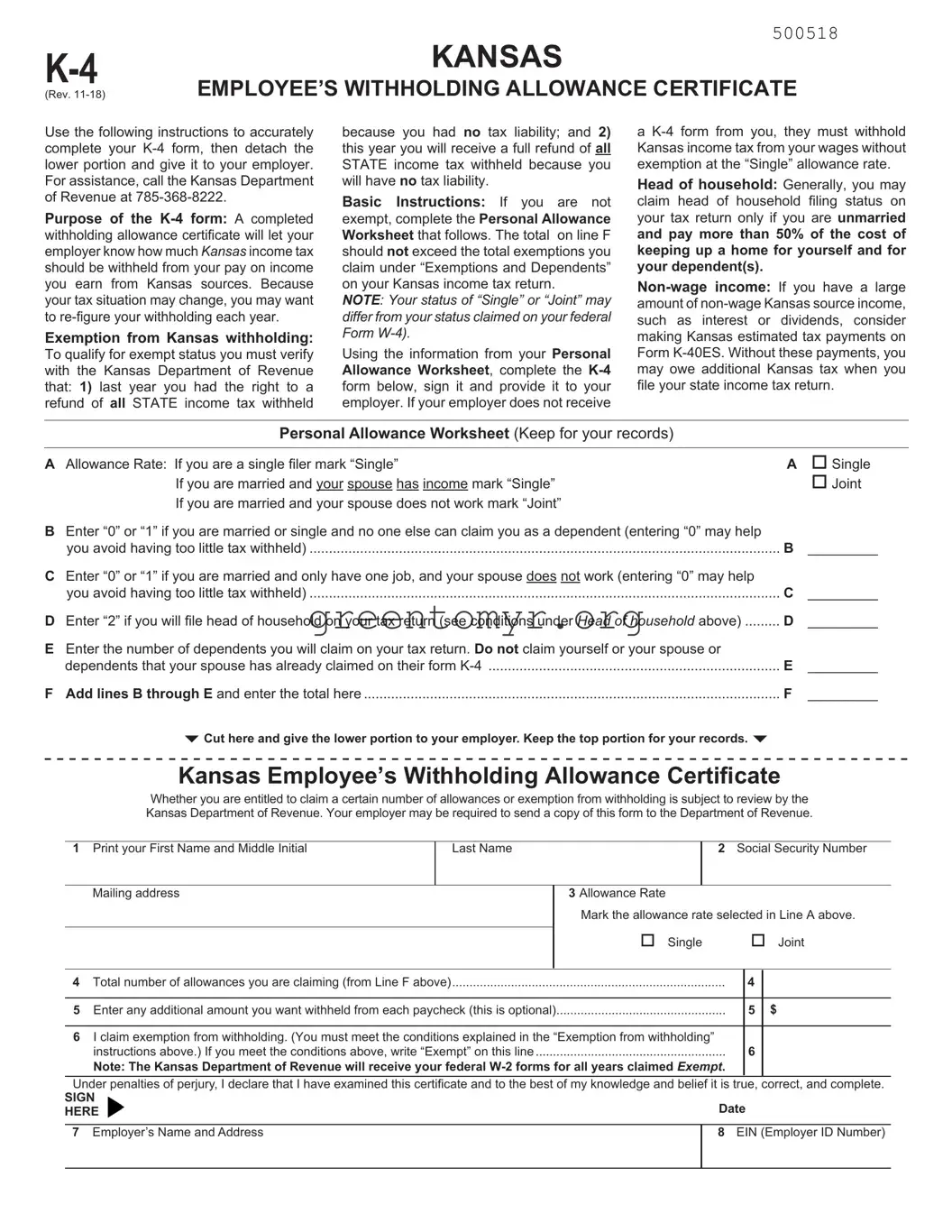

Filling out the Kansas K-4 form accurately is crucial for ensuring the correct amount of state income tax is withheld from your paycheck. However, many people unintentionally make mistakes that can lead to unpleasant surprises come tax time. One common error is not understanding the exemption criteria. To qualify for exemption from withholding, you must have had a right to a refund of all state income tax last year and expect a full refund this year. Failing to verify or incorrectly claiming this status can lead to under-withholding, resulting in a tax bill.

Another frequent issue occurs with the Personal Allowance Worksheet. It’s essential to fill this out carefully, as the total on line F should not exceed the number of exemptions you plan to claim on your Kansas tax return. Mixing up these numbers can lead to too much or too little tax withholding throughout the year. Remember, entering “0” instead of “1” might seem like a minor detail, but it can significantly affect your withholding.

People sometimes misunderstand their filing status as well. Sometimes the filing status on the K-4 form differs from what is claimed on the federal W-4 form. If you are married, but your spouse does not work, you should select “Joint.” On the other hand, if both you and your spouse work, selecting “Single” can result in over-withholding. Clarity on your marital status is essential to avoid such complications.

In addition, neglecting to consider potential non-wage income can be a mistake. Individuals who have significant non-wage income, such as interest or dividends, should think about making estimated tax payments. Ignoring this step can lead to an unexpected tax burden when filing your Kansas income tax return.

People also often overlook the importance of the signature on the K-4. The form must be signed for it to be valid. A simple omission can lead to your employer not processing the document, resulting in withholding at the highest tax rate. Take the time to double-check your signature before submitting the form.

Another issue arises when individuals forget to notify their employer of changes in their situation. If you get married, have children, or experience significant changes in income, these changes can affect your tax situation. Ensure you keep your employer informed by submitting an updated K-4 promptly.

Moreover, there can be a tendency to neglect to claim valid dependents. When entering the number of dependents on line E, ensure you account only for those you can legally claim on your tax return. Claiming others incorrectly can lead to complications and inaccuracies in tax withholding.

Lastly, people sometimes ignore the optional section for additional amounts to be withheld from each paycheck. Even though it’s not mandatory, if you anticipate owing taxes on other income, you may want to add an extra amount to be withheld to avoid a tax bill later. This small step can make a big difference come tax time.