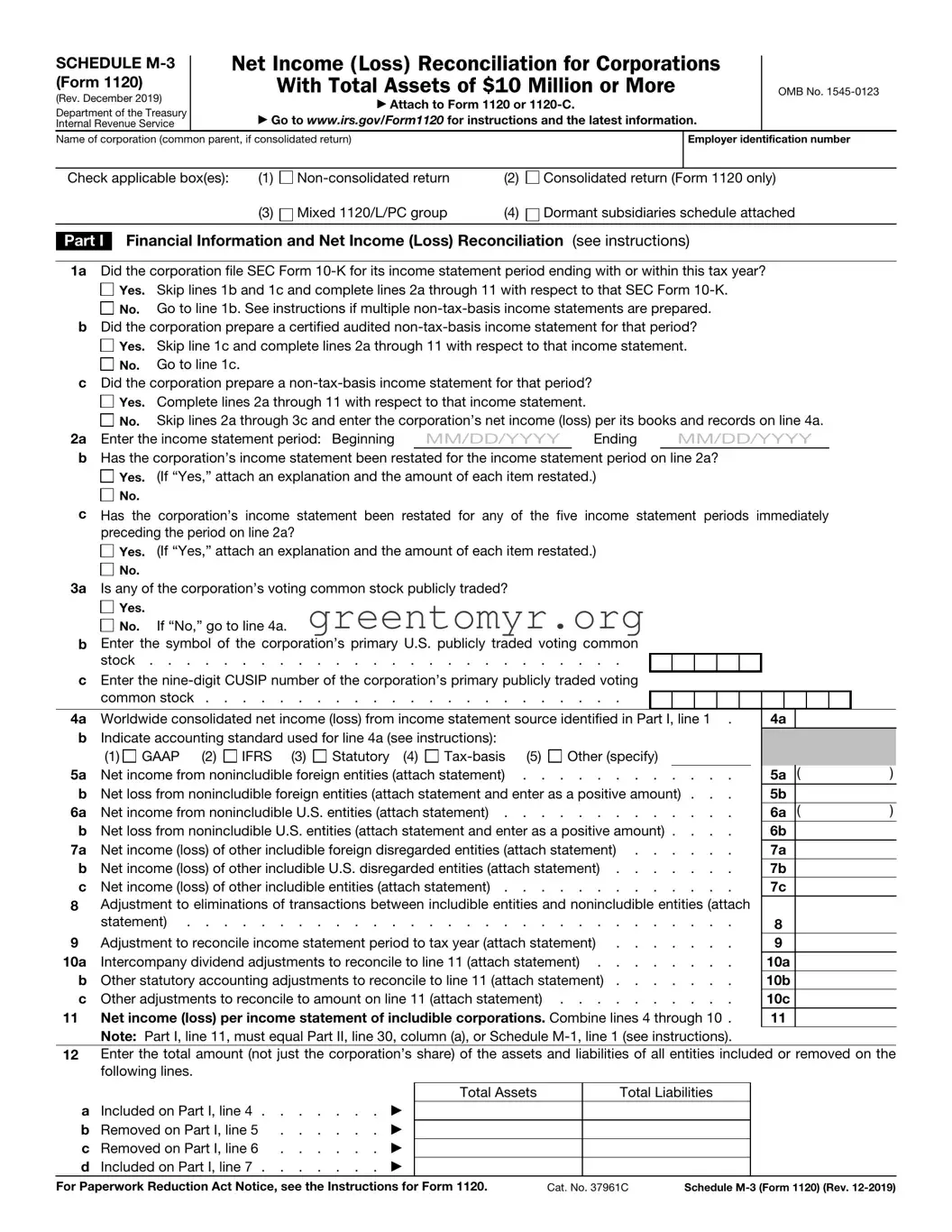

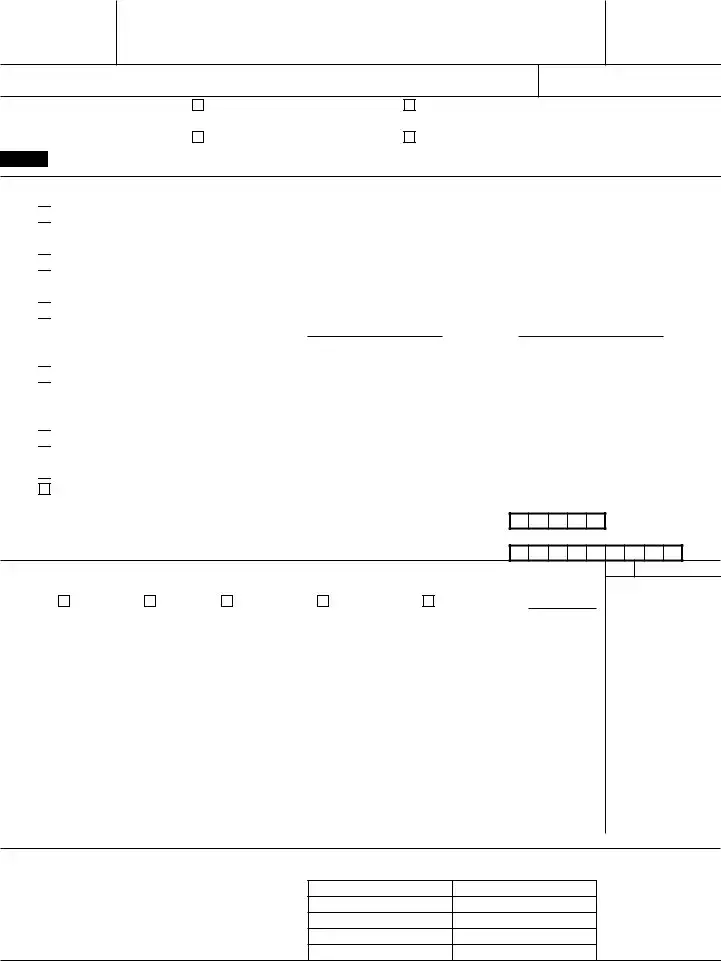

Check applicable box(es): (1) |

Consolidated group |

(2) |

Parent corp |

(3) |

Consolidated eliminations |

(4) |

Subsidiary corp (5) |

Mixed 1120/L/PC group |

Check if a sub-consolidated: (6) |

1120 group (7) |

1120 eliminations |

|

|

|

|

|

|

|

|

|

|

|

|

Name of subsidiary (if consolidated return) |

|

|

|

|

|

Employer identification number |

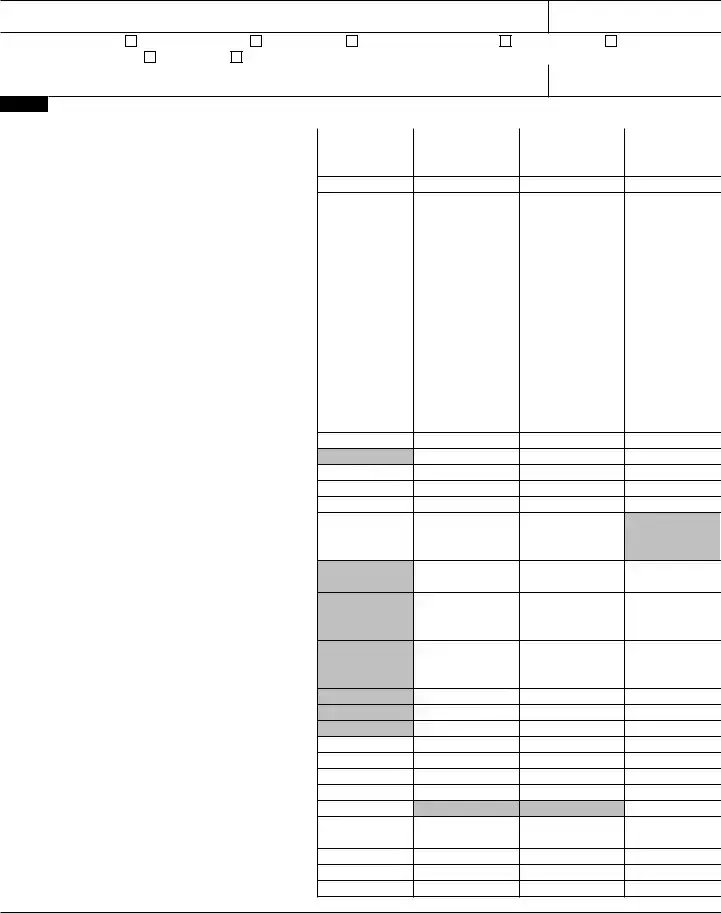

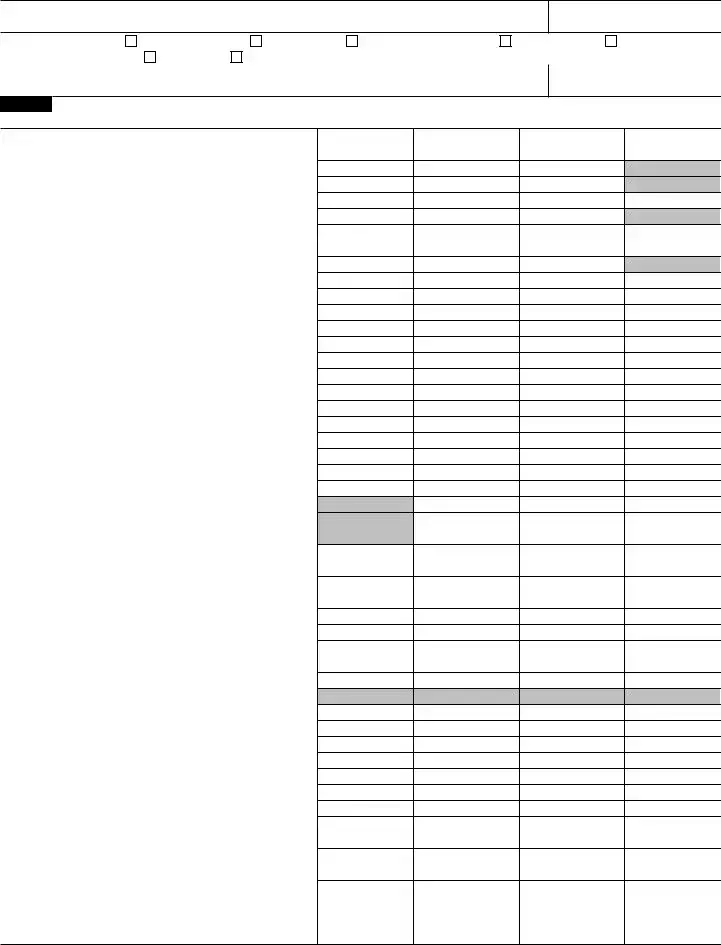

Part II Reconciliation of Net Income (Loss) per Income Statement of Includible Corporations With Taxable Income per Return (see instructions)

Income (Loss) Items |

(a) |

(b) |

(c) |

(d) |

Income (Loss) per |

Temporary |

Permanent |

Income (Loss) |

(Attach statements for lines 1 through 12) |

Income Statement |

Difference |

Difference |

per Tax Return |

1 Income (loss) from equity method foreign corporations |

|

|

|

|

2Gross foreign dividends not previously taxed . . .

3 |

Subpart F, QEF, and similar income inclusions . . |

|

|

|

|

|

4 |

Gross-up for foreign taxes deemed paid . . . . |

|

|

|

|

|

5 |

Gross foreign distributions previously taxed . . . |

