|

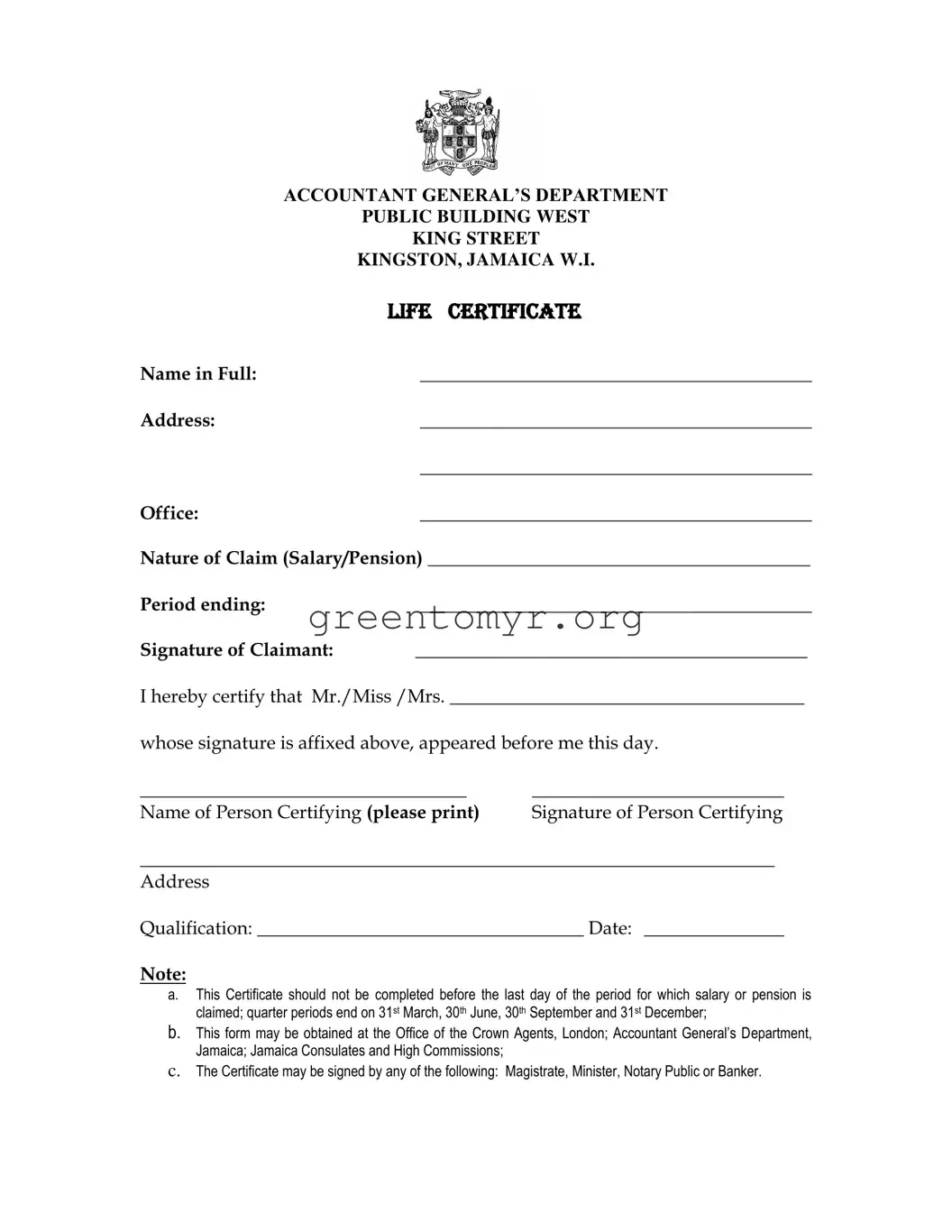

ACCOUNTANT GENERAL’S DEPARTMENT |

|

PUBLIC BUILDING WEST |

|

KING STREET |

|

KINGSTON, JAMAICA W.I. |

|

LIFE CERTIFICATE |

Name in Full: |

__________________________________________ |

Address: |

__________________________________________ |

|

__________________________________________ |

Office: |

__________________________________________ |

Nature of Claim (Salary/Pension) _________________________________________

Period ending: |

__________________________________________ |

Signature of Claimant: |

__________________________________________ |

I hereby certify that Mr./Miss /Mrs. ______________________________________

whose signature is affixed above, appeared before me this day.

___________________________________ |

___________________________ |

Name of Person Certifying (please print) |

Signature of Person Certifying |

____________________________________________________________________

Address

Qualification: ___________________________________ Date: _______________

Note:

a.This Certificate should not be completed before the last day of the period for which salary or pension is claimed; quarter periods end on 31st March, 30th June, 30th September and 31st December;

b.This form may be obtained at the Office of the Crown Agents, London; Accountant General’s Department, Jamaica; Jamaica Consulates and High Commissions;

C. The Certificate may be signed by any of the following: Magistrate, Minister, Notary Public or Banker.