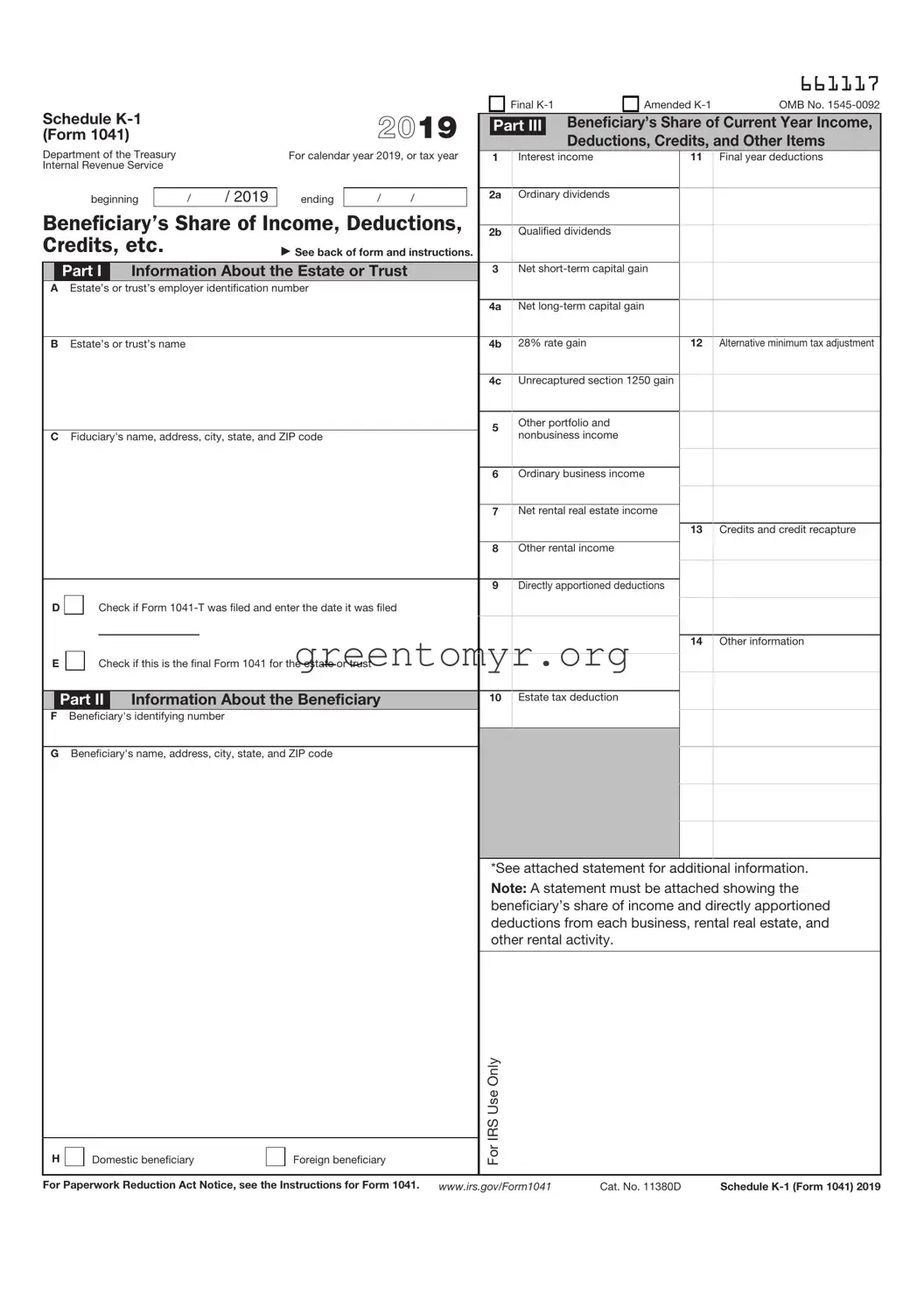

Filling out the IRS Schedule K-1 Form 1041 can feel daunting, especially if you're doing it for the first time. This form is crucial for reporting income, deductions, and credits from estates and trusts, but many make common mistakes that can lead to complications. Understanding these pitfalls can help ensure that your submission goes smoothly and accurately.

One prevalent mistake is not providing the correct taxpayer identification number (TIN). Every beneficiary must ensure that their TIN is accurate and matches their Social Security number or business identification. Errors in this area can lead to delays or issues with the IRS. Precision matters; double-check the numbers before submitting.

Another mistake often made is neglecting to report all income accurately. Beneficiaries might overlook certain types of income, such as capital gains or interest that were distributed throughout the year. It’s important to review what is reported on the K-1 carefully. Comprehensive reporting ensures that you’re compliant and reduces the risk of an audit.

Many also forget to verify the distribution amounts reported by the trust or estate. If the K-1 shows a distribution total that doesn’t match your records, it’s essential to communicate with the fiduciary responsible for the trust. Clarifying discrepancies early can save a lot of time and potential headaches later.

Using the wrong tax form is another common error. Some beneficiaries mistakenly file their K-1 information on the wrong type of tax return. For example, individuals must use Form 1040 for personal income, while entities like corporations and partnerships have different forms. Ensure you’re using the appropriate form to avoid issues with the IRS.

Underestimating the importance of checking for updated instructions can result in submitting outdated information. Tax laws often change, and the IRS regularly updates forms and guidelines. Before filling out the K-1, make sure to review the current year's instructions. Staying informed can help you avoid last year’s mistakes.

Another frequent oversight involves not keeping accurate records of distributions received. Remembering every detail can be challenging, particularly if distributions occurred throughout the year. Keeping thorough documentation not only aids during tax season but also helps track any discrepancies in the future.

Lastly, a lack of communication with the trustee or executor can lead to various misunderstandings and errors. Being proactive can help clarify any uncertainties regarding your K-1. Don’t hesitate to ask questions if anything seems unclear. Effective communication with the person managing the trust or estate is essential for a smooth filing process.