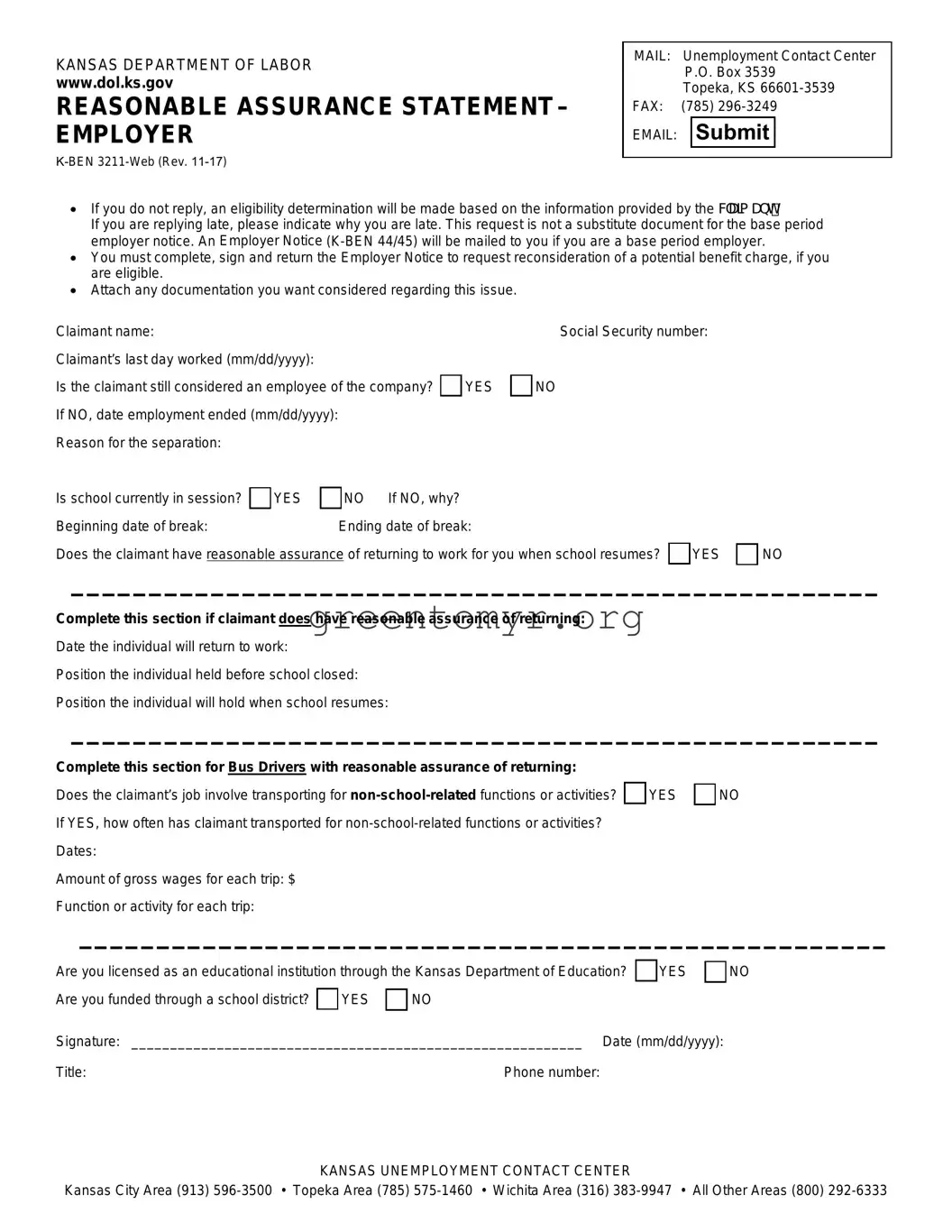

The Kansas K-BEN 3211 form is a Reasonable Assurance Statement used by employers to confirm an employee’s status with regard to unemployment benefits. It helps determine if an employee has reasonable assurance of returning to their job, particularly within educational institutions during breaks.

This form should be used by employers, specifically those in educational fields, who are confirming an employee's status for unemployment benefit claims. It is primarily utilized for individuals who work as educators or support staff in schools.

The form requires various pieces of information, including:

-

Claimant’s name and Social Security number

-

Last day the claimant worked

-

Whether the claimant is still considered an employee

-

Reason for the employee's separation, if applicable

-

Details about the school schedule and breaks

-

Assurance regarding the employee's return to work

To complete the K-BEN 3211 form, the employer must fill in all required fields accurately. They should provide specific dates, job information, and indicate whether the claimant has reasonable assurance of returning to work. The form must then be signed and dated by the employer.

If an employer submits the K-BEN 3211 form late, they should indicate the reason for the delay on the form. It is crucial to respond as late submissions could lead to an eligibility determination made without the employer's input.

Can an employer attach additional documentation?

Yes, employers may attach any relevant documentation they wish to be considered along with the K-BEN 3211 form. This adds context and may support the employer’s claims regarding the employee's status.

If the employer does not reply, the unemployment benefits eligibility will be determined based solely on the information provided by the claimant. This may not favor the employer if the claimant’s information is incomplete or inaccurate.

Are there specific considerations for bus drivers?

Yes, if the claimant is a bus driver, the employer must answer whether the driver’s job involves transporting for non-school-related functions. This information is crucial for determining the claimant's overall employment status.

Employers can submit the K-BEN 3211 form via mail, fax, or email. The mailing address and fax number are provided on the form itself, ensuring employers have multiple submission options to meet their needs.