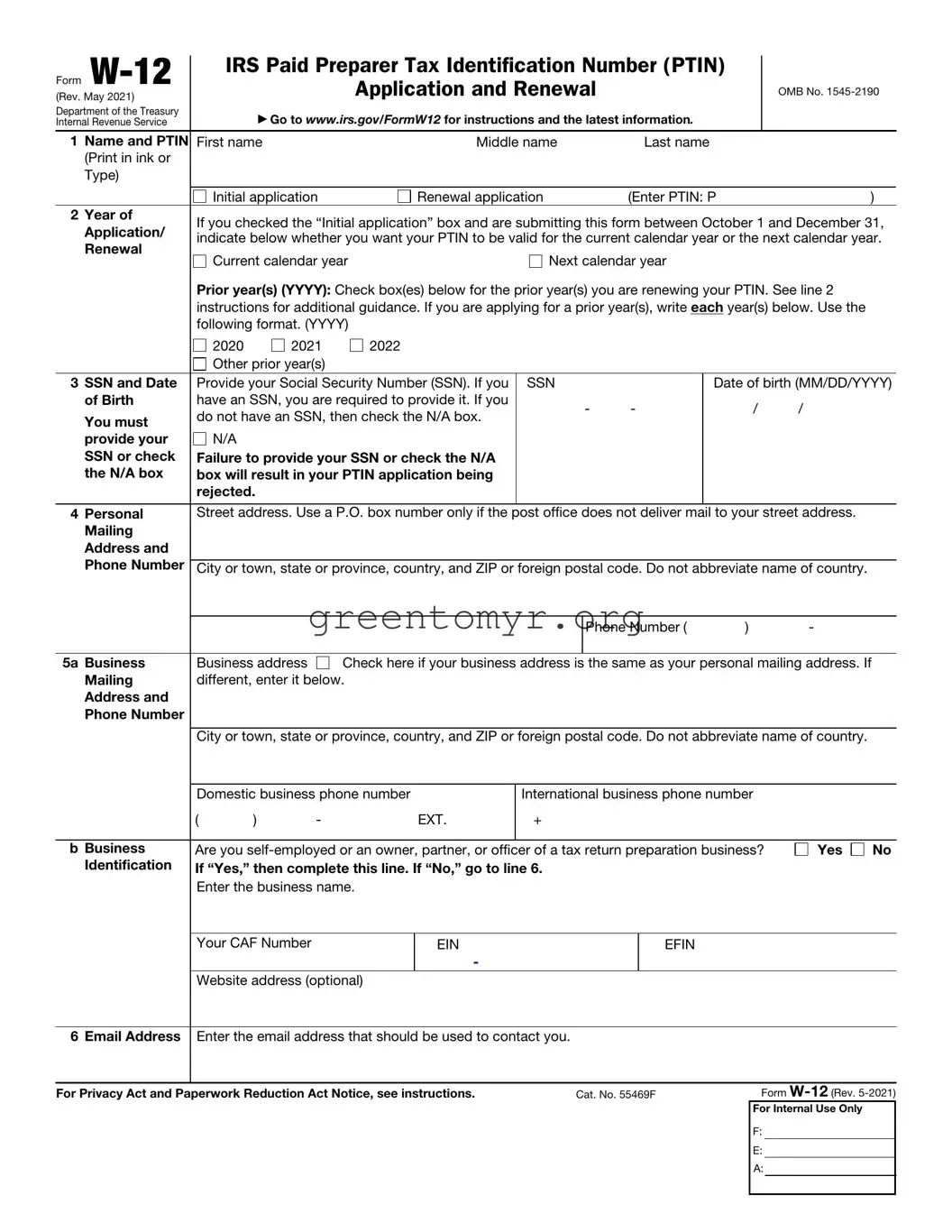

Form W-12

(Rev. May 2021)

Department of the Treasury

Internal Revenue Service

IRS Paid Preparer Tax Identification Number (PTIN)

Application and Renewal

▶Go to www.irs.gov/FormW12 for instructions and the latest information.

