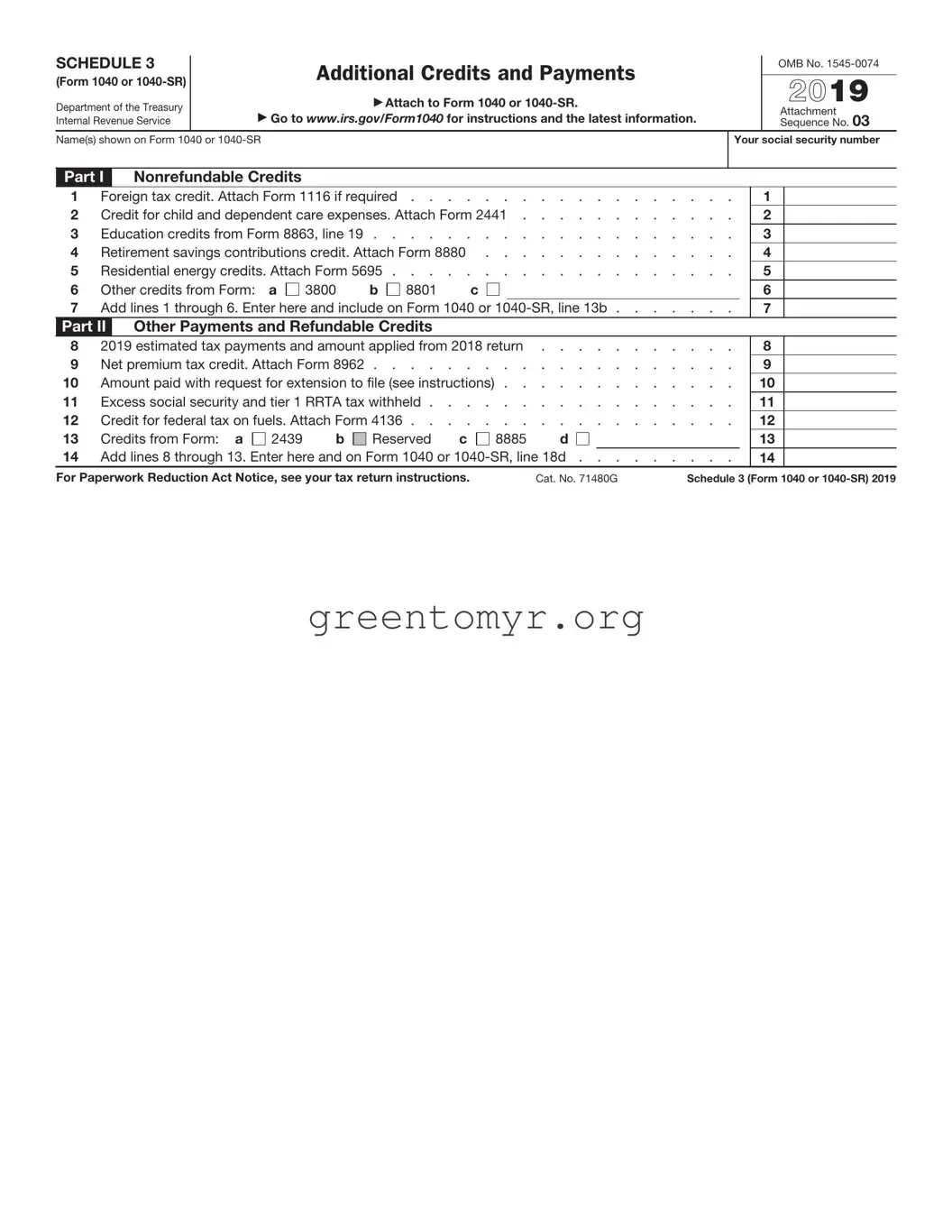

Filling out the IRS Schedule 3 on the 1040 or 1040-SR form can be a daunting task for many taxpayers. One common mistake is misunderstanding the purpose of the form itself. Schedule 3 is designed to report certain nonrefundable credits, other payments, and refundable credits. Some individuals mistakenly believe it is a place to list all deductions, which leads to an incomplete or incorrect filing.

Another frequent error is failing to properly calculate the amounts for each credit or payment listed on Schedule 3. Taxpayers may overlook instructions specific to each credit, leading them to enter incorrect figures. This can delay processing and may even prompt an audit if discrepancies are significant.

Many people also forget to double-check their eligibility for the credits they claim. Each credit has specific requirements, and if you do not meet those, it can result in an improper claim. A simple oversight in understanding the eligibility can lead to missed opportunities or the need for later corrections.

Inaccurate or missing identification information represents another mistake. Individuals often neglect to provide their Social Security number or that of their spouse if filing jointly. This small detail is crucial for ensuring that the IRS can match your form accurately with your tax records.

Using outdated forms is a further pitfall some encounter. Tax laws change frequently. Consequently, relying on an outdated version of Schedule 3 can cause complications. Always ensure you are using the most current form, as prior versions may not capture new credits or changes in eligibility.

Lastly, neglecting to sign and date the form is a common, yet easily avoidable error. A signature is necessary to validate the submission, and without it, the IRS may treat the form as if it were never filed at all. This not only complicates your tax situation but may also lead to penalties for late filing.