid . .

56 Enter the amount of line 55 you want: Credited to 2020 estimated tax |

Refunded |

46e

47

48

49

50

52

53

54

55

56

Part VI Statements Regarding Certain Activities and Other Information (see instructions)

57At any time during the 2019 calendar year, did the organization have an interest in or a signature or other authority over a financial account (bank, securities, or other) in a foreign country? If “Yes,” the organization may have to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts. If “Yes,” enter the name of the foreign country here

58During the tax year, did the organization receive a distribution from, or was it the grantor of, or transferor to, a foreign trust? .

If “Yes,” see instructions for other forms the organization may have to file. |

|

59 Enter the amount of tax-exempt interest received or accrued during the tax year |

$ |

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

F |

|

F |

|

May the IRS discuss this return |

|

|

|

|

|

|

|

|

|

|

with the preparer shown below |

|

|

|

|

|

(see instructions)? Yes No |

|

Signature of officer |

Date |

|

Title |

Paid |

Print/Type preparer’s name |

Preparer’s signature |

Date |

Check |

if |

PTIN |

|

|

|

|

Preparer |

|

|

|

self-employed |

|

|

|

|

|

|

|

Firm’s name |

|

|

Firm’s EIN |

|

|

Use Only |

|

|

|

|

Firm’s address |

|

|

Phone no. |

|

|

|

|

|

|

|

Form 990-T (2019)

Form 990-T (2019) |

Page 3 |

Schedule A—Cost of Goods Sold. Enter method of inventory valuation |

|

1Inventory at beginning of year

3Cost of labor . . . . . .

4a Additional section 263A costs

(attach schedule) . . . .

bOther costs (attach schedule)

5 Total. Add lines 1 through 4b

6 Inventory at end of year . . . . |

6 |

7Cost of goods sold. Subtract line 6 from line 5. Enter here and in Part

8Do the rules of section 263A (with respect to Yes No

property produced or acquired for resale) apply  to the organization? . . . . . . . . .

to the organization? . . . . . . . . .

Schedule C—Rent Income (From Real Property and Personal Property Leased With Real Property)

(see instructions)

1.Description of property

(1)

(2)

(3)

(4)

2.Rent received or accrued

(a) From personal property (if the percentage of rent |

(b) From real and personal property (if the |

|

|

3(a) Deductions directly connected with the income |

for personal property is more than 10% but not |

percentage of rent for personal property exceeds |

|

in columns 2(a) and 2(b) (attach schedule) |

more than 50%) |

|

50% or if the rent is based on profit or income) |

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

(4) |

|

|

|

|

|

|

|

Total |

|

Total |

|

|

|

(b) Total deductions. |

|

(c) Total income. Add totals of columns 2(a) and 2(b). Enter |

|

|

|

|

|

|

|

Enter here and on page 1, |

here and on page 1, Part I, line 6, column (A) . . . |

|

|

|

Part I, line 6, column (B) |

|

Schedule E—Unrelated Debt-Financed Income (see instructions) |

|

|

|

|

|

|

|

2. Gross income from or |

|

3. Deductions directly connected with or allocable to |

1. Description of debt-financed property |

|

debt-financed property |

allocable to debt-financed |

|

|

|

|

|

|

|

property |

|

(a) Straight line depreciation |

(b) Other deductions |

|

|

|

|

|

(attach schedule) |

(attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

(4) |

|

|

|

|

|

|

|

4. Amount of average |

5. Average adjusted basis |

6. Column |

|

|

7. Gross income reportable |

8. Allocable deductions |

acquisition debt on or |

of or allocable to |

|

|

4 divided |

|

|

(column 6 × total of columns |

allocable to debt-financed |

debt-financed property |

|

|

(column 2 × column 6) |

by column 5 |

|

|

3(a) and 3(b)) |

property (attach schedule) |

(attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

% |

|

|

|

(2) |

|

|

|

% |

|

|

|

(3) |

|

|

|

% |

|

|

|

(4) |

|

|

|

% |

|

|

|

|

|

|

|

|

Enter here and on page 1, |

Enter here and on page 1, |

|

|

|

|

|

Part I, line 7, column (A). |

Part I, line 7, column (B). |

Totals |

|

|

|

|

Total dividends-received deductions included in column 8 |

|

|

|

|

|

|

|

|

Form 990-T (2019) |

Form 990-T (2019) |

|

|

|

|

Page 4 |

Schedule F—Interest, Annuities, Royalties, and Rents From Controlled Organizations (see instructions) |

|

|

Exempt Controlled Organizations |

|

|

1. Name of controlled |

2. Employer |

4. Total of specified |

5. Part of column 4 that is |

6. Deductions directly |

organization |

identification number 3. Net unrelated income |

included in the controlling |

connected with income |

|

|

(loss) (see instructions) |

payments made |

|

|

organization’s gross income |

in column 5 |

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

(2) |

|

|

|

|

|

(3) |

|

|

|

|

|

(4)

Nonexempt Controlled Organizations

|

7. |

Taxable Income |

8. Net unrelated income |

9. |

Total of specified |

10. Part of column 9 that is |

11. Deductions directly |

|

included in the controlling |

connected with income in |

|

(loss) (see instructions) |

payments made |

|

|

|

organization’s gross income |

column 10 |

|

|

|

|

|

|

(1)

(2)

(3)

(4)

Add columns 5 and 10. |

Add columns 6 and 11. |

Enter here and on page 1, |

Enter here and on page 1, |

Part I, line 8, column (A). |

Part I, line 8, column (B). |

Totals . . . . . . . . . . . . . . . . . . . . . . . . .

