|

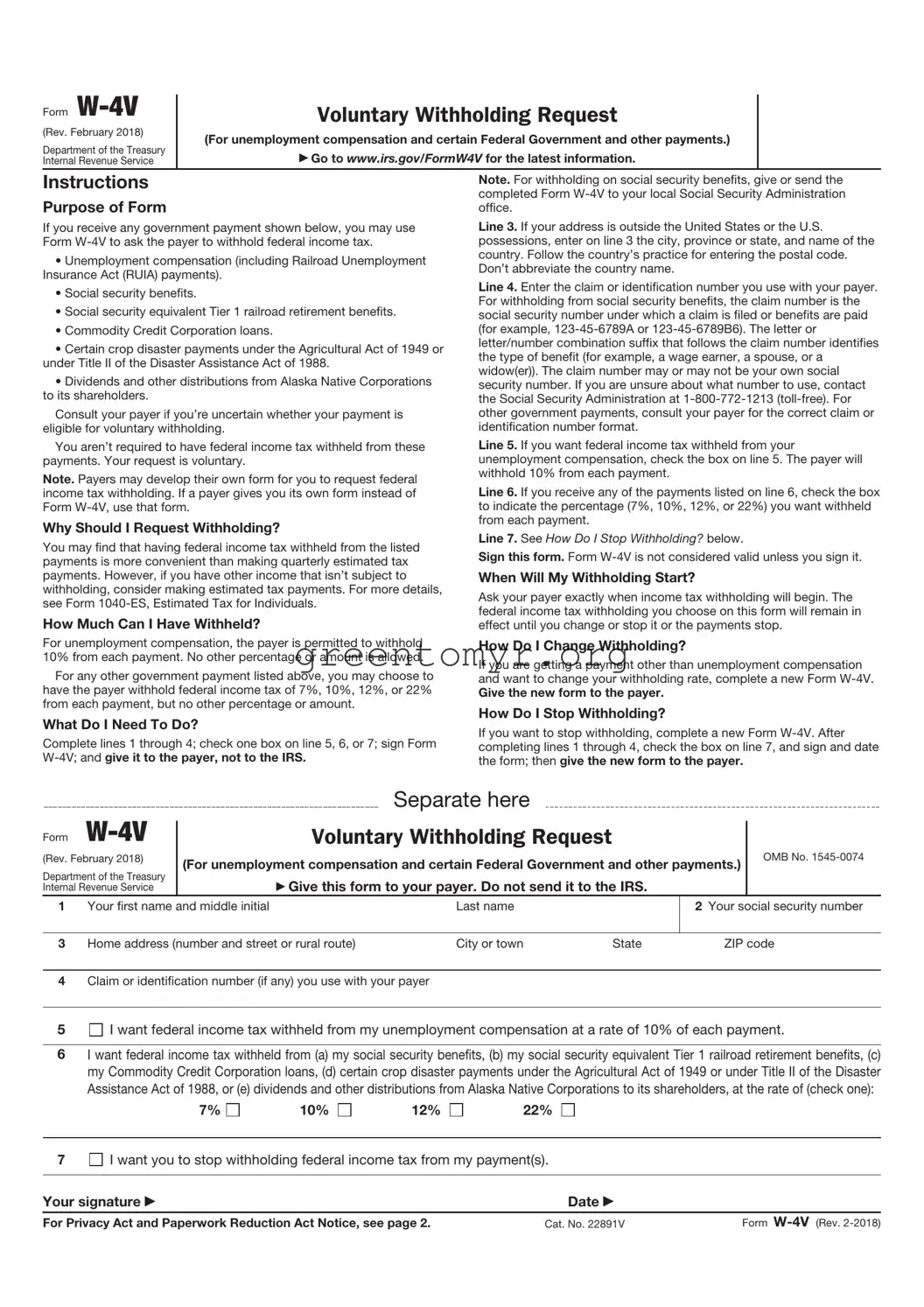

Form |

W-4V |

|

|

Voluntary Withholding Request |

|

|

|

|

|

|

|

|

|

|

(Rev. February 2018) |

|

(For unemployment compensation and certain Federal Government and other payments.) |

