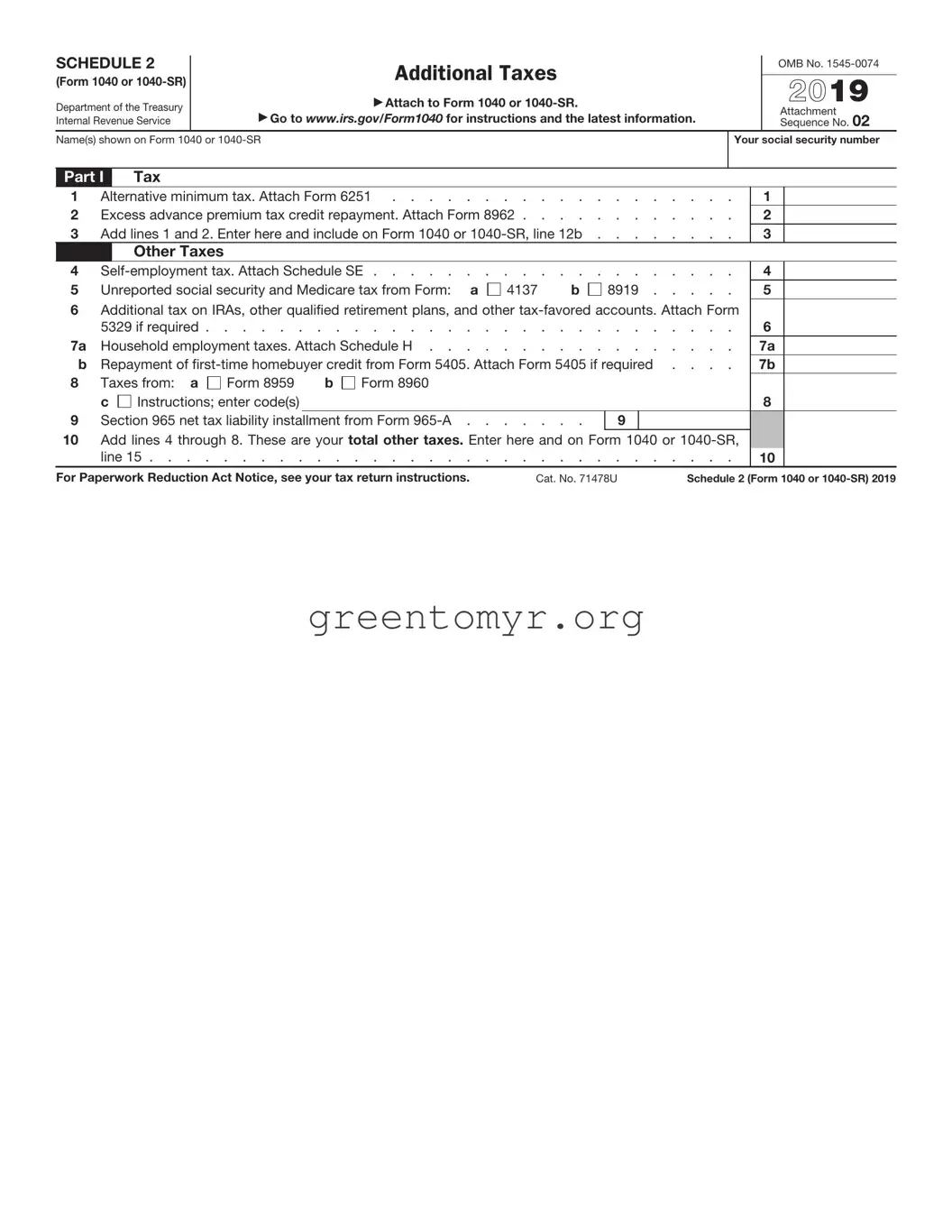

What is IRS Schedule 2?

IRS Schedule 2 is a supplement to the 1040 or 1040-SR form used to report additional taxes. It includes various types of taxes that aren't included on the main tax form. For example, it covers taxes like self-employment tax, repayment of advance premium tax credits, and other specific taxes. If you find yourself in a situation where you're subject to these additional taxes, you'll need to complete this schedule.

Who needs to file Schedule 2?

Not everyone needs to complete Schedule 2. You generally must file it if you owe specific taxes that are not reported directly on the 1040 or 1040-SR. This includes:

-

If you owe self-employment tax.

-

If you need to repay the advance premium tax credits for health coverage.

-

If you owe the alternative minimum tax (AMT).

-

If you have any other applicable taxes that require reporting.

How do I complete Schedule 2?

To complete Schedule 2, start by gathering necessary information related to any additional taxes. You'll find sections for each type of tax on the form. Fill in the required amounts based on your calculations or any guidance provided by the IRS. After completing Schedule 2, attach it to your 1040 or 1040-SR when you file your tax return.

Is there a deadline for filing Schedule 2?

The filing deadline for IRS Schedule 2 is the same as the deadline for your 1040 or 1040-SR. Generally, this is April 15 for most taxpayers. If you need more time, you can file for an extension. Just remember that even if you extend your filing, any taxes owed are still due by the original deadline to avoid penalties and interest.

Where can I find Schedule 2?

You can easily obtain IRS Schedule 2 from the IRS website. It is available as a downloadable PDF form. Alternatively, you can also access it through tax preparation software if you’re filing electronically. Always ensure you are downloading the version that corresponds to the tax year you are filing.

What if I make a mistake on Schedule 2?

Errors happen. If you discover a mistake after you've submitted your return, you can correct it by filing an amended return using Form 1040-X. This allows you to update your Schedule 2 and any other relevant forms or schedules. Make sure to provide an explanation for the changes you are making.

Yes, maintaining records is crucial. You should keep all documentation that supports the amounts reported on Schedule 2 for at least three years after filing your return. This includes any forms, receipts, or other materials that verify your additional tax obligations. Proper record-keeping can help you if you face an audit or have questions about your tax return later on.