1 Name and PTIN First name |

|

|

Middle name |

|

Last name |

|

|

|

(Print in ink or |

|

|

|

|

|

|

|

|

|

|

|

Type) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial application |

|

Renewal application |

|

(Enter PTIN: P |

|

) |

2 |

Year of |

If you checked the “Initial application” box and are submitting this form between October 1 and December 31, |

|

Application/ |

|

indicate below whether you want your PTIN to be valid for the current calendar year or the next calendar year. |

|

Renewal |

|

Current calendar year |

|

Next calendar year |

|

|

|

|

|

|

|

|

|

Prior year(s) (YYYY): Check box(es) below for the prior year(s) you are renewing your PTIN. See line 2 |

|

|

instructions for additional guidance. If you are applying for a prior year(s), write each year(s) below. Use the |

|

|

following format. (YYYY) |

|

|

|

|

|

|

|

|

|

2020 |

2021 |

|

2022 |

|

|

|

|

|

|

|

|

Other prior year(s) |

|

|

|

|

|

|

|

|

3 |

SSN and Date |

Provide your Social Security Number (SSN). If you |

SSN |

|

|

Date of birth (MM/DD/YYYY) |

|

of Birth |

have an SSN, you are required to provide it. If you |

|

- |

- |

|

/ |

/ |

|

You must |

do not have an SSN, then check the N/A box. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

provide your |

N/A |

|

|

|

|

|

|

|

|

|

|

SSN or check |

Failure to provide your SSN or check the N/A |

|

|

|

|

|

|

|

the N/A box |

box will result in your PTIN application being |

|

|

|

|

|

|

|

|

rejected. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Personal |

Street address. Use a P.O. box number only if the |

post office does not deliver mail to your street address. |

|

Mailing |

|

|

|

|

|

|

|

|

|

|

|

Address and |

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

City or town, state or province, country, and ZIP or foreign postal code. Do not abbreviate name of country. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number ( |

) |

- |

|

|

|

|

|

5a |

Business |

Business address |

Check here if your business address is the same as your personal mailing address. If |

|

Mailing |

different, enter it below. |

|

|

|

|

|

|

|

|

Address and |

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code. Do not abbreviate name of country.

|

Domestic business phone number |

|

|

International business phone number |

|

|

|

( |

) |

- |

EXT. |

|

+ |

|

|

|

|

|

|

|

|

|

|

b Business |

Are you self-employed or an owner, partner, or officer of a tax return preparation business? |

Yes |

No |

Identification |

If “Yes,” then complete this line. If “No,” go to line 6. |

|

|

|

Enter the business name. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your CAF Number |

|

EIN |

|

|

EFIN |

|

|

|

|

|

|

|

- |

|

|

|

|

|

Website address (optional) |

|

|

|

|

|

|

6Email Address Enter the email address that should be used to contact you.

