See back of form and separate instructions.

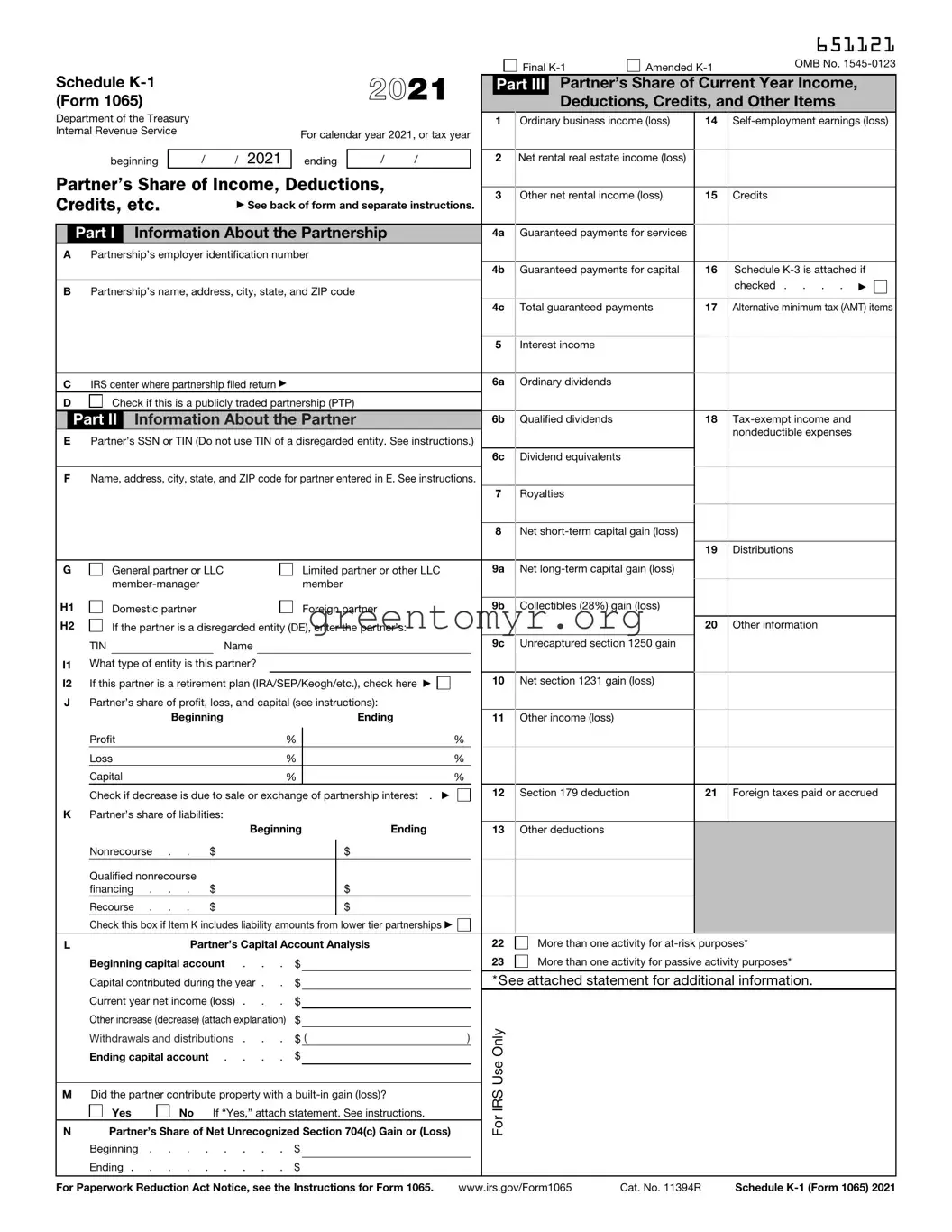

Schedule K-1 |

|

|

|

2019 |

(Form 1065) |

|

|

|

Department of the Treasury |

|

|

|

|

|

Internal Revenue Service |

|

|

For calendar year 2019, or tax year |

|

|

|

|

|

|

|

|

ending |

|

|

beginning |

|

/ |

/ 2019 |

/ |

/ |

Partner’s Share of Income, Deductions, Credits, etc.