|

|

Department of the Treasury |

|

|

|

|

|

Go to www.irs.gov/FormW4V for the latest information. |

|

|

|

|

Internal Revenue Service |

|

|

|

|

|

|

Instructions |

|

|

|

Note. For withholding on social security benefits, give or send the |

|

Purpose of Form |

|

|

|

completed Form W-4V to your local Social Security Administration |

|

|

|

|

office. |

|

|

|

|

|

|

If you receive any government payment shown below, you may use |

Line 3. If your address is outside the United States or the U.S. |

|

Form W-4V to ask the payer to withhold federal income tax. |

possessions, enter on line 3 the city, province or state, and name of the |

|

• Unemployment compensation (including Railroad Unemployment |

country. Follow the country’s practice for entering the postal code. |

|

Don’t abbreviate the country name. |

|

|

|

|

Insurance Act (RUIA) payments). |

|

|

|

|

|

|

Line 4. Enter the claim or identification number you use with your payer. |

|

• Social security benefits. |

|

|

|

|

|

For withholding from social security benefits, the claim number is the |

|

• Social security equivalent Tier 1 railroad retirement benefits. |

|

social security number under which a claim is filed or benefits are paid |

|

• Commodity Credit Corporation loans. |

|

(for example, 123-45-6789A or 123-45-6789B6). The letter or |

|

• Certain crop disaster payments under the Agricultural Act of 1949 or |

letter/number combination suffix that follows the claim number identifies |

|

the type of benefit (for example, a wage earner, a spouse, or a |

|

under Title II of the Disaster Assistance Act of 1988. |

|

widow(er)). The claim number may or may not be your own social |

|

• Dividends and other distributions from Alaska Native Corporations |

|

security number. If you are unsure about what number to use, contact |

|

to its shareholders. |

|

|

|

the Social Security Administration at 1-800-772-1213 (toll-free). For |

|

Consult your payer if you’re uncertain whether your payment is |

other government payments, consult your payer for the correct claim or |

|

eligible for voluntary withholding. |

|

identification number format. |

|

|

|

|

You aren’t required to have federal income tax withheld from these |

Line 5. If you want federal income tax withheld from your |

|

payments. Your request is voluntary. |

|

unemployment compensation, check the box on line 5. The payer will |

|

Note. Payers may develop their own form for you to request federal |

withhold 10% from each payment. |

|

|

|

|

Line 6. If you receive any of the payments listed on line 6, check the box |

|

income tax withholding. If a payer gives you its own form instead of |

|

Form W-4V, use that form. |

|

|

to indicate the percentage (7%, 10%, 12%, or 22%) you want withheld |

|

Why Should I Request Withholding? |

|

from each payment. |

|

|

|

|

|

|

|

Line 7. See How Do I Stop Withholding? below. |

|

|

You may find that having federal income tax withheld from the listed |

|

|

Sign this form. Form W-4V is not considered valid unless you sign it. |

|

payments is more convenient than making quarterly estimated tax |

|

|

|

|

|

|

|

|

payments. However, if you have other income that isn’t subject to |

When Will My Withholding Start? |

|

|

|

|

withholding, consider making estimated tax payments. For more details, |

Ask your payer exactly when income tax withholding will begin. The |

|

see Form 1040-ES, Estimated Tax for Individuals. |

|

federal income tax withholding you choose on this form will remain in |

|

How Much Can I Have Withheld? |

|

|

|

effect until you change or stop it or the payments stop. |

|

For unemployment compensation, the payer is permitted to withhold |

How Do I Change Withholding? |

|

|

|

|

10% from each payment. No other percentage or amount is allowed. |

If you are getting a payment other than unemployment compensation |

|

For any other government payment listed above, you may choose to |

|

and want to change your withholding rate, complete a new Form W-4V. |

|

have the payer withhold federal income tax of 7%, 10%, 12%, or 22% |

Give the new form to the payer. |

|

|

|

|

from each payment, but no other percentage or amount. |

How Do I Stop Withholding? |

|

|

|

|

What Do I Need To Do? |

|

|

|

|

|

|

|

|

If you want to stop withholding, complete a new Form W-4V. After |

|

Complete lines 1 through 4; check one box on line 5, 6, or 7; sign Form |

|

completing lines 1 through 4, check the box on line 7, and sign and date |

|

W-4V; and give it to the payer, not to the IRS. |

the form; then give the new form to the payer. |

|

|

|

|

|

|

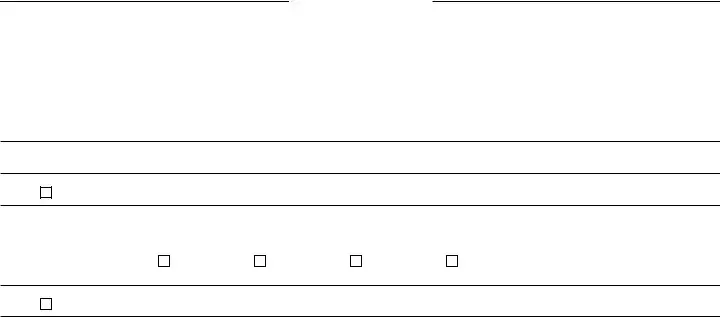

Separate here |

|

|

|

|

|

|

Form |

W-4V |

|

|

Voluntary Withholding Request |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. February 2018) |

(For unemployment compensation and certain Federal Government and other payments.) |

|

OMB No. 1545-0074 |

|

Department of the Treasury |

|

|

|

|

|

Give this form to your payer. Do not send it to the IRS. |

|

|

|

|

Internal Revenue Service |

|

|

|

|

|

|

1 |

Your first name and middle initial |

|

Last name |

|

|

2 Your social security number |

|

|

|

|

|

|

|

|

3 |

Home address (number and street or rural route) |

City or town |

State |

ZIP code |