Note: The payer won’t withhold federal income tax if the entire distribution is transferred by the plan administrator in a direct rollover to a traditional IRA or another eligible retirement plan (if allowed by the plan), such as a 401(k) plan, qualified pension plan, governmental section 457(b) plan, section 403(b) contract, or tax-sheltered annuity.

Distributions that are (a) required by federal law, (b) one of a specified series of equal payments, or (c) qualifying “hardship” distributions are not “eligible rollover distributions” and aren’t subject to the mandatory 20% federal income tax withholding.

See Pub. 505 for details. See also Nonperiodic payments—10% withholding on page 2.

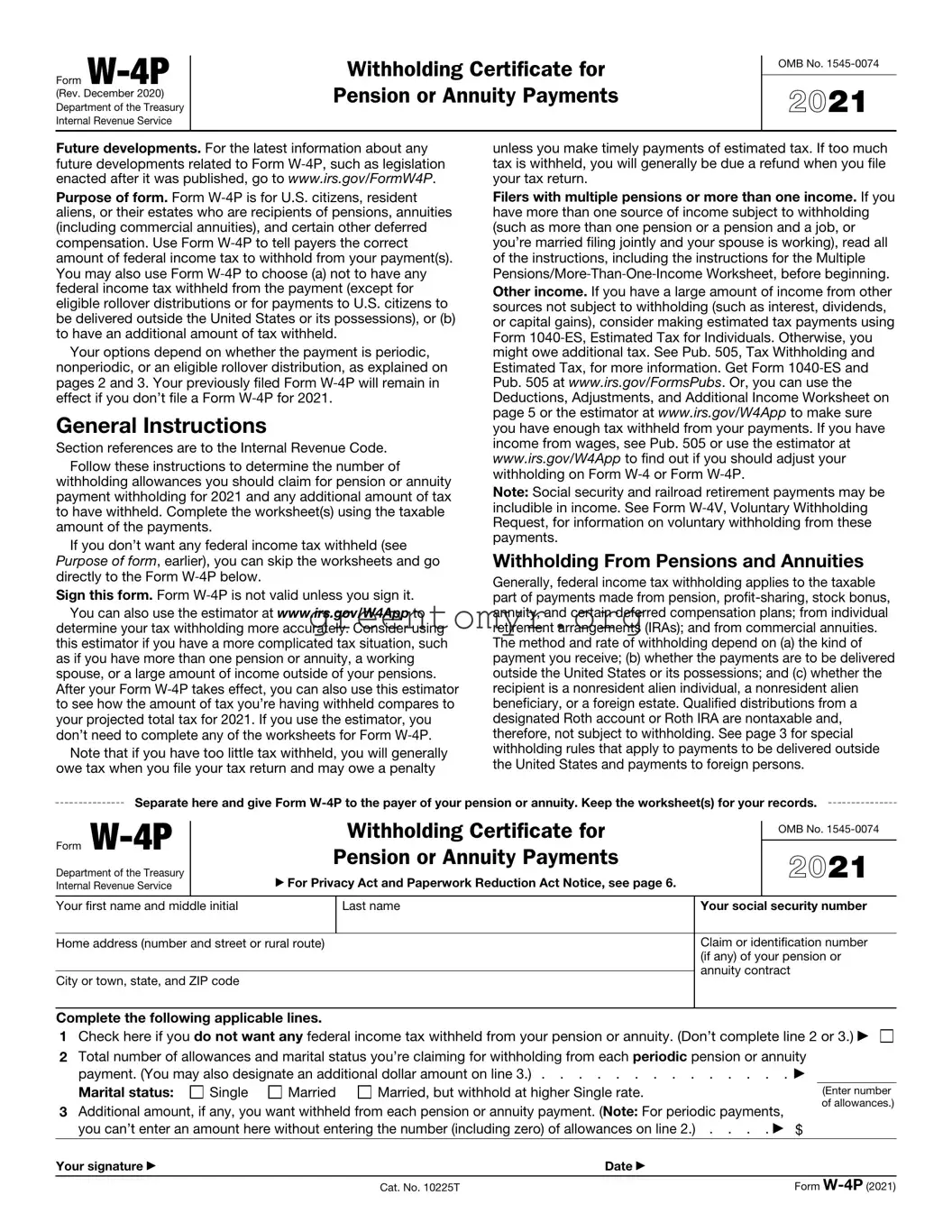

Tax relief for victims of terrorist attacks. For tax years ending after September 10, 2001, disability payments for injuries incurred as a direct result of a terrorist attack directed against the United States (or its allies), whether outside or within the United States, aren’t included in income. You may check the box on line 1 of Form W-4P and submit the form to your payer to have no federal income tax withheld from these disability payments. However, you must include in your income any amounts that you received or would’ve received in retirement had you not become disabled as a result of a terrorist attack. See Pub. 3920, Tax Relief for Victims of Terrorist Attacks, for more details.

