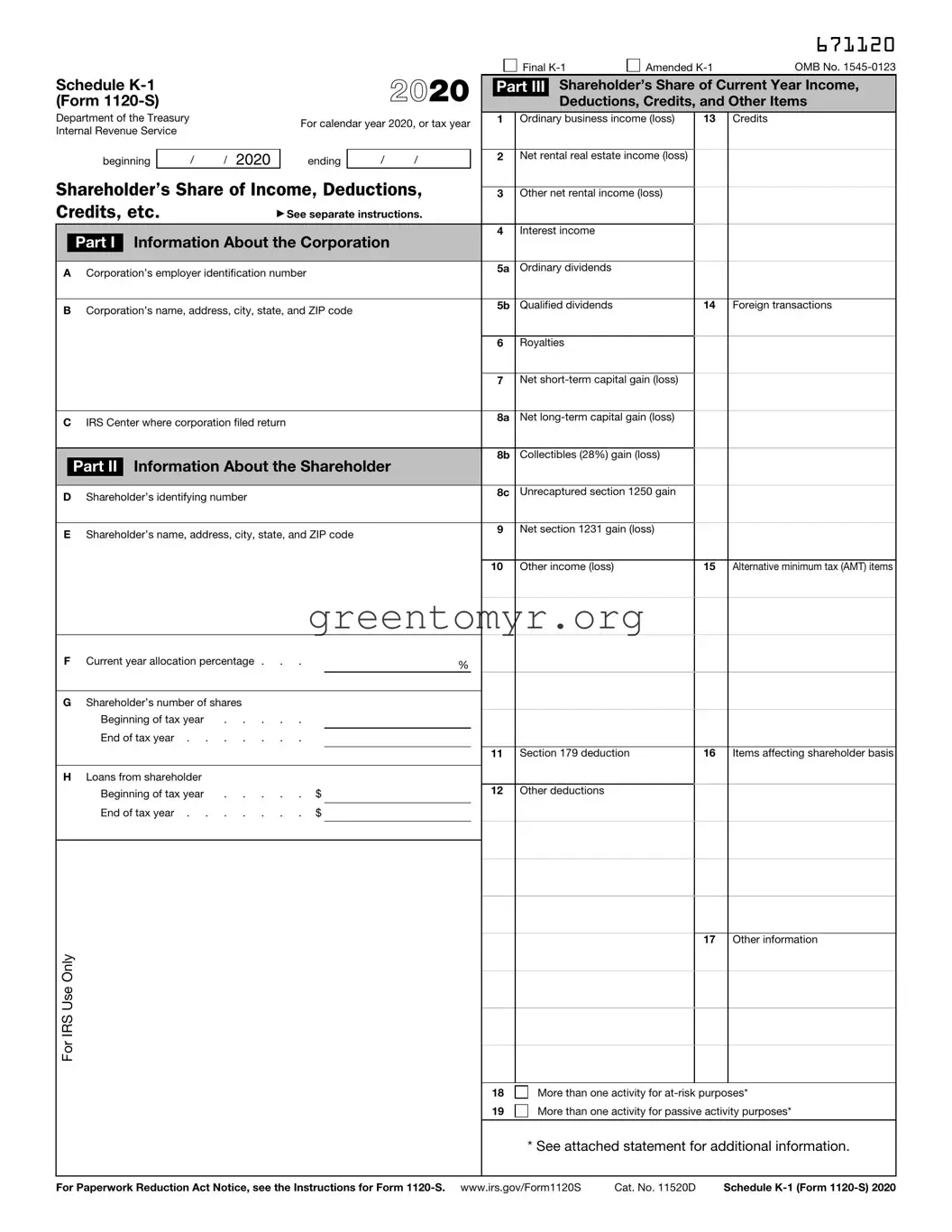

The IRS Schedule K-1 1120-S form is used to report income, deductions, and credits from an S corporation. It is also known as the “Shareholder’s Share of Income, Deductions, Credits, etc.” This form provides detailed information to shareholders about their share of the corporation’s financial activities for the tax year.

Who needs to file a Schedule K-1 1120-S?

The S corporation itself must file Form 1120-S with the IRS. Each shareholder then receives a Schedule K-1 that reflects their portion of the corporation’s income, losses, and other tax items. If you are a shareholder in an S corporation, you will receive this form.

When is the Schedule K-1 1120-S due?

The Schedule K-1 must be provided to shareholders by the due date of the S corporation's tax return. Typically, this is March 15 for calendar year filers. However, if the corporation has filed for an extension, the due date may be later.

Shareholders must report the amounts listed on the Schedule K-1 on their personal tax returns. Specifically, they will use the information to report their share of the S corporation’s income, losses, deductions, and credits on their Form 1040.

What if I do not receive my Schedule K-1 1120-S in time?

If you do not receive your Schedule K-1 in a timely manner, you should contact the S corporation. It is important to obtain this form to accurately report your income. You may need to file for an extension or estimate your tax liability if there are delays.

Can I file my taxes without the Schedule K-1 1120-S?

It is not advisable to file without the Schedule K-1. This document contains crucial information about your income from the S corporation. Filing without it may result in errors or underreporting your income, which could lead to penalties.

If you believe there is an error, contact the S corporation immediately. They will need to issue a corrected K-1 if there is indeed a mistake. It is essential to ensure that the information is accurate before you file your taxes.

Yes, foreign shareholders may have additional reporting requirements. They may be subject to U.S. tax on their share of income from the S corporation. It is advisable for foreign shareholders to consult with a tax professional to understand their specific obligations.

Where can I find additional resources or assistance regarding Schedule K-1 1120-S?

The IRS website offers forms, instructions, and a variety of resources related to Schedule K-1. You may also wish to consult with a tax professional or accountant for personalized assistance.