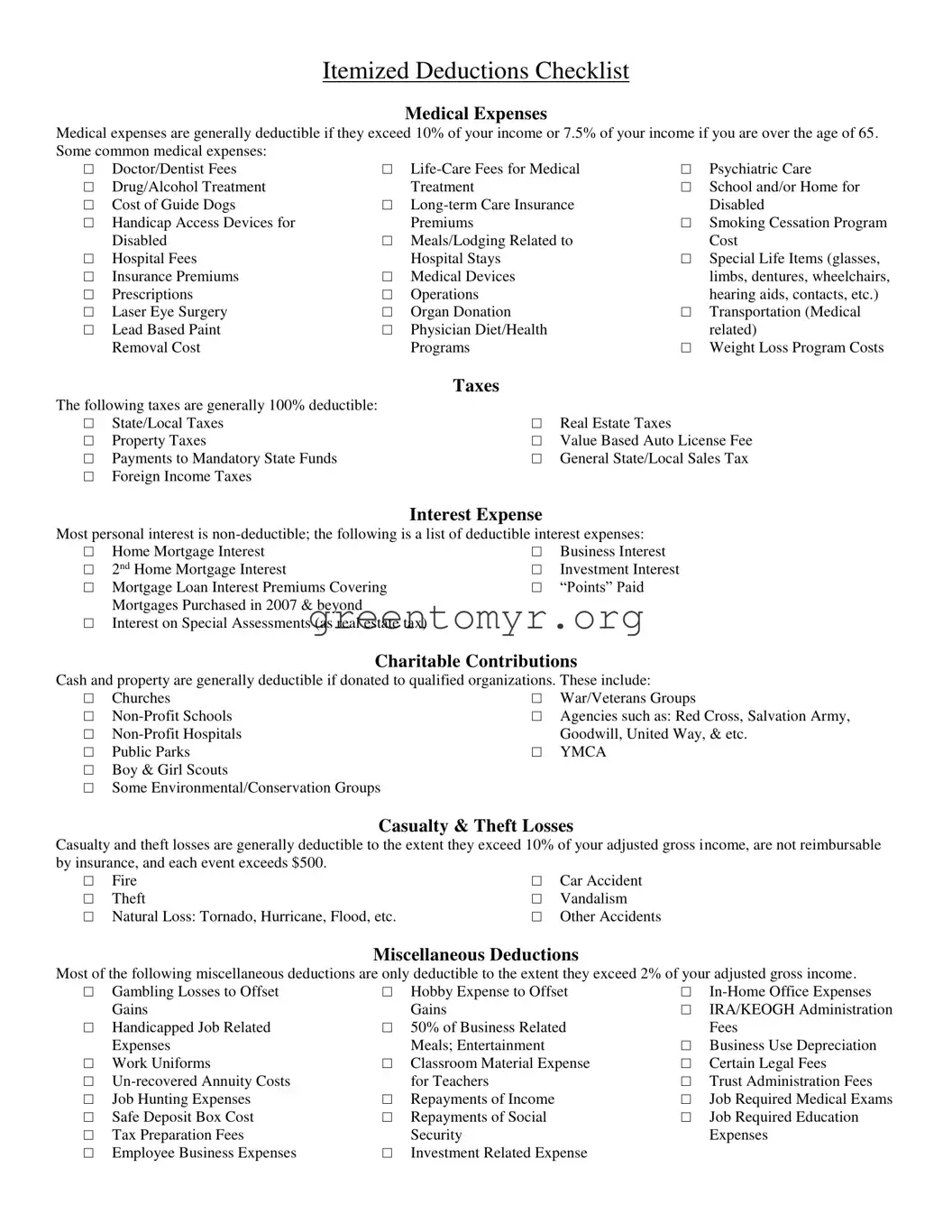

The Itemized Deductions Checklist form is a tool designed to help taxpayers identify potential deductions they may qualify for when filing their tax returns. By listing various deductible expenses, it allows individuals to evaluate whether itemizing their deductions will result in a lower tax liability compared to taking the standard deduction.

This form is particularly beneficial for taxpayers whose deductible expenses exceed the standard deduction amount. Individuals who have significant medical expenses, property taxes, or charitable contributions may find itemizing advantageous. It is also suitable for those with specific job-related expenses or other miscellaneous deductions.

What types of medical expenses can be deducted?

Taxpayers can deduct various medical expenses that exceed a certain percentage of their income. Common deductible medical expenses include:

-

Doctor and dentist fees

-

Prescription medications

-

Hospital expenses

-

Long-term care insurance premiums

-

Costs related to specific medical devices, such as wheelchairs or hearing aids

For individuals aged 65 and older, the threshold is lowered to 7.5% of income.

Are taxes considered deductible? If so, which ones?

Yes, certain taxes are fully deductible. These include:

-

Real estate taxes

-

State and local income taxes

-

Property taxes

-

General state and local sales tax

-

Foreign income taxes

It is essential to keep accurate records of these tax payments to claim the deductions correctly.

What are the qualifications for charitable contributions?

Taxpayers can deduct cash and property contributions made to qualified organizations. Such organizations typically include:

-

Religious institutions (churches)

-

Non-profit organizations (e.g., Red Cross, Salvation Army)

-

Educational institutions (non-profit schools)

Documentation is critical; retain receipts and records for any contributions made throughout the year.

How do casualty and theft losses affect my deductions?

Casualty and theft losses are deductible to the extent they exceed 10% of your adjusted gross income (AGI) and are not reimbursed by insurance. Each loss must surpass $500 to qualify. Events may include:

-

Fires

-

Thefts

-

Natural disasters such as hurricanes or floods

Thorough documentation, including photographs and police reports, can support claims related to these losses.

What miscellaneous deductions are available?

Many miscellaneous deductions are allowed, but they typically only exceed 2% of the taxpayer’s AGI. Examples include:

-

Gambling losses (up to the amount of winnings)

-

Home office expenses

-

Job hunting expenses

-

Certain unreimbursed employee expenses, such as business-related meals and entertainment

Detailed records are essential to substantiate these deductions.

When is it advantageous to itemize deductions?

Itemizing deductions becomes advantageous mainly when the total deductible expenses exceed the standard deduction amount set by the IRS. For the tax year 2023, the standard deduction is $13,850 for individuals and $27,700 for married couples filing jointly. Conducting a thorough review with the Itemized Deductions Checklist can aid in determining the most beneficial approach.