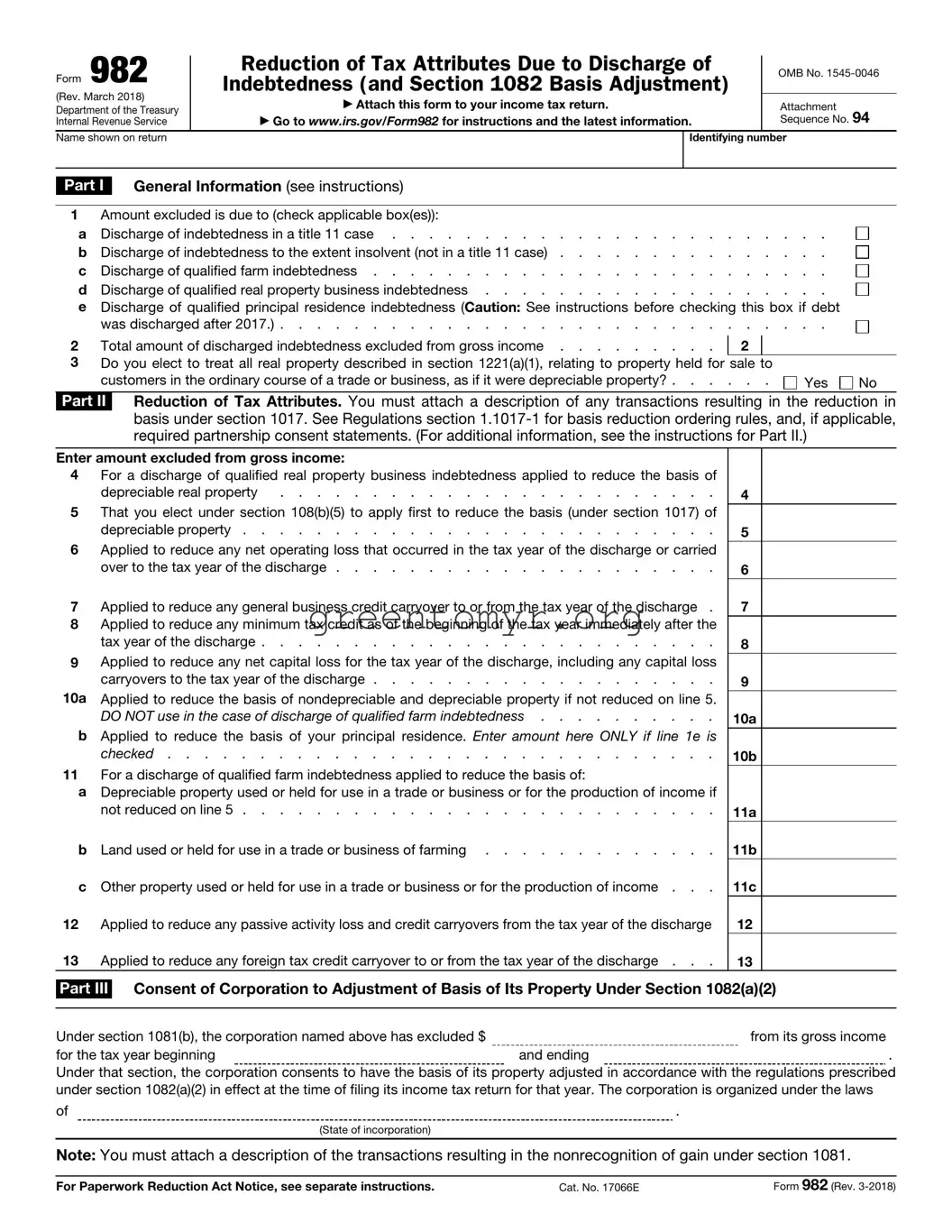

Completing the IRS Insolvency Form (Form 982) can be a tricky process for many people. Several common mistakes often lead to errors or delays in processing. Below, ten frequent pitfalls are outlined to help individuals navigate their way through filling out this important form.

1. Failing to Attach the Form: One of the most significant oversights occurs when individuals forget to attach Form 982 to their income tax return. This form is crucial, and failing to include it can result in rejected claims.

2. Incorrectly Marking the Boxes: Applicants often check the wrong boxes in Part I regarding the discharge of indebtedness. Each box corresponds to a specific situation. Misunderstanding the categories can lead to inaccurate reporting of one’s financial status.

3. Failing to Calculate Total Amount Accurately: Many people miscalculate the total amount of discharged indebtedness excluded from their gross income. Precision is key here, and using a calculator can help ensure accuracy.

4. Ignoring Instructions for Property Depreciation: A common error emerges when individuals neglect to read the guidance about electing treatment for real property as depreciable property. Misunderstandings may affect potential tax benefits.

5. Omitting Required Descriptions: Form 982 requires a description of transactions that result in the reduction in basis under Section 1017. Leaving out this information can impede the processing of the form.

6. Misunderstanding the Reduction of Tax Attributes: In Part II, applicants often confuse the various reductions of tax attributes. Each line item must be approached with care, as oversights can invalidate parts of the submission.

7. Missing Information on Non-depreciable Property: When reducing the basis of non-depreciable and depreciable property, applicants sometimes fail to reference the correct lines. It’s essential to follow the instructions closely to ensure compliance.

8. Not Considering Foreign Tax Credits: For those who have foreign tax credits, missing information related to foreign tax credit carryover can be a critical oversight. This can lead to complications in tax filings.

9. Ignoring Corporate Consent Requirements: For corporations filling out Part III, failing to obtain the necessary consents for adjustments of asset bases can hinder the completion process. Corporate tax obligations differ from individual requirements.

10. Submitting Without a Review: Finally, individuals often submit their forms without thoroughly reviewing their entries. A final check can catch simple mistakes that could affect the outcome.

By keeping these common mistakes in mind, individuals can better navigate the process of completing and submitting Form 982. Careful attention to detail helps ensure that tax filings are processed smoothly and accurately.