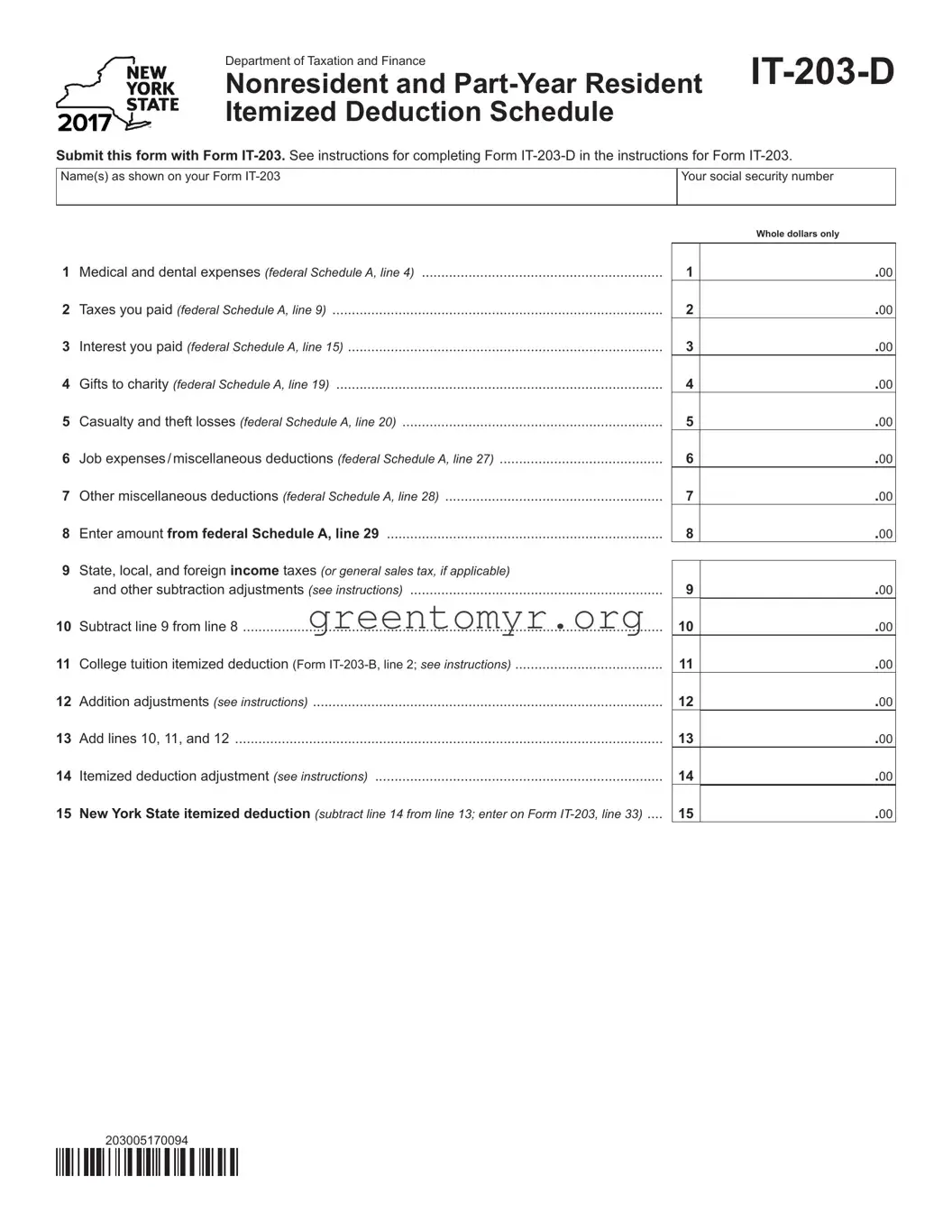

The IT-203-D form, also known as the Nonresident and Part-Year Resident Itemized Deduction Schedule, is a document that nonresidents and part-year residents file with their New York State tax returns. This form allows individuals to itemize deductions that can lower their taxable income, ultimately leading to potential tax savings. It requires information about various deductible expenses, such as medical expenses, taxes paid, and charitable contributions.

This form is specifically designed for individuals who qualify as nonresidents or part-year residents of New York State. If you meet either of these criteria and are filing Form IT-203, you must complete and submit the IT-203-D to accurately report your itemized deductions. If you have significant deductible expenses, itemizing may be more beneficial than claiming the standard deduction.

When completing the IT-203-D, you will need to provide several types of information:

-

Your name(s) as listed on Form IT-203

-

Your Social Security number

-

Details of various deductions, including:

-

Medical and dental expenses

-

Taxes paid

-

Interest paid

-

Gifts to charity

-

Casualty and theft losses

-

Job expenses and miscellaneous deductions

This information is crucial for determining your allowable itemized deductions for New York State taxation.

The calculation of itemized deductions on the IT-203-D involves several steps. First, enter the total from each applicable category, as detailed on the federal Schedule A. Then, you'll need to input the state and local taxes paid to derive key figures that impact your deductions. After calculating these amounts, you can sum the deductions and make any necessary adjustments based on the form’s instructions to arrive at your final New York State itemized deduction. It’s vital to follow the form’s instructions carefully to ensure accuracy.

When filling out the IT-203-D, several pitfalls can affect your submission:

-

Omitting necessary information, such as your Social Security number or complete name.

-

Errors in arithmetic, which can lead to incorrect calculations of your deductions.

-

Failing to review the instructions properly, leading to misinterpretation of what items are deductible.

-

Neglecting to round amounts to whole dollars, as the form specifically requests whole-dollar entries.

Being vigilant about these common mistakes can streamline your filing process and enhance accuracy.

The deadline for filing the IT-203-D form coincides with the deadline for filing your New York State tax return, which is typically April 15 for most individuals. Ensure that you submit both the IT-203 and the IT-203-D before this deadline to avoid penalties. If you require additional time, you may file for an extension, but make sure to adhere to the applicable rules regarding extensions and the submission of your forms.

If you find yourself with questions regarding the IT-203-D form, assistance is readily available. The New York State Department of Taxation and Finance provides resources online that include guidelines and frequently asked questions. Additionally, consider reaching out to a tax professional who can offer tailored advice and ensure compliance with tax laws. Whether you consult official resources or seek professional guidance, help is available to navigate the complexities of your tax filing.