What is IRS Schedule 8812?

IRS Schedule 8812 is used to calculate the Additional Child Tax Credit (ACTC), which allows taxpayers to claim a credit for qualifying children under the age of 17. If you don’t receive the full amount of the Child Tax Credit, you might be eligible for the ACTC, which is designed to provide financial relief to families.

Who needs to file Schedule 8812?

Taxpayers who are claiming the Child Tax Credit and whose credit exceeds the tax they owe should file Schedule 8812. This form is particularly important for those who qualify for the ACTC because it helps ensure that eligible families receive the maximum benefit available to them.

What are the eligibility requirements for the Additional Child Tax Credit?

To be eligible for the ACTC, a taxpayer must meet several criteria:

-

You must have qualifying children under the age of 17.

-

Your child must have a valid Social Security number.

-

The child must live with you for more than half the year.

-

Your modified adjusted gross income must be below certain limits, which can vary each year.

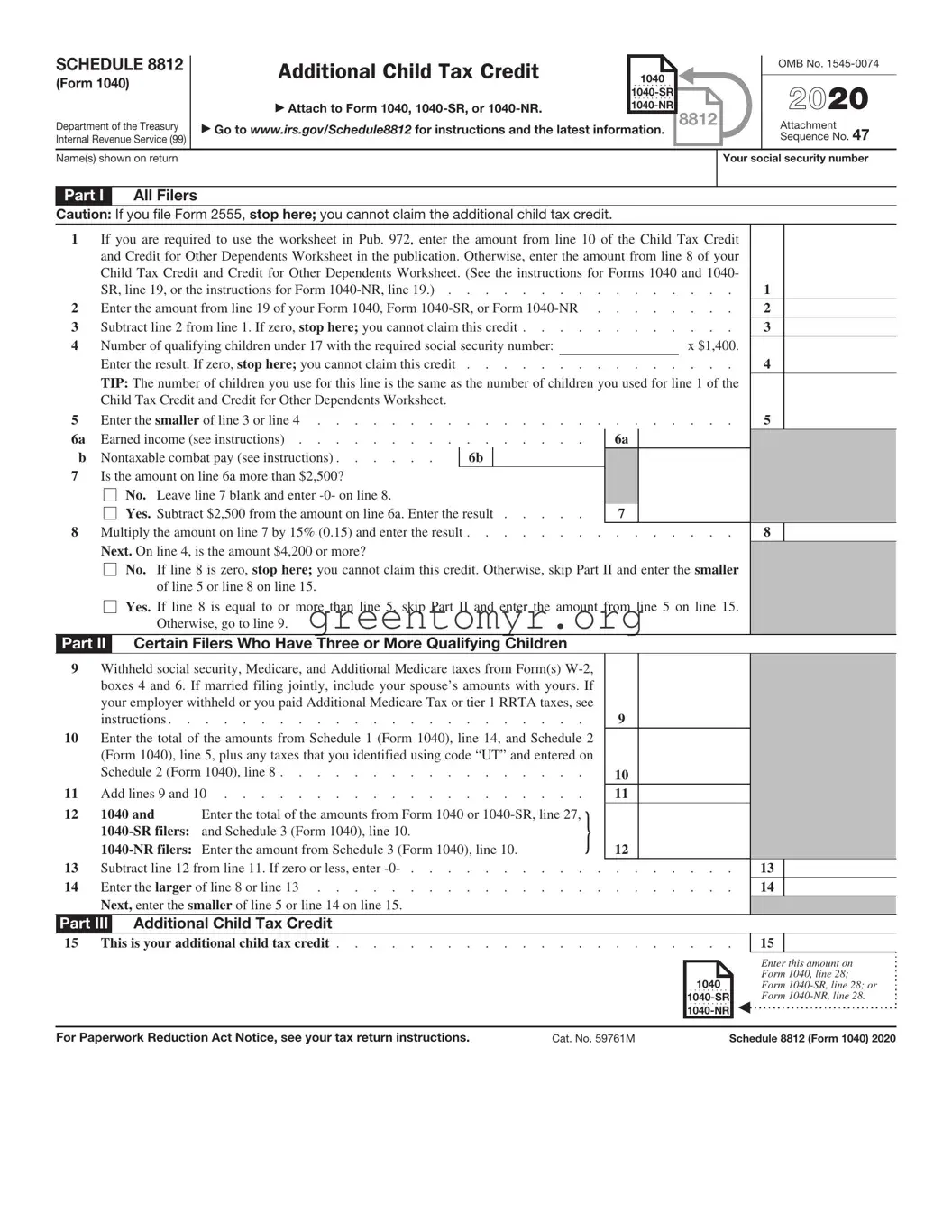

How do I complete Schedule 8812?

Completing Schedule 8812 requires several steps:

-

Begin by providing information on your qualifying children.

-

Calculate your Child Tax Credit based on the number of qualified children.

-

Fill in necessary sections to determine if you qualify for the ACTC by following the instructions provided with the form.

It’s essential to follow these directions carefully to ensure accurate filing and to maximize your potential refunds.

Where do I send my completed Schedule 8812?

Once you’ve completed Schedule 8812, it is submitted along with your main tax return, Form 1040. Depending on your location and filing method (e-filing or paper filing), the submission address may vary. Check the IRS website or the instructions on Form 1040 for specific details about where to send your documents.

When will I receive my refund if I claim Schedule 8812?

The time it takes to receive a refund when claiming the ACTC can depend on various factors, including how you file your return. Typically, refunds for electronically filed returns are issued faster, often within 21 days if there are no issues. However, claiming the ACTC might lead to additional processing time due to the extra steps involved in verifying eligibility.

Can the Additional Child Tax Credit affect my tax refund?

Yes, claiming the Additional Child Tax Credit can significantly increase your tax refund. If you qualify for the ACTC, this credit can potentially lead to a refund even if you do not owe any taxes. The credit is refundable, meaning you can receive a refund for the portion that exceeds your tax liability. It provides welcome relief, particularly for families who may be struggling financially.