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 55469F |

Form W-12 (Rev. 5-2021) |

|

|

For Internal Use Only |

|

|

F: |

|

|

|

E: |

|

|

|

A: |

|

|

|

|

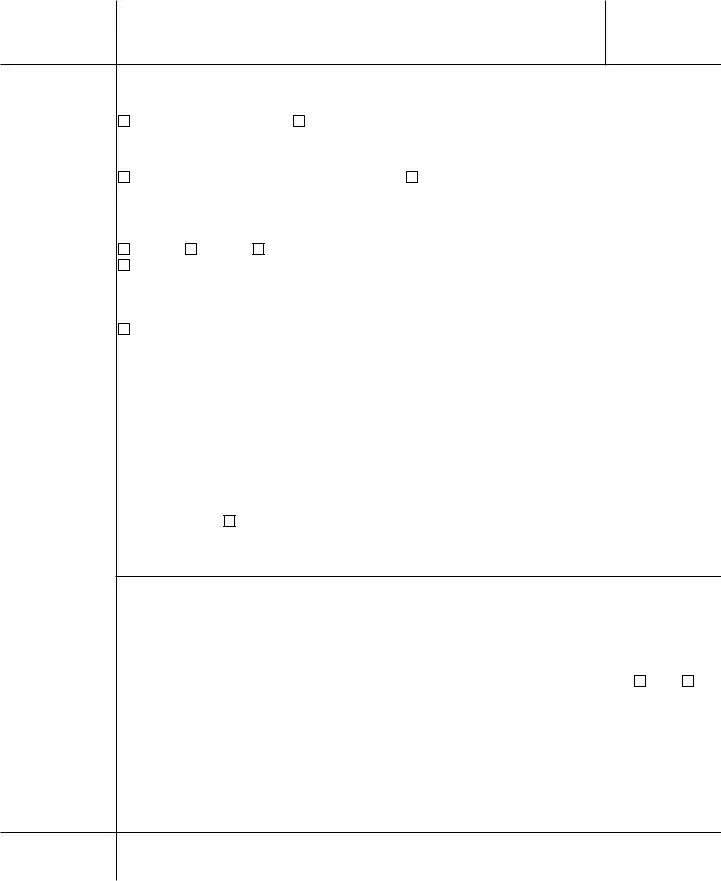

Form W-12 (Rev. 5-2021) |

Page 2 |

7Past Felony Convictions You must check a box. If “Yes,” you must provide an explanation.

Have you been convicted of a felony in the past 10 years?

If “Yes,” list the date and the type of felony conviction(s).

If this is your initial application for a PTIN, continue to line 8. If you are renewing your PTIN, go to line 10.

8 |

Address of |

Enter the address used on your last U.S. individual income tax return you filed. |

|

Your |

|

|

|

|

|

Last U.S. |

|

|

|

|

|

Individual |

|

|

|

|

|

Income Tax |

|

|

|

|

|

Check here if you have never filed a U.S. income tax return or do not have a U.S. income tax filing |

|

Return Filed |

|

requirement. See line 8 instructions for documents that must be submitted with this form and continue to |

|

|

|

|

line 10. |

|

|

|

|

|

|

|

|

|

9 |

Filing Status |

Single |

Head of Household |

|

and Tax Year |

|

|

|

|

|

on Last U.S. |

Married filing jointly |

Qualifying widow(er) with dependent child |

|

Individual |

|

|

|

|

|

Income Tax |

Married filing separately |

Tax Year (YYYY) |

|

|

|

Return Filed |

|

Note: If your last return was filed more than 4 years ago, see instructions. |

|

|

|

|

|

10 |

Federal Tax |

Are you current on both your individual and business federal taxes, including any corporate and employment |

|

Compliance |

tax obligations? Note: If you have never filed a U.S. individual income tax return because you are not required |

|

|

to do so, check the “Yes” box. |

|

|

Yes |

|

|

|

|

|

No |

|

|

If “No,” provide an explanation. |

|

|

|

11Data Security I am aware that paid tax return preparers must have a data security plan to provide data and system security Responsibilities protections for all taxpayer information.

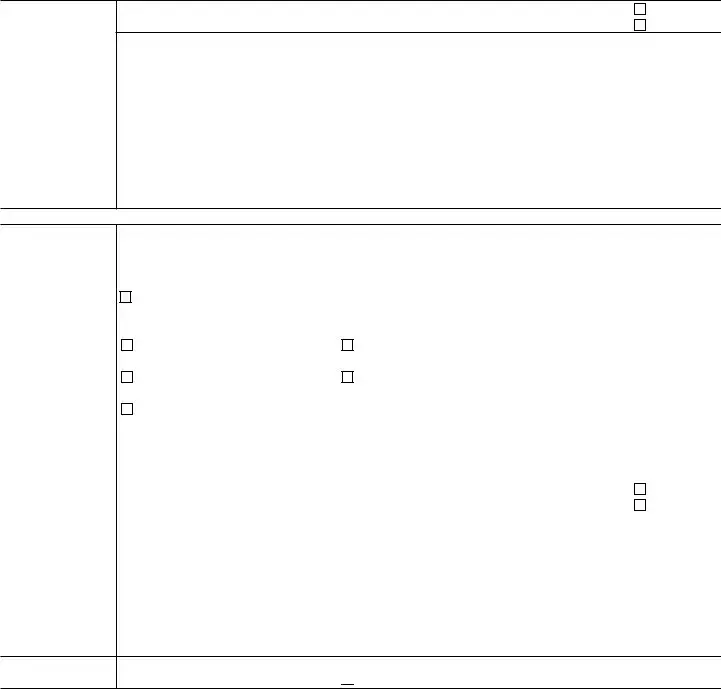

Form W-12 (Rev. 5-2021)

