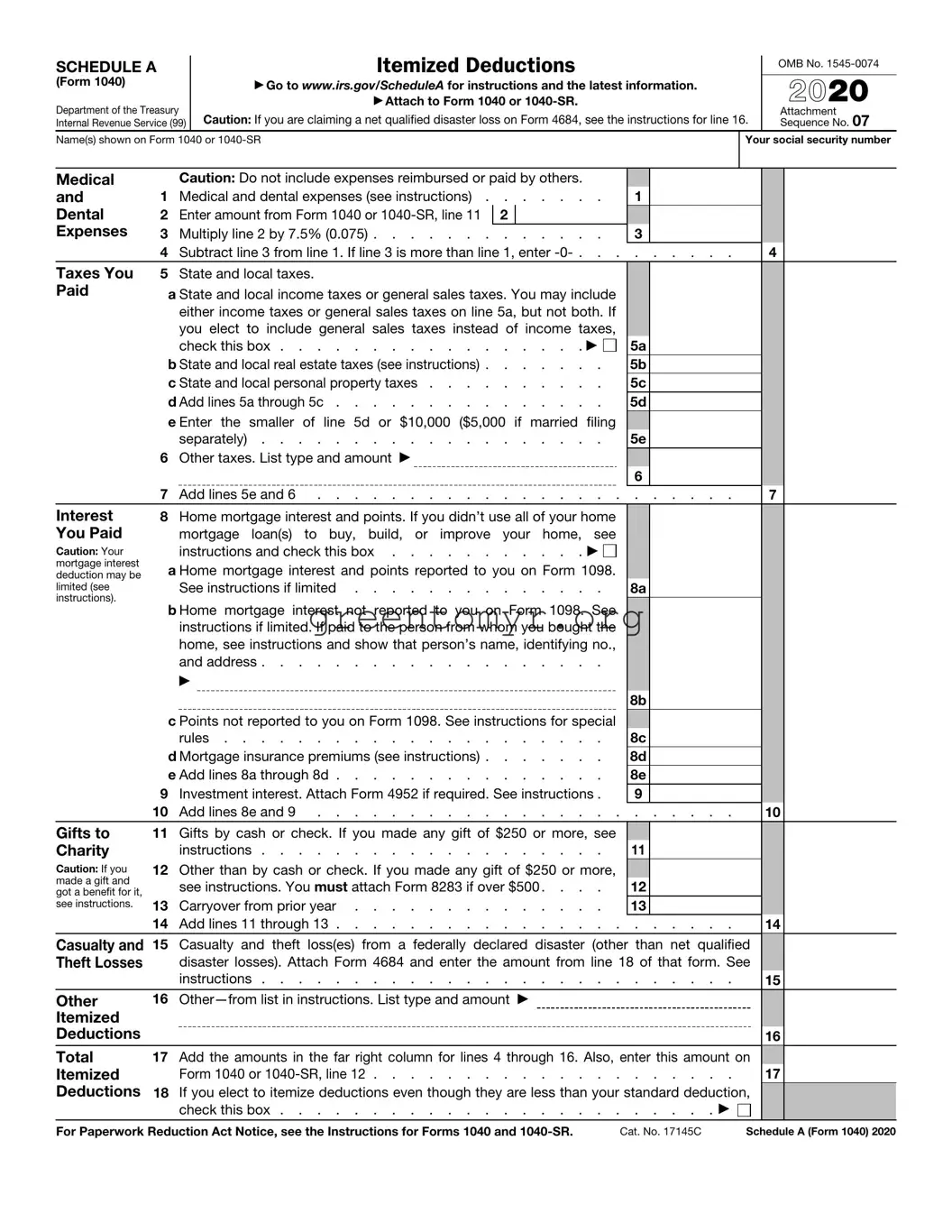

Medical |

|

Caution: Do not include expenses reimbursed or paid by others. |

|

|

|

|

|

|

and |

1 |

Medical and dental expenses (see instructions) |

|

1 |

|

|

|

|

Dental |

2 |

Enter amount from Form 1040 or 1040-SR, line 11 |

2 |

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

3 |

Multiply line 2 by 7.5% (0.075) |

|

3 |

|

|

|

|

|

4 |

Subtract line 3 from line 1. If line 3 is more than line 1, enter -0- . . . |

. . . . |

. . |

4 |

|

Taxes You |

5 |

State and local taxes. |

|

|

|

|

|

|

|

Paid |

|

a State and local income taxes or general sales taxes. You may include |

|

|

|

|

|

|

|

|

either income taxes or general sales taxes on line 5a, but not both. If |

|

|

|

|

|

|

|

|

you elect to include general sales taxes instead of income taxes, |

|

|

|

|

|

|

|

|

check this box |

. . . . ▶ |

|

5a |

|

|

|

|

|

|

b State and local real estate taxes (see instructions) |

|

5b |

|

|

|

|

|

|

c State and local personal property taxes |

|

5c |

|

|

|

|

|

|

d Add lines 5a through 5c |

|

5d |

|

|

|

|

|

|

e Enter the smaller of line 5d or $10,000 ($5,000 if married filing |

|

|

|

|

|

|

|

|

separately) |

|

5e |

|

|

|

|

|

6 |

Other taxes. List type and amount ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

7 |

Add lines 5e and 6 |

|

. |

. . . |

. . |

7 |

|

Interest |

8 |

Home mortgage interest and points. If you didn’t use all of your home |

|

|

|

|

|

|

You Paid |

|

mortgage loan(s) to buy, build, or improve your home, see |

|

|

|

|

|

|

Caution: Your |

|

instructions and check this box |

. . . . ▶ |

|

|

|

|

|

|

mortgage interest |

|

a Home mortgage interest and points reported to you on Form 1098. |

|

|

|

|

|

|

deduction may be |

|

|

|

|

|

|

|

limited (see |

|

See instructions if limited |

|

8a |

|

|

|

|

instructions). |

|

b Home mortgage interest not reported to you on Form 1098. See |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

