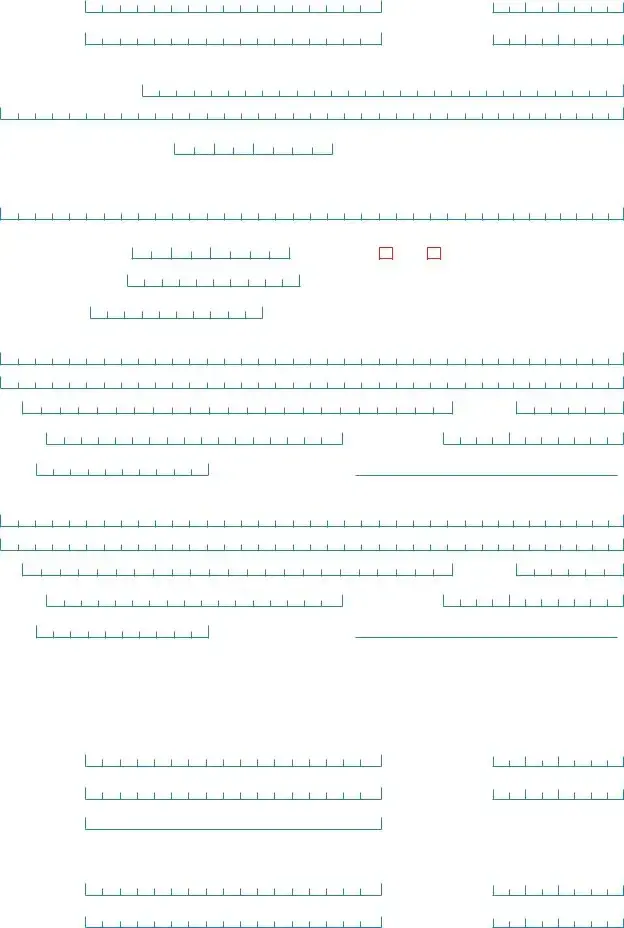

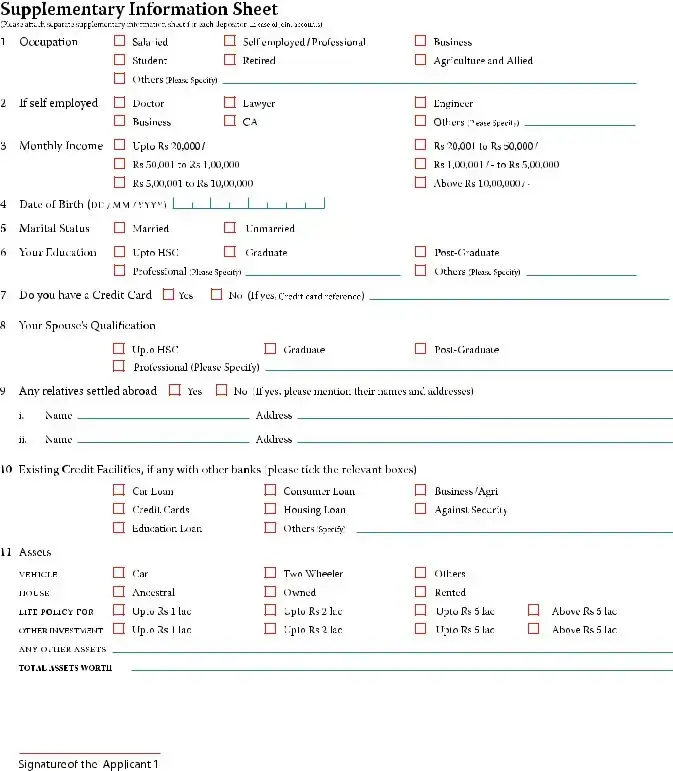

Other (please specify)

I shall represent the minor in all future transactions of any description in the above account till the said minor attains majority. I shall fully indemnity the bank against any claim of the above for any withdrawal/ transaction made by me in his/ her account .