Part I Information About the Partnership

APartnership’s employer identification number

BPartnership’s name, address, city, state, and ZIP code

CIRS Center where partnership filed return

D |

Check if this is a publicly traded partnership (PTP) |

Part II Information About the Partner

EPartner’s SSN or TIN (Do not use TIN of a disregarded entity. See inst.)

FName, address, city, state, and ZIP code for partner entered in E. See instructions.

G |

General partner or LLC |

Limited partner or other LLC |

|

member-manager |

member |

H1 |

Domestic partner |

Foreign partner |

H2 |

If the partner is a disregarded entity (DE), enter the partner’s: |

|

|

|

|

|

|

|

TIN |

|

Name |

|

I1 |

What type of entity is this partner? |

|

I2 |

If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here |

JPartner’s share of profit, loss, and capital (see instructions):

Beginning |

|

Ending |

|

Profit |

% |

|

% |

Loss |

% |

|

% |

Capital |

% |

|

% |

Check if decrease is due to sale or exchange of partnership interest . . |

|

KPartner’s share of liabilities:

|

|

|

Beginning |

Ending |

|

|

Nonrecourse . . |

$ |

|

|

|

$ |

|

|

|

Qualified nonrecourse |

|

|

|

|

|

|

|

|

financing . . . |

$ |

|

|

|

$ |

|

|

|

Recourse . . . |

$ |

|

|

|

$ |

|

|

|

Check this box if Item K includes liability amounts from lower tier partnerships. |

|

L |

Partner’s Capital Account Analysis |

|

|

|

Beginning capital account . . . |

$ |

|

|

|

|

|

Capital contributed during the. year |

. |

$ |

|

|

|

|

|

Current year net income (loss) . . . |

$ |

|

|

|

|

|

Other increase (decrease) (attach explanation) |

$ |

|

|

|

|

|

Withdrawals & distributions |

. . . |

$ ( |

|

) |

|

|

Ending capital account . . . . |

$ |

|

|

|

|

MDid the partner contribute property with a built-in gain or loss?

Yes |

No If “Yes,” attach statement. See instructions. |

NPartner’s Share of Net Unrecognized Section 704(c) Gain or (Loss)

Beginning . . . . . . .$ .

Ending . . . . . . . .$ .

651119

Final K-1 |

Amended K-1 |

OMB No. 1545-0123 |

|

Part III Partner’s Share of Current Year Income, Deductions, Credits, and Other Items

1 |

Ordinary business income (loss) |

15 Credits |

2Net rental real estate income (loss)

3 |

Other net rental income (loss) |

16 Foreign transactions |

4a |

Guaranteed payments for services |

|

|

4b |

Guaranteed payments for capital |

|

|

4c |

Total guaranteed payments |

|

|

5Interest income

6a |

Ordinary dividends |

|

6b |

Qualified dividends |

|

|

6c |

Dividend equivalents |

17 Alternative minimum tax (AMT) items |

7Royalties

8Net short-term capital gain (loss)

9a |

Net long-term capital gain (loss) |

18 |

Tax-exempt income and |

|

|

|

nondeductible expenses |

9b |

Collectibles (28%) gain (loss) |

|

|

9c |

Unrecaptured section 1250 gain |

|

|

|

|

10 |

Net section 1231 gain (loss) |

|

|

|

|

|

|

|

|

|

|

19 |

Distributions |

11Other income (loss)

20 Other information

12Section 179 deduction

13Other deductions

14Self-employment earnings (loss)

21 More than one activity for at-risk purposes*

22 More than one activity for passive activity purposes*

*See attached statement for additional information.

For IRS Use Only

For Paperwork Reduction Act Notice, see Instructions for Form 1065. |

www.irs.gov/Form1065 |

Cat. No. 11394R |

Schedule K-1 (Form 1065) 2019 |

Schedule E, line 28, column (h) See the Partner’s Instructions See the Partner’s Instructions See the Partner’s Instructions See the Partner’s Instructions Form 1040 or 1040-SR, line 2b Form 1040 or 1040-SR, line 3b Form 1040 or 1040-SR, line 3a See the Partner’s Instructions Schedule E, line 4 Schedule D, line 5 Schedule D, line 12

28% Rate Gain Worksheet, line 4 (Schedule D instructions)

See the Partner’s Instructions

See the Partner’s Instructions

Passive loss Passive income Nonpassive loss Nonpassive income

2. Net rental real estate income (loss)

3. Other net rental income (loss) Net income

Net loss

Schedule K-1 (Form 1065) 2019 |

Page 2 |

This list identifies the codes used on Schedule K-1 for all partners and provides summarized reporting information for partners who file Form 1040 or 1040-SR. For detailed reporting and filing information, see the separate Partner’s Instructions for Schedule K-1 and the instructions for your income tax return.