Changing Your “No Withholding” Choice

Periodic payments. If you previously chose not to have federal income tax withheld and you now want withholding, complete another Form W-4P and submit it to your payer. If you want federal income tax withheld at the 2021 default rate (married with three allowances), write “Revoked” next to the checkbox on line 1 of the form. If you want tax withheld at a different rate, complete line 2 on the form.

Nonperiodic payments. If you previously chose not to have federal income tax withheld and you now want withholding, write “Revoked” next to the checkbox on line 1 and submit the Form W-4P to your payer.

Payments to Foreign Persons and Payments To Be Delivered Outside the United States

Unless you’re a nonresident alien, withholding (in the manner described above) is required on any periodic or nonperiodic payments that are to be delivered to you outside the United States or its possessions. Don’t check the box on line 1 of Form W-4P. See Pub. 505 for details.

In the absence of a tax treaty exemption, nonresident aliens, nonresident alien beneficiaries, and foreign estates are generally subject to a 30% federal withholding tax under section 1441 on the taxable portion of a periodic or nonperiodic pension or annuity payment that is from U.S. sources. However, most tax treaties provide that private pensions and annuities are exempt from withholding and tax. Also, payments from certain pension plans are exempt from withholding even if no tax treaty applies. See Pub. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities, and Pub. 519, U.S. Tax Guide for Aliens, for details. A foreign person should submit Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals), to the payer before receiving any payments. The Form W-8BEN must contain the foreign person’s taxpayer identification number (TIN).

Statement of Federal Income Tax Withheld From Your Pension or Annuity

By January 31 of next year, your payer will furnish a statement to you on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., showing the total amount of your pension or annuity payments and the total federal income tax withheld during the year. If you’re a foreign person who has provided your payer with Form W-8BEN, your payer will instead furnish a statement to you on Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, by March 15 of next year.

Specific Instructions

Personal Allowances Worksheet

Complete this worksheet on page 4 first to determine the number of withholding allowances to claim.

Line C. Head of household please note: Generally, you can claim head of household filing status on your tax return only if you’re unmarried and pay more than 50% of the costs of keeping up a home for yourself and a qualifying individual. See Pub. 501 for more information about filing status.

Line D. Child tax credit. When you file your tax return, you may be eligible to claim a child tax credit for each of your eligible children. To qualify, the child must be under age 17 as of December 31, must be your dependent who generally lives with you for more than half the year, and must have the required SSN. To learn more about this credit, see Pub. 972, Child Tax Credit and Credit for Other Dependents. To reduce the tax withheld from your payments by taking this credit into account, follow the instructions on line D of the worksheet. On the worksheet, you will be asked about your total income. For this purpose, total income includes all of your pensions, wages, and other income, including income earned by a spouse if you’re filing a joint return.

Line E. Credit for other dependents. When you file your tax return, you may be eligible to claim a credit for other dependents for whom a child tax credit can’t be claimed, such as a qualifying child who does not meet the age or SSN requirement for the child tax credit, or a qualifying relative. To learn more about this credit, see Pub. 972. To reduce the tax withheld from your payments by taking this credit into account, follow the instructions on line E of the worksheet. On the worksheet, you will be asked about your total income. For this purpose, total income includes all of your pensions, wages, and other income, including income earned by a spouse if you’re filing a joint return.

Line F. Other credits. You may be able to reduce the tax withheld from your payments if you expect to claim other tax credits, such as tax credits for education (discussed in Pub.

970). If you do so, your payments will be larger, but the amount of any refund that you receive when you file your tax return will be smaller. Follow the instructions for the worksheet for converting credits to allowances in Pub. 505 if you want to reduce your withholding by taking these credits into account. If you figure all your credits using that worksheet in Pub. 505, enter “-0-” on lines D and E.

Deductions, Adjustments, and Additional Income Worksheet

Complete this worksheet to determine if you’re able to reduce the tax withheld from your pension or annuity payments to account for your itemized deductions and other adjustments to income, such as deductible IRA contributions. If you do so, your refund at the end of the year will be smaller, but your payments will be larger. You’re not required to complete this worksheet or reduce your withholding if you don’t wish to do so.

You can also use this worksheet to figure out how much to increase the tax withheld from your payments if you have a large amount of other income not subject to withholding, such as interest, dividends, or capital gains.

Another option is to take these items into account and make your withholding more accurate by using the estimator at www.irs.gov/W4App. If you use the estimator, you don’t need to complete any of the worksheets for Form W‐4P.

Multiple Pensions/More‐Than‐One‐Income Worksheet

Complete this worksheet if you receive more than one pension, if you have a pension and a job, or if you’re married filing jointly and have a working spouse or a spouse who receives a pension. If you don’t complete this worksheet, you might have too little tax withheld. If so, you will generally owe tax when you file your tax return and may be subject to a penalty.