Schedule G—Investment Income of a Section 501(c)(7), (9), or (17) Organization (see instructions)

|

1. Description of income |

2. Amount of income |

3. Deductions |

4. |

Set-asides |

5. Total deductions |

|

directly connected |

and set-asides (col. 3 |

|

(attach schedule) |

|

|

|

(attach schedule) |

plus col. 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

(4) |

|

|

|

|

|

|

|

Enter here and on page 1, |

|

|

|

Enter here and on page 1, |

|

|

Part I, line 9, column (A). |

|

|

|

Part I, line 9, column (B). |

Totals . . . . . . . .

Schedule I—Exploited Exempt Activity Income, Other Than Advertising Income (see instructions)

|

|

2. Gross |

3. Expenses |

4. Net income (loss) |

5. Gross income |

|

|

7. Excess exempt |

|

|

directly |

from unrelated trade |

6. |

Expenses |

expenses |

|

|

unrelated |

|

1. Description of exploited activity |

connected with |

or business (column |

from activity that |

(column 6 minus |

|

business income |

attributable to |

|

production of |

2 minus column 3). |

is not unrelated |

column 5, but not |

|

|

from trade or |

column 5 |

|

|

unrelated |

If a gain, compute |

business income |

more than |

|

|

business |

|

|

|

|

business income |

cols. 5 through 7. |

|

|

|

column 4). |

|

|

|

|

|

|

(1)

(2)

(3)

(4)

Enter here and on |

Enter here and on |

Enter here and |

page 1, Part I, |

page 1, Part I, |

on page 1, |

line 10, col. (A). |

line 10, col. (B). |

Part II, line 25. |

Totals . . . . . . . .

Schedule J—Advertising Income (see instructions)

Part I Income From Periodicals Reported on a Consolidated Basis

|

|

2. Gross |

|

|

4. Advertising |

|

|

|

7. Excess readership |

|

1. Name of periodical |

3. |

Direct |

gain or (loss) (col. |

5. Circulation |

6. |

Readership |

costs (column 6 |

|

advertising |

2 minus col. 3). If |

minus column 5, but |

|

advertising costs |

income |

|

costs |

|

|

income |

a gain, compute |

|

not more than |

|

|

|

|

|

|

|

|

|

|

|

|

cols. 5 through 7. |

|

|

|

column 4). |

(1)

(2)

(3)

(4)

Totals (carry to Part II, line (5)) |

. |

Part II Income From Periodicals Reported on a Separate Basis (For each periodical listed in Part II, fill in columns

2 through 7 on a line-by-line basis.)

|

|

2. Gross |

|

|

4. Advertising |

|

|

|

|

|

|

7. Excess readership |

1. Name of periodical |

3. Direct |

|

gain or (loss) (col. |

5. Circulation |

|

6. |

Readership |

|

costs (column 6 |

advertising |

|

2 minus col. 3). If |

|

|

minus column 5, but |

advertising costs |

|

|

income |

|

|

costs |

|

|

|

income |

|

a gain, compute |

|

|

|

|

not more than |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

cols. 5 through 7. |

|

|

|

|

|

|

column 4). |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

Totals from Part I. |

. . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter here and on |

Enter here and on |

|

|

|

|

|

|

|

|

Enter here and |

|

|

page 1, Part I, |

page 1, Part I, |

|

|

|

|

|

|

|

|

on page 1, |

|

|

line 11, col. (A). |

line 11, col. (B). |

|

|

|

|

|

|

|

|

Part II, line 26. |

Totals, Part II (lines 1–5) . . . . |

|

|

|

|

|

|

|

|

|

|

|

Schedule K—Compensation of |

Officers, Directors, and Trustees (see instructions) |

|

|

|

|

|

1. Name |

|

|

2. Title |

|

3. Percent of |

|

4. Compensation attributable to |

|

|

|

|

time devoted to |

|

|

|

|

|

|

unrelated business |

|

|

|

|

|

|

|

business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

% |

|

|

|

|

(2) |

|

|

|

|

|

|

% |

|

|

|

|

(3) |

|

|

|

|

|

|

% |

|

|

|

|

(4) |

|

|

|

|

|

|

% |

|

|

|

|

Total. Enter here and on page 1, Part II, line 14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form 990-T (2019) |

to the organization? . . . . . . . . .

to the organization? . . . . . . . . .