1.Ordinary business income (loss). Determine whether the income (loss) is passive or nonpassive and enter on your return as follows.

Report on

See the Partner’s Instructions

Schedule E, line 28, column (h)

See the Partner’s Instructions

Schedule E, line 28, column (k)

See the Partner’s Instructions

4a. Guaranteed payment Services

4b. Guaranteed payment Capital

4c. Guaranteed payment Total

5. Interest income

6a. Ordinary dividends

6b. Qualified dividends

6c. Dividend equivalents

7. Royalties

8. Net short-term capital gain (loss)

9a. Net long-term capital gain (loss)

9b. Collectibles (28%) gain (loss)

9c. Unrecaptured section 1250 gain

10. Net section 1231 gain (loss)

11.Other income (loss)

Code |

|

|

A |

Other portfolio income (loss) |

|

See the Partner’s Instructions |

B |

Involuntary conversions |

|

See the Partner’s Instructions |

C |

Sec. 1256 contracts & straddles |

|

Form 6781, line 1 |

D |

Mining exploration costs recapture |

See Pub. 535 |

E |

Cancellation of debt |

|

|

F |

Section 743(b) positive adjustments |

|

G |

Section 965(a) inclusion |

} |

See the Partner’s Instructions |

H |

Income under subpart F (other |

|

than inclusions under sections |

|

|

951A and 965) |

|

IOther income (loss)

12. |

Section 179 deduction |

} |

See the Partner’s Instructions |

13. |

Other deductions |

|

|

A |

Cash contributions (60%) |

|

|

B |

Cash contributions (30%) |

|

|

C |

Noncash contributions (50%) |

|

|

D |

Noncash contributions (30%) |

See the Partner’s Instructions |

|

E |

Capital gain property to a 50% |

|

|

|

F |

organization (30%) |

|

|

Capital gain property (20%) |

|

|

G |

Contributions (100%) |

|

|

H |

Investment interest expense |

|

Form 4952, line 1 |

|

I |

Deductions—royalty income |

|

Schedule E, line 19 |

|

J |

Section 59(e)(2) expenditures |

|

See the Partner’s Instructions |

|

K |

Excess business interest expense |

See the Partner’s Instructions |

|

L |

Deductions—portfolio (other) |

|

Schedule A, line 16 |

|

M |

Amounts paid for medical insurance |

Schedule A, line 1, or Schedule 1 |

|

N |

|

|

(Form 1040 or 1040-SR), line 16 |

|

Educational assistance benefits |

|

See the Partner’s Instructions |

|

O |

Dependent care benefits |

|

Form 2441, line 12 |

|

P |

Preproductive period expenses |

|

See the Partner’s Instructions |

QCommercial revitalization deduction

R |

from rental real estate activities |

|

See Form 8582 instructions |

Pensions and IRAs |

|

See the Partner’s Instructions |

S |

Reforestation expense deduction |

See the Partner’s Instructions |

T |

through U |

} |

Reserved for future use |

V |

Section 743(b) negative adjustments |

|

W |

Other deductions |

See the Partner’s Instructions |

X |

Section 965(c) deduction |

|

14. Self-employment earnings (loss)

Note: If you have a section 179 deduction or any partner-level deductions, see the Partner’s Instructions before completing Schedule SE.

