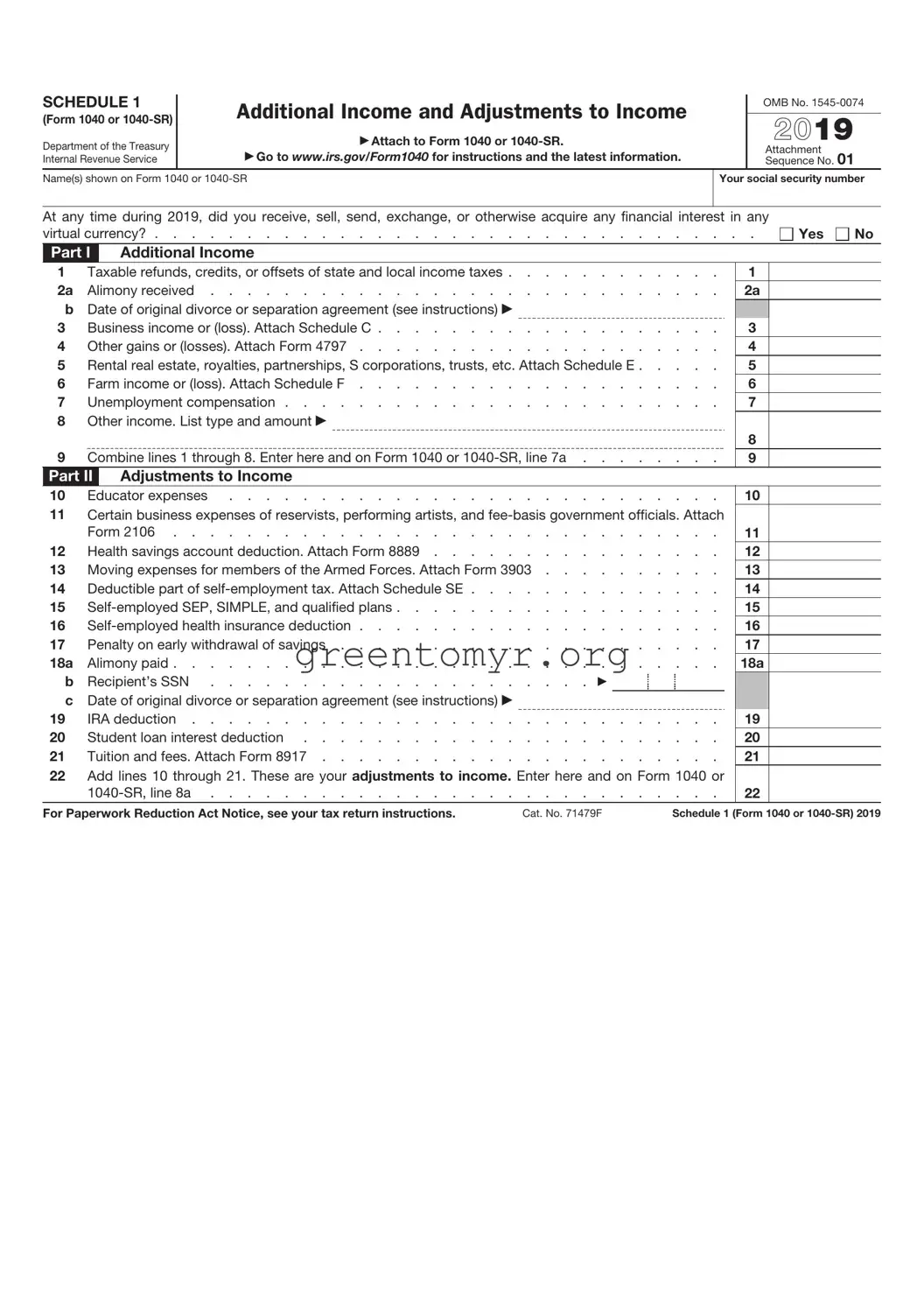

Filling out the IRS Schedule 1 with your Form 1040 or 1040-SR is crucial for accurately reporting additional income and adjustments to income. However, many individuals make common mistakes that can delay processing or lead to inaccuracies. One frequent error is mismatching names. If the name on the schedule does not match the name associated with the Social Security number, it can lead to unnecessary complications.

Another common mistake involves missing or incorrect Social Security numbers. Each entry, especially those concerning dependents, requires accurate Social Security numbers to avoid delays. Omitting these numbers can result in rejected filings or missed credits.

Many individuals also fail to claim all eligible deductions or adjustments. Access to specific tax benefits depends on reporting all relevant income and expenses. For example, if you qualify for health savings account deductions but do not list them, you miss out on valuable tax relief.

Some filers incorrectly classify income. Understanding whether an income source is taxable or not is crucial. For instance, unemployment compensation might be taxable, while some gifts or inheritances are not. Misclassification can lead to underreporting or overreporting of taxable income.

It’s also common to make calculation errors. Simple math mistakes can lead to significant discrepancies. Double-checking calculations or using tax software can help mitigate this risk.

Another mistake is overlooking other forms of income that should be reported on Schedule 1, such as canceled debts or cryptocurrency transactions. Failing to report these items can trigger an audit.

Poor organization of documents can lead to submitting incomplete information. Gathering all necessary forms, such as 1099s for additional income, ensures nothing is overlooked, promoting a smoother filing experience.

Finally, some individuals neglect to sign and date their return. An unsigned return is considered incomplete. Always ensure that the return is properly signed and dated before submitting it.