Form W-12 (Rev. 5-2021) |

|

|

|

|

|

|

Page 3 |

12 Professional |

Check all that apply. Note: DO NOT check any professional credentials that are currently expired or |

Credentials |

retired. Enter state abbreviation and appropriate number(s). If the expiration date is left blank or incomplete, |

|

then NO professional credential will be added when the application is processed. |

|

Attorney—Licensed in which |

|

|

|

|

|

|

jurisdiction(s): |

Number(s): |

Expiration Date(s): |

|

|

|

|

|

|

|

|

|

Certified Public Accountant (CPA)— |

|

|

|

|

|

|

Licensed in which jurisdiction(s): |

Number(s): |

Expiration Date(s): |

|

|

|

|

|

|

|

|

|

Enrolled Agent (EA) |

Number(s): |

|

Expiration Date(s): |

|

|

Enrolled Actuary |

Number(s): |

|

Expiration Date(s): |

|

|

Enrolled Retirement Plan Agent (ERPA) |

Number(s): |

Expiration Date(s): |

|

State Regulated Tax Return Preparer |

|

|

|

|

|

|

—Licensed in which jurisdiction(s): |

Number(s): |

Expiration Date(s): |

|

|

|

|

|

|

|

|

Certifying Acceptance Agent (CAA) |

Number: |

|

|

|

None |

|

|

|

|

|

13 Fees |

If you are applying for a PTIN or renewing your PTIN, your fee is $35.95. The fee is an application processing |

|

fee and is nonrefundable. Full payment must be included with your application or it will be rejected. If your |

application is incomplete and you do not supply the required information upon request, the IRS will be unable

to process your application. Make your check or money order payable to IRS Tax Pro PTIN Fee. Do not

paper clip, staple, or otherwise attach the payment to Form W-12. Separate payments are required for each

year you are applying for. No payment is due for 2020 and prior years.

|

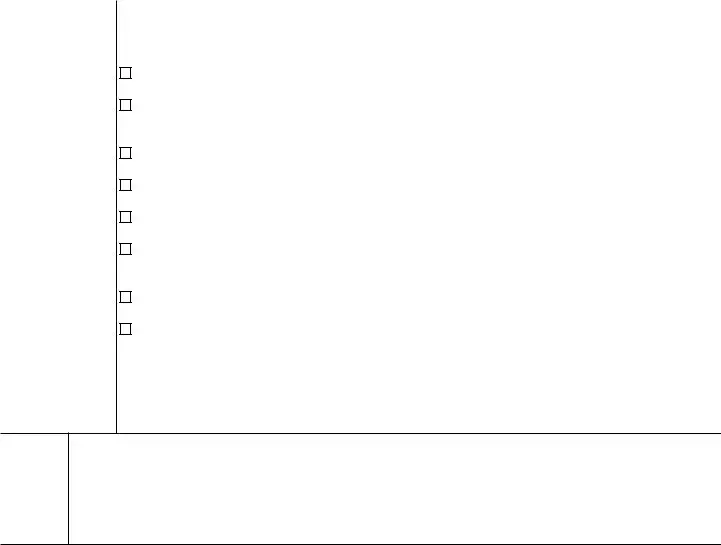

Under penalties of perjury, I declare that I have examined this application and to the best of my knowledge and belief, it |

Sign |

is true, correct, and complete. I understand any false or misleading information may result in criminal penalties and/or |

the denial or termination of a PTIN. |

|

|

Here |

▲ |

Your signature (Please use blue or black ink) |

Date (MM/DD/YYYY) |

|

/ |

/ |

|

|

|

|

How To File

Online. Go to the webpage www.irs.gov/ptin for information. Follow the instructions to submit Form W-12. If you submit your application online, your PTIN generally will be provided to you immediately after you complete the application.

By mail. Complete Form W-12. Send the form to:

IRS Tax Professional PTIN Processing Center PO Box 380638

San Antonio, TX 78268

Note: Allow 4 to 6 weeks for processing of PTIN applications. For additional information, refer to the separate Instructions for Form W-12.

For Internal Use Only |

Form W-12 (Rev. 5-2021) |