instructions if limited. If paid to the person from whom you bought the |

|

|

|

|

|

|

|

|

home, see instructions and show that person’s name, identifying no., |

|

|

|

|

|

|

|

|

and address |

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

8b |

|

|

|

|

|

|

c Points not reported to you on Form 1098. See instructions for special |

|

|

|

|

|

|

|

|

rules |

|

8c |

|

|

|

|

|

|

d Mortgage insurance premiums (see instructions) |

|

8d |

|

|

|

|

|

|

e Add lines 8a through 8d |

|

8e |

|

|

|

|

|

9 |

Investment interest. Attach Form 4952 if required. See instructions . |

|

9 |

|

|

|

|

|

10 |

Add lines 8e and 9 |

|

. . . . |

. . |

10 |

|

Gifts to |

11 |

Gifts by cash or check. If you made any gift of $250 or more, see |

|

|

|

|

|

|

Charity |

|

instructions |

|

11 |

|

|

|

|

Caution: If you |

12 |

Other than by cash or check. If you made any gift of $250 or more, |

|

|

|

|

|

|

made a gift and |

|

see instructions. You must attach Form 8283 if over $500 . . . . |

|

12 |

|

|

|

|

got a benefit for it, |

|

|

|

|

|

|

see instructions. |

13 |

Carryover from prior year |

|

13 |

|

|

|

|

|

14 |

Add lines 11 through 13 |

|

. . . . |

. . |

14 |

|

Casualty and |

15 |

Casualty and theft loss(es) from a federally declared disaster (other than net qualified |

|

|

Theft Losses |

|

disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See |

|

|

|

|

instructions |

. . . . |

. . |

15 |

|

Other |

16 |

Other—from list in instructions. List type and amount |

▶ |

|

|

|

|

|

|

Itemized |

|

|

|

|

|

|

|

|

|

|

Deductions |

|

|

|

|

|

|

|

|

16 |

|

Total |

17 |

Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on |

|

|

Itemized |

|

Form 1040 or 1040-SR, line 12 |

. . . . |

. . |

17 |

|

Deductions |

18 If you elect to itemize deductions even though they are less than your standard deduction, |

|

|

|

|

check this box |

. . . . |

. ▶ |

|

|

For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and 1040-SR. |

Cat. No. 17145C |

Schedule A (Form 1040) 2020 |