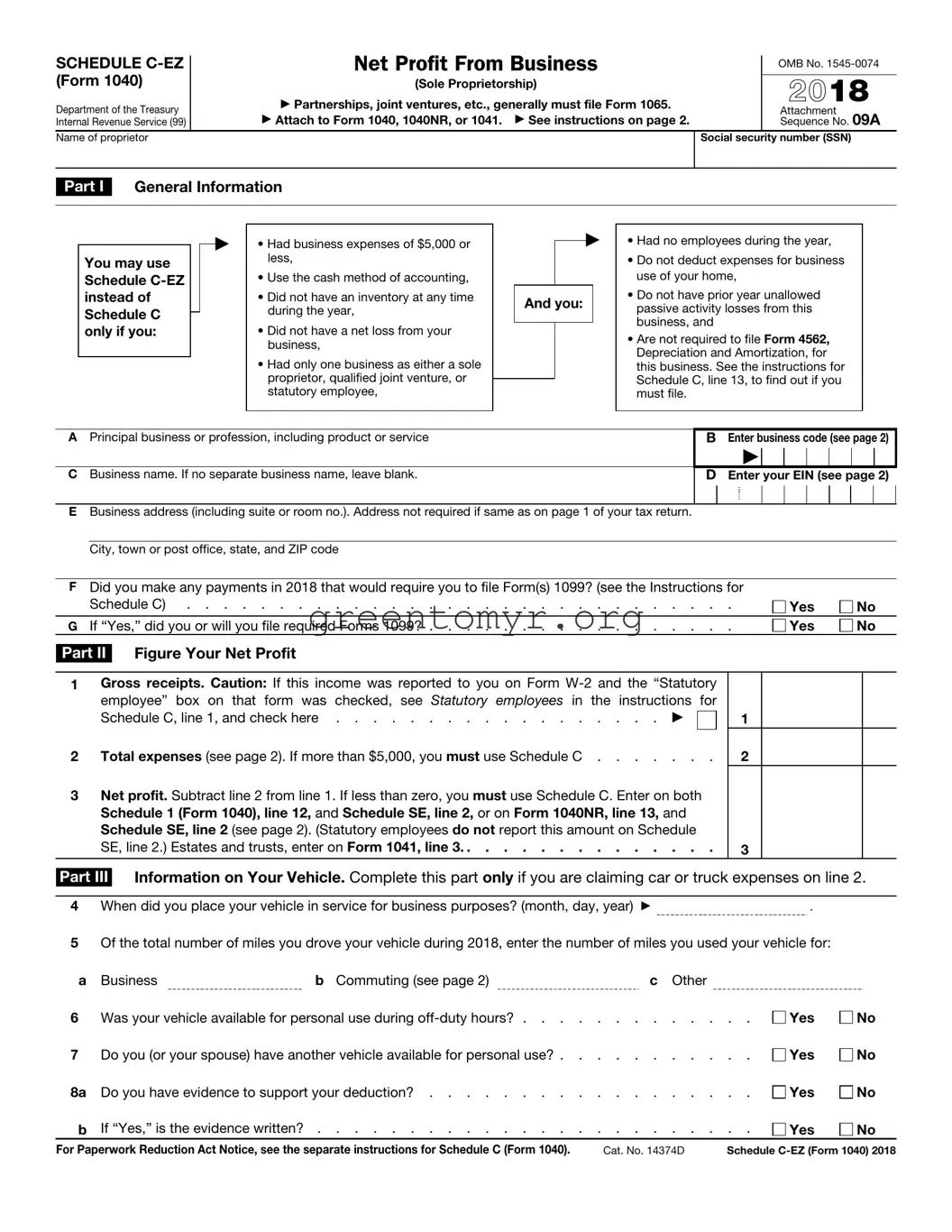

Instructions

Future developments. For the latest information about developments related to Schedule C-EZ (Form 1040) and its instructions, such as legislation enacted after they were published, go to www.irs.gov/ScheduleCEZ.

! |

Before you begin, see General Instructions in the 2018 |

▲ |

Instructions for Schedule C. |

CAUTION |

|

You can use Schedule C-EZ instead of Schedule C if:

•You operated a business or practiced a profession as a sole proprietorship or qualified joint venture, or you were a statutory employee, and

•You have met all the requirements listed in Schedule C-EZ, Part I.

For more information on electing to be taxed as a qualified joint venture (including the possible social security benefits of this election), see Qualified Joint Venture in the Instructions for Schedule C. You can also go to www.irs.gov/QJV.

Line A

Describe the business or professional activity that provided your principal source of income reported on line 1. Give the general field or activity and the type of product or service.

Line B

Enter the six-digit code that identifies your principal business or professional activity. See the Instructions for Schedule C for the list of codes.

Line D

Enter on line D the employer identification number (EIN) that was issued to you and in your name as a sole proprietor. If you are filing Form 1041, enter the EIN issued to the estate or trust. Do not enter your SSN. Do not enter another taxpayer’s EIN (for example, from any Forms 1099-MISC that you received). If you do not have an

EIN, leave line D blank.

You need an EIN only if you have a qualified retirement plan or are required to file an employment, excise, alcohol, tobacco, or firearms tax return, are a payer of gambling winnings, or are filing Form 1041 for an estate or trust. If you need an EIN, see the Instructions for Form SS-4.

Single-member LLCs. If you are the sole owner of an LLC that is not treated as a separate entity for federal income tax purposes, enter on line D the EIN that was issued to the LLC (in the LLC’s legal name) for a qualified retirement plan, to file employment, excise, alcohol, tobacco, or firearms returns, or as a payer of gambling winnings. If you do not have such an EIN, leave line D blank.

Line E

Enter your business address. Show a street address instead of a box number. Include the suite or room number, if any.

Line F

See the instructions for Schedule C, line I, to help determine if you are required to file any Forms 1099.

Line 1

Enter gross receipts from your trade or business. Include amounts you received in your trade or business that were properly shown on Form 1099-MISC. If the total amounts that were reported in box 7 of Forms 1099-MISC are more than the total you are reporting on line 1, attach a statement explaining the difference. You must show all items of taxable income actually or constructively received during the year (in cash, property, or services). Income is constructively received when it is credited to your account or set aside for you to use. Don’t offset this amount by any losses.

Line 2

Enter the total amount of all deductible business expenses you actually paid during the year. Examples of these expenses include advertising, car and truck expenses, commissions and fees, insurance, interest, legal and professional services, office expenses, rent or lease expenses, repairs and maintenance, supplies, taxes, travel, the allowable percentage of business meals and entertainment, and utilities (including telephone). For details, see the instructions for Schedule C, Parts II and V. You can use the optional worksheet below to record your expenses. Enter on lines b through f the type and amount of expenses not included on line a.

If you claim car or truck expenses, be sure to complete Schedule C-EZ, Part III.

Line 3

Nonresident aliens using Form 1040NR should also enter the total on Schedule SE, line 2, if you are covered under the U.S. social security system due to an international social security agreement currently in effect. See the Instructions for Schedule SE for information on international social security agreements.

Line 5b

Generally, commuting is travel between your home and a work location. If you converted your vehicle during the year from personal to business use (or vice versa), enter your commuting miles only for the period you drove your vehicle for business. For information on certain travel that is considered a business expense rather than commuting, see the instructions for Schedule C, line 44b.