Declaration

1.I am / We are Non Resident Indian(s) or persons of Indian Origin.

2.I / We under stand that the above account will be opened on the basis of the statements / declarations made by me / us and will be opened in the form and as per various Regulations framed under Foreign Exchange Management Act . 1999 and in particular. Foreign Exchange Management (Deposit) Regulations, 2000 as amended from time to time. I / We also agree that if any of the statements / declarations made herein is found to be not correct in material particulars, you are not bound to pay any interest on the deposit made by me / us and to discontinue the ser vice.

3.The account will be put into use only for bonafide transactions not involving any violations of the provisions of any Government / Exchange Control Regulation.

4.I/ We agree that the rate and the manner of interest to be paid shall be as per the Regulations and no claim will be made by me/ us for any interest on the deposits for any period after date/ s of maturity of the deposits.

5.I/ We agree to abide by the provisions of the FCNR/ NRE/ NRO Accounts scheme laid down by the RBI and as per the said act and the Regulations as emended from time to time.

6.I/ We hereby undertake to intimate you about my/ our return to India for permanent residence immediately on arrival.

7.I/ We authorise the Bank to automatically renew the deposit on due date for an identical period (unless otherwise specifically instructed before due date). The earlier receipt given to me will be treated as dicharged receipt on due date. I/ We understand that the interest applicable on renewals will be at the applicable ruling rates on the date of maturity and the renewed receipt will be made available on my/ our presenting the duly discharged origin receipt on the maturity date or later for payment . I/ We further understand that he renewal will be accordance with the provisions of the Reser ve Bank of India scheme in force at the time of renewal.

8.I/ We agree that if premature withdrawal is permitted at my/ our request the payment of interest on the deposit may be allowed in accordance with the prevailing stipulations laid down by the Reser ve Bank of India and J&K Bank in this regard.

9.I/ We shall not make available to any person resident in India, foreign currency against reimbursement in Rupees or in any other manner in India.

10.I/ We confirm that all debits/ credits to my/ our account shall be in accordance with the Regulations and are covered either by general or specific permission of Reser ve Bank of India.

11.I/ We will be liable to comply with the rules of the Foreign Exchange Management Act, 1999 and the Regulations and amendments thereof in force from time to time and as stipulated by the Reser ve Bank of India.

12.I/ We understand that the Bank may at its absolute discretion, discontinue any of the ser vices completely or partially without any notice to me/ us. I/ We agree that the Bank may debt my account for ser vice charges as applicable from time to time.

13.I/ We have read, understood and hereby accept & agree to the Terms and Conditions given for all the products and ser vices I have requested.

14.a) I/ We agree and undertake that in case of FNCR (B) Accounts, if the remittance from outside India is not in designated currency and the same is converted to the designated currency as stipulated in the Regulations, it shall be at my/ our entire risk and costs and I/ We shall not challenge the rate of conversion.

b)I/ We undertake that in case of premature payment and conversion into INRs of the FCNR (B) deposit is requested but within one year from the receipt of deposit, the deposit should be reversed at cash buying rate.

c)I/ We understand and affirm that in case at any time my/ our request for premature withdrawal of the FCNR (B) deposit is acceded to by the bank, the bank is authorised and entitled in its absolute discretion to levy penalty to recover the Swap cost from proceeds of the deposit paid prematurely.

15.I/ We hereby agree and confirm to bear any losses or claims that may arise directly/ indirectly on account of the Bank acting on any instructions received by it by fax or any electronic media given by me/ us or on my/ our behalf and agree to keep the Bank indemnified from any such losses and / or claims.

16.I/ We do hereby declare that the information furnished in this form is true to the best of my/ our knowledge and belief.

17.I/ We hereby indemnify and forever keep indemnified the Bank and its successors and assigns of, from and against any and all claims, actions, penalties that may be made, suffered or incurred by the bank by reason of my/ our non-compliance with the said Act and/ or the Regulations as amended from time to time.

Signature of Applicant 1 |

Signature of Applicant 2 |

Signature of Applicant 3 |