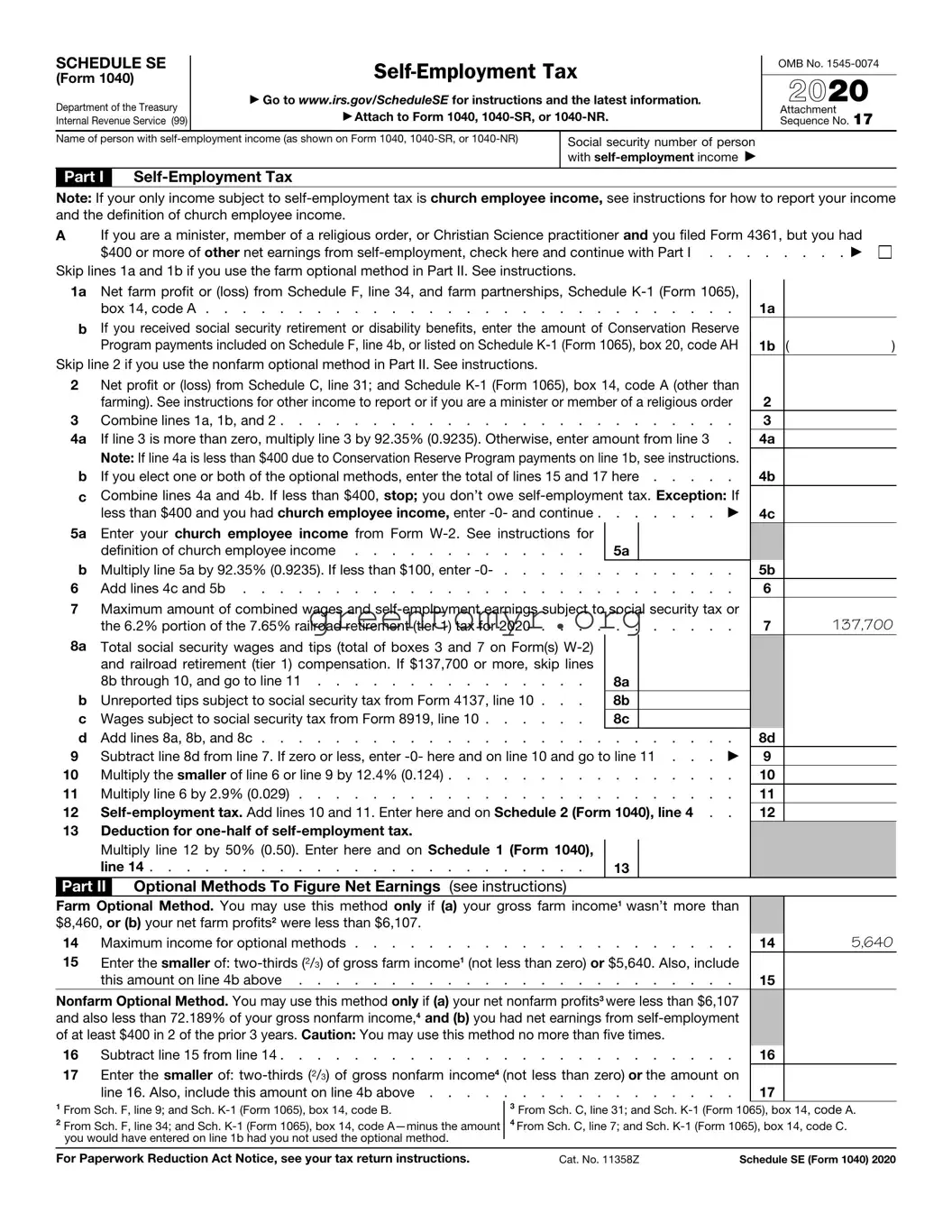

What is IRS Schedule SE?

IRS Schedule SE (Self-Employment Tax) is a form used by individuals who are self-employed to calculate their self-employment tax. This tax is primarily applied to income derived from self-employment or business activities. The self-employment tax consists of Social Security and Medicare taxes, which are typically withheld from employees' paychecks. Self-employed individuals are responsible for paying both the employer and employee portions of these taxes.

Who needs to file Schedule SE?

You need to file Schedule SE if you earn $400 or more in self-employment income during the tax year. This includes income from freelance work, contractual jobs, or income from a business that you own. Even if you have other sources of income, if your self-employment income reaches this threshold, you must complete this form.

How do I calculate my self-employment tax?

To calculate your self-employment tax, follow these steps:

-

Determine your net earnings from self-employment. This is generally your business income minus your business expenses.

-

Multiply your net earnings by 92.35% to calculate the amount subject to self-employment tax.

-

Use the self-employment tax rates (which are 15.3% for the tax year 2023) to compute your total self-employment tax.

This final amount will be reported on your Form 1040.

Can I deduct the self-employment tax when filing my income tax return?

Yes, you can deduct the employer-equivalent portion of your self-employment tax when calculating your adjusted gross income on your Form 1040. This is typically 50% of the self-employment tax you calculated in Schedule SE. It's important to note that this deduction does not directly reduce your self-employment tax liability but it does lower your overall taxable income.

What if I have a loss from self-employment?

If you experience a loss from self-employment, you are generally not required to file Schedule SE. A loss means your business expenses exceed your business income, resulting in no net earnings. In this case, self-employment tax is not applicable. However, you may still need to report this loss on your tax return, potentially affecting your overall tax situation.

How do I submit Schedule SE?

Schedule SE must be submitted along with your Form 1040 during tax filing. You can file your taxes electronically or by mailing paper forms to the IRS. If filing electronically, your tax software will usually prompt you to complete Schedule SE as part of the process. Ensure that all parts of the form are filled out accurately before submission to avoid delays and penalties.

What are the deadlines for filing Schedule SE?

The deadline for filing Schedule SE is typically the same as the Form 1040 deadline. For most taxpayers, this means April 15 of each year. If you need additional time, you can file for an extension, but remember that this only extends the time to file your return, not the time to pay any taxes owed. Make sure to pay any estimated self-employment taxes by the original deadline to avoid interest and penalties.