Filling out a Joint Check form accurately is essential for ensuring prompt payments and maintaining healthy business relationships. However, several common mistakes can hinder the process. Understanding these issues can save parties involved significant time and potential financial distress.

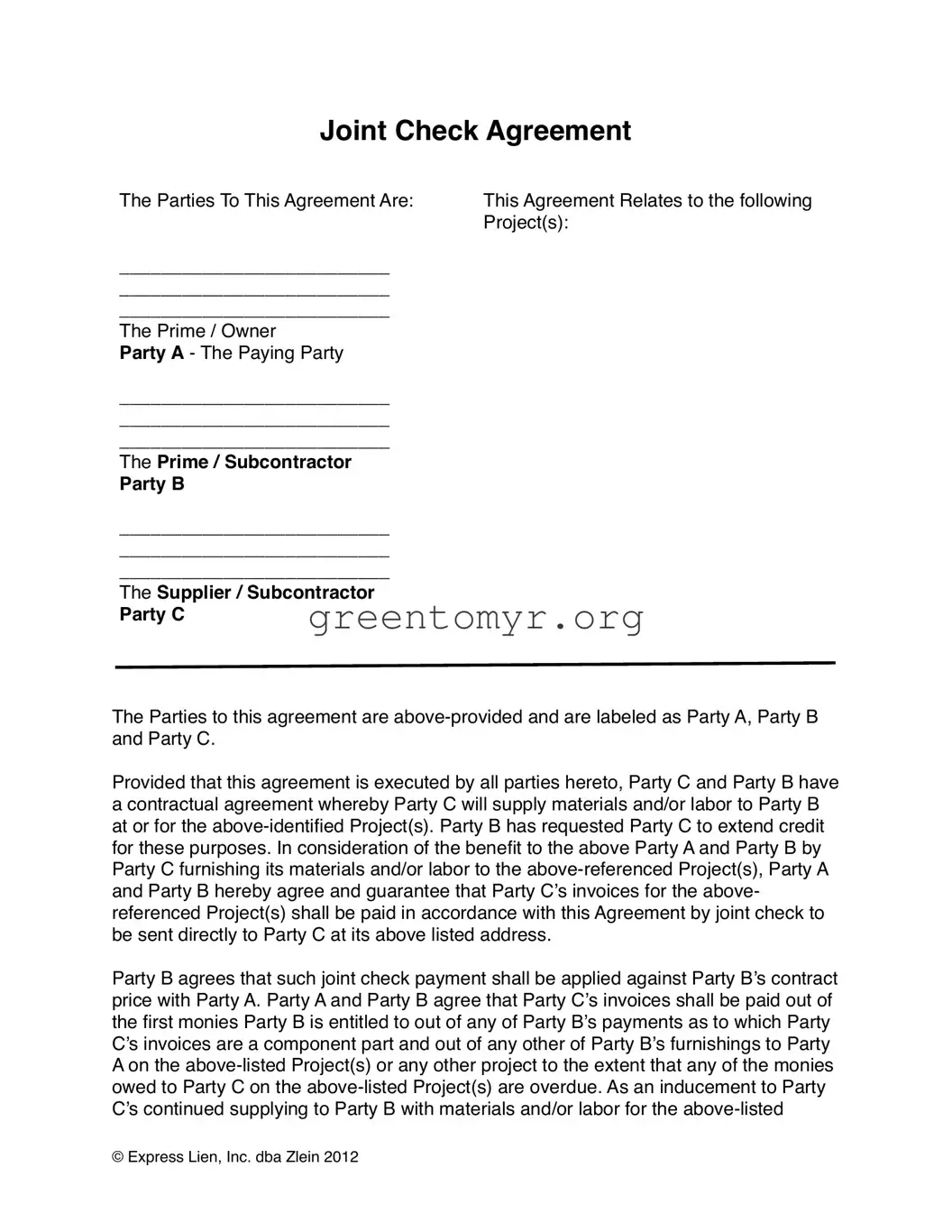

One frequent error is failing to include all necessary parties' names and titles. The agreement designates Party A, Party B, and Party C. Leaving out any of these crucial identifiers can lead to confusion about who is responsible for payments, creating disputes down the line. Each party should ensure they fill in their complete names and titles to avoid ambiguity.

Another mistake is neglecting to specify the project details clearly.

Without this critical information, the validity of the joint check agreement may be questioned. It is vital that parties list all relevant project identifiers as indicated in the form. Clearly specifying this can streamline communication and payment processes.

An overlooked item is the failure to date all signatures. Dates indicate when all parties agreed to the terms. Missing dates can complicate enforcement, especially if disputes arise later regarding payment timelines or contractual obligations. Each party should remember to sign and date their section before finalizing the form.

Additionally, miscommunication about the terms of credit can create issues.

If Party B does not clearly communicate their request for credit to Party C, this misunderstanding could lead to payment delays or disputes over the nature of the credit agreement. It's essential for everyone to understand the credit terms set forth in the agreement.

Parties often forget to review the payment obligations carefully. The agreement outlines that Party A and Party B will ensure Party C's invoices are paid. Failing to understand who holds responsibility at various stages may lead to default and create liability for all parties involved. Reviewing these obligations thoroughly helps prevent future disagreements.

Another mistake is not adhering to notification requirements.

The agreement specifies that if Party A becomes aware of insufficient funds, they must notify Party C in writing within ten days. Neglecting this requirement can burden Party C with unnecessary financial stress and complicate the payment process. It's crucial for Party A to stay vigilant and fulfill this duty.

Lastly, misunderstanding the implications of revoking the agreement can be costly. The document states that none of the parties can revoke the agreement without consent. A failure to recognize the binding nature of this provision could lead to significant consequences if one party attempts to change terms unilaterally. Consequently, all parties should grasp the seriousness of their commitments upon signing.

By being aware of these common mistakes, individuals can ensure that their Joint Check Agreement is executed effectively. Accurate and thorough completion of the form fosters a smoother transaction and minimizes future disputes, ultimately benefiting all parties involved.