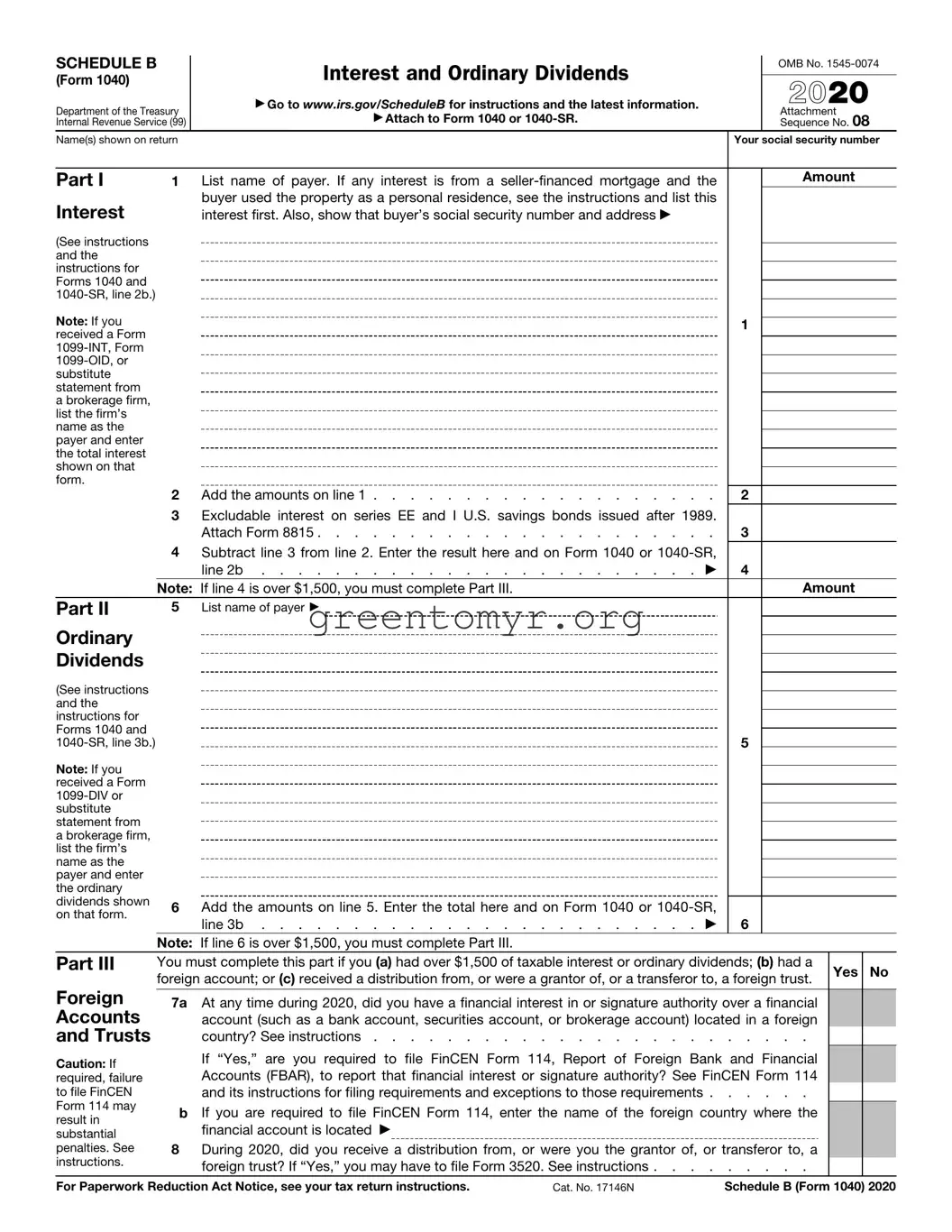

The IRS Schedule B form, also known as "Interest and Ordinary Dividends," is a supplemental form that accompanies the individual income tax return, Form 1040. This form is specifically used to report interest and dividend income that exceeds certain thresholds. If taxpayers received more than $1,500 in interest or dividends, they must complete Schedule B to provide the IRS with detailed information about these sources of income.

Who needs to file Schedule B?

Generally, a taxpayer must file Schedule B if they meet any of the following conditions:

-

The taxpayer earned more than $1,500 in taxable interest or ordinary dividends.

-

The taxpayer holds specific foreign accounts that require reporting.

-

The taxpayer received interest or dividends from certain relationships, such as from a trust or a mutual fund.

It's important for individuals to assess their financial documents to determine if they need to file this form.

Schedule B requires taxpayers to list the sources and amounts of interest and ordinary dividends they earned during the tax year. Specifically, the following details must be included:

-

The name of the payer

-

The amount of interest or dividends received

-

Any foreign accounts held, if applicable

Accuracy when reporting this information is crucial since it directly impacts the taxpayer's overall tax liability.

When filling out Schedule B, individuals should follow these steps:

-

Gather all relevant documents, such as Form 1099-INT for interest income and Form 1099-DIV for dividends.

-

Sum up the total interest and dividends from these documents.

-

Complete each section of the form as required, ensuring that the amounts listed match the information provided on the 1099 forms.

By carefully following each step, taxpayers can enhance the accuracy of their filings.

Are there penalties for not filing Schedule B?

Yes, there are penalties associated with failing to file Schedule B when required. The IRS may impose fines for underreporting income or for late filings. Additionally, neglecting to report interest or dividends could lead to an audit, further complicating the taxpayer's situation. It is in one's best interest to comply with the reporting requirements to avoid unnecessary penalties.

Can I e-file my tax return with Schedule B?

Absolutely, most e-filing services support the inclusion of Schedule B when submitting a Form 1040. Taxpayers should ensure that the software they are using accommodates this form. During the e-filing process, the service will typically prompt users to fill out Schedule B if it is necessary based on the information they provided.

What if I have foreign income reported on Schedule B?

If you have foreign income that needs to be reported on Schedule B, there are additional considerations. Taxpayers must disclose information regarding foreign bank accounts, which may also require compliance with the Foreign Bank and Financial Accounts Report (FBAR) regulations. It’s advisable to seek assistance from a tax professional to navigate these complexities correctly.

Can I attach additional documentation to Schedule B?

Generally, no additional documentation should be submitted with Schedule B unless specifically requested by the IRS. However, taxpayers are encouraged to keep all documentation related to reported income, such as Forms 1099, in a secure place. Should the IRS require verification, they may ask for these documents during an audit or inquiry.

Taxpayers can access the Schedule B form on the IRS website. The form is available for download in a PDF format, allowing individuals to print and fill it out manually if desired. Additionally, many tax preparation software packages include the form, simplifying the filing process.