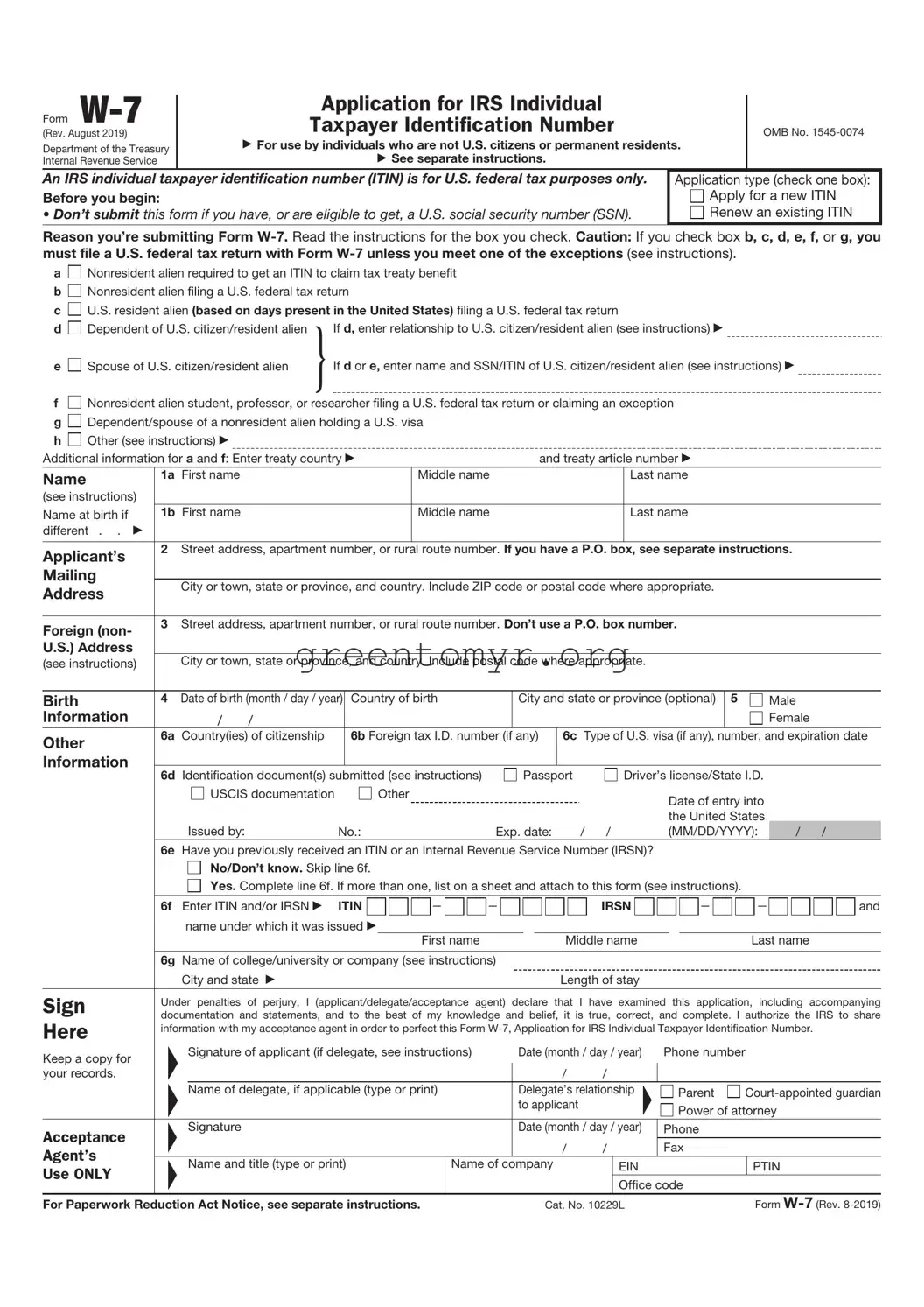

Additional information for a and f: Enter treaty country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and treaty article number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

1a First name |

|

|

|

|

|

|

|

|

Middle name |

|

|

|

|

|

|

|

|

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name at birth if |

1b First name |

|

|

|

|

|

|

|

|

Middle name |

|

|

|

|

|

|

|

|

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

different . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Applicant’s |

2 Street address, apartment number, or rural route number. If you have a P.O. box, see separate instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or town, state or province, and country. Include ZIP code or postal code where appropriate. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign (non- |

3 Street address, apartment number, or rural route number. Don’t use a P.O. box number. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S.) Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(see instructions) |

|

City or town, state or province, and country. Include postal code where appropriate. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Birth |

4 Date of birth (month / day / year) |

Country of birth |

|

|

City and state or province (optional) |

5 |

|

|

Male |

Information |

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Female |

Other |

6a Country(ies) of citizenship |

|

6b Foreign tax I.D. number (if |

any) |

6c Type of U.S. visa (if any), number, and expiration date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6d Identification document(s) submitted (see instructions) |

|

|

|

|

Passport |

|

|

Driver’s license/State I.D. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USCIS documentation |

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of entry into |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the United States |

|

|

|

|

|

|

|

|

|

|

|

|

Issued by: |

|

No.: |

|

|

|

|

|

|

|

|

|

Exp. date: |

/ |

/ |

|

|

|

|

|

(MM/DD/YYYY): |

/ / |

|

|

|

|

|

6e Have you previously received an ITIN or an Internal Revenue Service Number (IRSN)? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No/Don’t know. Skip line 6f. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes. Complete line 6f. If more than one, list on a sheet and attach to this form (see instructions). |

|

|

|

|

|

|

|

|

|

|

6f Enter ITIN and/or IRSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IRSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ITIN |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

|

|

and |

|

|

name under which it was issued |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First name |

|

|

|

|

|

|

|

|

|

Middle name |

|

|

|

|

|

|

|

|

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6g Name of college/university or company (see instructions) ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City and state |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Length of stay ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sign |

Under penalties of perjury, I (applicant/delegate/acceptance agent) declare that I have examined this application, including accompanying |

documentation and statements, and to the best of my knowledge and belief, it is true, correct, and complete. I authorize the IRS to share |

Here |

information with my acceptance agent in order to perfect this Form W-7, Application for IRS Individual Taxpayer Identification Number. |

|

Keep a copy for |

FF |

|

Signature of applicant (if delegate, see instructions) |

|

|

Date (month / day / year) |

F |

|

Phone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of delegate, if applicable (type or print) |

|

|

Delegate’s relationship |

|

|

|

|

Parent |

|

|

Court-appointed guardian |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to applicant |

|

|

|

|

|

|

|

|

Power of attorney |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acceptance |

F |

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date (month / day / year) |

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

/ |

|

|

|

|

|

Fax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agent’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

Name and title (type or print) |

|

|

|

|

|

|

Name of company |

|

|

|

|

EIN |

|

|

|

|

|

|

|

|

|

|

|

PTIN |

Use ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|