ANet earnings (loss) from

B |

self-employment |

} |

Schedule SE, Section A or B |

Gross farming or fishing income |

See the Partner’s Instructions |

C |

Gross non-farm income |

See the Partner’s Instructions |

15. Credits |

|

A |

Low-income housing credit |

|

|

(section 42(j)(5)) from pre-2008 |

|

B |

buildings |

|

Low-income housing credit |

|

C |

(other) from pre-2008 buildings |

|

Low-income housing credit |

|

|

(section 42(j)(5)) from |

|

D |

post-2007 buildings |

See the Partner’s Instructions |

Low-income housing credit |

|

|

(other) from post-2007 |

|

E |

buildings |

|

Qualified rehabilitation |

|

|

expenditures (rental real estate) |

|

FOther rental real estate credits G Other rental credits

Code |

|

Report on |

H |

Undistributed capital gains credit |

Schedule 3 (Form 1040 or 1040-SR), |

I |

|

|

line 13, box a |

Biofuel producer credit |

} |

See the Partner’s Instructions |

J |

Work opportunity credit |

|

K |

Disabled access credit |

|

|

L |

Empowerment zone |

|

|

M |

employment credit |

|

|

Credit for increasing research |

|

See the Partner’s Instructions |

|

activities |

|

N |

|

|

Credit for employer social |

|

|

|

security and Medicare taxes |

|

|

OBackup withholding P Other credits

16. Foreign transactions |

} |

|

A |

Name of country or U.S. |

|

B |

possession |

Form 1116, Part I |

Gross income from all sources |

C |

Gross income sourced at |

|

partner level |

|

Foreign gross income sourced at partnership level |

D |

Reserved for future use |

} |

|

E |

Foreign branch category |

|

|

F |

Passive category |

|

Form 1116, Part I |

G |

General category |

|

|

|

HOther

Deductions allocated and apportioned at partner level

I |

Interest expense |

Form 1116, Part I |

J |

Other |

Form 1116, Part I |

Deductions allocated and apportioned at partnership level to foreign source income

KReserved for future use L Foreign branch category

M Passive category |

}Form 1116, Part I |

NGeneral category O Other

Other information

P |

Total foreign taxes paid |

Form 1116, Part II |

Q |

Total foreign taxes accrued |

Form 1116, Part II |

R |

Reduction in taxes available for credit Form 1116, line 12 |

S |

Foreign trading gross receipts |

Form 8873 |

T |

Extraterritorial income exclusion |

Form 8873 |

U |

through V |

Reserved for future use |

W |

Section 965 information |

} See the Partner’s Instructions |

X |

Other foreign transactions |

17. Alternative minimum tax (AMT) items |

A |

Post-1986 depreciation adjustment |

See the Partner’s |

B |

Adjusted gain or loss |

C |

Depletion (other than oil & gas) |

Instructions and |

D |

Oil, gas, & geothermal—gross income |

the Instructions for |

E |

Oil, gas, & geothermal—deductions |

}Form 6251 |

F Other AMT items

18.Tax-exempt income and nondeductible expenses

|

A |

Tax-exempt interest income |

|

Form 1040 or 1040-SR, line 2a |

|

B |

Other tax-exempt income |

|

See the Partner’s Instructions |

|

C |

Nondeductible expenses |

|

See the Partner’s Instructions |

19. |

Distributions |

} |

|

|

A |

Cash and marketable securities |

See the Partner’s Instructions |

|

B |

Distribution subject to section 737 |

|

C |

Other property |

|

20. |

Other information |

|

|

|

A |

Investment income |

|

Form 4952, line 4a |

|

B |

Investment expenses |

|

Form 4952, line 5 |

|

C |

Fuel tax credit information |

} |

Form 4136 |

|

D |

Qualified rehabilitation expenditures |

|

|

E |

(other than rental real estate) |

|

See the Partner’s Instructions |

|

Basis of energy property |

|

Fthrough G

H |

Recapture of investment credit |

|

See Form 4255 |

I |

Recapture of other credits |

|

See the Partner’s Instructions |

J |

Look-back interest—completed |

|

|

K |

long-term contracts |

|

See Form 8697 |

Look-back interest—income forecast |

|

L |

method |

} |

See Form 8866 |

Dispositions of property with |

|

M |

section 179 deductions |

|

Recapture of section 179 deduction |

|

N |

Interest expense for corporate |

|

|

partners |

|

O |

through Y |

|

Z |

Section 199A information |

|

AA |

Section 704(c) information |

See the Partner’s Instructions |

AB |

Section 751 gain (loss) |

AC |

Section 1(h)(5) gain (loss) |

|

AD |

Deemed section 1250 |

|

AE |

unrecaptured gain |

|

Excess taxable income |

|

AF |

Excess business interest income |

|

AG |

Gross receipts for section 59A(e) |

|

AH |

Other information |

|