|

|

|

|

6 |

Income (loss) from equity method U.S. corporations |

|

|

|

|

7 |

U.S. dividends not eliminated in tax consolidation . |

|

|

|

|

8 |

Minority interest for includible corporations . . . |

|

|

|

|

9 |

Income (loss) from U.S. partnerships |

|

|

|

|

10 |

Income (loss) from foreign partnerships . . . . |

|

|

|

|

11 |

Income (loss) from other pass-through entities . . |

|

|

|

|

12 |

Items relating to reportable transactions . . . . |

|

|

|

|

13 |

Interest income (see instructions) |

|

|

|

|

14 |

Total accrual to cash adjustment |

|

|

|

|

15 |

Hedging transactions |

|

|

|

|

16 |

Mark-to-market income (loss) |

|

|

|

|

17 |

Cost of goods sold (see instructions) . . . . . ( |

) |

( |

) |

18Sale versus lease (for sellers and/or lessors) . . .

19 |

Section 481(a) adjustments |

20 |

Unearned/deferred revenue |

21 |

Income recognition from long-term contracts . . |

22Original issue discount and other imputed interest .

23a Income statement gain/loss on sale, exchange, abandonment, worthlessness, or other disposition of assets other than inventory and pass-through entities

b Gross capital gains from Schedule D, excluding amounts from pass-through entities . . . . . .

c Gross capital losses from Schedule D, excluding amounts from pass-through entities, abandonment losses, and worthless stock losses . . . . . .

d Net gain/loss reported on Form 4797, line 17, excluding amounts from pass-through entities, abandonment losses, and worthless stock losses .

e Abandonment losses . . . . . . . . . .

f Worthless stock losses (attach statement) . . . .

g Other gain/loss on disposition of assets other than inventory

24Capital loss limitation and carryforward used . . .

25Other income (loss) items with differences (attach statement)

26Total income (loss) items. Combine lines 1 through 25

27Total expense/deduction items (from Part III, line 39)

28 Other items with no differences . . . . . . .

29a Mixed groups, see instructions. All others, combine lines 26 through 28 . . . . . . . . . . .

b PC insurance subgroup reconciliation totals . . .

c Life insurance subgroup reconciliation totals . . .

30Reconciliation totals. Combine lines 29a through 29c

Note: Line 30, column (a), must equal Part I, line 11, and column (d) must equal Form 1120, page 1, line 28.

No.

No.

No.

No.

Yes.

Yes.