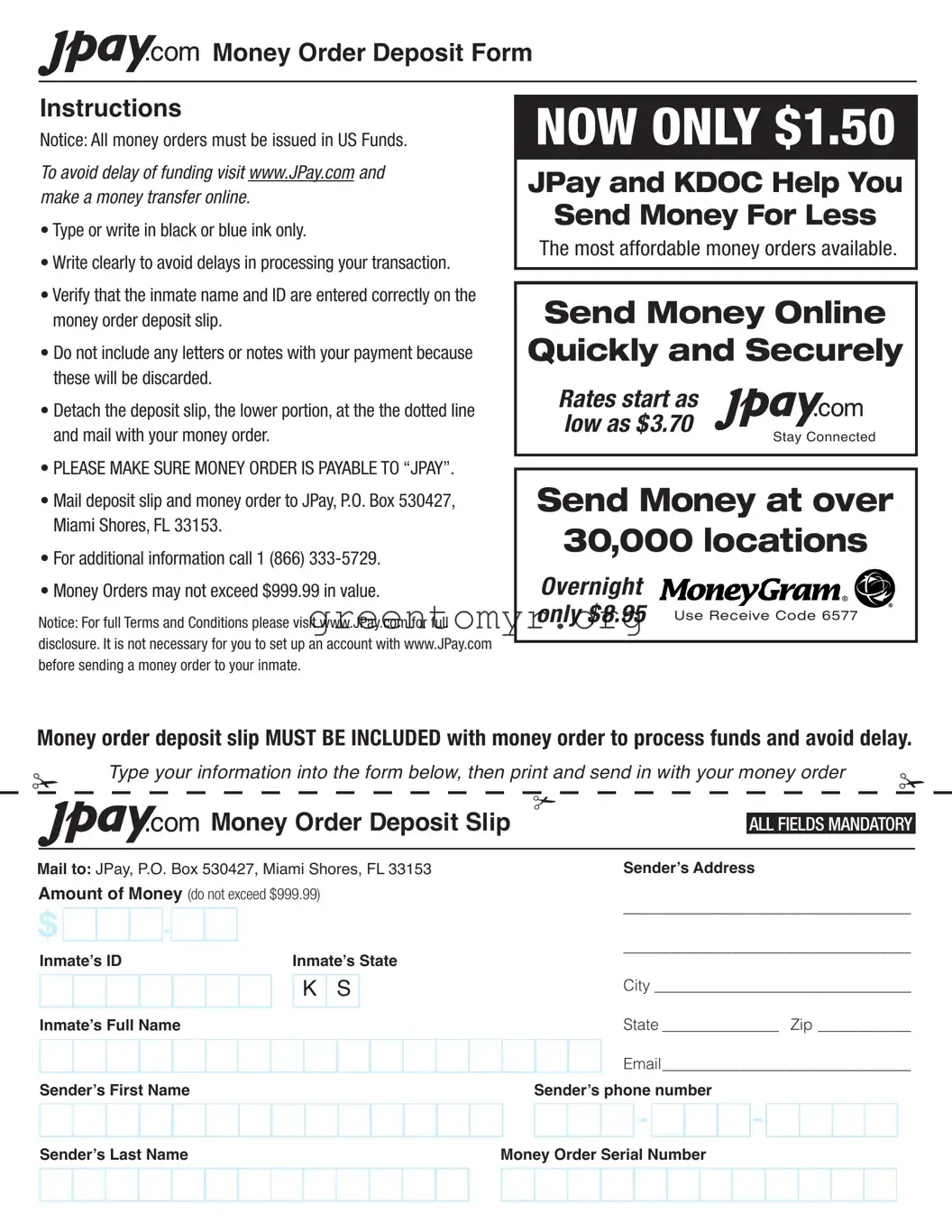

Misconception 1: The JPay Mailing Address form requires an account to send money.

Many believe that an account is necessary to use the JPay system. In reality, you can send a money order without setting up an account. This feature simplifies the process for those who prefer not to register online.

Misconception 2: You can include personal letters with your money order.

Some individuals think they can send notes or letters to inmates along with their money orders. However, JPay explicitly instructs users not to include any letters, as these will be discarded. This ensures a streamlined processing of transactions.

Misconception 3: You can use any type of money order for your deposit.

It’s a common misunderstanding that various types of money orders are acceptable. Only money orders issued in U.S. funds are permissible. Adhering to this rule is crucial for successful transactions.

Misconception 4: The deposit slip can be sent without detaching the lower portion.

Some may think it’s acceptable to send the entire document. Yet, it is important to detach the deposit slip at the dotted line before mailing it with the money order. Not following this condition can lead to delays in processing.

Misconception 5: Any amount can be sent through a money order.

Another misconception is that money orders can exceed $999.99. In fact, there’s a strict limit on the value of money orders. Staying within this cap is essential to prevent any transaction issues.

Misconception 6: There are no specific requirements for writing information on the form.

Some people may believe they can write the information as they please. Instead, it’s important to use black or blue ink and write clearly. Doing so minimizes the risk of delays in processing your transaction.

Misconception 7: Money transfers through JPay are costly.

Many assume that using JPay is expensive; however, rates start as low as $3.70. This competitive pricing makes JPay a practical option for those looking to send money affordably.

Money Order Deposit Form

Money Order Deposit Form S

S