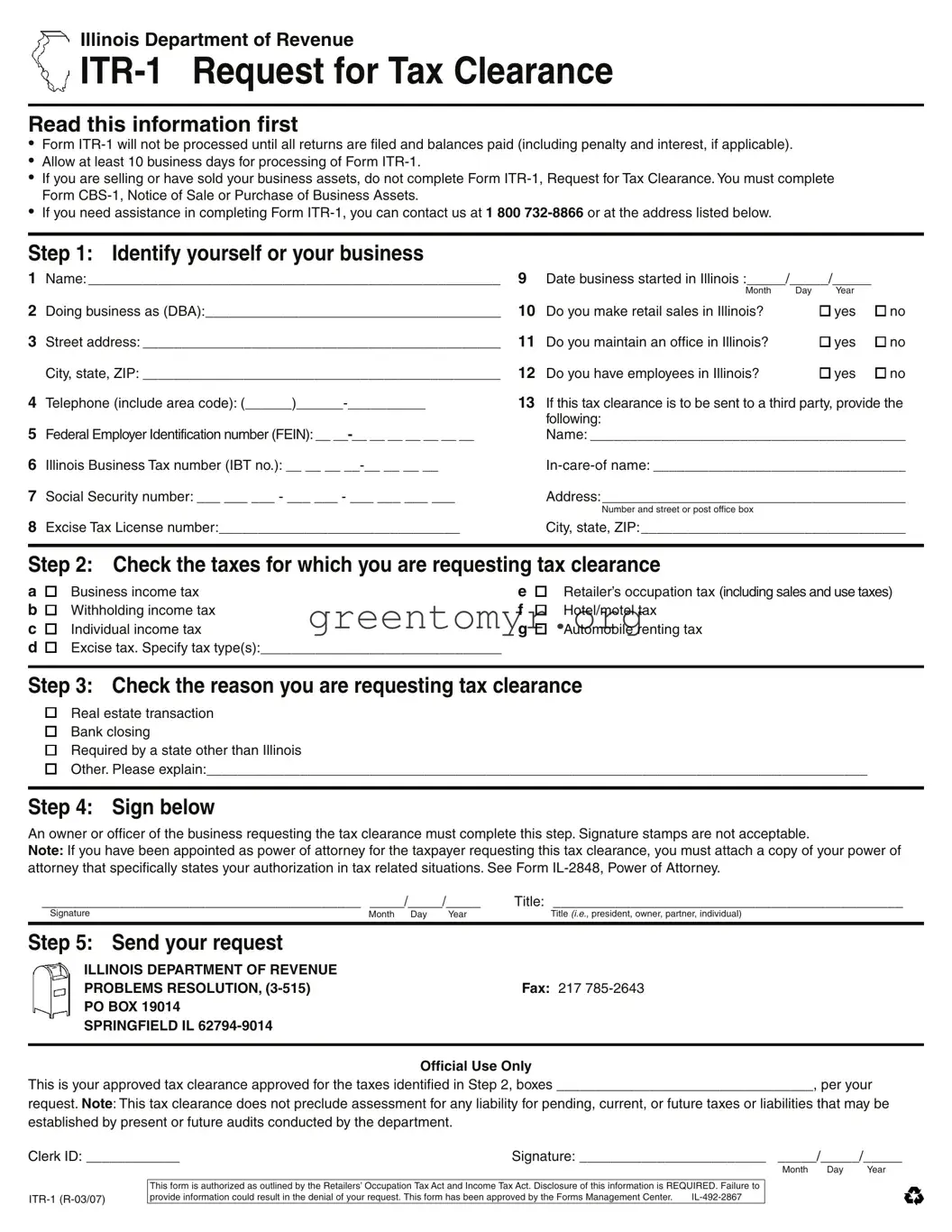

Illinois Department of Revenue

ITR-1 Request for Tax Clearance

Read this information first

•Form ITR-1 will not be processed until all returns are filed and balances paid (including penalty and interest, if applicable).

•Allow at least 10 business days for processing of Form ITR-1.

•If you are selling or have sold your business assets, do not complete Form ITR-1, Request for Tax Clearance. You must complete Form CBS-1, Notice of Sale or Purchase of Business Assets.

•If you need assistance in completing Form ITR-1, you can contact us at 1 800 732-8866 or at the address listed below.

Step 1: Identify yourself or your business

1 |

Name: _____________________________________________________ |

9 |

Date business started in Illinois :_____/_____/_____ |

|

|

|

|

Month |

Day |

Year |

|

2 |

Doing business as (DBA):______________________________________ |

10 |

Do you make retail sales in Illinois? |

|

yes |

no |

3 |

Street address: ______________________________________________ |

11 |

Do you maintain an office in Illinois? |

|

yes |

no |

|

City, state, ZIP: ______________________________________________ |

12 |

Do you have employees in Illinois? |

|

yes |

no |

4 |

Telephone (include area code): (______)______-__________ |

13 |

If this tax clearance is to be sent to a third party, provide the |

|

|

|

following: |

|

|

|

5 |

Federal Employer Identification number (FEIN): __ __-__ __ __ __ __ __ __ |

|

Name: ________________________________________ |

6 |

Illinois Business Tax number (IBT no.): __ __ __ __-__ __ __ __ |

|

In-care-of name: ________________________________ |

7 |

Social Security number: ___ ___ ___ - ___ ___ - ___ ___ ___ ___ |

|

Address: _______________________________________ |

|

|

|

Number and street or post office box |

|

|

|

8 |

Excise Tax License number:_______________________________ |

|

City, state, ZIP: __________________________________ |

|

|

|

|

|

|

|

Step 2: Check the taxes for which you are requesting tax clearance

Business income tax |

e |

Withholding income tax |

f |

Individual income tax |

g |

Excise tax. Specify tax type(s):_______________________________ |

|

Retailer’s occupation tax (including sales and use taxes) Hotel/motel tax

Automobile renting tax

Step 3: Check the reason you are requesting tax clearance

Real estate transaction Bank closing

Required by a state other than Illinois

Other. Please explain:_____________________________________________________________________________________

Step 4: Sign below

An owner or officer of the business requesting the tax clearance must complete this step. Signature stamps are not acceptable.

Note: If you have been appointed as power of attorney for the taxpayer requesting this tax clearance, you must attach a copy of your power of attorney that specifically states your authorization in tax related situations. See Form IL-2848, Power of Attorney.

_________________________________________ |

_____/_____/_____ |

Title: _____________________________________________ |

Signature |

Month Day Year |

Title (i.e., president, owner, partner, individual) |

|

|

|

Step 5: Send your request

ILLINOIS DEPARTMENT OF REVENUE |

|

PROBLEMS RESOLUTION, (3-515) |

Fax: 217 785-2643 |

PO BOX 19014 |

|

SPRINGFIELD IL 62794-9014 |

|

|

|

|

Official Use Only |

This is your approved tax clearance approved for the taxes identified in Step 2, boxes _________________________________, per your

request. Note: This tax clearance does not preclude assessment for any liability for pending, current, or future taxes or liabilities that may be established by present or future audits conducted by the department.

Clerk ID: ____________ |

Signature: ________________________ _____/_____/_____ |

Month Day Year

This form is authorized as outlined by the Retailers’ Occupation Tax Act and Income Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in the denial of your request. This form has been approved by the Forms Management Center. |

IL-492-2867 |